What Remains of Wages After the Liberalization of the Exchange Rate?

After weeks of discussions, and after a group of drafts was leaked, the Lebanese government approved last Thursday the "Financial Recovery Plan". As expected, the plan did not come close to correcting the economic imbalance, but it explained the financial and monetary conditions, and suggested solutions to correct them. Note that it is the first time that we have witnessed a government effort stating the Lebanese results of the monetary and financial policies that were followed in the past three decades. What the plan presented indicates disastrous results, whether on the level of the state’s public finances, the economy, or the Lebanese wages and consumption capacity. It is useful now to focus on the Lebanese wages and their ability to consume.

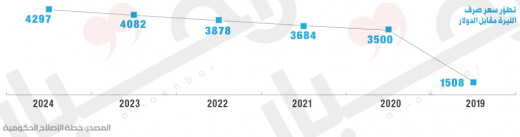

The first pillar, within the objectives of the program presented by the plan, is "to disconnect the lira to reduce pressures on the balance of payments and improve competitiveness." In other words, liberalization of the exchange rate of the Lebanese pound. The plan admits that restoring the exchange rate of the lira to its previous level is impossible in light of the interruption of the flows that were used to finance the current account deficit. She also believes that the adoption of a double exchange rate (official rate and market price), as is the case now, is not sustainable.

Therefore, the plan adopted the liberalization of the exchange rate of the Lebanese pound, instead of fixing that requires unavailable foreign currency flows. Originally, the previous policy led to a real exchange rate inflation, which is determined by comparing the prices of a consumer basket in the two countries of the two currencies being compared. Before the crisis, estimates emerged for some experts indicating that the real exchange rate for the Lebanese pound is three times the official exchange rate. This hidden tumor was the main reason behind harming the productive sectors in Lebanon, especially the industry, and it was he who encouraged the consumption of imported goods due to the impartial purchasing power of the Lebanese pound.

Why Do You Float?

In general and in theory, the devaluation of the local currency produces significant benefits for the economic cycle. As the exchange rate declines, imports will become more expensive, which will reduce the import bill. On the other hand, local products will become cheaper due to the low value of wages and locally sourced raw materials, which increases export competitiveness abroad and increases demand for them.

This bilateral equation, that is, the lower the import bill and the higher the amount of exports, will improve the state of the current account. In turn, an improvement in the current account and an increase in demand for national exports will stimulate aggregate demand and lead GDP to growth. This growth is accompanied by inflation resulting from the high cost of import, and from the impact of increased demand for exports on the rise in the value of domestic production.

But this cycle has risks, because increasing rates of inflation more than rates of increasing wages (which decreased by depreciation of the currency) will lead to a decrease in the real value of wages.

Although the liberalization of the local currency exchange rate is considered a purely monetary pillar, its economic consequences directly affect the lives of citizens and they can sense its effect quickly, whether negative or positive. The problem, however, is that in an economy that is severely flawed, such as the Lebanese economy, the negative impact is greater and more severe. Because of the devastation caused to the productive sectors in the past three decades, it may be difficult to take advantage of the low exchange rate to stimulate the productive cycle, but it becomes evident that the focus on exchange rate implications is on the real value of wages and its effect on purchasing power.

From the Pockets of the Poor to the Pockets of the Rich

The ability to consume will be affected unevenly between layers. One of the most common consequences of a currency devaluation is income redistribution. The difference between the percentage of high wages and the proportion of the high cost of consumption means that there will be profits to be made at the expense of wages by transferring income from fixed and limited income owners to the rest of the economic cycle. This process can be measured by observing two factors: average propensity to consume (Average Propensity to Consume), and Marginal Propensity to Consume.

The rate of propensity to consume indicates the percentage of income that is used in consumption, while what remains is what is saved. The marginal tendency to consume is the ratio of the increase in consumption to the increase in income. Usually, these two factors are not related exclusively to the cost of consumption, but rather to society’s consumer behaviors as well, except that in the case of a “short-sighted consumption model,” workers relate to the cost of consumption exclusively. The "short-sighted consumption model" is based on the individual benefiting from his previous consumption experiences without taking into account the influence of his consumer present on his future capabilities. In other words, an increase in income leads to a parallel increase in consumption without regard to the future value of consumption.

Therefore, when the local currency exchange rate drops, the marginal propensity to consume rises, because a greater portion of the income will go to pay the increase in the consumption bill, that is, the greater percentage of the increase that will be attached to the nominal amount of wages after its correction will finance consumption. However, this applies to people with lower incomes, while those with higher income groups will not be affected significantly because of the depreciation of their income. In his paper, Nasser Badra concludes, in his research "Short-sighted consumption and increased wages: the case of Lebanon", that the consumption model in Lebanon is short-sighted. This brings us to the marginal propensity to consume. For example, this marginal propensity to consume appears in a study prepared by Banque du Liban and Overseas that concluded that it equals 0.74 in 2013, meaning that from every dollar an increase in income turns $ 0.74 into consumption; this is a very high percentage.

Destructive Production: No Use

If we collect these data, we will be in front of a scene that combines the terrible inflated real exchange rate with a high tendency to consume indicating a very high cost of consumption relative to income. In this sense, the effect of fixing the lira exchange rate on nominal wages can be explained. In the mid-1990s, the governments of the late Rafik Hariri presented what might be called a "collective bribery" because it involved relatively high wages with a growing consumption bill until all wages increases served the consumption bill.

In practice, the situation is worse. In the absence of a production infrastructure, whether agricultural or industrial, the benefits of lower costs cannot be relied upon. Production is not able to cover, at least in part, the needs of the local market, while the expected decline in the import bill will come at the expense of the ability of low-income people to consume these goods instead of stimulating the dispensing of imported goods and replacing them with local goods.

Therefore, the decline in the exchange rate may not be beneficial to most Lebanese, but it will have a negative impact on the real value of wages. And most Lebanese, especially those with low incomes, will not be able to consume at the previous level, either qualitatively or qualitatively. Indeed, the bribery they were given in exchange for their silence ended with the terrible imbalance in the economy, which was due to striking the productive sectors.

Phantom Fixed Exchange Rate

So, the Lebanese have no interest in floating the exchange rate? The intuitive answer is no. But the problem is that the Bank of Lebanon has been unable to stabilize the exchange rate since September of last year. Once the parallel market emerged, the exchange rate in practice was no longer fixed. Moreover, the creation of the Banque du Liban by a group of mobile exchange rates covering banks, money transfer institutions and money changers means that the instability of the exchange rate has become applicable to all economic and financial sectors in the country.

The Lebanese wages will be increasingly eroded to finance a consumption bill that reflects the real value of the pound

Where Is the Fixed Exchange Rate that the Plan Talks About?

In fact, the exchange rate remains fixed on the bill for importing only three commodities, namely flour, fuel, medicine, and some services that the state pricing in dollars, such as the cellular sector, for example. This stabilization is a direct government support for these commodities, and they are the most essential commodities in the lives of citizens. As for the rest of the Lebanese consumption bill, it has become subject to multiple exchange rates, most of which are subject to the black market exchange rate.

There is a definite interest in moving to a moving exchange rate. It cannot be assumed that a return to the fixed exchange rate is a real or beneficial option, especially given the terrible imbalance in the structure of the economy and the heavy losses in the current account. The bribery effect has ended, and the Lebanese wages will be eroded more and more to finance a consumption bill that reflects the real value of the pound. The coming days will bear the price of silence over the actions of the Hariri governments, but the debate should be about the best way to liberalize the exchange rate. If the government wants to express the interest of people with low incomes, it must liberalize the exchange rate in a way that takes into account the necessity of supporting the three basic commodities, and indeed must add to it another group of commodities whose support can alleviate the burden of those with low incomes losing the value of their real wages. The current government must also devise an economic plan that reflects the effects of the nineties ’crimes, promotes and adopts the productive sectors and controls the import process, to take advantage as quickly as possible of any possible positive effects of the depreciation of the lira. Otherwise, the suffering of low-income people from the Lebanese people will follow the collapse of the exchange rate we are witnessing without any future benefit.