How Lost Is Wall Street Right Now?

This Wicked Generation, Looking For Signs

Every day my mailbox fills up with Analyst Reports and Commentaries. Deep Analysis isn't something we see on our Cable TV Business Channels. Their Market is in making trades. Always making trades. For years I've described CNBC as "It's always a good day to buy". The Market's up? Don't worry, it'll get higher. Keep buying. The Market's down? What a good time to find bargains. Keep buying. No matter what's happening, buy, buy, buy. Bloomberg's only slightly better.

It stands to reason, the guests and half the hosts are Stock & Bond Market Traders. That's not only how they make money. It's how they think.

But that thinking doesn't always make for good Economics. And deep down most Wall Street Analysts know that. For years they screamed about the free and ultra-cheap money. Something the General Public never hears about is that we've never had a period of ultra-cheap money like this. And every period longer than about a year has been followed by a major Recession or Depression. When President Donald Trump is complaining about the Federal Reserve, what he's actually upset about is when The Fed begins acting responsibly for the first time in a decade. Cheap money brings inflated Markets. And we've been artificially inflating them since the waning months of the Bush Administration.

"What Goes Up Must Come Down" was one of the most common themes among Analyst Reports & Commentaries for years. Until they just finally gave up and decided to go along for the ride for as long as it lasts. But riding a ride often means giving up using the rudder. Or even going without a compass and a map.

And that's where Wall Street is right now. Especially with Trade War uncertainty and a likely increase in angst and antagonism with China.

QE4?

Permanent QE?

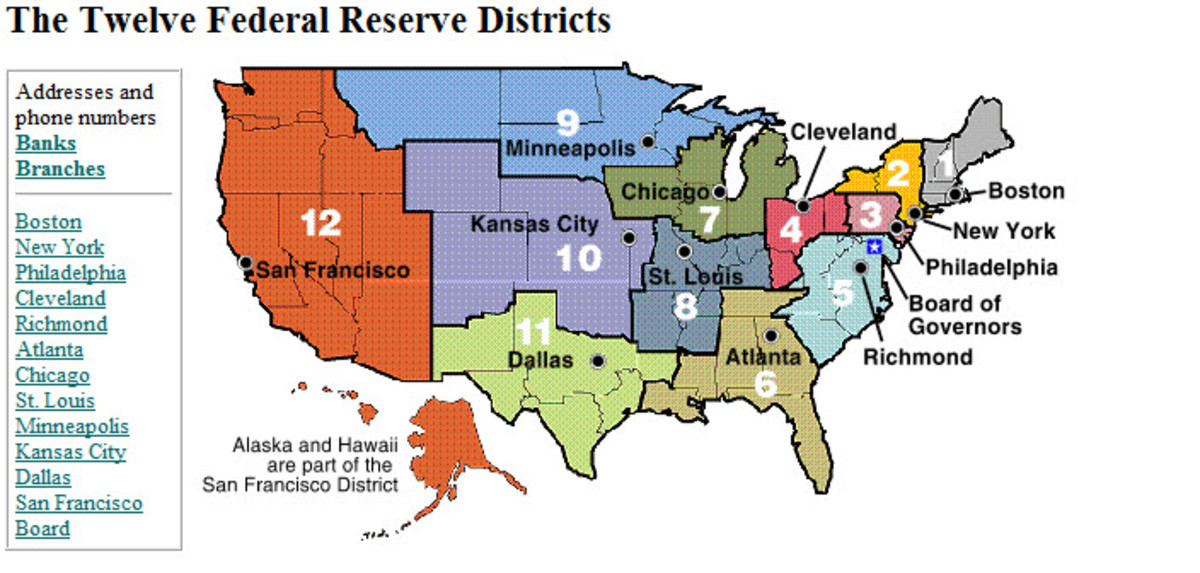

QE is short for Quantitative Easing. It is when the Federal Reserve buys assets. Historically the US Federal Reserve holds assets in the form of Treasury Notes and other Bonds well under a $Trillion worth. But when the free & cheap money came with the Recession, The Fed pushed its "Balance Sheet" up over $5 Trillion. It pushed it down to about $4.5 Trillion. But now it will be pushing it up again and will build in "permanent increases". But it's more than that.

The Federal Reserve is providing additional Bailout money to Banks. Ultimately, 100s of $Billions worth. But it's what's being called by many a "Stealth Bailout". One that goes unseen by most of the Public. This is further adding to Wall Street's confusion. Is the Federal Reserve now going to be endlessly keeping banks solvent? Without even telling Taxpayers? The ones who will have to pay for it all.

This approach goes back to the beginning of the Currency manipulation originally started by then-Fed Chairman Ben Bernanke. While Congress and the Public & Media were fighting over "TARP", the roughly $900 Billion "Bailout", Bernanke began dumping $Trillions of then completely free money on the Banks and major Corporations. Eventually this has grown to nearly $40 Trillion. In order to prevent the Dollar from becoming worth less than a dime, US Treasuries have to be issued and purchased. The Fed negotiated Bond Buys. But even with no or low interest, Banks and Companies had to do paybacks and so issued their own Bonds. And among those buying them was the Federal Reserve.

Name a trick, it's been played. And it may well have had a sound purpose. Initially, to prevent a Depression. If so, that part of it worked. But the Banks and Corporations' own Balance Sheets were filled with alot more problems than anyone knew when this all started. 10s of $Trillions went into just cleaning those up.

It apparently turns out we weren't done with that as some of the Banks have assets that were still "toxic". And are now being bought up by the Federal Reserve...and US Taxpayers.

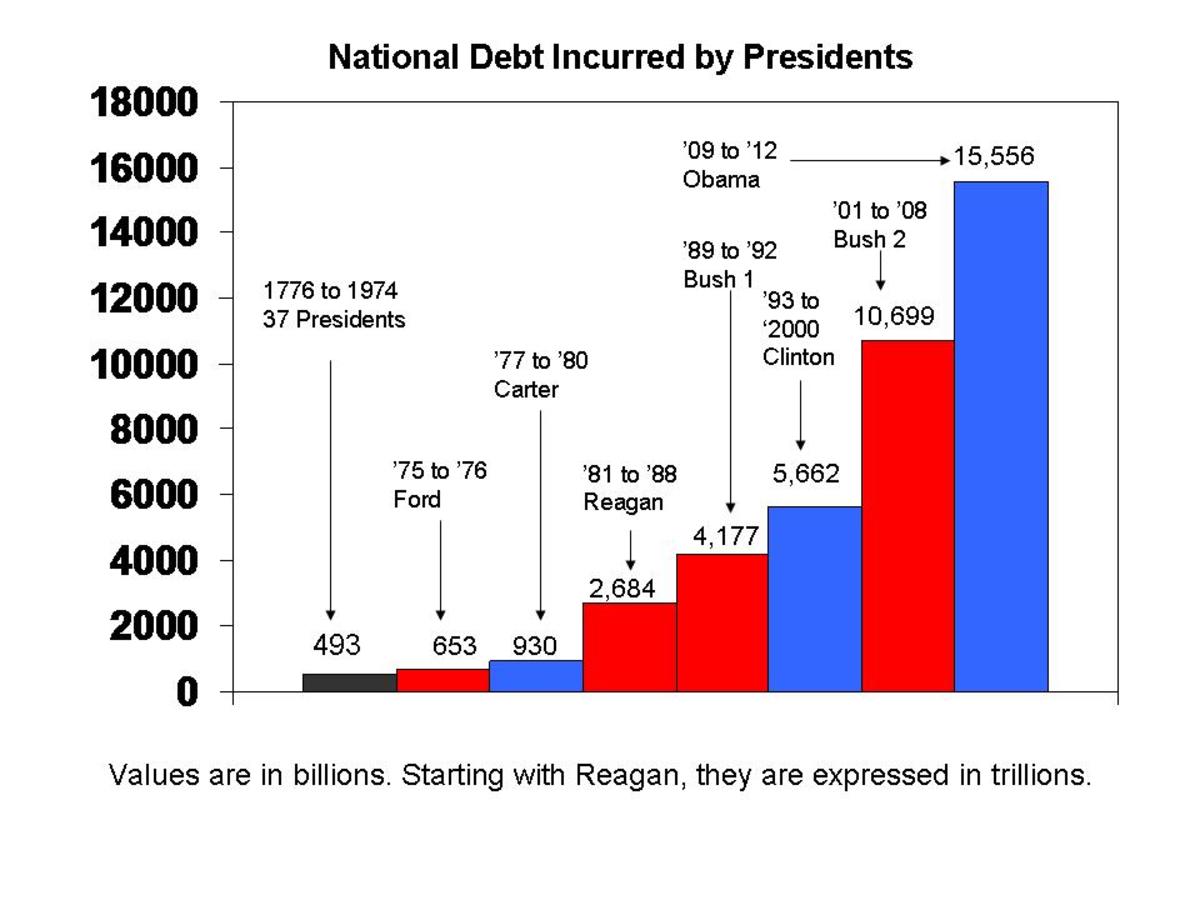

Is it any wonder we don't hear alot of talk about all of this? The most comprehensive analysis I've seen is that when all is said & done, these Currency Ponzi Schemes will double the National Debt. At a minimum.

That's a discussion that eventually will have no choice but to take place. Can't raise the debt ceiling without it. On that day two things will be more widely known by the Public. What QE and all of these Currency Machinations that are going on are. And that we're far too far down the road to do anything about it now but try to figure out how we'll eventually pay for it all.