On the European Vision of the Chinese Challenge

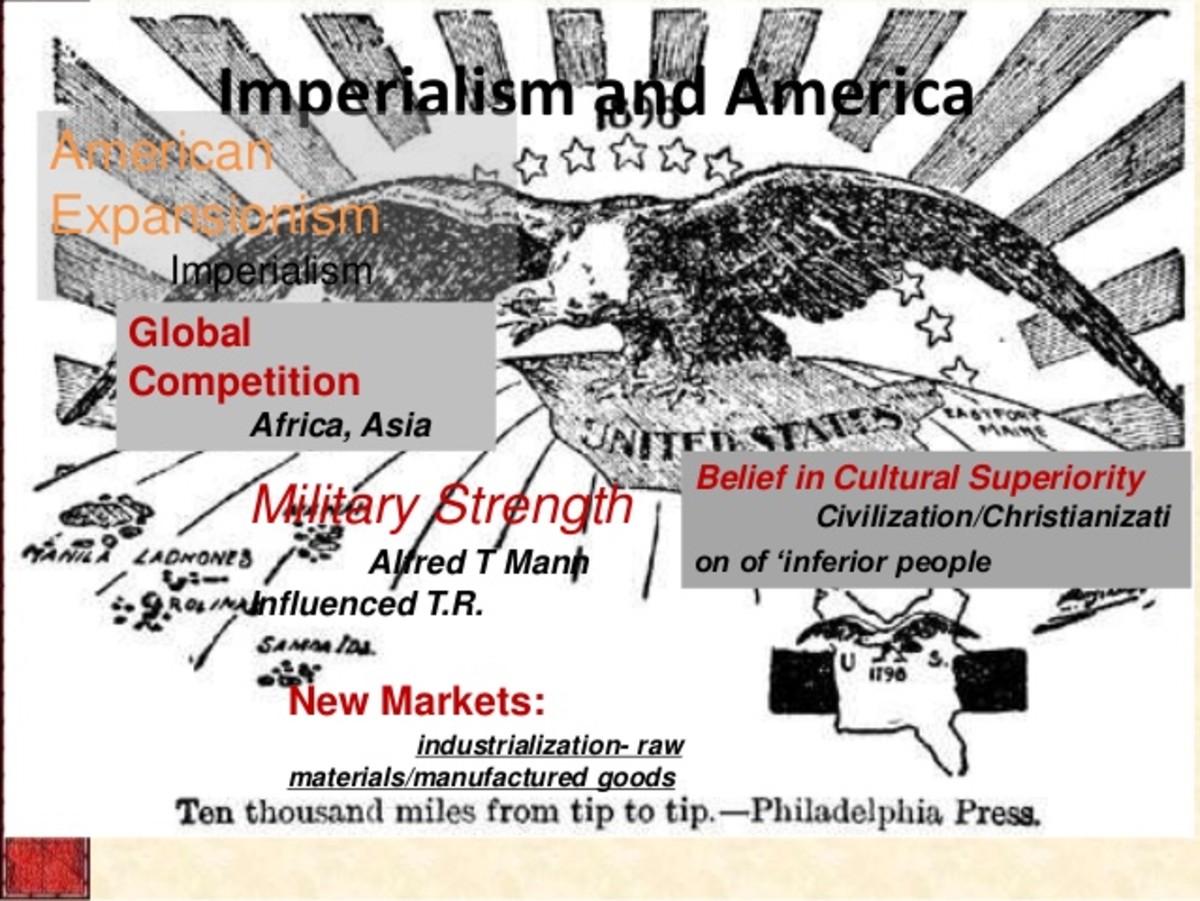

"There is a ghost hovering around Europe". He is not the specter of communism, as Marx and Engels said in the introduction to the Communist Manifesto in 1848, and if he holds an affiliation card to the Communist Party, it also comes from outside the continent, and they call it the threat of Chinese expansionism. No one is interested in spreading communism in Europe, and this European-origin ideology could not have been realized in political power in any of the Western European countries, where the Communists were in their best days, with the exception of Germany, far from political power. But today, popular China is reappearing in European official and academic discourse not only as an economic danger, but also as an ideological danger. During a conference on security on the European continent in February 2018, former German Foreign Minister Sigmar Gabriel said: “The Chinese Silk Road Initiative is not, as some people in Germany believe, an emotional memory of Marco Polo, but rather an attempt to imprint the world with a comprehensive, institutionalized system. It is based on Chinese interests, and it is no longer only a matter of the economy, but China establishes a comprehensive alternative system for the West. The Chinese model does not resemble our values based on freedom, democracy, and individual human rights”. The comprehensive alternative system that Sigmar talks about, begins with penetration into the old system as a first step, by seeking more influence in existing international organizations, and then moves on to establishing organizations equivalent to traditional organizations with global influence. Getting international organizations and building others in line with China's ideological interests and vision is a strategy founded by Mao Zedong, according to Jean-Pierre Capstan, professor of political science at the Baptist University of Hong Kong. In 2012, China established a so-called "16 + 1" summit in Europe, an initiative for cooperation in the fields of investment, transport, technology and finance, that has held several conferences so far. In this organization, China is the one, in addition to 11 countries from Central and Eastern Europe that are mainly members of the European Union, and five countries that are not members of it, and accordingly, according to the director of the China-Asia Program, Frankus Godment, they are less immune to the strength of Chinese attraction, and Europe becomes more subject to division. A hack by China. This is an example of China's policy in the field of regional and international organizations, in which Europeans are most concerned that they are in their own homes. Of course, this adds to the purchase of Chinese companies for ancient European companies, and strategic and important ports, such as the Greek port of Piraeus, part of the French port of Toulouse, in addition to many other examples.

Another Point of View: Pragmatic Realism

It may not be true that the owners of this view constitute a balanced current in Europe, but it consists of individuals and weights in the academic and journalistic circles. Indeed, the American impact in Europe is the loudest, and it is primarily a tactical one, and it aims to mobilize the allies and recruit them for the coming battle. Nevertheless, realists admit that we have already grown into a multipolar world, and even expect that China will be the most prominent pole. Of course, this will have decisive results in the field of international relations, the most important of which is the central atrophy of the old European-American strategic alliance. Here, Europe must search for a place, far from a strategic positioning with one of the parties, in a multipolar world.

Zirin does not see the Americans as being able to hold back the Chinese leadership

One of the most important scholars specializing in Chinese affairs in Germany is Frank Zerin, a representative of this trend. In his latest book published this year, Zerin answers this issue through the title of the book, which is a question followed directly by the answer: "The future? China". He says: China will definitely replace the United States of America. In some areas, such as the purchasing power rate, the Chinese economy is the largest, although average per capita income in China is close to that of Bulgaria. For the first time in 500 years, Western sovereignty over the world is coming to an end. Since Christopher Columbus accidentally discovered the continent of America, it has been us who set the rules of the game in the world. We are the leading technical power, despite being a minority in the world, as the West does not constitute more than 15 percent of the world's total population, while China is 18 percent. Here, a kind of balance is restored, as the majority in the world must take its place. The main question here is not whether we can stop this climb or not, or whether it will happen or not, then it is coming for sure. The question is, "What are our perceptions and our reaction to this rise?" Zerin does not see the Americans as having the ability to curb this leadership. The Chinese have almost no effective foreign debt. The balance of trade tends to their advantage. China's per capita income rate is relatively low. This means that when investing in China, the opportunity to obtain greater profit returns is higher than in countries such as America or Japan, where many sectors are long-completed and completed, and where the economy’s position necessitates more dependence on Debts. The rate of car ownership in America, for example, is about 800 owners per 1,000 people, while in China it does not exceed 200, so sales of electric cars in China are the highest globally, and it is a sector that is likely to be the locomotive of the global economy in the coming years. Besides China's relatively low foreign debt, its savings rate is close to 30%, while in America it does not exceed 6%. Of course, according to Zirin, indebtedness is not necessarily bad, if the debtor is not an external party with an ability to put pressure, and thus the degree of confidence in the economy in general and the overall potential of the potential is enhanced. Some German commentators refute this pink image, and talk about the end of the Chinese miracle, after the Chinese economy this year recorded growth figures of approximately 6.6%, which is lower than the rates recorded in previous years. Zirin answers that this is normal and possible, as the last time the American economy recorded a growth rate of approximately 6.5% was in 1965, then the size of the economy became greater than before, and similar growth rates can no longer be achieved. Therefore, the decrease in the growth rates by two points or more is not an indication of the decline in the economy. The most important factors that can be decided in the economy today are the amount of foreign exchange reserves, which for China is very huge. And before these reserves begin to thaw dramatically, we cannot talk about a downturn in the economy. On the ground of the crazy rise in real estate prices in Chinese urban areas, some are betting that a crisis similar to the one in 2008 is taking its toll there, and that it could undermine the country's financial stability. Here, Zerin distinguishes between the persistent (fixed) real estate crisis in America and the unstable or non-structural real estate crisis in China. In other words, the Chinese state has all the means to control it and limit its influence. For example: enacting a law in which one family is only allowed to own one apartment. Difficult lending terms. Increasing requirements on construction contractors, such as ensuring that the sale of the apartment is guaranteed before its completion, and that these procedures were previously approved and succeeded.

Criticism of Pragmatic, Realistic Direction

The problem with this trend is that even when it talks about the structural differences between the Chinese and Western economies, its analysis remains limited to the quantitative aspect, as well as to procedural processes, without looking (intentionally) at the deep nature of the economy in both cases. Neither the form of private property and its legal outputs, nor the nature of investments, whether inside or outside China, allow us to describe the Chinese economy as a purely centralized capitalist economy, living and prospering on global disparities in commercial location and wealth. The dominant class and its political expressions (the Communist Party of China) confirm this difference. Comprehensive land commodification, in the legal sense, is the basis that must be examined when we classify a country as capitalist, socialist, or transitional with special features. It is here that Chinese privacy prevents us, as Samir Amin says, with its extremely important results, from simply describing contemporary China as capitalism. The massive involvement of private banks in the West in financial speculation, and the transformation of the real estate sector into a source of profits greater than the real value of this sector as a whole, always carries with it the risk of a repeat of the 2008 crisis. This essence does not exist in China. The role of the state there is the decision, and it has the authority to define and direct financial flows to various sectors. The shape and essence of this role - and this is what Zerin and others in Europe will not endorse - is related to the nature of the ruling class in China, and the legal form of ownership, based on the socialist concept according to Chinese characteristics as it is called there. The concept and consequences of Chinese land ownership law differ from the classical capitalist form, as well as from its current neoliberal development, which makes the land as a whole a subject of speculation and the creation of imaginary money.

Representatives of this view do not speak outside the logic of hierarchy within the scope of the capitalist rivalry of the dominant powers, that is, within the rules of the game itself, those drawn by the West since the era of commercial capitalism. The Capital Center Club is a closed club, similar to the nobility in the feudal era, and there is doubt about the ability of this club to tolerate a newcomer in the size of China, which, despite its adaptation to the new world order since the 1980's, maintained its independence and elements of its strength. China's success in pioneering the global economy, changing terms of trade and the flow of goods, and even changing the position of the world, may not be possible within the logic of the capitalist system itself. In other words, the triangle, as Samir Amin calls it the club of imperialist states made up of America, Europe and Japan, expands to become square with the addition of China, contrary to the logic of the functioning of the fully centralized world economy. Sometimes the straw breaks the camel's back if its load reaches its maximum capacity. Here I want to pretend that the camel is in front of the task of carrying several large bags of straw, and has to walk in the rain.

Sources

This content is accurate and true to the best of the author’s knowledge and is not meant to substitute for formal and individualized advice from a qualified professional.

© 2020 Hafiz Muhammad Adnan