A new global exchange for Allocated Gold Trading and Pricing

London - breaking - new Global Gold Exchange -

For Gold, Silver, Platinum and specific bars and coins

Bullion Capital is implementing a "unique market-model" according to Tom Coughlin, C.E.O. The Brisbane, Australia based company is inserting itself into the global market of Gold, in a way that- historically was only held and dominated by the Rothschild (Red Shield) German-Jewish family of Gold-Traders of Europe's antiquity. And, believe it or not, even BitCoin and other cryptocurrency or alt-currency figures into this new market- though it's not directly discussed here.

The ABX exchange is a Market model that actually brings efficiency and transparency for allocated Gold between institutional (global) entities. When you talk about an exchange traded fund (GLD is the biggest one) it's a pool of unallocated gold. It's not even gold, it's PAPER that represents a "claim" on gold, but is actually senior to the claims of a bank. Traditionally it is a bank that makes that particular product in the marketplace function. ...But it is not allocated gold. It is at that time UN-allocated within markets.

So if I have a ton of gold, and it's allocated in MY name, I can start to trade that gold (as allocated) on this new exchange.

Legal title is always allocated to the end-investor or trader.

So, what this means is, there is no 'layering' of financial "Engineering" in this exchange, or anything like that. (As with the unlimited "layering" in America's DERIVATIVES MARKET born of Wall Street, in recent decades.) It's just a pure and unadulterated allocation to the "End Investor".

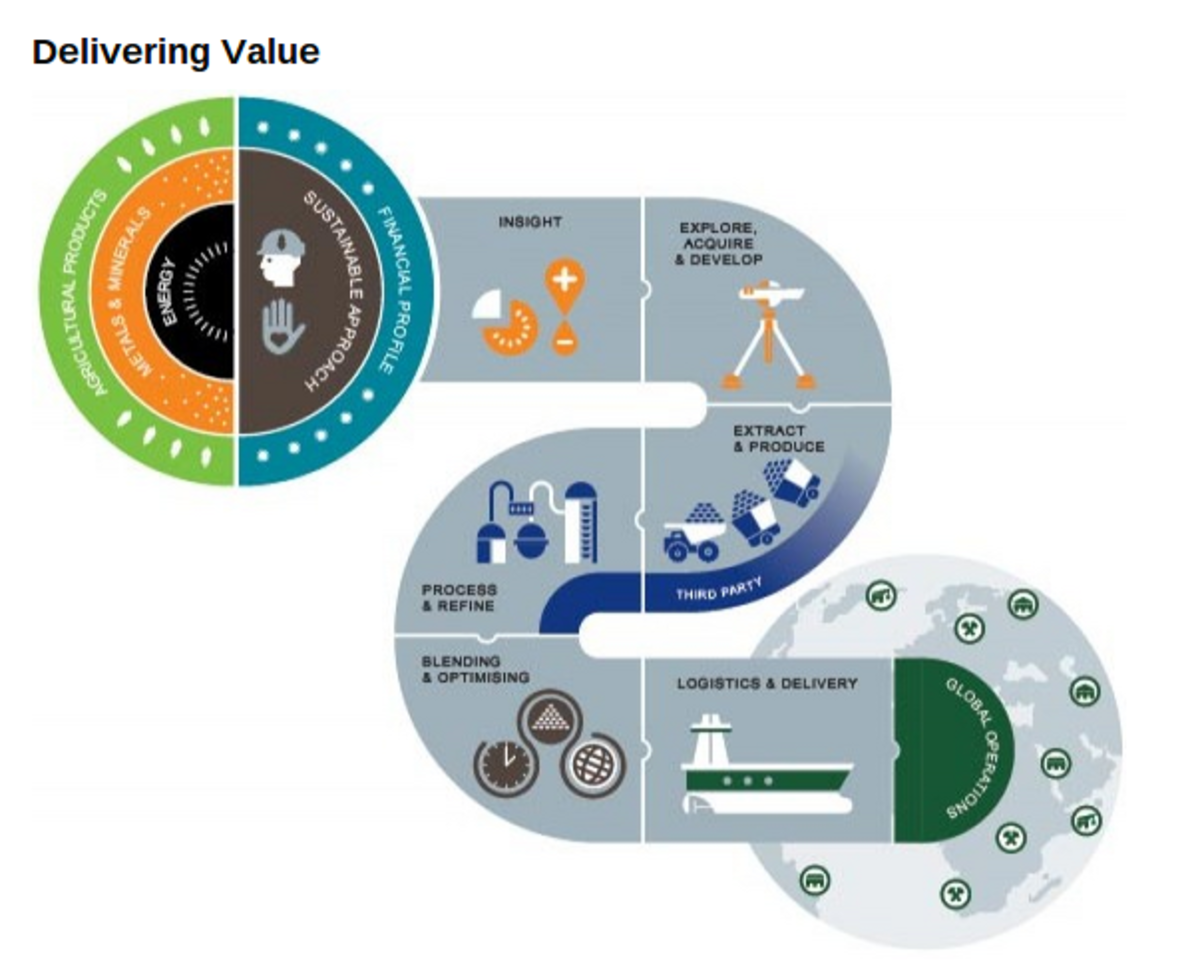

ABX is not a "market maker". It is an exchange. ABX brings together the "market-makers" and liquidity providers (and the liquidity takers as well). What ABX has done is it has adopted a fully institutional architecture, and market-model whereby they bring together the traditionally recognized Gold-market institutions... this allows these market-makers to "connect" institutional gold investment services to any clients, anywhere- Globally.

Allocated Bullion Exchange - ABXGlobal.com

The web link to ABX Global

ABX has eleven global trading hubs

ABX has an extensive Quality Assurance framework. And this governs the rules of the exchange, and the way trades are executed over the eleven trading hubs. These eleven locations bring Gold "Price Discovery" to the region serviced in a more transparent fashion. All eleven sites are Trading, Storage, and Delivery locations.

This means that ABX has market-makers that "put in prices" (for Gold) in these different locations, and they have "Liquidity Takers" that take that liquidity out of the market.

Said another way. ABX matches Gold-buyers and Gold-sellers as a centrally-cleared exchange. And ABX is willing to post a "Price-discovery" to make those trades happen. But ABX does not build up it's own Gold-inventory to act as it's own buyer or seller. It's business is the act of overseeing global exchanges, and assuring quality and transparency of those exchanges.

ABX operates a C.C.P. or "central counter-party" which clears the trades of the exchange. They also govern the rules of the exchange, meaning they set (and disclose) the rules. And, they host the technology of the exchange which they developed in-house.

Before you go saying "it sounds like they just can make (and break) the rules", understand that their existence is to BE the "referee" between vast sums of wealth, and the purpose of ABX is to provide alternative trading routes to (possibly more corrupted / influenced) OLDER systems.

Their purpose is to bring transparency to an aging market that has "issues" requiring resolution through new alternatives.

... they could be a "breath of fresh air", in other words.

As long as established (older) systems don't subvert or destroy ABX...

How does this compare with London or New York Gold Trading?

LBMA or, the London Bullion Market (London Bullion Association) oversees the wholesale of gold and silver markets in London, and is the center of the world's physical bullion trade.

COMEX - is the New York based version, dealing in precious metals, and commodity futures prices or quotes and maintaining market data ("snapshots") that are updated continuously during trading hours.

The LBMA and COMEX system has been coming under a lot of "fire" lately because they are encouraging people to do things like sell "naked contracts" -short ... or to sell "futures contracts" and things of that nature.

Can you say "price-fixing" or "price-manipulation"?

In the case of LBMA it was discovered that in the silver market, they've been running with a 100:1 leverage. ( said as 'One Hundred to One' ) as a "fractional-reserve" market. Meaning they're beginning to run even the precious metals trades in the same (corrupt) way that fiat-currency banking is being run. This means that if they have "One Dollar" of silver, they then make up rules, giving themselves permission to perform "speculative trading" at 100 times the current (real) value, of their account. That is what 100:1 leveraging means.

In other words, ... as more and more "paper" is created that represents the precious metals. That paper is automatically DE-valueing the precious metal itself with "derivative" styles of thinking. And inevitably some of these trades do go badly and must be "written-off" or "buried" within new derivative (paper) assets, and the debt of that failed trade is shoved into the future of some OTHER 'trade'... (sound familiar?) This should sound familiar since it is now how the worst of Wall Street functions. And it's also the basis of a lot of our economic "shuffling" and nonsense going on with the budget.

Precious metal is supposed to be traded directly "at value"... one for one.

Which is the entire point of Gold (or silver... or platinum). "Value". But you see, these older markets can (now) turn anything into "junk". Basically, it's just legalized fraud. And I simply do not understand how the SEC is "in on this" and allowing this kind of thing.

In short, the established traders are corrupt. And they're corrupting each and every market possible. Simply because they can.

This is "rental-fee-based behavior" which also is why BitCoin itself will be considered to be as good as Gold (or better) due to the inherent resistance to "rental based behavior" that a decentralized currency system hinges upon. But rent-seeking is another topic itself. All "rent-seeking" is, is when a person or agency, (due to their position and influence of that position) sticks a straw into any financial stream and then draws off a "fee" for themselves. Eventually this tends to lead to a form of corruption. And it basically adds NO VALUE whatsoever to the revenue stream but does tend to weaken that stream or eventually pervert the entire process.

ABX is offering a cleaner (transparent) system.

Illegal price-fixing and price-manipulation in established markets

"We're offering an alternative to the London market. ... The main difference is that it is allocated."

Trades are cleared and settled on an allocated basis. It is just legal-title transferring from one party to another party or end-investor. The fact that ABX is a global market, trading 23 hours-a-day, while offering "price-discovery" in each region of operation. Catering to the market-demands of each local region. But then also (for each region) offering what is globally available. ABX is offering to connect liquidity giver's and takers globally in a more transparent fashion, with NO LAYERING of "paper" or "futures" involved.

Trading, at Value... transparently.

That's the whole idea behind gold, anyway. ... at least, that was the ORIGINAL intent.

Max Keiser: "Your network of 11 exchanges breaks the strangle-hold of illegal price-fixing and price-manipulation that's going on right now in these markets."

Tom Coughlin: " I believe so, because we're on the street in all these different locations and we're working / collaborating with the market participants and we are giving them what THEY want. We are giving the physical markets what the physical markets WANT. For instance, a physical trader in Hong Kong, that is selling whole-sale lot-sizes to Chow Tai Fook the largest Jewelery store in the world... And they are also the largest Gold-Consumer in the world right now. And what I am saying is we have built this out with the physical market participants NOT the Bankers... We've done this to give the physical market what the physical market wants- transparently. From over-the-counter, to the consumer. "

Max Keiser: " The paper-market price is the phoney price determined by manipulators and scoundrels in New York and the City of London. Now, there've been a lot of attempts to come up with "new Price-discovery" but... is ABX finally going to get rid of the "Bad Actors" in the Gold and Silver market? That's what I want to know.... (Max smiles) THAT'S MY QUESTION! You come on my show ... is this REALLY gonna happen? ... Tom???

Tom Coughlin: (smiling back) " All I can say is we are going to try our hardest to do it the best that we can do it, which is to bring efficiency and transparency into the market. It's going to take a little bit of time but we need collective support as well, from everyone in the precious-metals industry. We want millions of users on this. We've created the full architecture to do it. It's institutional level. Our theory is (and we know this to be the case) to get this "Right" we need to go to the very top and create the necessary institutional facilities."

This is the full Keiser-report interview with Tom Coughlin