Money, Politics, Reform, Gold, & Revolution

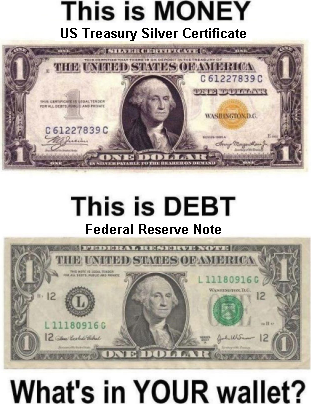

What EXACTLY is in your wallet?

What’s in your wallet? We have all heard the commercial phrase.

Money, what is it really? Beyond the obvious, have you ever thought of where it comes from, who has the monopoly to create it, and if indeed, it is representative of any tangible measure of wealth?

Paper money used to be certificates of obligation backed by gold or silver. In fact, the constitution states clearly that the "Congress shall have Power…To coin Money, regulate the Value thereof, and fix the Standard of Weights and Measures. No State shall coin Money; emit Bills of Credit; make any Thing but gold and silver Coin a Tender in Payment of Debts."

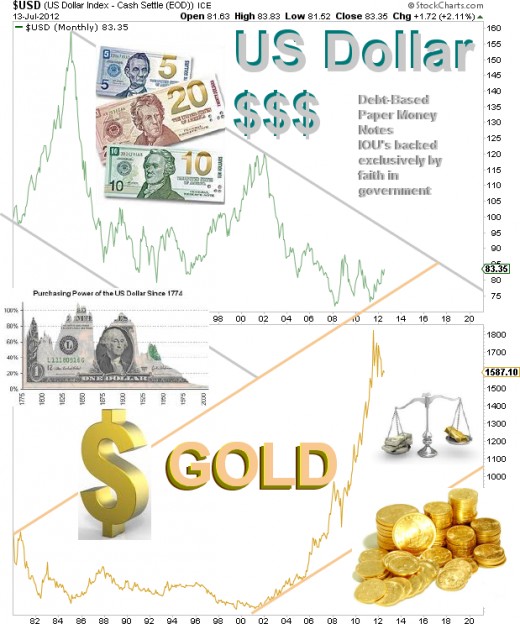

The paper money we use today is a note without obligation backed only by legal tender laws, and is a simply a debt created by the Federal Reserve, which is lent to the US Treasury at interest.

In contrast, the obligation of a certificate states how much of a specific commodity the government of a country will "pay to the bearer." On such Certificates, the obligation reads, "This certifies that there is on deposit in the Treasury of the United States of America (number) silver dollar(s) payable to the bearer on demand."

Connecting the Dots

Why bother pointing this out to those who had not a clue, or to those who are already aware of how the global systems of money attempt to function?

There are many reasons, the most important of which is to illuminate the nature and purpose of real money, and the significant role that our debt-based paper money and credit systems play in each of our lives, and in the destinies of our respective nations.

Jim Grant speaks recently on flawed “faith-based” monetary systems

Global Crisis everywhere you turn

It is clear that the entire world is suffering a succession of severe and persistent maladies, which if left sufficiently to their own devices, may one day lead to a mega-crisis of existential proportion. Although there are numerous global challenges such as war, poverty, disease, hunger, etc. we shall allude in this piece, specifically to the global debt crisis.

The reason for doing so is simple. The debt crisis, which is perpetuating a prolonged economic crisis, has largely spawned from mounting failures inherent within the political and financial spheres, specifically, the way in which these two highly influential spheres of society have intertwined themselves.

As such, if one wishes to get to the bottom of the matter to find out who or what is at fault, and take the necessary measures to protect oneself from the effects while attempting to form solutions, one must eventually seek the lowest common denominator amongst the many antagonists responsible.

The far right, the extreme left, the socialists, the tea party, the terrorists etc. are all bread and circus fodder, which distracts our critical thinking. Surely, someone, some group, or some nation is to blame for such intractable problems.

Perhaps there are people to blame, more likely responsible however, are the structural systems in which such individuals and groups operate that are the cause of egregious errors and widespread flaws in their seemingly logical decision-making processes.

When you finally break it all down, and one-by-one, unpack every potential cause, the common denominator and structural root cause for all maladies and behaviors of willful ignorance stem from the current design, monopoly, and production of debt-based money.

The true nature of real money is indispensible to modern civilization however the present system of money, which has fueled the global economy for the past 100-years, is in contrast, highly destructive and destabilizing to the whole of humankind. In the sense that it currently exists, we must conclude that in its present form and effect, that money is indeed the root of all evil, and a breeding ground of corruption.

“For every thousand hacking at the leaves of evil, there is one striking at the root.” − Henry David Thoreau

Striking Back

If all of this makes you mad as hell, and you feel as though you want to do something constructive about it, then continue to educate yourself on the various philosophies of political economy, monetary systems, and the rule of law.

If you conclude that nothing short of a revolution will change the current status-quo, then we invite you to witness the genesis of intelligent revolution.

A group called Rootstrikers along with the Tea Party and Harvard Law School collaborated effectually across party lines, and held a conference debating the pros and cons of invoking and Article-V convention to amend the constitution.

We trust that these links will help shorten the path to your process of critical thinking however; we strongly encourage you to seek corroboration elsewhere and share with us that which you find most illuminating.

Physical Gold (not GLD or paper futures) is simply a staple insurance product like "life" or "home" to which everyone should reflexively allocate and rebalance on occasion, 10% - 20% of their entire net worth.

Of late, the price of gold is under the gun. Although still strong, its nominal value has been under duress due to the deflationary pressures pervading global economies.

As such, now might be a good time to start gradually accumulating your discretionary allotment. Once you have worked up your holdings to 10%-20% of your entire net worth, you can then periodically rebalance your holdings based upon the changing conditions of your net worth relative to the price of gold and how much of it you have.

Until next time…