Solutions to America's Economic Crisis: A Window into the Past

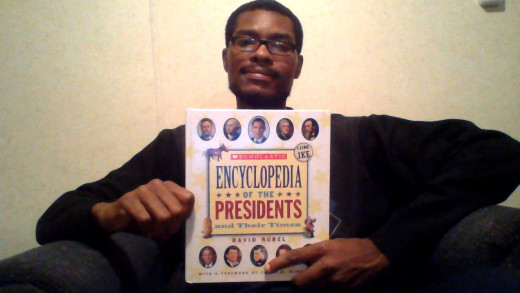

Some of our greatest discoveries were uncovered by a little curiosity and courage. I made an astonishing one while looking for a book fitting for a college student at a Scholastic book fair in an elementary school. It took curiosity to enter the library doors past other potential buyers as tall as my legs; it took courage to exit under the laughing eyes of teachers and librarians. I walked away with the Encyclopedia of the Presidents and Their Times by David Rubel, laughing at myself, thinking the book would make a great addition to my 12 year-old brother's book collection. The first ten minutes of reviewing the work, I found myself putting my professor's hat on. Rubel not only includes information on our great presidents, their families, and the important political decisions they made, but also summarizes important economic, cultural, civil, and even sports issues of their times. The most compelling issue, and one taking the highest precedence in today's stage, concerns the economy. How many times does one's car battery have to die before one invests in a battery charger? How many times must one stub one's toe before the layout of a living room is changed? The United States has endured 5 economic crises in the past, not counting our present catastrophe, and yet the government still can't decide on a means to solve the current depression. By noting what caused America's previous recessions and how the country recovered from them, a potential solution to America's current economic instability can be uncovered.

The Panic of 1873

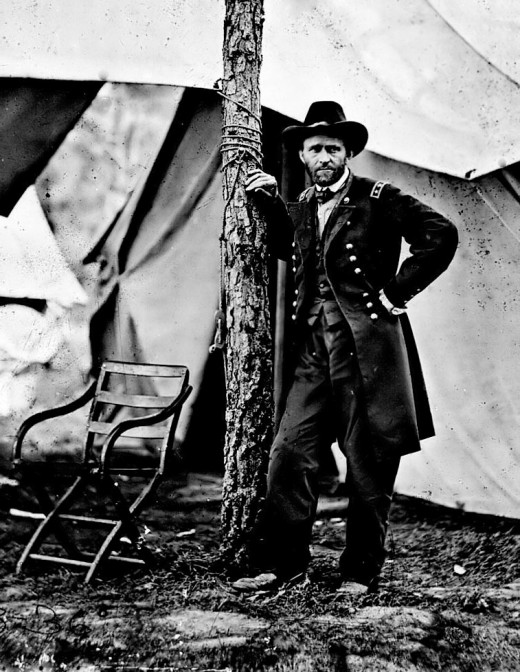

The Problem: Everyone knows Ulysses S. Grant as the dedicated Union general that helped bring a conclusion to the Civil War; however, military discipline sometimes fails to translate into political leadership, for he was also one of the worst presidents in America's history. Immersed in a world of politics he didn't understand, the former military general left all decisions concerning the country's state to his cabinet, and since the country found itself during a vulnerable moment, the reconstruction after the Civil War, many politicians took the opportunity to steal from the American people. The biggest and first hit came when James Fisk and Jay Gould attempted to control the gold market. For the plan to work, they bribed Abel Corbin, Grant's brother-in-law, to keep the government's gold off the market. Grant realized their plan, yet pretentiously sold 4 million dollars worth of gold from the government. "The sale - which took place on September 24, 1969 - ruined Fisk and Gould's plan, but it also sent the price of gold plummeting" (83). The event, known as Black Friday, affected the national as well as the international economy. The corruption of The Gilded Age, along with the loose investments in railroad construction and the Chicago fire of 1871, contributed to the economic decline in the 1870s. The final nail in the coffin was the bankruptcy of Jay Cooke and Company. "When the banking house of Jay Cooke and Company failed in September 1873, the stock market collapsed along with it" (85). An economic depression that lasted five years resulted.

The Recovery: The allowance of unqualified individuals to become government officials grew from the Spoils System enacted by Andrew Jackson (42), which allowed many "robber barons" instead of qualified politicians to take office positions. After Grant, the 19th president, Rutherford Hayes, attempted civil service reform by trying to implement Interior Secretary Carl Schurz's idea for competitive exams for hiring and promotion for government offices (92). When Congress failed to create his reforms, he performed some himself by, "removing the heads of the post office in St. Louis and the customhouse in New York" (92). The high tariff rates set on foreign goods to pay for the Civil War also helped build income for the United States, resulting in a large federal surplus in the late 1800s. "Ever since the Lincoln administration, when rates were raised to pay for the Civil War, tariffs had been extraordinarily high" (100). Tariffs generated decent profit for the American economy, shifting Americans to buy from American businesses, until the ridiculously high McKinley Tariffs of 1888 caused greedy manufacturers to raise their prices to "compete."

The Panic of 1893

The Problem: It wasn't just the greed of politicians or the greed of wealthy businessman that caused dents in America's financial system, but the greed of powerful people that did. The trend continued during the Panic of 1893 when the Philadelphia & Reading Railroad crashed in February 1893, taking other railroads down with it (105). Similar to the Panic of 1873, a single domino falling caused the economy to collapse, yet a string of events shook the table. The McKinley Tariff, created as a favor to big business for helping President Benjamin Harrison win his election campaign, raised the tariffs on foreign products to record highs for peacetime, supposedly ensuring Americans would buy domestic. The greedy businesses had different plans. "But the greedy manufacturers just raised their prices to match those of foreign goods" (104). Passed alongside the McKinley Tariff Act, as a measure for silver-mining lobbyists to get their support for the tariff increase, was the Sherman Silver Purchase Act. The silver purchasing act "committed the government to buy 4.5 million ounces of silver each month, or nearly the entire output of the western mines" (104) to compensate for the abundance of silver discovered in Arizona and Nevada. Of course, greed transformed a beneficial article into a catalyst for a recession. "When people began using this law as a way to trade silver for gold, the government's gold supply dropped sharply. By April 1893, the Treasury had less than one hundred million dollars in gold left" (106). A combination of the hike in prices caused by the McKinley Tariff Act and the drain of gold reserves by the Sherman Silver Purchase Act created the perfect storm for the Philadelphia & Reading Railroad to fall, and for the rest of America's economy to follow after.

The Recovery: The repeal of the Sherman Silver Purchase helped to eliminate the pressure on the gold reserves, an act performed by the next president, Grover Cleveland. "Cleveland's first move was to call an emergency session of Congress to repeal the Sherman Silver Purchase Act" (106). The repeal of the act ended the potential inflation that would have resulted if America's financial system was backed by gold and the new abundance of silver. Unfortunately, not even stopping that act proved enough to provide an adequate recovery. "But even that didn't stop the gold drain - forcing Cleveland, now more desperate than before, to ask Wall Street for help" (107). In contrast to the government bailout recently issued to key businesses, The Panic of 1893 required a corporate bailout to the government. "... financier J.P. Morgan organized a group of New York bankers to come to the Treasury's aid. Their loan of sixty-two million dollars in gold halted the drain and stabilized the economy by restoring people's faith in the financial system" (107). The America then hadn't reached the affluence of today's America, but the concept of a large scale bailout still existed before our current crisis.

The Panic of 1907

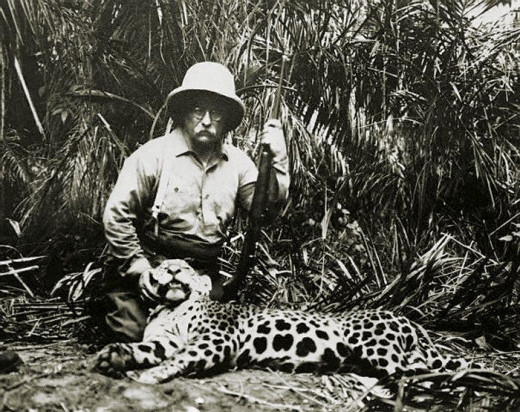

The Problem: The early 1900s symbolized a progressive time in our country, and Theodore Roosevelt, the 26th president, led the country through those times. Ahead of the movement, the man set himself on a mission to make the United States an active participant of world events and to eliminate business corruption by tackling trusts, "companies that work together to limit competition in a particular industry, such as tobacco or steel" (114). Some change cools the land like a rainstorm in a desert, while others shift tectonic plates like earthquakes. The New York bank, the Knickerbocker Trust Company, collapsed in October 1907, taking several banks, some railroads, and the economy with it, yet no one knew who to blame. "The president's critics blamed his Progressive policies for cutting corporate profits. He blamed bad business practices" (120). Either way, the transition from a country ruled by industrialized corruption to one containing more balance between the average worker and the employers caused an upheaval in the economy.

The Recovery: The president after Teddy Roosevelt , William Howard Taft, continued the trust-busting to combat corruption, yet it was President Woodrow Wilson who passed the policies needed to halt the crisis. Wilson passed the Underwood Tariff, which "cut the average rate from 41 to 27 percent, the lowest that tariff rates had been since the Civil War" (126). In return, to compensate for the revenue lost by the tariff reduction, the Sixteenth Amendment, the one creating the national income tax, become ratified. Under its measures, "Americans making above three thousand dollars a year would have to pay 1 percent of their income to the government, with people making over twenty thousand dollars a year required to pay an additional amount as high as 6 percent" (126). The combination of the tariff reduction, which made businesses lose their excuse of raising their prices to "compete" with foreign goods, as well as the income tax to generate national income beside the tariffs, created a great atmosphere for economic recovery. To further abet the country's climb, Wilson's administration passed the Federal Reserve Act, legislation that organized a tottering banking system that dragged itself through several recessions. The Federal Reserve Act not only organized a network of twelve regional banks that reported to a national board of governors, but also used this board to regulate the amount of money usable for investment. "During boom times, the board was supposed to raise interests rates, so that people wouldn't borrow and spend too much. During recessions, it was supposed to lower rates, so that people could get the credit that they needed" (126). The recovery following the Panic of 1907 helped reduce the price of domestic products, generate more profit for the U.S. economy, and organized the banking system for the shock of potential future recessions. Yet the worst depression in America's history was waiting.

The Great Depression

The Problem: Everyone who studied history in high school has heard the great, infamous Great Depression story at least once. During the 1920s, the years of President Calvin Coolidge, American employers and employees were doing equally well, so well that they took loans and invested them in the stock market to make themselves richer. The stock market prices eventually fell, the lenders panicked, called back their debts in full, and all the borrowers rushed to sell their stock to pay off the debts. This drove down the value of those stocks, making all the borrowers now in deep debt, without the money to purchase goods anymore. "Five thousands bank went under, wiping out the savings of nine million ordinary people, and during the next three years, an average of one hundred thousand people a week lost jobs" (142). The market crashed on Hoover's watch, yet what wasn't covered well in history classes were the tax cuts created during the Coolidge years that shortened the profits which boosted the economy from the Panic of 1907 and led American's to take detrimental financial risks. "The new tax laws Coolidge shepherded through Congress were extremely favorable to business. They lowered income taxes and eliminated several other taxes that had been put in place to raise money during World War I" (138). The economy, and the American people as a whole, became more prosperous from these cuts, giving rise to the famous yet infamous Roaring Twenties, but the reduction in government taxes during a prosperous time is the same as cutting back on one's savings after a pay raise.

The Recovery: Herbert Hoover made two attempts to save the economy, both of which failed. He used the tariff idea with the Smoot-Hawley Tariff, but it raised tariff levels so high it caused an international trade war that worsened the depression. He also used the bailout idea by creating the Reconstruction Finance Corporation in 1932, which "loaned two billion dollars to businesses, banks, and state governments to help them survive the depression" (144). Herbert Hoover hoped the money would flow down to those experiencing the brunt, but it didn't. It took the President Franklin D. Roosevelt's progressive policies to save America from the Great Depression. People having money yet not spending it by financial insecurities makes economic depressions monetary as well as psychological. FDR realized this, restoring people's faith in America's economy by passing the Emergency Banking Act. "This law endorsed the president's action and kept the banks closed until federal auditors could examine their books" (146). The act delayed the population from snatching their funds from banks so they wouldn't lose all their financing and close, and it allowed the government to check the records of the banks, closing the ones deemed fraudulent. To further secure the people's trust, the president signed the Banking Act, a measure that, "created the Federal Deposit Insurance Corporation to guarantee individual accounts up to five thousand dollars" (146). Another progressive innovation was the Civilian Conservation Corps, which hired those unemployed to do work conserving the environment. The Federal Emergency Relief Administration made cash payments to the unemployed, but more importantly, provided jobs as well (148). Another important piece of legislation was The Industrial Recovery Act of June 1933, which suspended the antitrust laws in return for higher wages as well as "worked with business groups with trade associations to create 'codes of fair competition' for their industries" (149). Even though the suspension of anti-trust laws to correct the Depression production quotas and prices, and the higher wages were a benefit, the NRA codes that resulted proved impractical. The FDR administration introduced Social Security in 1935, the Wagner Act to make it illegal to interfere with union organizing, and the Wealth Tax to raise income taxes on those making more than 5 million a year to 75 percent (150). These reforms didn't rocket the United States from the Great Depression, but they did accelerate the recovery by providing the people with jobs so they could spend money and restoring people's faith in their country's financial system.

Our Dilemma: The Financial Crisis of 2008

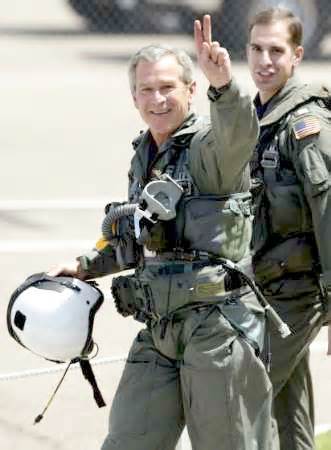

The Problem: Finally, we arrive at our current economic crisis. A mix of the complacency seen during the Coolidge administration before the Great Depression and the corruption felt during the Ulysses administration before the Panic of 1873 created a storm that sank the United States. The crashing of the housing market by bad bank loans crashed the economy, yet several other factors weakened it. 9/11, the terrorist attack where al-Qaeda terrorists crashed commercial jetliners into the world trade center, served as the spark to ignite the Bush administration's retaliation against Afghanistan, where "the Taliban government had been sheltering Osama bin Laden and other al-Qaeda leaders" (215). Then came the invasion of Iraq for the weapons of mass destruction supposedly in the hands of the country's dictator, Saddam Hussein. Saddam Hussein did get removed from power, yet resistance fighters, "staged ambushes and car bombings that killed more than four thousand American soldiers" (217). The answer to the problem? President Bush "reasoned that deploying five additional brigades to Iraq would reduce the violence, there by allowing the Iraqis to reach the political settlement that everyone agreed was necessary for a lasting peace" (219). However, the surge didn't work, and only raised tensions between America and Iraq. The economic implication of the Afghan and Iraq War was the increase in oil prices from "political instability in the oil-rich Middle East caused by the Iraq War" (218). Also, just like before the Great Depression, Bush proposed and Congress approved a "$1.35 trillion tax cut" (214) to spend the surplus created during the Clinton administration. Also similarly, "Of this amount, 43 percent would go to the richest 1 percent of Americans" (214). Caught between the Iraq and Afghanistan War for two years and the cuts in federal taxes made the country a person on a shopping spree after becoming unemployed. The government spent so much money for the war, yet abandoned the taxes that generated the government surplus in the first place.

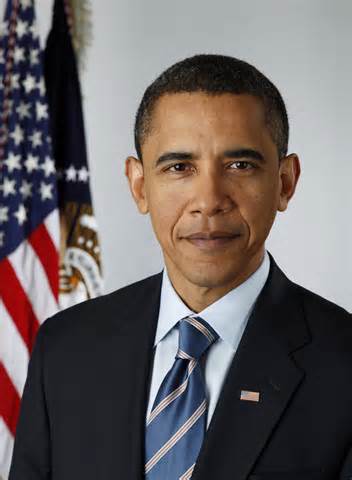

The Way to Recovery: It doesn't take astrophysics, statistics, organic chemistry, or even accounting to discover a starting point from this mess. All it takes is a little look into history and a little courage to do what is necessary. The United States always needs to generate profit as a country and not always rely on capitalism for it, considering our capitalist system is basically an experiment and therefore needs a safety net until the country "gets it right." We should reinstate the tax systems that generated a surplus in the past, such as the those enacted during the Clinton administration. Even increasing tariff rates would help lighten the income tax rate on Americans, especially when one can order something from another country for a price lower than buying it domestically. However, tax cuts almost always came before economic instability, and therefore should either have a cap or not diminish at all. Secondly, confidence in the American economic system needs restoration, something done at the conclusion of every financial panic, to get the population spending again. The government bailouts to businesses under the Obama administration did not restore people's faith, since a number of the banks responsible for issuing bad loans received salvation. Similar to Pres. Franklin D. Roosevelt's Emergency Banking Act and the Civil Service Reform started by Pres. Rutherford Hayes, the "unsound" banks should have fell while the ones simply affected by the economic downturn should have been saved. Finally, more proactive measures, as a forecast of how certain tax cuts and businesses act as cornerstones to America's economy, should be used. Even though a succession of poor budget decisions and business corruption weakened the financial system, in 1873, 1893, and 1907, it took one company falling to create a domino effect that toppled other banks and jobs. If financial advisers kept closer eye on such a company's impact on the economy, they could take more preventive steps to keep a recession from growing into a depression.

Final Word

Our capitalist system needs to evolve. The continuous cycle of prosperity - recession - depression weakens the United States, causing the country to blink on the world's stage. So far we've been lucky. The United States may have experienced depressions in the past, but the worst happened while the U.S. was a world power or while the rest of the world sat in debilitated state. However, if the America and its 50 stars lose their economic stability at a moment when another country on relative footing has their's, the U.S. would become a stalled boat in the sea of the world. The best way to prevent such a scenario from occurring? To develop a permanent system to keep the economy stable during prosperous times, yet proactive measures to keep the scales from tipping when our little capitalist experiment hiccups. If the United States fails to awaken to the dangers of complacency, it may be too late next time the ship stalls. Then, at that moment, a shark might stand, waiting, for a drop of blood foreseen in our country's own history.

Reference:

Rubel, David. Encyclopedia of the Presidents and Their Times. New York: Scholastic Inc, 2013.