Oil From "War" to Crisis: Towards a New "OPEC +"?

With the absence of the ground for the expected OPEC + negotiations tomorrow, Thursday, Donald Trump's options to deal with the repercussions of the "price war" on his country are narrowing, in light of the increasing repercussions of the Corona virus and the effects of the first month of the battle that his ally Muhammad bin Salman pushed, which makes The last weakest link

The fallout from the Corona virus was a bad time for the Saudi-Russian "price war". But the end of the battle, a month after the collapse of the coordinated reduction agreement for oil production, which has been in effect since the beginning of 2017 within the OPEC + coalition, does not seem certain, in light of the lack of clarity of the results of the group's upcoming meeting on Thursday, except through Saudi statements And Russia still sees the coalition as a way out of the crisis, and another American seeks to reassure its severely affected energy sector.

While the paths of solution go beyond the path of the OPEC + coalition in its present form (comprising OPEC countries and independent producers led by Russia), there are three scenarios looming for a broader and longer-term solution. These scenarios may end: either to the expansion of "OPEC +" to include the United States and other countries such as Canada and Brazil (which is a Russian demand expressed by more than one official); or to the exit of Russia to create an American-Saudi coalition that includes allied countries (this idea, which is a girl The ideas of the National Security Advisers in the White House are currently frozen, even if their mere presentation sheds light on the depth of the crisis facing the global oil industry and the growing importance of it in relation to the American economy); or Trump goes to the option of forcing Riyadh to bear the largest share of the costs of reducing production.

Out of the enthusiasm shown by Saudi Arabia regarding the agreement, and its willingness to retreat from the option of dumping the market, in conjunction with its postponement of official prices for the month of May pending the outcome of the meeting, this does not mean, according to experts, the end of the crisis, especially in light of the entry of global demand for oil An extremely slow spiral of unknown duration, ranging between 25 and 30% (25 to 30 million barrels per day), due to the isolation measures imposed by the epidemic. This point was clearly mentioned by Federal Reserve Chairman Jerome Powell last week, saying it would take "a long time" to get rid of the global oversupply.

With regard to the transformation of the "war" into a crisis, it moved from the stage of attacking Russia after the latter's decision to withdraw from the production-reduction agreement, to the stage of seeking a satisfactory solution for both parties, after the US President's foreign bets to press Moscow to adhere to the OPEC proposals in proportion to the prices Washington maintains its position in the market. Also, the failure of his internal bets to take advantage of cheap oil, whether by filling the entire oil reserve tanks, and granting oil companies tax exemptions and interest-free loans, or even taking advantage of the price of cheap gasoline in the framework of his election campaign, after he appeared before public opinion in a position responsible for the actions of the Saudi crown prince Muhammad bin Salman, especially since he welcomed at the outset that the prices had reached a level "I had never dreamed of before".

In front of that, Moscow appears to be in a strong position, despite the great losses it has suffered. However, in light of the increasing losses of the shale oil companies, of which only five companies are making profits at the present time, it seems that Russia is betting on Trump's pressure on Riyadh to push it back, knowing that the American President's reaction may be more violent before the presidential elections are due. However, if that does not succeed and consequently lead to a strategic change in the relationship between Washington and Riyadh, then the Russians will be waiting for the US oil and shale companies to leave the market, which would restore prices again. And, according to Rosneft CEO Igor Sechin, it could reach $ 60 a barrel.

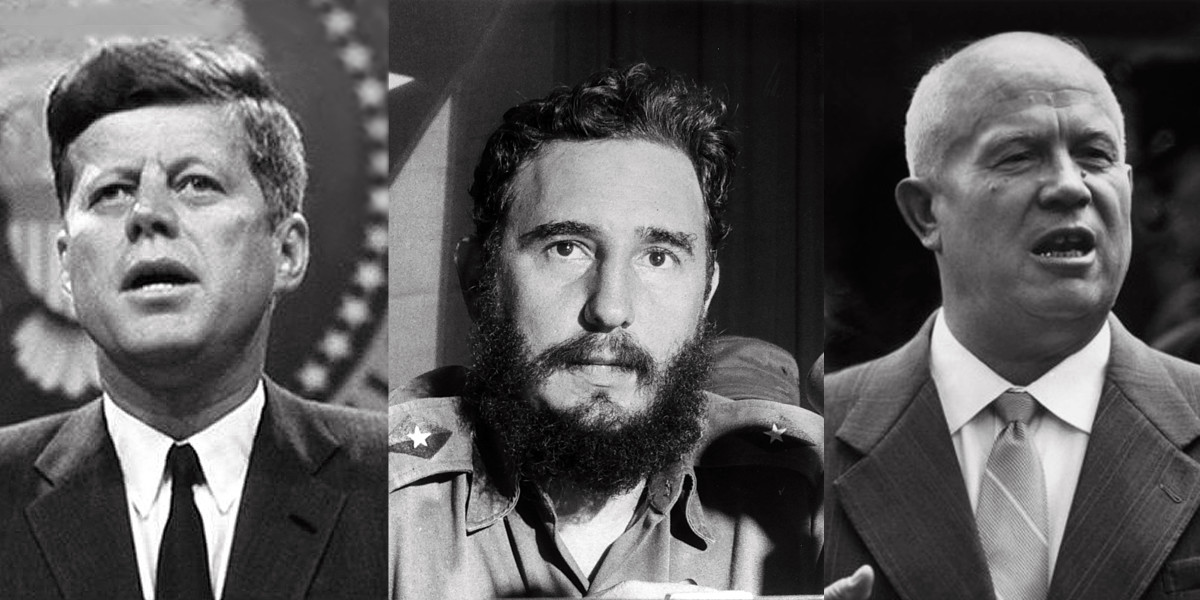

Into a Triple Alliance?

Saudi measures may succeed in returning Russia to the OPEC + table. But the desired goal, which is an agreement that guarantees a joint move to cut 10 million barrels per day, as Russian President Vladimir Putin declared, seems to be difficult to achieve without involving the rest of the producers, especially the United States. Moscow was ready to deal with Washington, after it refused to interfere as a mediator. For the Russian and Saudi Arabia, the latter's entry into the line appears as a partner, as well as for Russia and Saudi Arabia, also necessary to achieve this goal, even though reducing global production by 10% will not be sufficient to balance the bloated market, given the massive decline in demand for crude, in parallel with the filling of reserves in the world The most recent. The direction of the tripartite agreement reinforces the assertion of the Director-General of the Russian Fund for Direct Investment, Kirill Dmitriyev, yesterday, that "we are closer than many people think", and revealed that his country "is working closely with Washington to join the new oil agreement." However, until now, the idea seems far from the mind of Trump, who confirms his willingness to join Saudi Arabia and Russia, if necessary, in the ongoing talks, and nothing more. And he expressed his refusal of this option, last Saturday, by saying that the United States "will not join them ... I don't care about OPEC", and indicating yesterday that the OPEC countries did not pressure him to ask the oil producers in the United States to reduce their production to support Global crude prices, but he added that US oil production automatically declined, however.

Moscow still appears to be in a strong position, despite the heavy losses

Trump's narrow options, in the event he rejects a tripartite partnership with Riyadh and Moscow in distributing market shares, may lead him to accept them in the end, or move in one of two difficult options if Moscow insists on its position at the next meeting:

The first is to go toward forming a US-Saudi oil alliance that, according to observers, would make Saudi Arabia and the United States, with their current production, acquire about 25% of the oil market, and with the addition of other producers to this alliance, the percentage will increase, allowing both countries to acquire Significant influence in setting prices. Although the project, currently frozen, has already been put on the corridors of the White House, an option of this kind seems unlikely at the present time, especially since it is very difficult for the United States to coordinate a production cut with another country, given that the oil companies are not state-owned. .

As for the second option, Trump is going to force Saudi Arabia to stop the "war" and impose customs duties on oil imports, and thus force it to take the process of reducing production on its shoulders and allies away from Russia, regardless of the large losses and potential risks, with its impact on the relationship The two are strategic. It is also an unlikely option, as it requires first a radical change in foreign policy, given the connection of American projects in the region with Saudi Arabia, and secondly, because it requires Russian-American cooperation in the end.

Saudi Media: The Solution With Washington's Accession

The Saudi semi-official media recently focused seemingly in a coordinated manner on the idea that there is no solution except by entering the United States in the OPEC + club and submitting to reduction decisions. The journalist specializing in economic affairs, Mohamed Al-Bishi, in an interview with Russia Today, said: "The solution depends on the United States agreeing to participate in the policy of reducing production, if Russia accepts to actually share this reduction with Riyadh."

In the same direction, analyst Sherine Damj, in an interview with Al-Arabiya channel, saw that "OPEC Plus alone cannot reduce oil production by between 10 million and 15 million barrels per day", considering that "reducing global production by this amount requires the participation of producers Outside of OPEC Plus, like the United States ». For his part, the oil expert, Kamel Al-Harami, said in an interview to the same channel, that "OPEC" cannot reduce its production by about 3 million barrels per day, to restore the balance to the market that lost its balance due to the decline in Chinese demand. It seemed remarkable to repeat the headline: "Does America join OPEC Plus in reducing oil production?" In more than one media. Under him, Al Arabiya stated that "there are those who believe that any effective cuts should include the United States, the largest oil producer in the world today". Abd al-Azim Mahmoud Hanafi, in "Al-Khaleej" newspaper, under the same headline, summaries of some American research that talks about the possibilities of America joining OPEC, "to lead with its allies in the organization the rudder in controlling and controlling international oil prices".