The Stupid, Unnecessary Battle Over Raising The American Public Debt Ceiling

The Burden

Will It Be Deja Vu All Over Again?

NEXT MONTH, FEBRUARY 2015, RAISING THE DEBT CEILING becomes what use to be a routine chore brought about by a self-imposed requirement from the Great Depression. Article 1 of the Constitution gives Congress the right take on debt to pay America's obligations. During the Great Depression, Congress gave that authority to the Treasury, but to keep that action Constitutional, they imposed an upper limit, in other words, a "debt ceiling". Consequently, since Congress, except during 1999 and 2000, continues to run a deficit which means bills keep mounting up. Sooner or later the Treasury runs out of debt authority to pay bills that come in the mail.

Since there are rumblings within the Conservative caucus to repeat the debacle of 2011, I thought I would dust this Hub off and republish it. Since I wrote this article, Conservatives got their wish, America's debt rating was lowered and the compromise that resulted had nothing in it which benefitted them in the "short-term"; so on that front, they lost. What it did have in it was what was supposed to have been a "poison pill" which would force the two sides to compromise for the alternative was draconian budget cuts to both defense (to incentivize the Right) and non-defense (to entice the Left) programs; it was called "The Sequester".

To the surprise of no one, the Right would not give a meaningful inch on their demands and the Left would not cave to all of the Right's demands, therefore no compromise occurred in Dec 2011. And America has been suffering ever since as the effects of sequestration shaved a percentage point or two off of GDP growth.

A later debt ceiling crisis was averted by giving Congress to spend what it needed, under certain restrictions, until Feb 2015; which is where we find ourselves today. There is a BIG difference, however. Those on the far Right who created the 2011 disaster lost power within their own Party. Granted, the 2014 mid-terms gave control of the Senate to the Republicans and deepened the Republican majority in the House; the dynamics are entirely different.

The far Right tried to increase their gains within the Party but failed miserably. With one or two exceptions, those Republicans who did win were run-of-mill fiscal/social conservatives ALONG WITH a few moderates in the North. Also, they have the experience of failure and being blamed for the down-rating of American debt. As a result, the Conservative leadership has vowed to not let the nation be downgraded any further. Unfortunately for them, many on the far Right, like Sen Cruz, have different ideas. As before, these politicians appear not to mind hurting America to score ideological points. This time that means defunding ACA (and put the millions of Americans who now have insurance because of ACA back into the ranks of the uninsured) AND stop helping long-term immigrants which most economists will improve GDP.

We will now see if Leader McConnell and Speaker Boehner have the ability to keep their troops in line.

WHAT IS THE PUBLIC DEBT?

THIS FALSE FIGHT THE CONSERVATIVES HAVE CREATED over raising the public debt would be funny, it really would be laughable if the consequences of not doing it weren't so damn dangerous if they are successful. Their reasoning proves they haven't a clue as to how the federal budget process works or, if they do, then they don't mind "misrepresenting" the truth to the American people over and over and over again; take your pick because, as you will see, it has to be one or the other.

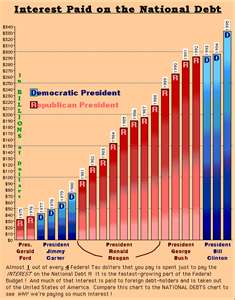

What is the public debt? It is simply the amount of money America owes from what it has borrowed to pay for programs PREVIOUSLY signed into law. The Constitution prevents the Treasury Department from paying cash out of the treasury if there isn't the money there to do it. There are two primary ways the Treasury receives cash; from taxes and from the sale of bonds, which is debt. Normally, debt is taken on in times of war or other emergencies and has often been paid off before the next emergency arises, or at least that was the original idea. But after WW I, the Great Depression, and WW II, we weren't so lucky for the accumulated debt was huge but manageable because the marginal tax rate was high. It wasn't until the latter part of President Reagan's administration did the amount of debt, relative to the GDP, become a real problem that had to be addressed; and it hasn't been the same since.

Reaganomics made structural changes in the way government did business regarding tax and spending policies that left the country with its first out of control deficit and, in the following years, an unsustainable, ballooning public debt; just like what we are faced with in 2011. Under the first President Bush and President Clinton, things were brought back under control and the country experienced surpluses and a public debt whose growth was quickly decelerating; in one more year, it would have had real decline but that was 2002 and it never happened. In 2002, the second President Bush effectively reintroduced Reaganomics and history repeated itself. Before the Great Recession of 2008, the deficit was once more out of control and the public debt had quadrupled and was on its way to double once more. All of this happened BEFORE President Obama's Stimulus (as it has turned out, the TARP hasn't contributed a significant amount to the deficit or the debt).

Finally, the coup de grace was President Obama's efforts to prevent total catastrophe from happening as a result of the 2008 recession and undo the damage that has already been caused; this required the expenditure of a great deal of money and still requires even more. If you don't believe me, you turn to my Hub on the 1873 Depression; you will see the consequences of government inaction in the face of an economic collapse. So that is where we stand today; booming deficits and soon to be booming public debt, EVEN IF WE HAVE A BALANCED BUDGET FROM THIS DAY FORWARD, i.e., revenues equal outgo from existing programs and any new programs, not counting normal inflation. Why? Two reasons, interest and preplanned allowance for program growth that cannot be predicted with certainty at the time the program was passed.

Boy, How It Grows

SO WHAT'S THE PROBLEM

THE CONSERVATIVES WANT TO HOLD AMERICA HOSTAGE in order to wring more FUTURE budget concessions out of the Democrats be for they will allow America to honor its PAST obligations. Exactly how American is that? Not very, in my book. What America isn't asking the Conservatives to do is raise the debt ceiling so much as to accommodate obligations that will be accrued in the 2012 budget and beyond, no; what is being asked for is for America to raise its debt ceiling enough to honor its debt, a long standing, proud, ethical American tradition.

Instead, when you blow away all of the fog of rhetoric, what the Conservative's bottom line is that they are willing to let America go effectively go into a sort of bankruptcy if the Democrats don't cave in and give them what they want now for the 2012 budget rather than debating it at the appropriate time during discussions ON the 2012 budget. Instead, the Conservatives obfuscate the arguments by couching them in terms that have nothing to do with public debt, which is dealing with the past. They should be worrying about how to fight the 2012 budget battles which is dealing with the future.

COMMENTARY ON THE PUBLIC'S STUPIDITY ABOUT THE CONSEQUENCES OF FAILING TO RAISE THE DEBT CEILING.

I am guessing from the news reports that most Americans have been conned by conservative propaganda, for it seems a majority actually believe it is no big whoop if America runs out of ceiling come August 2, 2011. I don't get it. You have virtually every expert in the field speaking out about the disaster that would befall us if that were to happen; the Great Depression would be a walk in the park by comparison. I heard one commentator ask another why this was. The answer was "because they have never experienced one."

I find this fascinating, but when I stop to think about it, I suppose he is right, sadly so. It is beyond my comprehension that so many people cannot connect the dots or draw the comparison between failing to meet their personal debts and what happens to their families when all is lost to what happens to a country when essentially the same thing happens. The whole country is still living through the aftermath of the Great Recession of 2008 and they can't see that this would just be the first act of something worse if America defaulted on its debt? I just don't get it, but it is true that they don't.

- A Short History of Significant American Recessions a...

THE following hub will attempt to present the record of significant depressions and recessions in American history and take a quick look at the fundamental causes, who was in power leading up to the...

© 2011 Scott Belford

![The Fallout From the Conservative Assault on the Right to Privacy and the Supreme Court's Lurch back to 1820 [Updated] The Fallout From the Conservative Assault on the Right to Privacy and the Supreme Court's Lurch back to 1820 [Updated]](https://images.saymedia-content.com/.image/t_share/MTkxMTU1MjUyMDYwMjM1NTM5/the-fallout-from-the-conservative-assault-on-the-right-to-privacy-and-the-supreme-courts-lurch-back-to-1820.jpg)