Causes for a recession: external variables and debts in household balance.

How come that an economic crise explodes; do you know for which reasons the most important crises in the last three centuries arose? A threat is basically defined as the possibility that something bad or harmful could happen. Like for example natural catastrophes (heartquakes) and exceptional and stressful events (wars). Even though public opinion is not so aware of that being oriented most on classic examples nowadays reality is more complex and the private household debt is a threat for a country's stability.

Historically speaking we don't need a war or a disastrous and violent attack to set an economic crisis. In both Great depression and Great recession the cause seems to be internal.

As a great event for the northern Europe nutrition, following the America's conquest, potato came to Ireland where it had a great and appropriate environment for being cultivated and grow on. Than the late blight caused a sensible reduction of the harvest generating a national crise which expressed itself mostly between 1845 and 1852.

Nothing that politics ans human decision could prevent at the time. Exactly as for 9.11 and the recession it provoked.

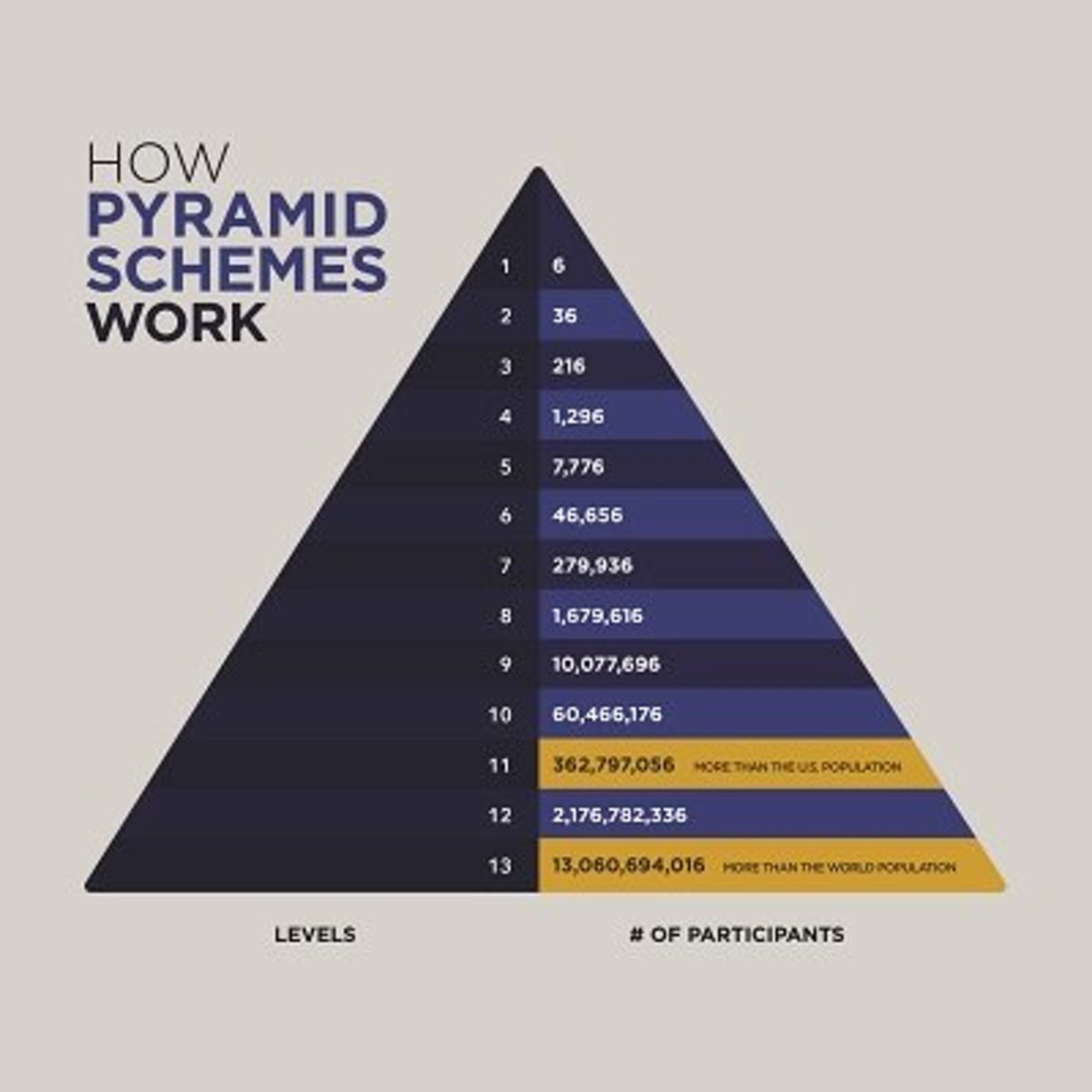

At the same time both Great depression and Great recession seem to bo provoked by an eccess of private household debts. And that is revealed by a book came out in America last year. ; at heart of the unbalanced budget of a America there is no external variable (e.g. natural disaster) but a policy concerning both banks and families. That policy has provoked a relation between household's debt and household's capital that's just too high.

But let's have a look at the various levels of privately owned portfolioes:

the poorest 20% households presents a portfolio that can be summarized as follows...

80% debts

17% real estate

3% financial assets

At the direct opposite the richest 20% presents a reversed situation:

80% financial assets

17% real estate

3% debts

The middle class of the households shows a situation that is essentially outlined by a bigger presence of the real estate property, that borders on 40% for the central fifth. The debt declines bit by bit thoward the increasing wealth.

The last fifth has no diversification and the total amount of the debts overcome the assets and produce a negative balance sheet.

The middle class has no much diversification and real estate plays a great role in their portfolio. Debts occupying an important part that lowers slowly thowards the riches.

The first fifth, the richest one, presents a situation that's characterized by a strong diversification and a deep trust on financial products. It goes against instinctual prejudice on financial assets a and uses them as a powerful mean to diversify the investments done.

Considering a design involving politics, households and banks as well, America urges a policy regulating loans. Far from being secure, the amounts in money due to the first and second fifths to the banks are just too high! The lack of regulation for the banks branch is far from allowing the creation of more wealth. It creates an atmosphere of unstability and opens the road to the forthcoming of big government.