Tariffs Made Simple

Introduction

Since tariffs and trade wars are in the news, I have tried to educate myself on what they are about. In this article I'm sharing what I have learned. My main sources are from CNBC, Investipedia, and my own observations.

What is a Tariff?

Simply put a tariff is a tax that is levied on imported goods. However, the official name for a tariff is called a Duty. Duties are placed on imported goods and services and collected by the Customs and the Border Patrol agency of Homeland Security. Once the duty is collected it is sent to the Treasury Department to be used by the government for its needs. Last year the government collected 35 billion in duties.

How do Tariffs Work?

Let’s say a company is importing shoes for a large big box retailer. Without a tariff, the importer pays $10.00 for the shoes. Let’s say he imports 15,000 pairs of shoes. That is: $10.00 x 15,000 = $150,000.

Now let’s put a 20% tariff on top of those shoes. Now the importer has to pay $12.00 per pair of shoes. That is an additional $2.00 per pair of shoes. That increases his total cost for the 15,000 pair of shoes to $180,000. That is a $30,000. Increase in the shoes.

He now has a choice to pay the increase in the tariff and pass on the cost to the retailer, who in turn passes on the cost to the consumer by increasing the price of the shoes. Or the importer can find another cheaper source for the shoes either from a domestic supplier or from another country that either doesn’t have a tariff or where the tariff is much lower than 20%.

What is a Trade War?

A trade war is when one country starts adding tariffs on imported goods and the exporting country retaliates by adding tariffs on goods that they import from the other country. For example, we are currently in a trade war with China. Trump has currently placed a 25% tariff on 250 billion of goods and products. China in turn is placing tariffs on importing our agriculture goods, aircraft, and electrical machinery. China now has the choice of paying the import tax on these goods and services or produce them themselves, or go elsewhere for them. If they quit importing those goods and services, it will have an impact not only from those that are employed by those companies, but the cost of those goods and service will be increased to our consumers.

What is a trade deficit?

A trade deficit is when a country is importing more goods than it exports. The elephant in this room is that we borrow money from China to finance our budgets and national debt. One of the ways we pay that back is via importing goods. However, depending on how long these trade wars go on, it may have impact on our national debt. Trump wants to reduce our trade deficit with China from 370 billion to 200 billion by 2020.

Why Tariffs are Used?

- Protect consumers

- Protect emerging industries

- National Security

- Retaliation

Protect Consumers

A government may levy a tariff on products that it feels could endanger its population. For example, South Korea may place a tariff on imported beef from the United States if it thinks that the goods could be tainted with a disease.

Protect Emerging Industries

This is a strategy that is used by developing countries to develop growth in their own country. They will increase the price of imported goods in order to create a domestic market for their goods and services while protecting those industries from being forced out by the competition from other countries. This usually requires subsidizing by their government.

National Security

Countries have a need to protect their defense industries and national security interest from competition. For example, Trump is currently concerned that China is competing with the U.S. on developing the next generation internet protocol called 5G. We need to protect our intellectual property as well as goods and services.

The first one to market 5G will have captured that market. That protocol will also be used by the military to increase their capabilities. Therefore, we may levy Tariffs on China to protect our interest.

Retaliation

That is currently the game that we are playing with China. It is a trade war. We are retaliating against them, according to Trump because they have not been playing fair and have taken advantage of us. China is retaliating by placing tariffs on our agriculture goods, and other durable goods. They can either produce them themselves or go elsewhere to other countries.

What are the Types of Tariffs?

- Specific tariffs

- Ad valorem tariffs

- License

- Import quotas

- Voluntary export restraints

- Local content requiremet

Specific Tariff

This is where a fee is levied on one unit of imported goods. It can vary according to the type of good imported. For example, a $10 levy on each pair of shoes, but a $100 levy on each bicycle imported.

Ad Valorem Tariff

Ad Valorem is Latin for according to value. Example: if Japan wants to protect its car market, it could levy a 15% increase on the value of cars imported from the U.S. If the value of the car is $30,000, its price to Japan would be $34,500 to import it. This increase protects Japans producers from undercutting, but keeps prices artificially high to Japanese consumers.

License

If there is a general restriction on importing of certain goods and services, the government can grant a license that specifies those restrictions be waived for that particular importer.

Voluntary Export Restraint (VER)

If two countries wanted to protect an increase in prices on their products. The importing country could place an order of Voluntary Export Restraint (VER) to the exporting country and the exporting country could do the same to the importing country. For example, Chile could place a VER on exportation of sugar to Mexico. Mexico could then place a VER on exportation of corn to Chile; thus, increasing the price of both corn and sugar. But it protects both domestic industries.

Local Content Requirement

Instead of placing a quota on the number of goods that can be imported, the government can require that a certain percentage of the goods or a percentage of the value of the goods be made domestically. For example, a restriction on the import of cell phones might be that 25% of the components used to make the phone are made domestically or that 10 percent of the value of the goods come from domestically produced components.

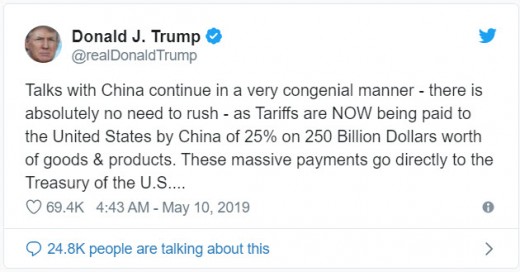

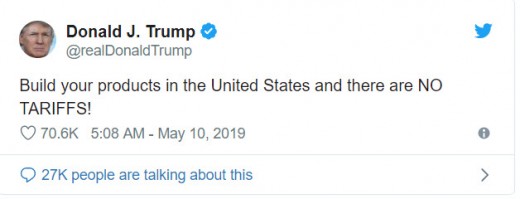

Trump's Tweets

After reading Trump's first tweet below, I'm not sure that he understands how tariffs really work. After reading his second tweet below, I'm not sure he understands how our economy works. It's not as simple as building our products here and there will be no tariffs.

In order to increase profits, and keep prices relatively low corporations have outsourced labor and assembly of goods and services for years. Our economy is a behemoth engine that does not take kindly to be converted from a global economy to a national economy overnight. It would take years to perform that conversion and more than likely prices to the consumer would increase to the point of being untenable.

China has a hybrid system of government. They are still a communist country with only a single party system. They have the ability to quickly and efficiently subsidize their enterprises in case of trade wars. Where our system of government does provide subsidies but not to the degree that China is able to do. Below are two of Trump's latest tweets on tariffs with China.

After reading the above tweet,

view quiz statistics

Do you believe it is better to outsource goods and services or bring everything back to the U.S.?

The Short Term and Long Term Effects of Tariffs

When tariffs are put in place, in the short term, the prices are increased to both the importer and the consumer. The revenue to the government is also increased in the form of duties collected. Domestic industries also benefit from a reduction in competition, since import prices are artificially inflated.

In the long term businesses may see a decrease in profits due to more competition. But the losers in this game are the consumers because of higher prices rippling through the economy from the price of steel rising to especially in food related products. Because food related products are an essential commodity, consumers will have less disposable income. However, the biggest winner will be the government as it continues to collect revenue from its own importers.

© 2019 Mike Russo