Influence of International Organisations and Trade Agreements in Promoting Free Trade in Australia

Free trade is where governments impose no artificial barriers to trade that restrict the exchange of goods and services between countries. Over the last twenty years, the global economy has witnessed significant progress towards free trade. Prior to 1970, Australia was considered as one of the highly protectionist countries. Today, it ranks amongst the most open economies. Australia’s transition has been facilitated by both international organizations and trade agreements. Recently the World Trade Organization (WTO) has struggled with building a strong consensus for a comprehensive multilateral free trade agreement. Consequently, regional and bilateral trade agreements have gained popularity. As a result, countries, including Australia, ‘cherry pick’ trading partners and secure preferable trading agreements (PTA).

Global Multilateral Level - General Agreement on Tariffs and Trade (GATT)

At a global multilateral level, Australia became a member of General Agreement on Tariffs and Trade (GATT) in 1947 and the World Trade Organisation in 1994. In doing so, it created an avenue for Australia to instigate the Cairns Group to advocate for free trade in agriculture. In the 1994 Uruguay Round, they successfully established the first ever agreement on agricultural trade. This saw tariffs decrease by 36% and is worth over $4 billion per annum. In addition, Australia pursued unilateral trade policies, such as the 25% across the board tariff cut in 1975. This inevitably opened Australia’s domestic market to international competition from imports, helping to promote free trade.

Abolishing Agricultural Subsidies

However, following agreements to phase out agricultural subsidies have stalled since the 2001 Doha Round. To date, progress on finalising the wider agreement have proved difficult due to numerous unsuccessful attempts to reach a conclusion with all 163 member of the World Trade Organisation. Nonetheless, in December 2015, they finally have agreed to abolish all subsidies on agricultural exports. This translates to the removal of $15 billion of export subsidies around the world.

As a result of this historic elimination of farm subsidies, which distort world trade flows, Australia benefits immensely, as it does not materially subsidies its agricultural sector. As of 2014, Australia had the second-lowest level of agricultural protection in the Organization for Economic Co-operation and Development (OECD). These advances in trade policy will help Australia’s sector grow during the presence of Asia’s burgeoning demand for premium Australian agricultural product. Therefore, the permanent removal of a long-standing source of distortion in global agricultural markets will boost our export competitiveness in the agricultural sectors, and hence, promote free trade.

Although this recent positive outcome highlights the powerful influence of the World Trade Organisation, it does not diminish its lack of progress in finalising negotiations in the Doha round. Under these circumstances, countries, including Australia, have made numerous bilateral/regional trade agreements at an accelerating rate. Over 100 countries have vigorously pursued preferential trade agreements, with an average of each World Trade Organisation member having signed 13 preferential trade agreements. As a consequence, the world has a ‘Spaghetti Bowl’ of trade arrangements. This raises the concerns that the global economy is being segmented into regional clusters, resulting in the shift from trade creation to trade diversion.

Selectively Choosing Trading Partners

More recently, Australia has been selective in choosing their trading partners on the basis of most favourable trading conditions. Subsequently, Australia’s geographical location has resulted in strategic trade agreements with many Asia-Pacific nations. Moreover, The Asian Century White Paper issued by the government in 2012 reinforces this idea. It states a commitment to lower tariffs especially with large Asian nations such as China and India.

Trans-Pacific Partnership

Currently a high priority for the government is the Trans-Pacific Partnership (TPP). This is a multilateral free trade agreement signed in Feb 2016 with aims to further liberalise trade across the Asia-Pacific region. It is seen as a gigantic foundation stone for Australia as the TPP consists of 12 economies with a combine worth of $US28 trillion. It will allow Australian industries to expand into the lucrative Asia-Pacific markets slated to contain 3 billion middle class consumers within 15 years. Early estimates suggest tariffs will be eliminated on $US8.6 billion of Australia’s exports to Trans-Pacific Partnership countries. However, a recent study by the World Bank states the Trans-Pacific Partnership will barely benefit Australia. They expect it to increase Australia’s gross domestic product by just 0.7% by 2030, with a boost in exports of only 5%. The real benefits of the Trans-Pacific Partnership for Australia won’t be known until months after becoming effective.

Australia - New Zealand Closer Economic Relations Trade Agreement (ANZCERTA)

On the other hand, the bilateral trade agreement known as Australian – New Zealand Closer Economic Relations Trade Agreement (ANZCERTA) (1983) is one of the most comprehensive free trade agreement in the world. It established a free trade zone between Australia and NZ in the 1990s, and has led to the growth in trans-Tasman trade, harmonised business regulations and the free movement of labour and capital. Consequently, since 1983 there has been an 8% average annual increase in trade between the two.

Korea - Australia Free Trade Agreement (KAFTA)

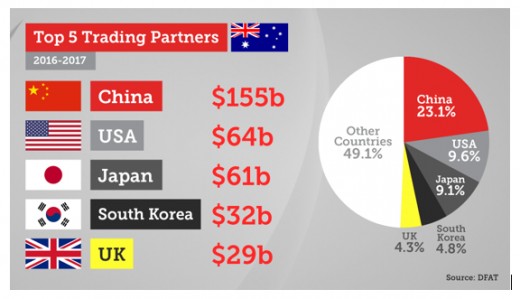

In addition, since late 2014 The Korea-Australian Free Trade Agreement (KAFTA) has improved access for Australian exporters with our 4th largest trading partner with a $US1.2 trillion economy. Within the next 20 years, our tariff free exports will raise from 84% to 99% of exports. Ultimately, the increase in traded goods is projected to add $650 million to our GDP by 2030 according to the Department of Foreign Affairs and Trade (DFAT). Furthermore, the Korean - Australian Free Trade Agreement will develop opportunities for investment both ways. The agreement will increase the screening threshold for Korean investment in Australia from $248 million to $1,078 million.

Japan - Australia Enterprise Partnership Agreement (JAEPA)

More recently, in 2015 Australia ratified negotiations with Japan to establish the Japan – Australian Enterprise Partnership Agreement (JAEPA). Japan is Australia's 2nd largest trading partner. This is illustrated by 17.7% of our exports heading towards Japan and 7% of imports coming from them. The Enterprise Partnership Agreement will provide preferential market access for Australian exporters across a range of eligible agricultural, industrial, energy and mineral products as well as bilateral commitments on services and investment. But the most notable major beneficiary will be the beef industry. They will witness a $5.5 billion boost over 20 years as tariffs reduce from 38.5% to 20%.

China - Australia Free Trade Agreement (ChAFTA)

However, of greater significance is the China-Aust Free Trade Agreement (ChAFTA). Signed in 2015, it is expected to further promote trade with Australia’s largest trading partner. In 2014 alone, total trade was worth $160 billion. Once the agreement is fully implemented, 95% of Australian exports to China will be tariff free. It is estimated this will increase our gross domestic product by 0.25 – 0.5% per annum, according to Credit Suisse. This will improve the competitiveness of key agricultural industries such as beef (worth $722 million) and dairy. It will also create greater access for Australian producers to the growing Chinese consumer market.

Impact on Australian Households and Businesses

Additionally, Australian households and businesses will reap the benefits of lower priced and wider range of goods and components from China. However, when China’s exports of household electronics, textile, clothing and footwear (TCF) and private motor vehicle (PMV) become tariff free by 2019, it will force sunset industries, such as consumer electronics and cars, to disappear. Moreover, import-competing firms will shrink unless they improve their international competitiveness. Thus structural u/e will arise, for example in manufacturing areas of Victoria and South Australia. However, this will be offset by the increase job opportunities in services, such as tourism and education.

Yet, the overarching benefit for Aust from all the recent free trade agreements, lies in Asia’s increasing demand for services, especially from China’s growing middle class of over 400 million people. Services account for over 80% of Australia’s gross domestic product but contributes as only 15% of its exports. The numerous agreements will enable greater market access for Australian service exports, such as the legal and telecommunications sectors, which will benefit firms by broadening our export base. This is of upmost importance due to Australia’s current needs to diversify its economy away from a reliance on mining and resource exports.

Ultimately, Australia’s shift towards regionalization based on the principle of comparative advantage has been the major influence in increasing our trade in the world economy.

© 2018 Billy Zhang