Revisiting Bernard Madoff’s Ponzi Scheme

Early Childhood and Education

Bernard Madoff was born in Queens New York on April 29th, 1928. His parents are of Jewish ancestry. His father, Ralph Madoff, was a plumper and a stockbroker. His Mother was Sylvia Muntner. Madoff grandparents had immigrated from Romania, Poland, and Austria. He is the second of three children. Madoff attended and graduated from Far Rockaway High School in the year 1956. He attended the University of Alabama for a year. During his stay at the university, Madoff became a brother of the Tau Chapter of the Sigma Alpha Mu fraternity. He then transferred to Hofstra University in the year 1960, where he graduated with a bachelor’s degree of arts, in political science. He briefly attended the Brooklyn law school.

Career

He founded the wall street firm at Brooklyn law school Bernard L. Madoff Investment Securities LLC and remained working for his own company. He was the companies chair from the start-up in 1960 to his arrest in December 2008. He started the firm from his saving which he had earned while working as a live guard and sprinkler installer. His father-in-law had also granted him additional $50,000 loan. With the father-in-law help and referrals to family members and friends, his business grew from initially dealing with in market quotes -the quoted bids and the asking prices, through the national quotation bureaus pink sheet, to using NASDAQ an innovative computer information technology that enabled the company to disseminate its quotes easily. This technology was a great success.

Nasdaq success allowed the firm to function as a third market provider. This allowed it to bypass the firms which had specialized in executing orders over the counter from the retail brokers. With this, his firm was controlling the biggest market maker at Nasdaq. In his firm, he was among the first prominent practitioners of the payment for order now, where he would meet a broker’s fee for the right to effect a customer’s order("Too good to be true: the rise and fall of Bernie Madoff", 2010). This practice is currently recognized and is known as legal kickball. Madoff had argued that this payment didn’t affect the price the customers were receiving.

Madoff was also an active member of the national association of securities dealers. (NASD). When he was arrested, he was serving as the chairman of its board of directors. He was also a member of the association’s board of governors("Too good to be true: the rise and fall of Bernie Madoff", 2010).

Bernie together with wife Ruth had contributed about $240,000 to the federal candidates’ committees and parties, these includes a $25,000 a year from the year 2005 through to the year 2008, where they had also contributed to the democratic senatorial campaign committee form the year 1991 to 2008, when his scheme was discovered.

In 1992, his name appeared in an investigation on fraud where two persons had complained to the Securities exchange commission about an investment they were claiming to have made with Avellino&Bienes. The case was discontinued by the Securities exchange commission after Avellino returned the investors’ money( Oppenheimer, 2013).

Pre-trial

Madoff wealth management increased into a multi-million-dollar business, although almost all the firms in the major derivatives did not trade with him or his company. This is because all of them did not believe his company’s business numbers were practical. Majority of these high ranking executives believed that his operations were not legitimate. Madoff had targeted wealthy Jews with the aid of his in-group status. He managed to obtain multiple investments from Jewish individuals and their institutions, some of the institutions include; Steven Spielberg’s Wunderkinder Foundation, the Elie Wiesel Foundation, the women Zionist organization of America and, Hadassah, where some of the affected Jews charitable organizations swindled of their investments in this scam (Blois & Ryan, 2013). A great number of Jews and federations and hospitals lost millions of shillings forcing a number of them to close, example is the Lapin foundation which had invested its funds in Madoff company, was forced to close temporarily("Too good to be true: the rise and fall of Bernie Madoff", 2010).

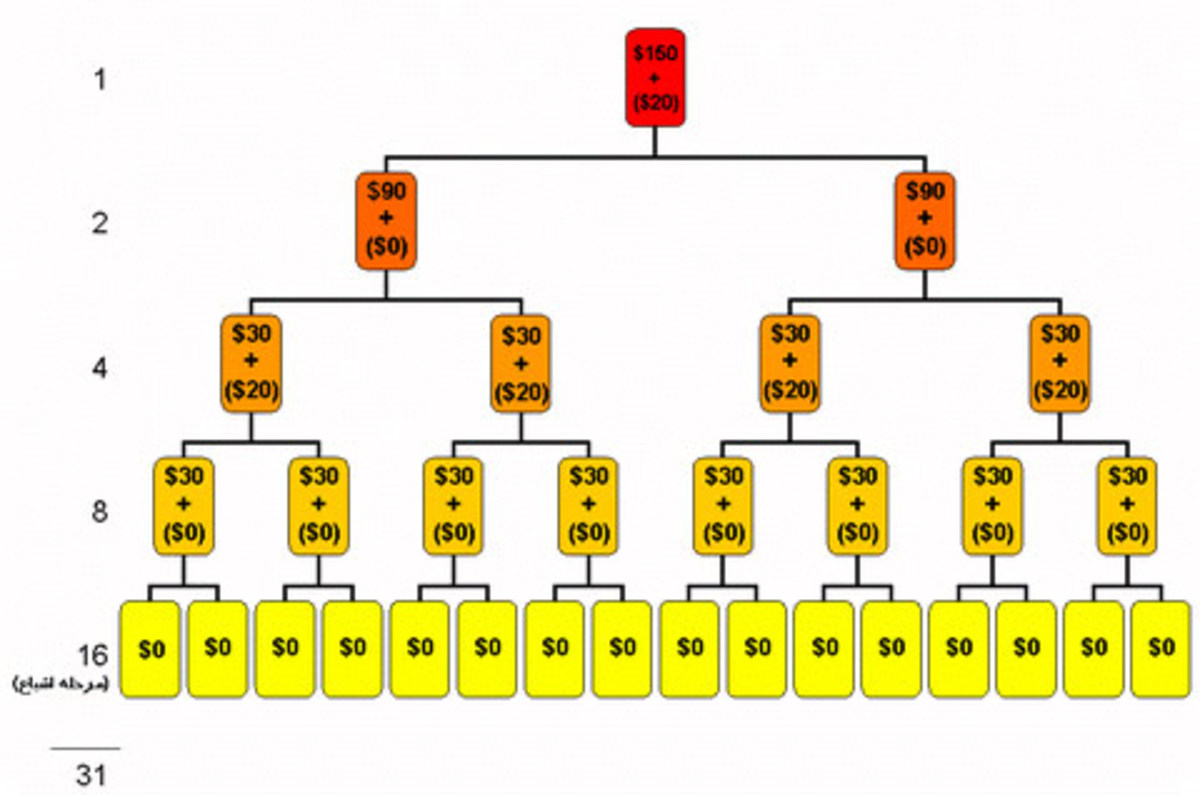

He had taken the money offering the clients great returns and deposited them into his account where he would withdraw them regularly and pay the investors. It is estimated that the Ponzi scheme began sometime after the 1987 crash when Madoff was scrambling to improve his company’s performance after the downturn, though various individuals point to it starting immediately after he opened his office in 1956(Blois & Ryan, 2013).

People who tried to take him down

A financial analyst had informed the Securities Exchange Commission in 1999 that it was mathematically and practically difficult to realize the profits that Madoff was promising to deliver. According to the analyst, Harry Markopolos, he was unable to replicate what Madoff was promising. He also tried in 2000, 2001 2005 and 2007 but was ignored by both the Securities and Exchanges Communion in Boston and the Meaghan Cheng at the SEC’s New York offices.

Neil Chelo, ’93, MSF ’00 made an assessment of into Bernie Madoff and his team. Having carried out series of interviews with the management with the prospect of investing together with Markopoulos, he also discovered that it was a scam but was shut out like Markopoulos.

Madoff gigantic fraud was also not noticed when he started using Irish funds where he was required to give huge amounts of information. This information would have enabled the Irish authorities to uncover the fraud much earlier than 2008(Oppenheimer, 2013).

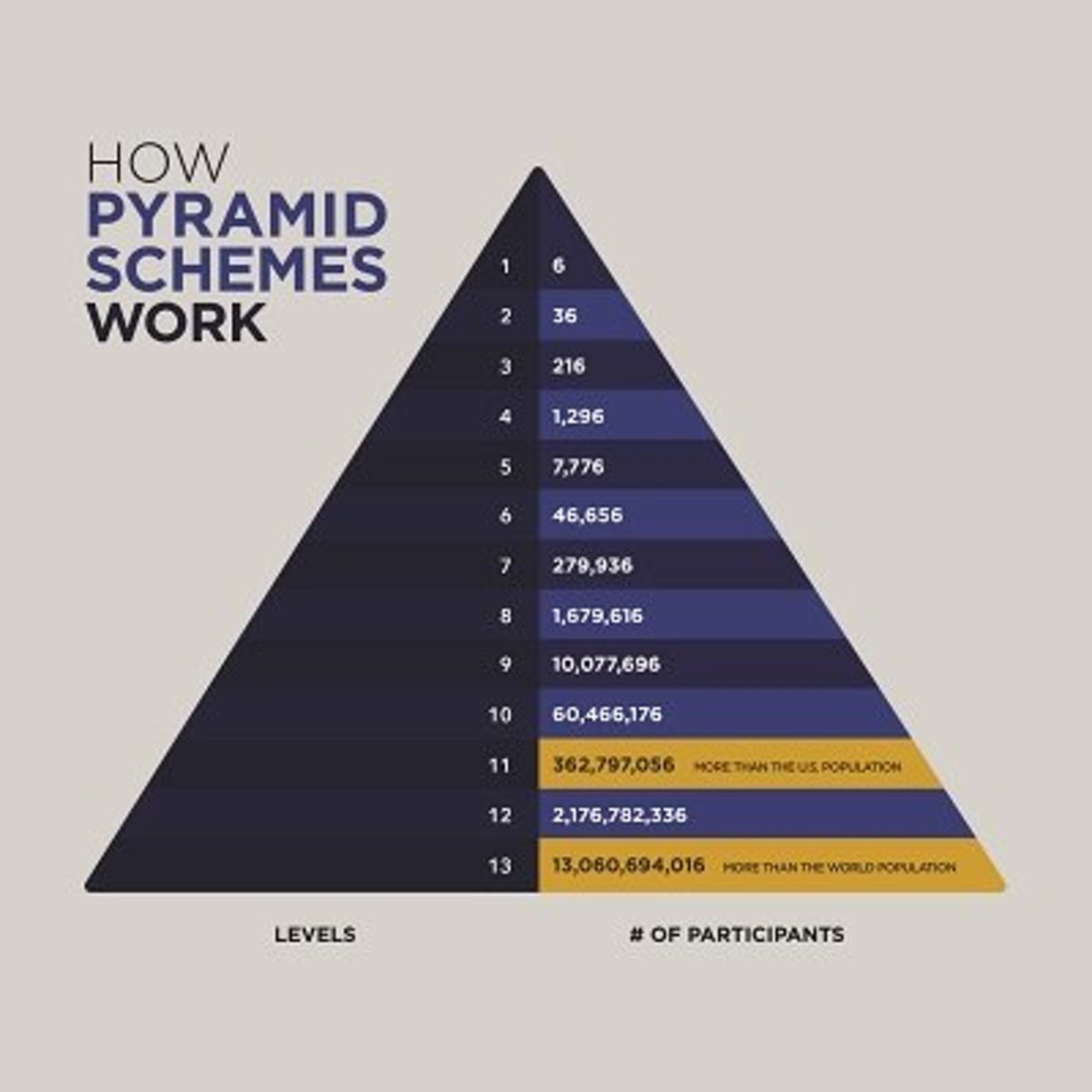

As a well-revered financier and advisor, he had influenced thousands of investors to hand in their individual savings, with a false promise that they will get consistent profits in return.In 2008, he was arrested after he was unable to meet his investor demand of $7 billion in redemption. Unfortunately for Madoff, he only had between $200 million to $300 million left in the account to give out (Blois & Ryan, 2013). After confiding to his sons that he couldn’t meet the inventors’ demands. The sons reported him to the federal authorities. He was caught in December 2008 and charged with 11 counts of money laundering, perjury, theft, and fraud. Currently, he is serving a prison sentence of 150 years. He confessed to operating a Ponzi scheme in which, based on the amounts in his 4,800 clients, estimated at 65 billion as at November 30th, 2008, makes it the world’s biggest Ponzi scheme. This was a Ponzi scheme as it was guaranteeing the investors falsified high returns.

He was able to keep up with his dealings despite multiple reports to the securities exchange commission majorly due to him being a well-revered individual and an active member of the financial industry. He had started his own market firm in the early 1960 and had helped launch NASDAQ, a very successful tool in the stock market. He also sat on the boards of multiple associations of stock companies, the most significant one was the board of National Association of Securities Dealers. He also had an advising roll into the Securities and Exchange Commission on trading securities. With all the above privileges, it was easy for him to pass through the information that his dealings were a legal (Blois & Ryan, 2013). He made off with about 20 million, although in the paper it was estimated that he cheated clients out 0f 65 billion.

Participants in the Madoff Ponzi scheme

Notwithstanding his insistence that he was a solo mastermind and the only person responsible for the large-scale Ponzi scheme The investigates are still looking for other individual deemed to have taken part in the investment scandal. Among the notable individuals believed to have had a hand include, Stanley Chaise, a philanthropist believed to have been heavily invested heavily with Mr. Madoff, and Carl J. Shapiro, one of Madoff’s oldest friends who are among the individuals still being scrutinized. His firm had 9 directors. The members of his family who had shares include his sons. Mark Madoff and Andrew Madoff, Peter Madoff, and Bernard himself. His wife, Ruth also had shares

Other notable ones include Frank Avellino who was an accountant in Florida believed to have invested the clients’ money; Noel Levine, who was a real-estate investor who referred potential investors to Madoff. Madoff family member and employees are still being probed by the prosecutors. Some of the notable convictions include:

Paul Konigsberg

Paul was an accountant in New York City accountant and Madoff friend who had helped prepared two of Madoff family Foundation tax returns, and in return receive non-voting shares valued at$35,000.Konigsberg held Madoff accounts under his real names including two in the name of the Westlake Foundation(Oppenheimer, 2013). A lawsuit was filed against Paul and his accounting firm in 2009 by Steven liber for negligence and breach of fiduciary duty. He answered this charges with affirmative defenses.

In connection to the Madoff case, he pleaded quilt in 2014 and was to face a term of 30 years, but in 2015, the US District Court Judge agreed with prosecutors that Konigsberg was not aware of Madoff’s pyramid scheme and had provided full cooperation with the investigators. She ruled that Paul had earned mercy from the state sentencing rules and did not deserve to serve time in prison.

Peter Madoff

He was the company’s chief compliance officer, he had to run the daily operation. Peter Madoff had aided in the creation of the computerized trading system that Madoff firm and Peter’s daughter used. He pleaded quilt to various charges and agreed to a 10years’ jail term.

Frank DiPascal

He referring to himself as the director of options trading and a chief financial officer at Madoff’s firm. He was arrested and pleaded guilty in 2009, to 10 counts relating to the firm fraud allegations though he died due to lung cancer before being sentenced.

Other notable employees include Joann Crupi who was a former investment advisor to Madoff. She was given a sentence of 6 years for her role in the scheme; Jerome O’Hara and George Perez were former computer programmers for Madoff, they were both sentenced to 2.5 years each(Oppenheimer, 2013).

His son, Mark Madoff, was found dead two years after Bernie Madoff arrest in his apartment building. The medical examiner ruled that suicide by hanging was the cause of death. His second son, Andrew died a year later. His death was due to his mantle cell lymphoma condition he was suffering from.

Some companies were also involved in the mix-up. One of the company included Sosnik Bell and Co. this firm compiled profits, losses and gains and prepared tax summary statements for Madoff company(Blois & Ryan, 2013).

His wife was forced to forfeit all her assets living her with only 2.5 million dollars. She moved to one of her son Andrew's house in old Greenwich Connecticut after spending about two years living with her sister in Boca Raton, Florida, after her son Andrews’ death, she moved to a condo-complex in Old Greenwich.

Even today, Madoff’s investment scheme can still be felt today in the investment community and all across the wall street. Immediately after he confessed the securities and exchange commission begun to take stapes the were aimed at preventing similar scandals in the future and to protect the future investors.

Among the first initiatives implemented after Madoff's Ponzi scheme was the Wall Street Reform and Consumer Protection Act; also known as Dodd-Frank Act. In addition to registration requirements and new rules that were required for exemption, Dodd-Frank also required the hedge funds and the investments companies to ensure that they followed the new reporting requirements that were given by the SEC authority to monitor the financial firms that had a potential of triggering systemic risks.

The investment industry has also begun requesting for greater transparency to investors. The investors rise in inquiries in comprehensive due diligence has been significant as the investors seek more clarity and insights into the funds they are allocating their investments to(Clauss, et al. 2009).

More recently, the SEC has adopted additional reporting requirements to prevent future Madoffs from arising(Oppenheimer, 2013). In July 2013, the SEC voted to approve a rule requiring brokers to file quarterly reports detailing how they maintain customer securities and cash.

Lastly, according to Forbes, the SEC has continued to file record numbers of investigations and enforcement actions against advisors and other investment firms, making good on their promise to pay closer attention to the actions of those in the investment world.

In conclusion, though Bernie Madoff may currently be incarcerated in a prison in North Carolina, the fallout of his incredible Ponzi scheme is very much part of our world today(Clauss, et al. 2009)

. Five former Madoff employees are currently still standing trial for their alleged participation in the scandal.

Beyond their individual fates, Wall Street and the greater investment community will continue to feel the effects of Madoff’s fateful decisions. Investors have come a long way in demanding greater transparency and reporting standards from firms, and we expect that will only continue in the years to come(Blois & Ryan, 2013).

On the technology side, investors are careful to inquire about the specific systems and infrastructure used to secure and protect their assets – another critical component to ensuring a similar financial crisis does not take place(Clauss, et al. 2009)

. Only time will tell how else the industry will continue to adapt following the Madoff scheme and other financial crises.

References

Blois, K., & Ryan, A. (2013). Affinity fraud and trust within financial markets. Journal of Financial Crime, 20(2), 186-202. http://dx.doi.org/10.1108/13590791311322364

Clauss, P., Roncalli, T., & Weisang, G. (2009). Risk management lessons from Madoff fraud. In Credit, Currency, or Derivatives: Instrumentsof Global Financial Stability Orcrisis? (pp. 505-543). Emerald Group Publishing Limited.

Oppenheimer, J. (2013). Madoff with the money. Hoboken, N.J.: Wiley.

Too good to be true: the rise and fall of Bernie Madoff. (2010). Choice Reviews Online, 47(06), 47-3272-47-3272. http://dx.doi.org/10.5860/choice.47-3272