The Role that the Federal Government Should Play in the United States Economy

A Regulator, Stabilizer, and Occasional Investor

Since the 2012 election is drawing near, I have found myself writing a lot of political blog posts lately. I am, however, getting a bit tired of them, and I will be glad when this election is over. So in the future, if I manage to find the time to write anything at all, I hope to get back to more topics related to History, Education, and maybe even a little Religion. But while engaging in a little political dialogue on Facebook the other day, I wrote a rather long comment discussing the role I believe that the federal government can (and should) play in the United States today. It seemed a shame to waste all of that effort on just another Facebook comment, so I decided to go back and touch it up a bit and turn it into this little essay. So for those who are still interested in what I have to say, I promise (for the moment) that this will be my last statement about the upcoming elections:

Particularly during election season, many people seem to believe that presidents are personally responsible for the state of the economy. And while I believe that the economic impact of the president and of the government in general is often exaggerated, I do recognize that the federal government has a role to play. In my view, there are a few basic things that the government can do to help the economy. Most importantly, it can serve as both a regulator and a stabilizing force. Before the Great Depression, the American economy experienced several violent downturns. This was partly because the financial system was essentially unregulated, so bankers would do the same stupid things again and again that led to periodic crises. And without any kind of a government safety net, little was done to alleviate some of the suffering or to stabilize consumer demand during those bad times. So once the crash began, it took a while to hit bottom. But beginning with the New Deal, some basic financial regulations were put into place, and the concept of a federal safety net was established. Over the course of the next several decades, periodic recessions occurred, but they were nowhere near as extreme as in the mid-19th to early 20th centuries.

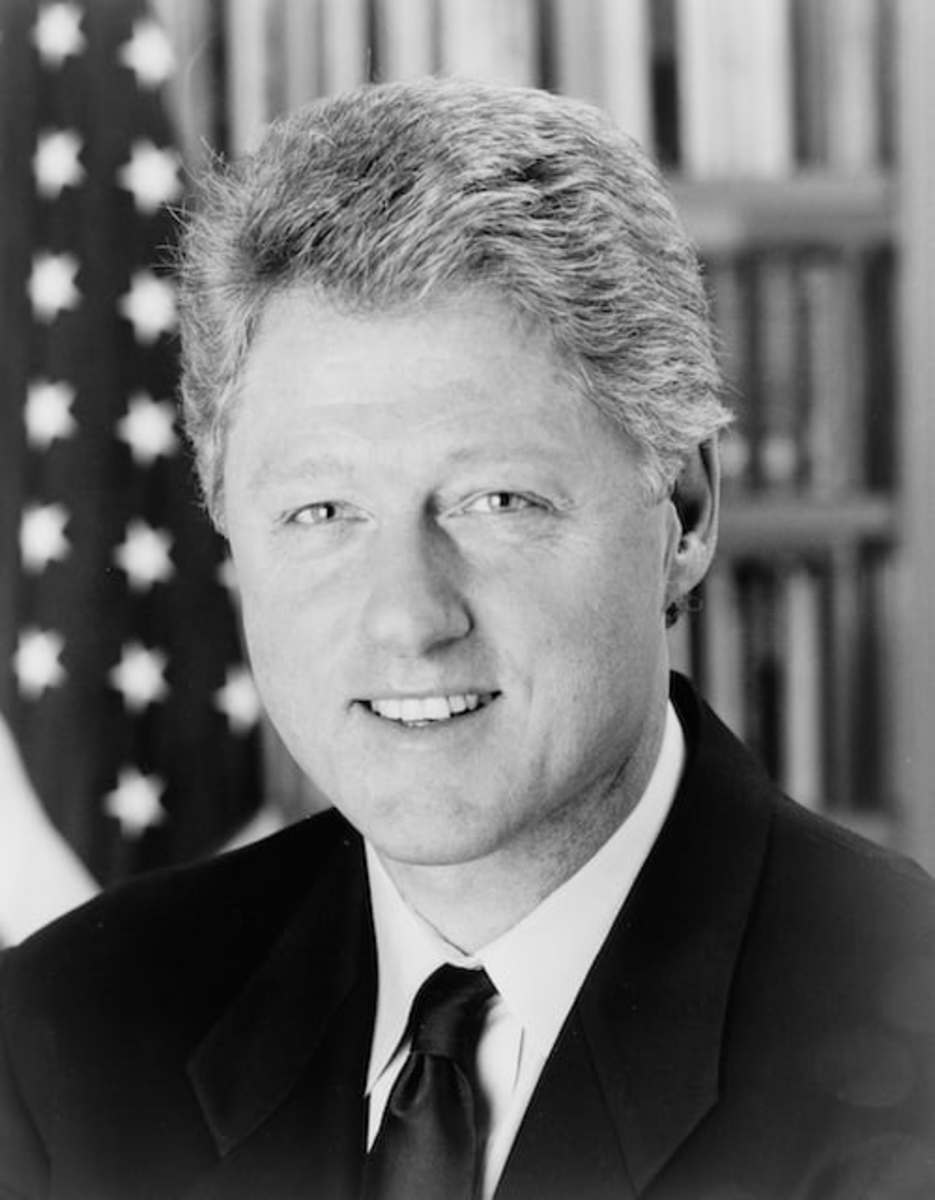

Unfortunately, the dismantling of basic financial regulations began in the 1980’s and was taken even further toward the end of the Clinton administration. The Gramm-Leach-Bliley Act of 1999 eliminated the divide between commercial and investment banking, allowing federally insured commercial banks to engage in risky, speculative activities that were previously the domain of firms such as Lehmann Brothers or Bear Stearns. The Commodity Futures Modernization Act of 2000 exempted many types of exotic financial derivative products, most notably Credit Default Swaps, from federal regulation. Acts such as these freed up many major financial institutions to engage in the behaviors that led to the near collapse of the financial sector in 2008, an event reminiscent of the financial panics of the past. Nothing comparable to this had been seen since the meltdown of the 1930's, the last huge collapse to take place before the implementation of common sense regulations.

Fortunately, the safety net still more or less functions, and this has been a stabilizing force. Food stamps and unemployment checks are not long-term solutions to people’s economic problems, but they help to both keep people alive and to increase consumer demand. But unfortunately, massive, unprecedented financial bailouts and Federal Reserve “quantitative easing” were considered necessary to prevent an utter disaster. And at least in the short-term, these efforts have been quite successful. Because as bad as the current situation may be, a peak of about 10% unemployment is nowhere near as bad as the 20-25% unemployment after the crashes of 1873, 1893, and 1929.

So in the short term, the government has definitely made the crisis less severe. But there are two big problems. The safety net as currently constructed is not sustainable over the long haul, and inflation will likely be an increasing problem soon. So entitlement reform must happen in the not so distant future, and in my mind, this must be tackled with a combination of tax increases and spending cuts. Also, the FED, hopefully, will recognize when the time is right – assuming that it has not already passed – to raise interest rates and restrict the growth of the money supply. Because if the debt grows too much, and the rate of inflation starts to increase significantly, these problems will crowd out investment in the private sector, decrease the value of people’s savings, increase the government's borrowing costs, and take a bite out of any future economic growth.

For the last four years, the federal government has been in crisis control mode, so I am willing to cut them some slack on both the issues of the debt and of potential future inflation. The trouble with crisis mode, however, is that it tends to be more reactive than proactive, with a short-term focus that puts off major sacrifices for another day. The other problem, however, is that an indebted federal government in continual crisis mode will fail to perform another of its crucial, economic functions: invest large amounts of money into areas that have little short-term profit potential. Without federal investment into satellites, early computers, and massive road construction during the 1940's through the 1960's, the economy as we know it would not exist. In some cases, there are certain worthwhile endeavors that only the government can afford. At the moment, I would put investment into alternative energy and the upgrade of much of our nation’s decaying infrastructure into this category. Sure, some of this investment might not generate profits in the short term. But these are two areas where I am willing to "waste" some money on the road to long-term, future payoffs.

I doubt that either presidential candidate or party is willing to implement all of the things that I just suggested. But I have more hope in the willingness of the Obama administration to protect the safety net, regulate the financial industry, and invest public funds into technological innovation than I see with the Romney people, who just keep talking about the same old tax-cutting / deregulation stuff that led to some of this mess in the first place. Our most fundamental political problem, however, transcends political party. We have become a society consisting largely of individuals and organizations focused primarily on short-term interest, and the special interests and institutions that spend the most on lobbyists and on political campaigns tend to get their way. Large corporations, in particular, have reached a level of power perhaps not seen since the late 19th century, and I can only hope that President Obama or some other political leaders out there have at least a little bit of a Roosevelt – either Theodore or Franklin – residing deep inside them.

The government, however, is not the only factor in shaping the state of the economy. You would be hard-pressed, in fact, to find a decent, objective economist who would claim that a presidential administration is the most important factor in determining economic circumstances. There are simply too many variable involved. The government can, however, strive to set up a playing field with some basic rules in place, help some people out in times of need, and stimulate some growth here and there. But in the end, the state of the American economy mostly comes down to how individual Americans – and, increasingly, people throughout the world – work, invest, innovate, and spend. History has shown that the free market does many things much better than government planning. But History has also shown that the free market works best when you have consistent, common-sense rules that apply to everyone and well maintained, basic infrastructure. And when the bad times inevitably come, we are all better off when people have somewhere to turn for help.

![Obama's General Motors [GM] Tarp Bailout - The Untold Details Obama's General Motors [GM] Tarp Bailout - The Untold Details](https://images.saymedia-content.com/.image/t_share/MTc0MTU0NDA1OTcxNzY1MTE2/obama-general-motors-gm-tarp-bailout-untold-details.jpg)