Ill Take the Classic Bern Burrito in the New Organic Millennial Wrap (Yes I Have a Coupon)

Outsider Candidates Dominating Election

The 2016 presidential election has been dominated by the rise of the Washington outsider candidate. On the Republication ticket, we have bombastic front runner Donald Trump closely followed by Carly Fiorina and Ben Carson. For the moment, let’s call this the Trump revolt. On the Democratic ticket, we have an emerging disruptive force in Bernie Sanders. Let’s call this the Bernie revolt. What these candidates have in common is that they do not represent the status quo. The three top candidates in the Trump revolt are all Washington outsiders with no political or government experience coming from business and industry. The Bernie revolt is represented by a 73 year old Vermont Senator whose self-avowed socialism sets him apart, in fact some would say too apart to viably run on the Democratic ticket. At both ends of the spectrum, the emergence of these populist movements rejects attempts by national media and big money donors to fill the political roster. Both revolts are growing largely from organic grass-roots efforts, with independent funds, drawing large impressive crowds. American’s seem to be sending a message that they are tired of politics as usual. The Trump revolt is fueled by a visceral anger towards a majority lead Republican Congress that is too bi-partisan and feckless to act to block and defund a host of issues unpopular with the conservative base. The Bernie revolt seems to be a disdain for the potential front-runner, Hilary Clinton, whom is also viewed as too bi-partisan, untrustworthy and politically self-serving.

This Isn't your Father's Politics

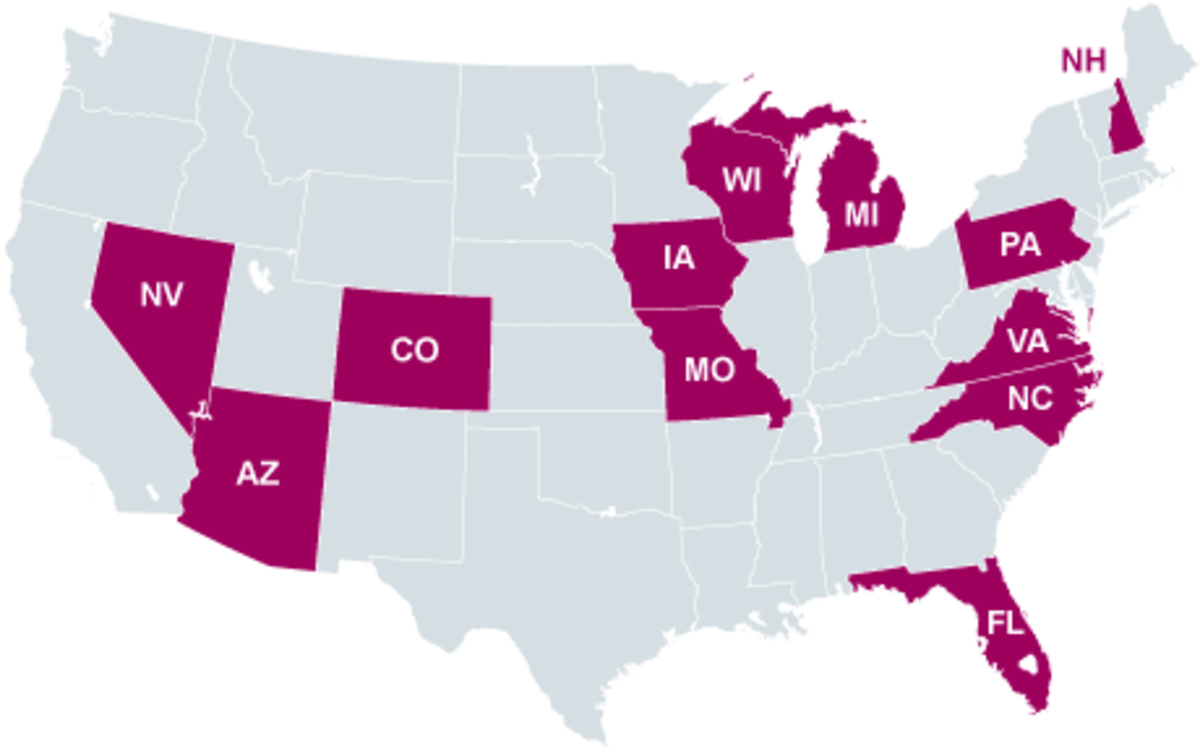

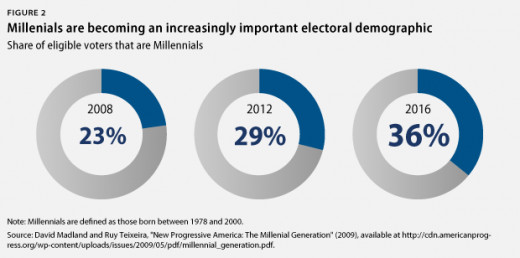

What this election year also marks is the rise of the millennials – those between the ages of 18 and 35. And the millennials are just, well – weird. That is to say, they don’t conform to expected establishment norms of American politics. While they may not be necessarily angry with Washington, they are looking for something new. And perhaps now is a good time to revive a theme from the old 80’s GM marketing slogan – “This isn’t your father’s politics.” And if you are a millennial, you will just have to go look this one up. Many grew up remembering a Bush or a Clinton in the Whitehouse and are now seeking something that their generation can identify with as theirs. In fact, while about 55% could be considered left leaning, largely because of social issues, millennials reject even the notion of party labels. They prefer not to be manipulated and confused by party politics. And the millennial base is growing, about 76 million according to the Pew Research Center as of the 2014 Census now even surpassing the Boomer population, ages 51 to 69, at 75 million. What’s also helping the millennial number grow is immigration with about 61% weighted with this younger group. With the 2016 election, millennials will represent fully over a third of the election base. Thus, as this demographic grows, more effort will likely be made to capture their vote.

If we are to learn anything from this election cycle, it’s that large groups of young people regardless of their positions or values are feeling disconnected from establishment politics. And they are beginning to ask – what’s in this for me? And who could blame them? College educated millennials were sold the expectation that investing heavily in a degree would entitle them to rewarding job prospects and easily obtained prosperity at the end of the rainbow. But the reality turned out, for most, to be high student loan debt and low paying positions for which they must also still compete. The millennials have largely grown up in a decade of recession and economic stagnation leading some to dub this the generation of debt. Except for health care employment that’s largely subsidized by government, real wages across most industries have dropped by as much as 10% since 2007 when the recession hit. Millennials are busily working in jobs paying less while the cost of housing and health care continue to rise making it difficult to save or invest in home ownership, get married or start a family.

Bernie Sanders' Message Resonating With Millennials

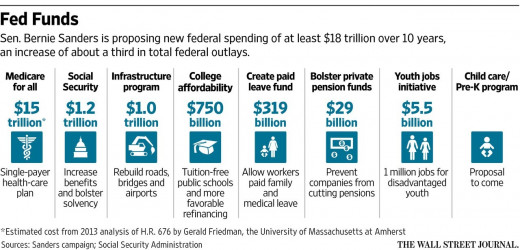

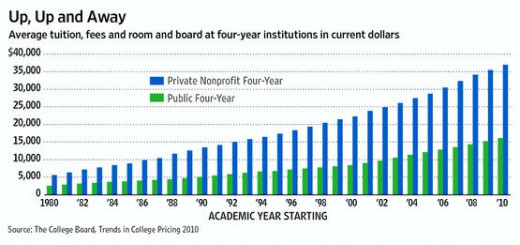

Enter Bernie Sanders. His message couldn’t have been more timely. First there is the idea of free public education, even for a four year college degree. Those with student loans would also receive additional cuts in interest rates on those loans, a figure that's close to two trillion dollars nationally for all student debt holders. The idea here is that education is a basic right and because the cost of tuition has grown out of proportion to income, it's now unaffordable. Then there is free healthcare, putting everyone on essentially Medicare type single payer coverage. He's also talking about free Pre-K child care, something that Millennials are struggling with now raising a young family. Finally there are his plans to increase minimum wage and fund jobs for disadvantaged youth. Most of all, Bernie is talking directly to this generation when he addresses the problem of income and wealth inequality. As any millennial knows, people entering the workforce a decade earlier are more successful and having a much easier time of it and therefore an unfair advantage. And then there are those immoral rich people on Wall Street that only seem to be getting richer. Bernie has an answer for that too; tax the rich heavily, as much as 90%, and then spread the money around. As mentioned earlier, millennials also tend to lean left by about 55% and this is mainly to social issues like legalization of certain drugs, gay marriage rights and transgender equality, and access to federally funded abortion. These are things the left has supported from the beginning. Toot, toot – all aboard the Bernie train – get ready to #FeelTheBern.

Old Socialist Ideals in a New Package

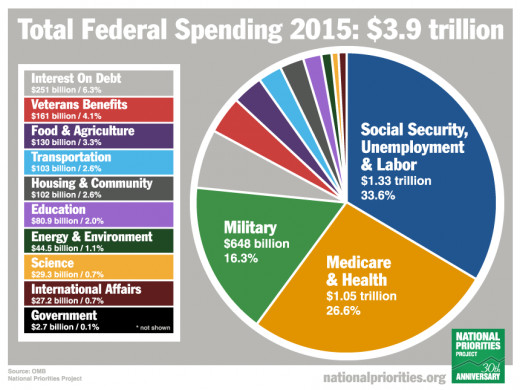

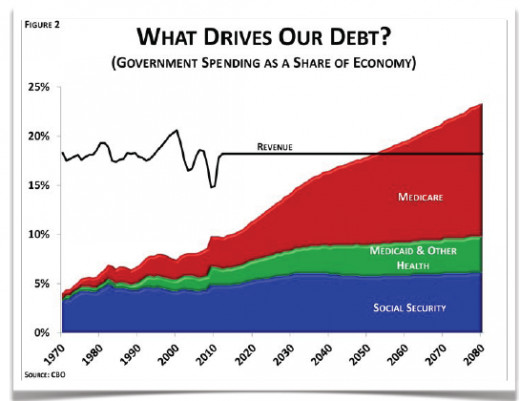

But wait! Hold the train, says the #trumpforpresident, we’ve heard all this before and it’s the classic redistribution model of socialism. When Bernie supporters hear this, they don’t really have a frame of reference that would conjure up the oppressive and smothering effects of a heavy handed government as with the Boomers. In fact, less than 16% of these supporters even know what socialism means - and they don’t care because they view this as just nuance. Besides, they argue, Bernie represents “Democratic Socialism.” So apparently labels do matter to the extent “democratic” effectively tempers any ill effect of socialism. But more importantly, millennials actually welcome the idea of government managing things and providing benefits. Better living through bigger government, especially if someone else is footing the bill. And who is footing the bill? Bernie hasn’t quite explained how not reforming and actually adding to entitlement programs along with debit servicing that already absorbs 70 cents of every tax dollar won’t necessarily add to our budget crisis and national deficit currently at 20 trillion and counting. He is candid in estimating that it would cost $750 billion over the next 10 years to fund free higher education alone and critics warn his programs could cost as much as 18 trillion dollars. But Bernie does have a solution and it’s again designed to go after the rich.

Besides raising the top tax rates for individuals and corporations whom are already taxed higher than any other industrialized country, Bernie would like to impose a Financial Transactions Tax (FTT) on Wall Street of 0.5% on stocks, 0.1% on bonds, and 0.005% on derivatives like futures and options. He estimates that this could raise hundreds of billions a year creating millions of jobs. There is only one problem – history shows that this won’t work. When profits are reduced, use of an FTT in other countries such as Sweden has resulted in less capital gains tax being collected. But worse still, since this is a tax on transactions, trades may slow or even migrate to other exchanges outside the country as was the case in Sweden when traders moved their activity to the London Exchange. And the result was that Sweden actually collected even less revenue overall than prior to imposition of the FTT according to the Tax Foundation.

Making the Conservative Case to Millennials

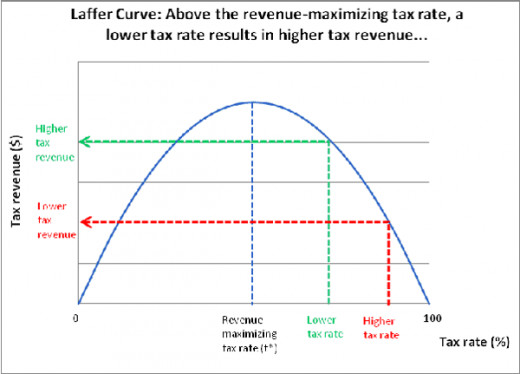

Given these easily demonstrated flaws in effective tax strategy, conservatives should be able to make a very compelling case in the marketplace of ideas to persuade this generation. While tax policy is a much larger debate, economics 101 can be simply explained that when tax policy is highly punitive as proposed by Bernie Sanders with a 90% top marginal tax rate, the effects are a net reduction in revenue (see inset). This is just common sense as you would have less to no incentive to produce more if most of your profit were confiscated by the government. The converse is true in that as profits grow for business, GNP and tax revenue grows as does the ability to spend more dollars on hiring employees.

The millennials are shopping and looking for solutions. But so far, many of them have been romanced by the allure of free government handouts. They are not being taught the negative long term effects of deficit spending and stifled economic growth due to punitive tax policy nor a healthy skepticism for centralized power. No one is making the case to them that the greatest prospect for improving their lot has been free market capitalism and government policies that encourage growth. The morality of capitalism has largely been on the defense. From the president criticizing and apologizing to the world for American imperialism and exploitation of other nations for commercial gain to left leaning Hollywood actors promoting the virtues of socialist ideals, and even to the pope conflating the evils of Juan Peron style corrupt corporatism with the American regulated free-market. The message has been that capitalism is a battered brand.

Perhaps Milton Friedman, the American economist, put it best when he noted: “The key insight of Adam Smith's Wealth of Nations is misleadingly simple: if an exchange between two parties is voluntary, it will not take place unless both believe they will benefit from it. Most economic fallacies derive from the tendency to assume that there is a fixed pie, that one party can gain only at the expense of another.” These critics should also take note of some simple statistics. For instance, according to the Cato Institute’s annual Economic Freedom of the World Index countries in the top quartile had an average per capita GDP of $23,450 in 2013, compared with $2,556 for those nations in the bottom quartile. The poorest 10 percent of the population in the most economically free nations had an income more than twice the average income in the least economically free nations. It’s why citizens of nations around the world flock to Reagan’s description of America’s “shining city on the hill.” It is capitalism that unleashes and incentivizes innovation, creativity, and discovery. And capitalism doesn’t just produce wealth, it produces opportunity and jobs; things sorely missing for millennials in this economy.

Neither party can afford to ignore this large and growing block of voters that have the potential to significantly change the landscape of American politics for decades to come. And now is a critical time for America to decide, will the party of maximum economic freedom and prosperity demonstrate to millennials that herein lays their best pathway to salvation? Or will antiquated socialist ideals repackaged as a new social justice movement be allowed to win the debate?