Oil And Gas Prices

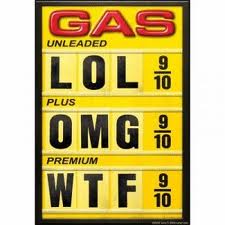

Been To The Pump Lately?

I had a brief encounter with a liberal loon concerning the Big Oil Boogie Man that Obama created the other day concerning subsidies to the oil companies. The article in question wasn't really about the price of oil, oil production or anything close. The thesis was the creation of yet another Boogie Man by the Boogie Man-In-Chief. I was told, in the usual liberal fashion, that I didn't know what I was talking about as this person had been in the oil industry for however many years, yadda, yadda then more yadda. It degenerated into a personal attack, again not unusual, against myself. You never got to read it because I delete personal attacks from my Hubs. They have nothing to do with the subject at hand.

As I was reading this morning, I hit a few articles about gas prices of late. So the question is, "Why Are We Paying $4.00 a gallon for gasoline?" Obama can create all the boogie men he wants to explain why, other than the fact that he has publicly stated that he wants $7 a gallon fuel for our primary means of transportation, the price of gas has more than doubled since he sat his butt in the hot seat of being President. I never feel sorry for Obama because he asked for everything he is getting or not getting.

Now bear in mind that I know nothing about oil and its production and obviously don't have any idea what I am talking about - as usual. But lets take a look at the "why" here from an angle other than the boogie man angle. One has to break it down to what constitutes 100% of the price to get a fix on this subject.

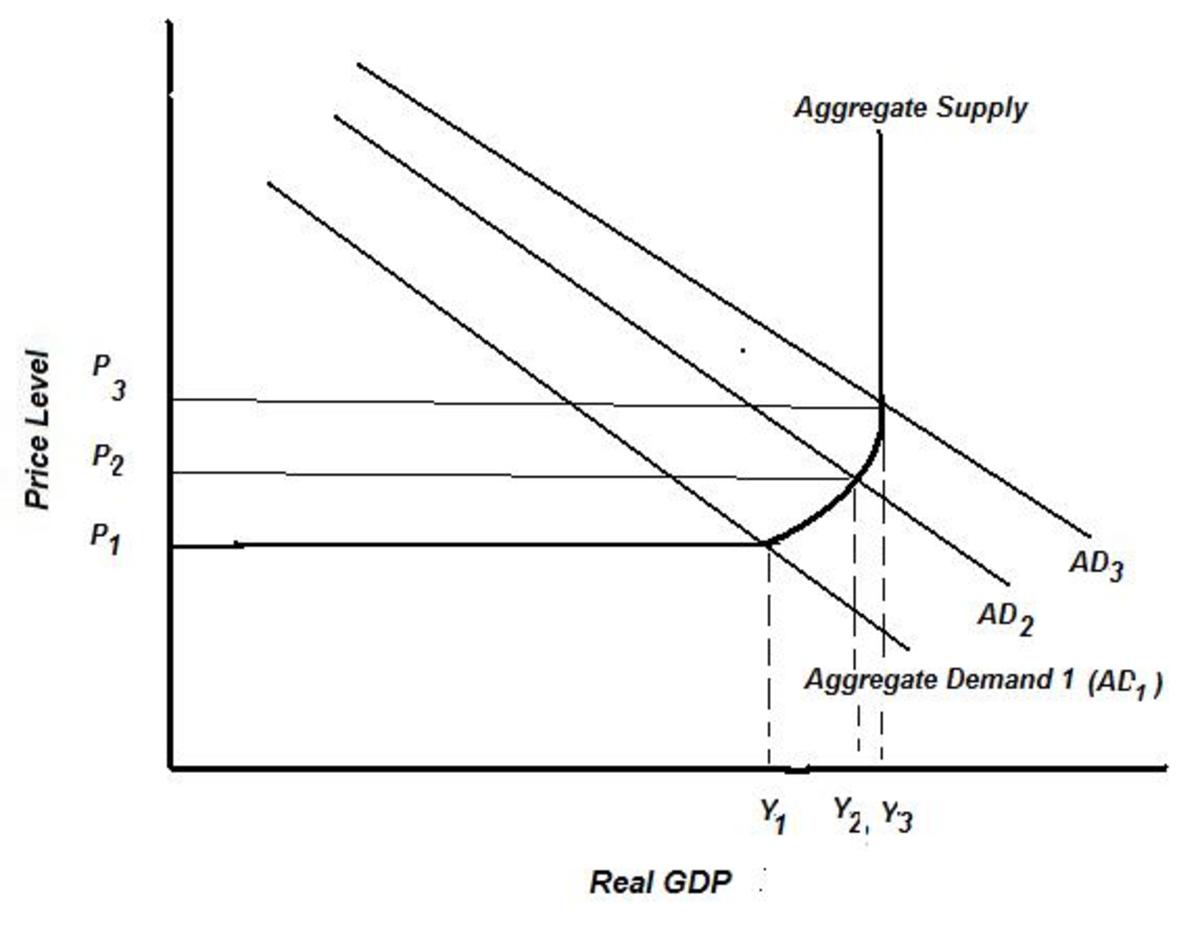

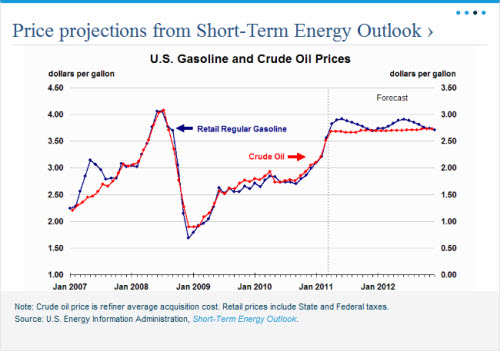

Somewhere around 68% of the price of a gallon is centered on the price of crude. The graph below shows the correlation between the price of crude and the price of gas. The left axis is gas price and the right axis is the price of a gallon of crude oil. Note that move upward and downward with almost being bosom buddies. This chart was made available by the Energy Information Administration and not something I, personally conjured up.

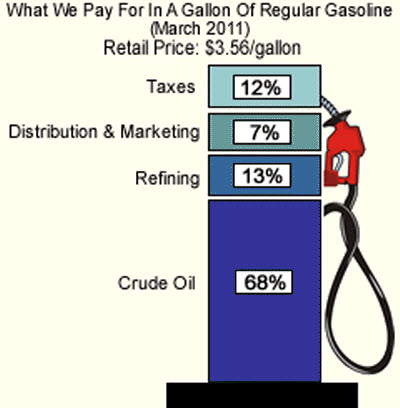

You can usually figure out the price of a gallon of gas if you know the price of a gallon of crude. Take the price of the crude and add a dollar. So if a barrel of crude (42 gallons) is $105, that places the price of the crude at $2.50 and results in the price of a gallon of gas somewhere in the range of $3.50. The question at this point is really where the $1 goes that isn't buying the crude? The next graph is the answer to that question.

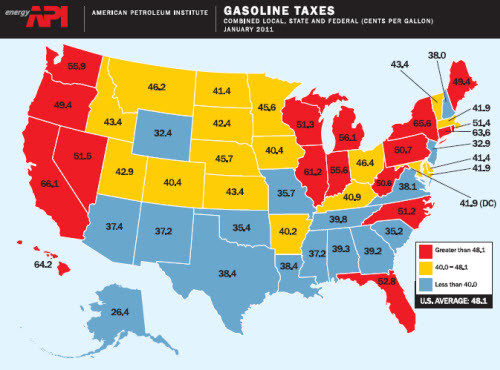

To explain state and federal taxes, one must use the average of 43 cents per gallon. It's right there in the price which isn't how taxes are usually viewed. The norm is a sales tax. This isn't the norm since it is embedded in the price. Viewed askew like this, it results in a 13,6% tax from a sales tax perspective.

Some states, such as California, have higher tax levies than others. Californians are averaging around $4.26 per gallon because of the state tax. California's government actually benefits from higher gasoline prices because they levy their gas taxes like a sales tax. The federal tax is fixed across the state lines at 18.4 cents a gallon. Most states don't follow California's lead as my last graph illustrates

The remaining 53 cents per gallon goes to refining and marketing costs. Whether you question if this is a fair price or not isn't the subject here. It is what it is but the rate of return on that end hasn't been really all that spectacular. It does cost money to refine the crude.

While we are saying "OUCH" at the pump, we do continue to pull that lever and watch the numbers spin by based upon the utility of the product we are consuming. The world runs on oil whether Obama likes it or not, whether a tree hugger likes it or not or whether you or I like it or not. It takes people and goods from Point A to Point B. Pack up the two kids and the dog into your tin can of relative comfort and off you go. Does that have any value?

From a producer's standpoint the price is a higher price for replacing a gallon of gas in inventory. Those inventory replacement costs keep getting higher as the government intervenes. That's a stone-cold fact. This administration is threatening big oil (the boogie man) with higher taxes on exploration and development of our domestic crude. That's a fact. What is the cause and effect of this? It discourages, rather than encourages the oil companies. What will they do? Go elsewhere to a more business friendly environment. Does that ring a bell?

Okay, so I know nothing about what I am talking about here. But at least I give it the old Bullfrog U try.

Have a nice day.

As Always,

The Frog Prince