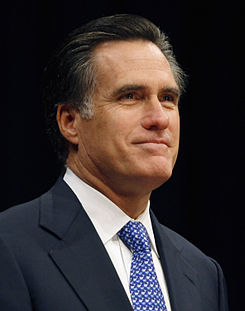

Why Doesn't Mitt Romney Understand Taxes and Mathematics?

MITT ROMNEY - THE MATHEMATICIAN ... Not!

SMALL BUSINESS AND MILLIONAIRS

I THOUGHT MITT ROMNEY UNDERSTOOD how taxes and hiring and profits all worked together. But, after listening to his stump speech recently, I get the distinct impression he really doesn't; nor does he have a good grasp of his statistics either. Anyway, when I heard his speech, I thought of another way to debunk his assertions, so I am dashing off this hub in response.

The first assertion Romney made was that most small business owners pay their taxes as individuals, probably true. His next assertion was that most small business owners would therefore be impacted by Obama's desire to increase the top marginal tax rate by 5% from 35% to 40%, not quite the right percentages, but close enough for government work. This is definitely not the truth! For this assertion to be true, one must assume that most small business owners earn more than $250,000 from their businesses which they claim on a Schedule C or Schedule K-1; and remember, this has to be large enough to leave more than $250,000 after it has been reduced by all of the deductions and the resulting taxes reduced by any tax credits.

Now, how likely is it that a small business owner is going to be able to show an adjusted gross income of more than $250,000 to start with? NOT VERY LIKELY, FOLKS! A small business is generally classified as a business with less than 500 employees; do you know how many of those there are? Around 5.7 million. Considering a business with that many employees, you would think a lot of them could easily net over $250,000 for its owner or owners; and you would be right, except that there are only 600,000 companies with 20 - 500 employees; not so impressive now, is it?

But hey, many companies with 20 people can earn $250,000 for their proprietors, correct? Probably so, if most of the remaining companies had 20 employees . Problem is again, there are only 1.6 million businesses with 5 - 20 employees, mostly at the lower range. The other 3 million or so companies have between 0 and 4 employees, and I bet your bottom dollar, very few of them have net profits over $250,000!

So, what are we left with? A candidate for president who doesn't have a clue as to what he is talking about relative to his statistics.

Now, let's suppose he was right on that point anyway; how about his business acumen?

In business, there is a measure called Return on Assets, or your ROA, it measures how well a company is using its assets (of which an employee is one) and is figured by dividing total net profit by total assets. So, if you had total profits of $250,000 and assets of $1.25 million your ROA would be 20%, not an unreasonable nor an unobtainable number. Hold that thought.

Romney's next assertion is that because of Obama's dastardly tax hike on the poor rich people, they will be disincentivized to hire anybody because it will cost them too much in taxes!! That is his main stump speech line and the drumbbeat message from the conservatives since Day One. I really worry about his(their) ability to understand simple math and how a business operates, I really do. Now back to my numbers, sorry.

Let us say our poor businessman or woman hires, against their better judgement because it is going to cost them so much in taxes in the end, an efficient worker whose gross cost to the business is $50,000/year. Given the company's ROA, she/he would expect to earn an additional $10,000 in net profit. Since she/he files his/her taxes individually, then he/she may or may not be taxed on that additional $10,000. IT ALL DEPENDS ON WHAT THEY DO WITH THE MONEY, don't you see. Romney assumes it is a forgone conclusion they will do nothing with it, put it in a mattress or spend it friviously or something, which of course, is two of their options, but nevertheless is a rather presumptuous assumption on his part, don't you think. Let's say they do just as Romney assumes, instead of investing it in a munucipal bond which helps a community and pays tax-free interest. What happens then?

Well, they get taxed at the 35% rate which they always have, so there goes $3,500. No difference there. BUT, HERE IS ROMNEY AND THE CONSERVATIVE'S HEARTBURN, the aspect of the increase in the tax hike on the wealthy that is going to kill all possibility of any job increases, especially of our poor business person in the example, is that they will pay an additional $500 as well!!!! OMG the sky is falling!

The bottom line of Romney's reasoning is that in order to not pay that extra $500 in taxes, the small business owner will refuse to hire the $50,000 employee and earn a net $6,000 in spending money. That is Romney math for you, lol.

© 2012 Scott Belford