A Recent History of Politics and Progress

Politics

Consider our recent American political experience. The common understanding of recent American political and economic history has largely been a misinterpretation, and is at the heart of the current extreme populist momentum, vis-à-vis Bernie Sanders and Donald Trump. For Trump, the overriding cause is not anti-immigrant sentiment, or trade laws, but rather people who feel they have no voice.

The common narrative is as follows: in the post-Reagan years, George H. W. Bush raised taxes (true) and starting an expensive war overseas. Bill Clinton balanced the budget and reduced the size of federal government (false, he expanded marginal tax rates, began to expand regulatory burden, and set the government up for increased spending, mitigated only by congress). George W. Bush reduced federal regulation which led directly to the recession of 2008 and spent a great deal of money on the war in Iraq and Afghanistan (false – only about 1% of GDP). People believe, I think incorrectly, that this broad sequence of events is what has led to the decline of prosperity for the common American.

Economics

Consider an alternative explanation, which also contains the benefit of pointing us towards salvation: the economic history that the people have been sold is false, has not been effective at improving the lives of the honest and hardworking average person, and will consistently lead us to further decline until we properly learn and act upon certain economic truths. This has been true of every president since Reagan.

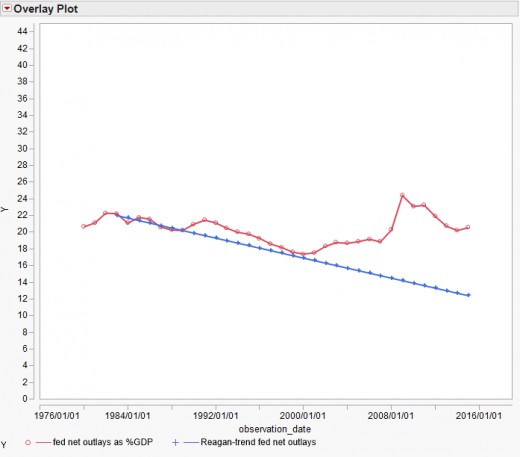

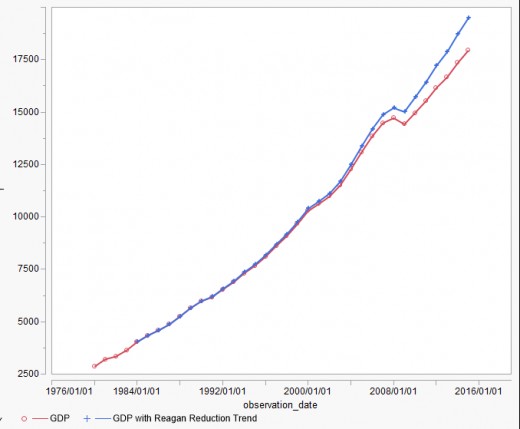

Let’s fact check the economic evidence for this history, and glean what we can from our possible pasts. Reagan indeed set the federal government on a path of lower federal spending rates as a percent of GDP. George H. W. Bush partially reversed this trend and increased marginal tax rates. Clinton, with a republican congress, was forced to keep federal spending smaller than he would have liked but further increased the marginal tax rates. George W. Bush, perhaps contrary to popular opinion, expanded government spending, and therefore continued the robbery of the growth rate of our economy. The Iraq war, whatever you think about it’s geopolitical effects, was not expensive in comparison to total government spending as a percent of GDP, and therefore has not contributed in a material way to a decrease in living standards compared to other governmental growth. Obama has expanded governmental growth in a truly historic way and is the worst offender in terms of growing government spending. He may rightly be seen as the anti-Reagan in this way and others.

The Reagan federal spending trend

Recent GDP vs. median income correlation

Diminished GDP growth due to government burden

Median income suppression due to government burden

It is expenditures, not debt, that most directly affect long term prosperity. This is because government spending, historically with few exceptions, and as an experimental fact with a great deal of evidence, replaces private wealth, and does not add to it.

Citizens

Let us investigate what this means in terms of the ordinary honest hardworking citizen. Democratic and Republican presidents since Reagan have either spent too much or raised tax rates or both. Hypothetical prosperity: if federal spending had followed the Reagan trend, decreasing by roughly 2% over each 6 year period, starting with federal spending at 22% of GDP in 1982, we would now be sitting at a federal spending rate of about 11% of GDP, which is about right. The average government spending over that time period would have been about 16.5%. The actual government spending over that time period has averaged 20.2% of GDP. The difference probably accounts for, rather conservatively, an extra 0.25% GDP growth on average, year over year. This would mean that our GDP would most likely be at least $1.5 trillion higher right now.

This is ignoring state and local spending and regulatory burden. The regulatory burden is now probably around $2 trillion per year. Some regulation is certainly necessary, but conservatively, $1 trillion per year could easily be eliminated. If federal, state, and local spending, roughly 30%-35% since Reagan, and over 40% recently, had been reduced to 20% of GDP, our GDP would conservatively be $3-4 trillion higher than where it currently stands.

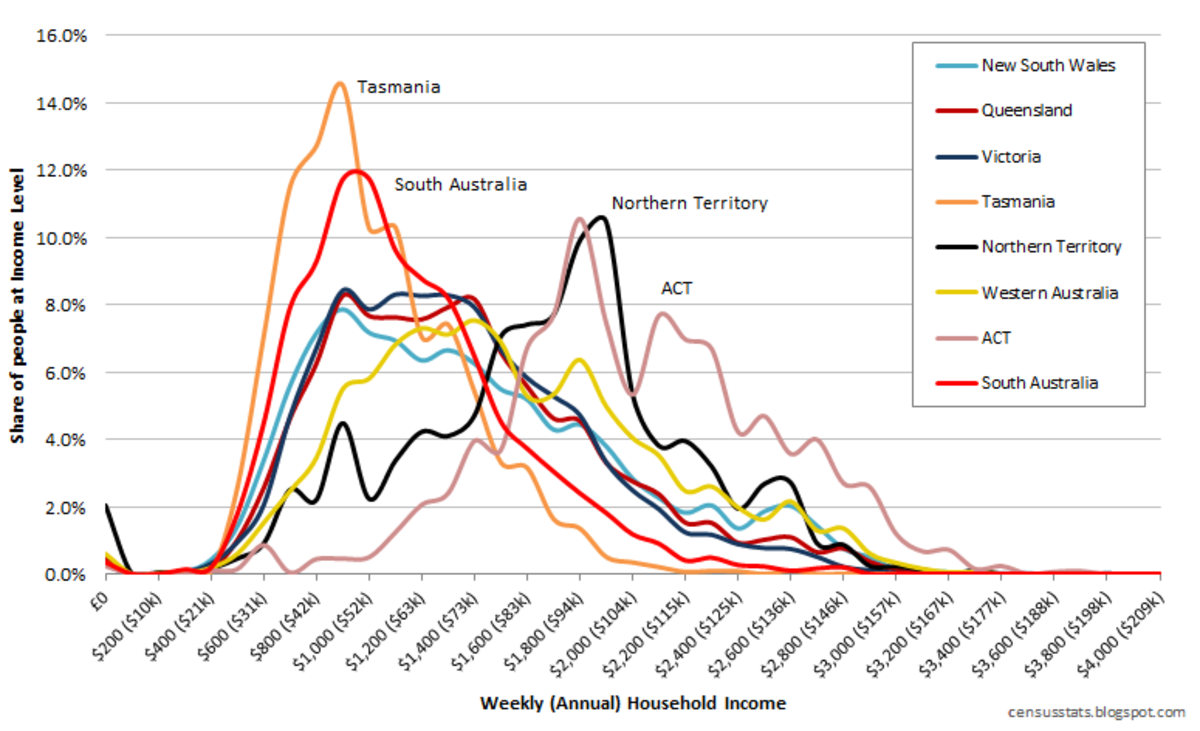

For the common person trying to create a good life for their family, what matters is real income. Real median income has changed largely in line with changes in GDP over the past 30 years, at an average of about 2.3% less than the change in GDP annually. Since 1984, median incomes have only gained about $5000 dollars in inflation-adjusted terms. Were the federal government reduced in size as described above, median income would most likely have increased at least twice as much: another $5000 dollars. And of that income, a much lesser amount would be taken in taxes. If total government spending were reduced to about 20%-25%, median income would probably have grown in that period somewhere between $15,000 and $25,000. These spending reductions would require people to prepare to a greater degree for their own livelihoods, but would not preclude humane welfare measures such as the negative income tax, to provide a reasonable safety net for those that fall on hard times.

Imagine if since the early 1980’s, the median-income earning person had earned an extra $20,000 in real income in addition to the pathetic $5000 that we have actually gained. Imagine we were taxed at an effective rate of 10% instead of 15%, so that we kept an additional $3000 each year – of our own money! With an extra $23,000 in their pockets each year and reliable prospects for further growth, would people be resorting to socialism and anti-immigrant sentiment?

Democrats are following the Republican primary with a barely concealed sense of glee, but they should exert some self-control: the people will resort to increasingly desperate solutions in their party as well, as the economics of large government burden continue to bear down on us. Americans are optimistic, inventive, and entrepreneurial, but we have never dealt well with scarcity. We collectively made a historic economic mistake in the reelection of Obama in 2012, and economic history indicates that things will not turn around until we begin to address the governmental burden underlying our economic malaise. Meanwhile, the fortunes of Trump and Sanders rise.

© 2016 Jeff Evey