O'Malley's Maryland Rain Tax Details Prove Fatal

See why Maryland Governor O'Malley's Rain Tax, (Watershed Protection and Restoration Program), is doomed by it's details.

Monday, June 24, 2013 Daily Constitutional editorial from the Curmudgeon's desk: GA Anderson

Maryland's Impervious Surfaces Tax

It may not be fair that Maryland Governor O'Malley's "Impervious Surfaces" tax, (intended to finance the State's Watershed Protection and Restoration Program ), has been popularly dubbed "The Rain Tax," but it certainly should have been politically predictable.

Consider telling property owners they would have to pay a tax based on the amount of rain-blocking surfaces on their property. Consider explaining that things like their driveway and the roof on their house created polluting runoff because they did not allow the rain to soak into the ground where it could be naturally filtered.

Then consider that this new tax was called the Impervious Surface Tax and was intended to address the pollution costs of stormwater runoff from those massive mall parking lots - but it also applied to the roof over your head.

That's right, Maryland is going to tax you for blocking the rain from following its natural course.

For the common good, the "Rain Tax" is born.

Regardless of the program's intent, that explanation was all the bill's opponents needed. And the "Rain Tax" burst onto not just the state, but also the nation's landscape.

Fox News on Maryland's Rain Tax

The "Rain Tax" Backstory

It's all about cleaning up the Chesapeake Bay. The EPA, (Environmental Protection Agency), determined that the largest source of pollutants in the bay is stormwater runoff. The runoff from impervious surfaces, and poor agricultural land management practices frequently contains oil, dirt, nitrogen, phosphorus, and other pollutants; and that runoff flows into the bay.

In 2010 the EPA mandated that states bordering the Eastern Shore's Chesapeake Bay reduce stormwater runoff by varying percentages, (about 20%), no later than 2017. Although the EPA issued the mandate, it did not provide the funding. Each state must fund its own efforts to meet the EPA goals.

Beyond task-specific conservation programs; this can only be accomplished by building very expensive runoff control devices. Maryland’s cost for this is estimated to be $14.8 billion.

Rather than create a new tax on every Maryland citizen, the Governor's idea was to tax Maryland's property owners proportionally - based on the amount of runoff they created, (or facilitated).

Looked good on paper, but not the 5 o'clock news.

Especially when a supportive organization like the Chesapeake Bay Foundation comes out in defense of the "Impervious Surfaces" tax with a statement like their Maryland Executive Director, Alison Prost, made in an interview with a local TV station:

“All residents of Maryland are a pollution source,” she replied. “Everyone wants to point the finger at some other source that’s going to solve the problem.

It’s going to take all of us collectively, rolling up our sleeves, and also taking responsibility for the choices that we make. This is one way for Maryland residents to own up to the pollution they contribute."source: Washington Channel 5 News

That's right, she said you are a polluter for having a roof on your house.

Some Marylanders get free rain

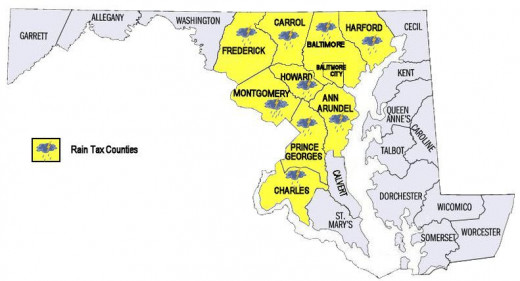

The first challenge to O'Malley's Rain Tax will probably come from the courts, because it only applies to some Marylanders. Those in the nine largest counties, and Baltimore city.

There are 23 counties in the state, but the Rain Tax will only apply to the nine largest Western Shore ones: Arundel, Howard, Carroll, Harford, Charles, Montgomery, Prince Georges, Frederick and Baltimore counties.

But what about the Maryland counties on the eastern shores of the bay; Cecil, Kent, Queen Anne's, Talbot, Caroline, Dorchester, Wicomico, and Somerset? Don't they have driveways, roofs, and malls too?

Could it have anything to do with the fact that the Eastern Shore counties of Maryland vote Red? And are a bit more independent minded. Did O'Malley see the Eastern Shore counties as a fuse he didn't want to light? Of course not. That would just be politics, and he has already stated that the Rain Tax is for the greater good of all Marylanders.

Maryland counties subject to Rain Tax

10 Counties - 10 Tax Rates

That's right, 10 different tax plans and rates. The state law left it up to each county to formulate and implement its own tax plan. Which would appear to be fertile ground for the next challenge to the Rain Tax - a citizen's revolt.

As the county plans were unveiled, the disparities were glaring. From Baltimore county's highest rates that could cost large commercial property owners hundreds of thousands of dollars per year, and churches and non-profits tens of thousands, to Frederick country's "protest" rate of one penny per year.

Imagine the outcry when circumstances provide the example of two business, (or home owners), across the street form each other; but separated by a county line. One business could pay tens of thousands in Rain Tax, and the other only a few hundred dollars.

And, it gets even more confusing. Many of the counties have no plans or procedures for appeals, rebates, or any other method of mitigating the tax impact in cases where it would be unfair or an undue burden.

Baltimore city is not one of them. It has already started giving some of the city's largest commercial businesses waivers - in June of this year, (2013), it granted several port and harbor property owners an 85% waiver. Which, based on one businessman's complaint that his Rain Tax would be over $400,000.00, means the city could be giving favored business discounts worth hundreds of thousands of dollars.

Other counties have plans to help homeowners reduce their Rain Tax too. According to Adam Ortiz, Prince Georges county's Department of Environmental Resources acting director,;

"Property owners who have environmentally friendly features on their land, such as rain gardens, cisterns, rain barrels or green roofs, or remove pavement from their lots entirely, can qualify for reductions in their assessed rain tax fees.

Source: The Baltimore Sun

It doesn't appear difficult for home owners to read that as saying; tear out your driveway and stick a barrel under your downspout, and you can reduce your Rain tax. And what about that "green roofs" part? Is he suggesting a return to sod roofs?

How the Rain Tax will be determined

Contrary to many pundit claims that Marylanders are going to be taxed on how much rain falls, the Impervious Surfaces tax is not based on rainfall, it is based on impervious surfaces. Of course.

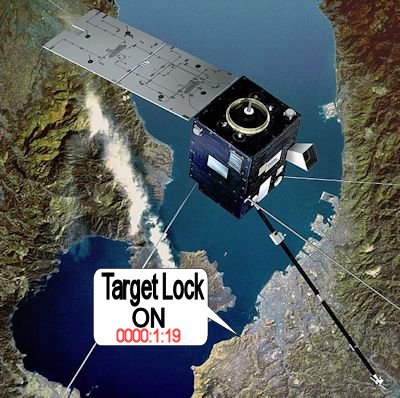

That doesn't mean county inspectors are going to visit you with a tape measure and clipboard. Maryland is using technology and standards. They are going to use satellite imagery, and a defined impervious surfaces unit, called an “equivalent residential unit”, or ERU.

The satellites imagery may be technology, but the ERUs are anything but standard. Depending on the county, an ERU could be 500 sq. ft., as in Harford county, or it could be 2800 sq. ft. like it is in Ann Arundel county. And how much will the Rain Tax be on an ERU? Once again it depends on the county. It could be as little as that one cent in Frederick county, or $15 (per ERU) in Harford county, to as much as $88.40 per ERU in Montgomery country.

This could be the seed of a new accounting field - ERU accountants. Or a new Wall Street game - ERU derivatives.

Staying with the technology theme, Howard county has even teamed with Google Earth to offer an ERU calculator. You just input your address and a Google earth image of your property pops up with the impervious surfaces highlighted, and, an estimated tax bill.

Screenshot of Howard counties "free" Rain Tax calculator

Author's note: This screenshot was taken during article research June 16 - 18, 2013. But apparently Howard county has now amended its Rain tax and decided to charge flat fees based on property size. The URL now returns a 404 error message, and follow-up research discovered this June 20 Howard county council release regarding the new flat-rate fee structure- GAA

Under the revised plan, owners of townhouses and condominiums would be charged $15 annually. Owners of single-family homes on lots up to one-quarter acre in size would pay $45, and residential properties larger than one-quarter acre would be charged $90.

The release notes that commercial properties will still be charged based on an impervious surfaces calculation, but it does not note the method of calculation that will be used.

Maybe it will be county inspectors with tape measures and clipboards after all.

The Curmudgeon's take

Note: The Curmudgeon is a resident of Maryland

Maryland's new "Rain Tax" is like a block of Swiss cheese - it has so many holes and convolutions that it challenges a rational mind, (unlike my own), to foresee it retaining validity. As the title states, it is the law's details that will prove fatal:

- 10 different plans - 10 different tax rates

- no standard unit of measure agreed upon

- no standard implementation plans: full price from the go, 3 year phase-in, 10 year phase-in, rebellious 1 cent rates, favored waivers, etc. etc.

- applied to churches, non-profits, and civic organizations, but not to state, federal, or firefighting properties

- demonstrably discriminatory in several categories

- and just flat-out crazy

Town council meetings are already being overrun with angry protesting citizens. Council members are already granting favored businesses waivers. And even some supporting legislators are backing off of their support for the tax, as demonstrated by the video below.

MD State Sen Kasemeyer (D) "It's not over yet!"

Maryland is a Blue state, and under Governor O'Malley's guidence it has already earned a nickname as the "Tax Me" state. 37 new taxes, and a recent substantial gas tax increase preceded this latest "Rain Tax."

To paraphrase a local community paper pundit:

Consider all the ways we are taxed in Maryland.

When we’re born (birth certificate fee), when we die (death certificate fee)

When we earn money (income tax), when we spend money (sales tax)

When we own property (property tax), when improve that property, (building permits), and when we sell that property (capital gains tax - hopefully)

When we go to a concert or ball game we pay an amusement tax, and when we vacation in a hotel or motel we pay a accommodations tax

When we own a vehicle (license, registration, tolls, gas tax) and special taxes on cell phones, tobacco, alcohol, energy, etc.

Then, when we die, they tax our income all over again (death tax)

And for businesses in Ocean City, Maryland - they even tax our bowel movements (flush tax).

But have they have gone too far trying to tax us for the rain? Or could this be a covert jobs bill? Think of all the new industries that could be created.

- New Astroturf driveway covers to fool the satellites

- New life for surplus military camouflage net sales to hide your impervious surfaces from those spying satellite eyes

- New jobs for turf farms hiring to meet the demand of all those new sod roof requests

- New carwash jobs for all those muddy cars parked in dirt lanes instead of on what used to be driveways

- New government jobs as counties scramble to hire new impervious surfaces inspectors

- ERU accountants for large businesses seeking loopholes and waivers

The list goes on and on, but still, taxing the rain? What next? A tax on reflective surfaces that bounce away the sun rays needed to maintain earth's temperature equilibrium?