Slash Taxes for Me, You . . . Us

Are We Watching Our Pennies?

Republicans, Democrats Face-off

Sometimes it's not easy to separate politics from the politician, good rhetoric from good policy, the wheat from the chaff.

Republicans want big tax cuts. Democrats want big tax cuts. Most Americans want big tax cuts.

Great! So what's the problem?

The problem is that Republicans and conservatives tend to buy into the rhetoric of the Republican Party and its leadership while the Democrats tend to go along with Democratic leaders and, this year, President Clinton.

Conflicting Views

The GOP says its cuts are better because they will cut out the fat in the budget and reduce or eliminate items that can best be handled by the states or by local governments.

Democrats say their cuts are better because they won't throw out the baby with the bath water; they won't unfairly place the burden on low income families and the elderly. The Democrats say Republicans' tax cuts will hurt the middle class while unfairly lining the pockets of the wealthy in the country.

Adding to the confusion is the way most Americans look at the issue of cutting taxes. When cuts in Medicare are proposed, for example, people tend to react, not unnaturally, by saying, "I'm on Medicare and that's going to take money right out of my pocket." Or, "I'm not on Medicare, so this is a good way to come up with the money we need."

Judge the Issues on Their Merits

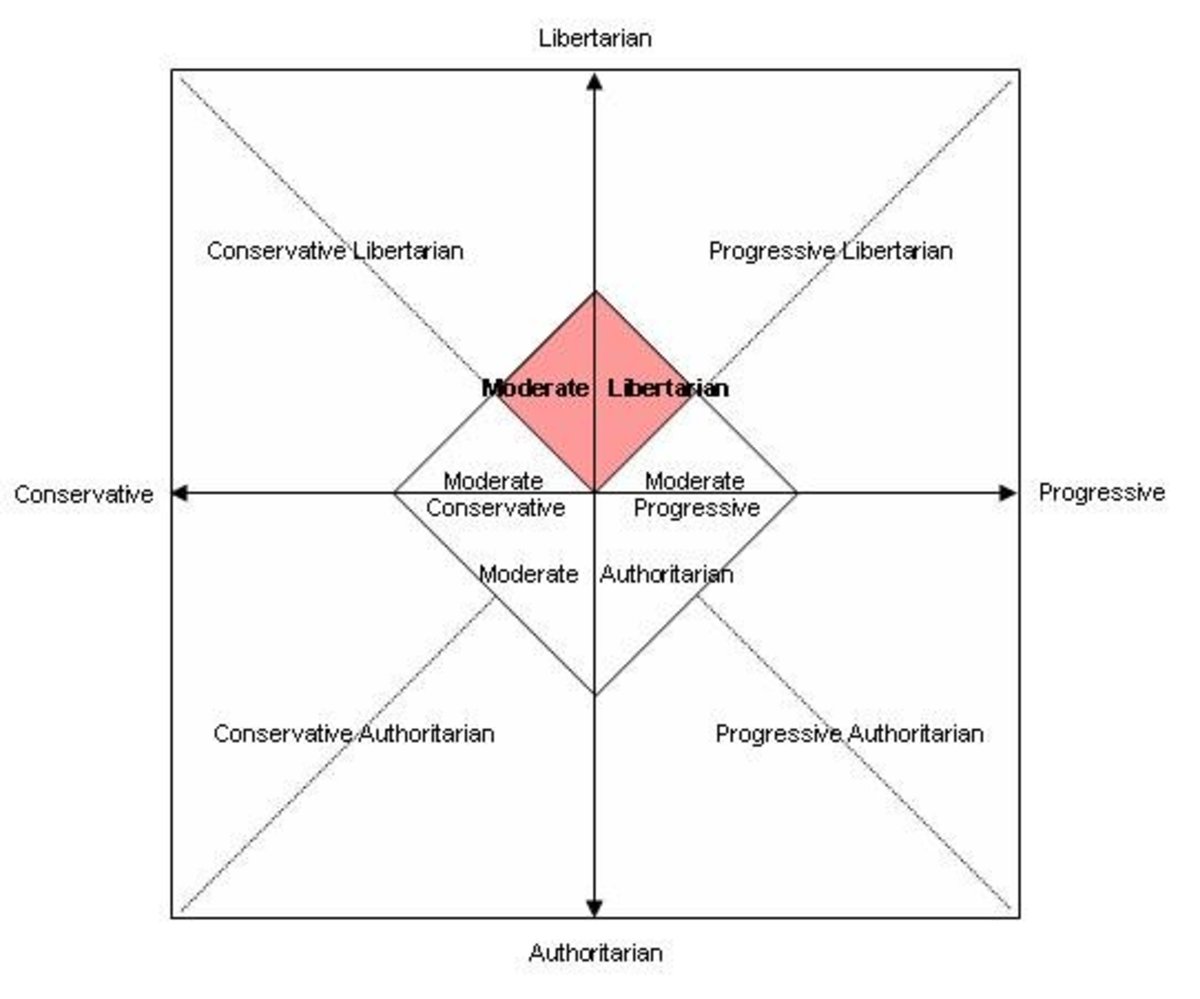

Whether one is Republican/conservative and believes that government should do only what is absolutely essential or one is Democrat/liberal and believes the government must step in to help the helpless, one should look at each issue on its merits, politics aside, and opt for the solution that is best for the country.

In today's world, cutting taxes is an issue of macroeconomics not microeconomics, that is, the $50 or $350 you might save under one proposal or another is not what's important (except to demagogues); what is important is the effect on the overall economy that the additional billions of dollars in the hands of consumers produces.

But, politicians -- being what they are -- tax cuts are always sold on what they will do for you. Sure it's nice to get a tax break (heaven knows few of us can afford the taxes we pay now), but the whole country benefits when taxes are raised fairly and spent equitably.

The Congress and the president are wrestling with the economic issue now. House and Senate Republicans and Democrats are in a particularly caustic debate over which expenditures should be cut (or, should we say, how much should the rate of increase be reduced?)

Who Should Get the Tax Cuts?

Which programs should be cut back or eliminated? Should middle income taxpayers or wealthy investors be granted a tax cut?

How much can we squeeze out of Medicaid or Medicare?

None of these questions can be answered fairly and equitably unless we cast politics aside and strive for the middle ground.

Can't we look carefully at the myriad budgets that bureaucrats have allowed to grow out of control for years and trim the fat -- not the bone?

As for tax cuts it matters little if America's middle class is given a break this year; that only assures us that we'll have to keep paying excessive taxes for decades to come just to try to put a dent in the national debt.

I wrote this column as a "My View" for The Hour newspaper of Norwalk, Conn., on March 20, 1995. I now write my views on a wide variety of topics on HubPages.