Social Security, Where's It Going?

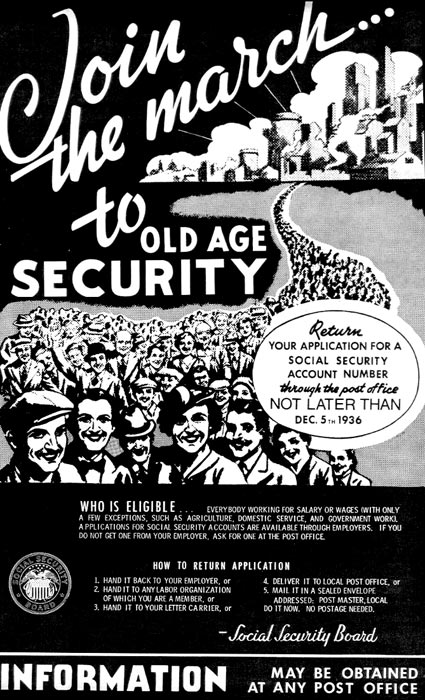

What is the Social Security Act of 1935?

It was an act to provide for the general welfare by establishing a system of Federal old-age benefits, and by enabling the States to make more adequate provision for aged persons, blind persons, dependent and crippled children, maternal and child welfare, public health and the administration of their unemployment compensation laws. To establish a Social Security Board and to raise revenue for other purposes.

LAYMAN'S TERMS

- Prior to Social Security, the elderly were usually unable to work, poor and unable to support themselves and were placed in sanitariums or the poor house. All at government expense and sub-par care.

- A mother whose husband ran out on them (and they did back then, more than we have been lead to believe) or died and left them without anything (remember in the past, women had no rights to own property or vote), so the government took over and put them in poor houses.

- Those that suffered from health problems or couldn't work, ended up in a sanitarium or the poor house.

- Dependent and crippled children were institutionalized at government cost and care was usually sub-par.

Most of our elderly, poor and ill have always been covered by our government, because it's the "moral" thing to do. We as human beings and of christian faith have always sought after taking care of those less fortunate. However, it was very expensive to run these poor houses and sanitariums and the care that was given was terrible. The Social Security Act came into place and people were given the assistance without losing their freedoms. Only this time around, they had to pay into the program to fund it. It was not a "government handout." And when it began, there was a surplus of money to cover the program. (see Robbing Peter to Pay Paul)

Fiscal cliff took front and center - Tax break allowed to expire

During all the wrangling over the fiscal cliff, the temporary tax break that went from 4.2 back up to 6.2 of the withdrawal for social security out of your paycheck was allowed to expire and so tax payers will see a little less money in their paycheck because it is going back towards their social security retirement. On the average, a burger meal and a coke is what you will have to cut back on in a month to cover the difference. However, the Republicans will exaggerate the fact to scare American's and blame Obama for "hiking taxes". The Democrats will point out the fact that Republican's have control right now and they didn't follow through with it because they knew it had to be done or that they were so embroiled in a fight to save the rich from paying taxes that they forgot about the "little people".

THE WAY I SEE IT

As I read the many articles on this subject. I realize that all the rhetoric from both sides of the isle will accomplish nothing.

They both agree on the idea of changing the retirement age to 70 or they wouldn't have mentioned it. They both agree on "savings" accounts, except one wants a "savings account" (which very few could ever save enough money to support someone through old age, unless it were invested- $50 - $100 a month doesn't add up to much with inflation) the other wants an invest-able savings account like 401K. Which most people that can "afford" that money to be taken out of their pay are already doing it. The only way to make this happen would be to as the Republican like to say, "shove it down your throat". It would be like the Health Care, whether you want it or not. Millions of people lost their entire savings in 401K when the recession hit, since this country is not recession proof, what's to say that those investments would be "secured" from the recession? Without a "guaranteed savings", Americans would be left out in the cold like those today who lost everything. Each worker would be forced to invest 1.6% of their wages into this retirement account.

We vote for our representatives to do what is in "our" best interest. And when they can't agree they stoop to divisiveness and name calling. Spinning in all directions that we don't know who to believe.

The cost to privatize social security would be $2 trillion dollars. What happens to all of those who are on Social Security and have no retirement plans because they paid into Social Security as a retirement? Only the politicians know.

Social Security Funds--Robbing Peter to Pay Paul

The problem began the 1980's, under President George H.W. Bush. He began looting the Social Security trust fund when he included the monies as part of the overall budget, which allowed him to spend it on other items other than Social Security. This has continued through the terms of both political parties. In 1990, Senator Harry Reid called it "thievery" and embezzlement". Senator Heinz also described it as embezzlement. They joined with other congressional members that saw it the same way and tried to repeal the 1983 payroll tax increases to keep the surplus funds out of Bush's hands, it failed and precedence was set for what has continued to be "thievery" of our Social Security system.

Another no much discussed reason for problems.

It's the recession and the lack of jobs. No jobs, no payroll tax to pay into Social Security. When you lose more than 8 million jobs, that's a large loss in revenue.

So How Do You Fix It?

A reform of the Social Security Act.

- An amendment that would not allow funds to be used for anything other than Social Security and tightening on fraudulent claims would not completely solve the problem, but would put us on the right track to securing the future of Social Security.

- An amendment that it would require a "vote" by the American people in order to touch the funds in Social Security for any other purpose. School districts are required to put it to a vote if they want to use taxpayers money from one account to put it into another account. So why not Social Security?

- And the money that has already been spent, would have to be paid back and that would increase the deficit even more. However, it would put the funds needed back into the program.

- An amendment that calls this an investment and not an entitlement. An entitlement is the belief that one is inherently deserving of privileges or special treatment. Which is what politicians call it. This is not special treatment, it is workers wages invested for retirement.

Democrats

The Social Security Act of 1935 was passed by the mostly democrats who were known for taking up social issues and supporting the American people.

They See the following as pros for this issue.

- Giving the American people assistance without hindering their life and their freedoms.

- To have the people pay into this program so that it can assist them later.

How do they plan to fix it?

- The president's budget lays a foundation for all Americans to participate in a retirement account at work that will increase savings participation by 80 percent for low and middle-income workers. (As per the presidential website; www.whitehouse.gov)

- Possibly increase the retirement age to 70 (Suggested by Stanley Hoyer, Dem.-MD)

During the 80's we had savings accounts through our employers and they worked great, you would figure how much you could afford to save, min. $5 dollars a pay period, you didn't see the money and when you needed it, you could draw against it or remove it all. Kind of like a Christmas Club fund that they also had back then, only down fall was that if the company went bankrupt, you lost your savings, something that could easily be amended.

Republicans

They have pretty much always been against the Social Security Act and seen it as a "handout", unless of course, they and their policital opponents were using the funds for other things.

They see the following as cons for this issue.

- The government is controlling the Americans money.

- It's just another "big government" program that needs to go.

- John Boehner believes that Americans who have money saved up for retirement, should not be filing for Social Security because they don't need it.

- John Boehner also said that the retirement age should be raised to 70.

How do they plan on fixing Social Security?

George H.W. Bush, called it "privatization" of Social Security, it polled badly, so in 2005, George W. Bush corrected a Washington Post reporter and called the plan "a personal savings account". Karl Rove called it a "modernizing" Social Security plan. Either way, these are various options to the Republican Plan for fixing Social Security:

2000:

- Anyone currently receiving Social Security, or close to it will not be impacted by any changes.

- Key changes "should" merit bipartisan agreement.

- No tax increases.

- Workers could direct a portion of their payroll to personal investmants (stock market,etc.)

- Should be voluntary, workers could continue on the same plan or opt out into the new plan.

2010:

In books being release by top ranking Republicans are pushing what the Republican agenda is for Social Security and Medicare. As John Boehner, who is in line for Nancy Pelosi's job if the Republicans take over, said; "a pretty good list of options" when referring to Paul Ryan's ideas (Young Guns, written by Eric Cantor, Kevin McCarthy and Paul Ryan, the ranking Republican in the House Budget Committee).

- Converting Social Security for future retirees into private accounts--could be invested in the stock market. (The stock market nearly crashed in 2009 and devistated savings accounts for millions of Americans)

- Medicare could become a "voucher" system, government gives "seniors" money to purchase health insurance. (So, the government would still be paying for insurance and adding to the deficit)

- Also, to cut funding to existing Social Security, which is called "entitlement" spending by Republicans.

- They also look to balance the budget through slimmer versions of Medicare-Medicaid, Social Security and the tax code. (Which would still add to the deficit)

What To Do About Social Security?

Can continued divisiveness be good for the country?

© 2010 Lady Liberty