Is the Fair Tax Fair?

by Joni Douglas

The nation should have a tax system that looks like someone designed it on purpose . ~William Simon

There is a lot of talk going on these days about the Fair Tax. Folks are talking about the Fair Tax vs. the value added tax (VAT). The VAT tax is getting mixed up in people’s minds with the Fair Tax, because they both are a form of a national sales tax. The VAT tax that certain members of Washington are considering right now, would be in addition to the income tax and all of the other taxes that we currently pay. The major difference is the fair tax would be instead of the income tax and all of the other taxes we currently pay.

Did you ever notice that when you put the words "The" and "IRS" together, it spells "THEIRS?" ~Author Unknown

What is the Fair Tax?

I want to like the idea of a Fair Tax; I just don’t know enough about it. Some of the politicians that I admire are all for the Fair Tax. So I did some checking to figure out why. The first thing we need to do is define what the Fair tax is. I found this definition on Wikipedia that simplifies the whole thing down to a single sentence. ”The Fair Tax is a proposed change to the federal tax laws of the United States that would replace all federal income taxes with a single national consumption tax on retail sales. “

This is a very simplified definition to be sure. Article after article has been written about it, some are all for it but there are a whole lot of people vehemently against it. There is absolutely no way we could cover all the information about the Fair Tax in this article, so we will just stick to the basics of the plan.

The first thing that people realize about the Fair Tax is that no federal taxes would be withheld from their paychecks, and that includes Social Security and Medicare withholdings. Initially, that sounds like a great plan. That also means individuals would not need to file a tax return at all. April 15th would be just another day. We would totally do away with the IRS and all 20,000 pages of their regulations. We would all receive our full wages. State and local taxes would still be deducted as would any other deductions you normally have taken out of your check, however.

So far, I’m liking it. There’s something about seeing all of those IRS agents looking for work that appeals to me. Maybe that’s not fair, given the economy and all, but nonetheless, just the thought of it makes me smile.

Okay, so here we are with all the extra money in our paycheck. How do we pay taxes? Well, with every purchase you make, you will pay a national sales tax. There are a lot of arguments as to what that percentage would have to be, in order to match the revenue received by all the various taxes which would no longer be collected. Some argue the tax would have to be as high as 33%, but the writers of the bill place the percentage at 23%. Either way, it will be a noticeable increase in the purchases we make.

Now I understand that the retail price of any given item currently includes a certain amount of taxes before it ever hits the retail market. These would be taxes that were levied against the raw materials to make the item and would also include any taxes levied against the item during the manufacturing and distribution process. Estimates of these taxes placed upon products are as high as 22%. These taxes would be totally eliminated making the actual price of the item less. So the product would sell at a lower price and this would be the amount that the sales tax would be figured on. It sounds kind of complicated. But I understand this much, people will get a lot more money in their paycheck but everything they buy is going to cost more.

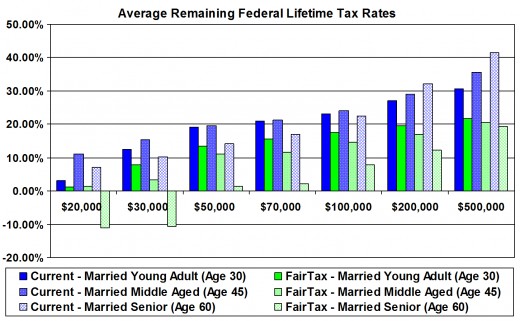

Right now, we have a graduated tax. This means that people, who make a lot of money, pay a higher percentage of taxes than those making less money. The Fair Tax would charge every one equally at the cash register. But as logic tells us, people who make lots of money also spend lots of money. So the actual amount in taxes that they pay will still be much greater than those don’t have a lot of money to spend. Although the Fair Tax is not a graduated tax, because the percentage would be the same for everyone, it would be a progressive tax because those that spend more will pay more.

So how does this help the middle class or folks nearer the poverty level? Here is where it gets really complicated. I’m going to try and explain as best as I can from what I understand. First, let me say these poverty guidelines are set by the Department of Health and Human Services. Using their guidelines of2003, the poverty level was set for a family of four at $24,240 annually. Using that family of four as our example; means that this family, would be able to spend up to that amount tax-free. The Fair Tax would provide the family a monthly prebate check of $465 that would cover the sales tax for that month.

[23% (the tax rate) of $24,240 (the yearly poverty rate)equals $5,575 which divided by12 months equals $465 (the amount of the prebate check) a month.]

Stay with me now. The Fair Tax is going to pay the family $465.00 every month to offset the 23% rise in the cost of the sales tax added to the retail products that they buy. So, if this family spends less than $24,240 a year, then they actually make money and no taxes would be required from them. But if they spend more than $24,240 a year, they pay taxes.

Let me phrase this in a different way. If you divide the annual amount of $24,240 by 12, you get $2,020.00. The sales tax of 23% on $2,020 equals $465. The government is going to assume that a family of four living at the poverty level, making only $24,240 a year, will spend $2,020 every month on new purchases, including food, gas, and clothing. So, the rebate check of the $465 that the government will issue every month is to cover the cost of the sales tax of the $2,020 worth of spending each month. Every American family will receive a $465 every month. The money is not tied to purchasing; it is yours to spend or save as you will.

The first $24,240 spent every year then becomes tax-free. If you spend more than that amount, the sales tax is paid out of your income. For low income families and the middle class, would be exempt from paying any taxes until their spending exceeded the $24,240 a year. Under the Fair Tax all taxpayers would sit pay the same rate of taxes, the 23% sales tax.

The special rates for special circumstances of our current tax system violate our Constitution and can place unfair burdens on many taxpayers. The Fair Tax allows every family to control their tax liability through their spending. Their spending habits will determine the amount of taxes that they will pay. Basically, the more you spend the more tax you’ll pay.

You can figure out what your tax liability would be under the Fair Tax click Calculator

To learn more about the Fair Tax click Fair Tax

Or visit their website click Fair Tax Org.

What will be taxed?

The Fair Tax is a federal retail sales tax. This tax is collected only once, on every new product purchased for personal use. Used items are not taxed.Business-to-business sales are not taxed.

What taxes will be eliminated?

Unlike the VAT tax, the Fair Tax will replace our current tax system. That means it will replace the federal income tax including individual and corporate income tax, estate, gift, capital gain, dividend, alternative minimum, payroll, Social Security, Medicare, self-employment, and corporate taxes.

Summary of the Pros of the Fair Tax

The Fair Tax is one national sales tax; a fair, simple, transparent, easy to collect, harder to cheat, revenue neutral, end-of-sales process consumption tax, can collect the same tax revenue, if not more, than our current tax policy. Every American, no matter how they earn their money, will pay their fair share. Folks will have more of their own money to spend. The economy will be stimulated which will create jobs and bring in off the shore capital. Everyone buying new products in the USA will contribute, that includes visitors both legal and illegal.

Summary of the Cons of the Fair Tax

Studies show that the actual tax rate would have to be much higher than 23% in order to make up the revenue that would be lost by eliminating other taxes. This would certainly lead to higher levels of cheating and tax evasion requiring intrusive enforcement. The end result may be a marked shift in the tax burden from the wealthiest Americans to the middle class as many of the wealthy would purchase their expensive products outside of the USA, to avoid the sales tax.

The income tax created more criminals than any other single act of government. ~Barry Goldwater

If you would like to support the Fair Tax

http://www.fairtax.org/campaigns/support_fair_tax.html

For an in-depth read or for printing

http://www.pafairtax.org/resrcs/FAQprint.pdf