The Tale of Two Depressions

Depression vs Depression

Most of us who are too young to have lived through the Great Depression have either listened to our parents and grandparents tell us stories of what it was like, whereas others simply studied the cause and effects from as young as grade school. Yet more and more economists over the years have taken a closer look at some of the policy responses that came from the Gov’t during this era and have come to very different conclusions than those of political historians. One recent look was that of the 2003 book authored by Jim Powell…”FDR’s Folly”

1929

The Great Depression which began in 1929 produced numerous policy responses. For years, FDR was credited for guiding the nation through these challenges quite successfully. In reality there were few differences between the policies of Hoover and his successor FDR. FDR simply applied these ideas on a much larger scale. The evidence points out that it is more likely both FDR and Hoover's policies prolonged the recession into a long lasting Depression. This is just some of the analysis done by Powell which points out the following:

Hoover

During the depression, about 10,000 US banks failed between 1929-1933. During this time many states had banking laws that prohibited the banks from having branches. This lack of diversification made financial institutions far weaker. The vast majority of these failed banks were single office rural banks. During this global crisis countries like Canada had no such restrictions and saw NO bank failures.

Hoover was president during the onset of the depression in 1929. Hoover had tried to encourage industry in the US to keep employee wages high despite falling prices. He signed the Davis-Bacon Act to require local governments to pay union wages, which helped to keep labor costs artificially high.

In 1930, Hoover signed the Smoot-Hawley Tariff which raised prices on goods that were imported to the US. In return, many countries retaliated by raising prices for American goods that the US exported and US exporters suffered.

Hoover passed laws that limited the short sale of stocks, which caused price distortions. Simultaneously he passed laws to revise bankruptcy and limited the rights of creditors.

Many new taxes were created by the Revenue Act of 1932.

FDR and the New Deal

In 1933, FDR took office and continued many of these policies on a much larger scale. One of his actions was the creation of the Glass Steagall Act, which prevented investment banks from engaging in commercial lending. Many point to the repeal of this act in 1999 as a contributing factor to the 2008 crisis. This is hardly the case since the act was not enforced for decades while financial institutions simply participated in both business models through separate holding companies. In fact, during the 2008 banking crisis, it was the banks that had a diversified model that did NOT need Gov’t assistance. Yet those with a pure investment-banking model were in desperate shape (Lehman Brothers/Bear Sterns).

One of his first actions was to declare a series of national bank holidays. As Powell notes, this actually contributed to bank runs. In the days before ATM’s and credit cards, individuals would have to pull their deposits from the banks earlier and in larger numbers out of fear that the banks would be closed.

FDR instituted dramatic tax increases to Federal Income, dividends, and estates, then subsequently limited deductions. The Undistributed profits tax of 1936 raised the corporate income tax and limited deductions for business losses incurred. Tax rates in excess of 90% greatly reduced incentives to invest capital and take risk. Disincentive was particularly high when there were limits on deductions on the potential loss of business investments.

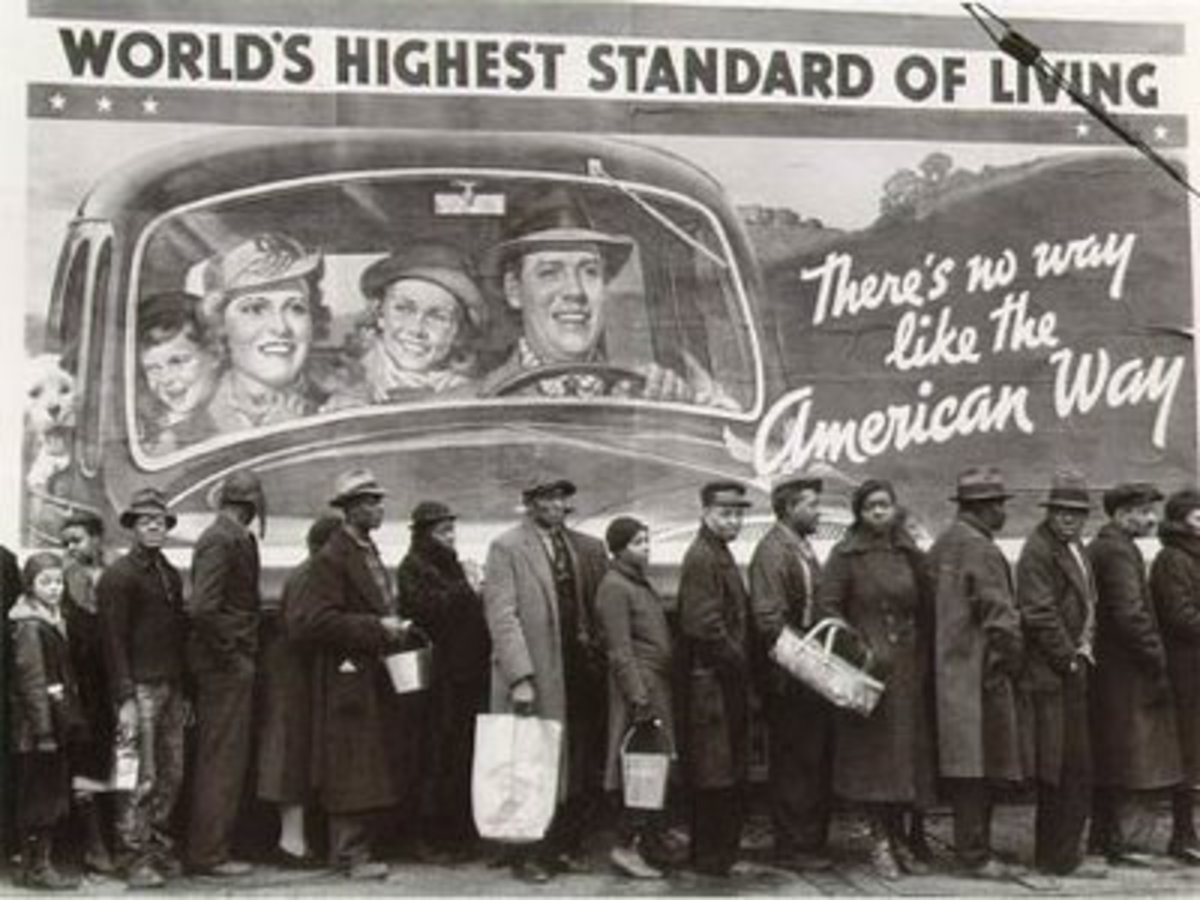

The National Industrial Recovery Act (NIRA) of 1933 created a number of central planning measures, set minimum wages, minimum prices and instituted production quotas. This made it easier for workers to unionize. Then the Wagner Act of 1935 created closed shops and banned in-house unions. The effect of these acts was to artificially increase wages. This coupled with price controls forced many companies to cut more workers. This was particularly harmful to minorities, as many of them were not permitted to join labor unions at that time. The US Supreme Court eventually deemed NIRA unconstitutional.

The Civilian Conservation Corps (CCC) and the Public Works Administration (PWA) recruited huge numbers of Americans for public projects. However, these programs concentrated the vast majority of the work in western states which were considered swing states at that time for the purpose of FDR’s re-election. Furthermore, most of these jobs were exclusively for skilled labor. Therefore, those that were largely excluded were at the lower end of the economic spectrum and saw no benefit.

In 1934, the Frazier Lemke farm bankruptcy Act limited the rights of creditors in an attempt to reduce farming foreclosures. The result of the rights of creditors being limited was to actually reduce the available credit to borrowers.

Other attempts by FDR to fix prices and reduce competition were the Robinson-Patman Act of 1936. This made it essentially illegal for wholesalers to give cheaper prices to larger chain stores making the cost of goods to the consumer more expensive. Then the Miller-Tydings Retail Price Maintenance Act of 1937 required minimum prices on products sold through smaller chains, which also artificially inflated prices for the consumer.

The Agricultural Act of 1936 had more price controls as well as production limits designed to reduce the supply of food and keep prices higher. Amazingly under this program, as millions across the nation were literally starving, the Federal Gov’t was actually DESTROYING perfectly good food. Over 10 million acres of crops and 6 million farm animals were ordered to be destroyed. This not only influenced the food supply, but also costs jobs to those in the farming industry. Eventually this act was also declared unconstitutional. It was quickly replaced by the Soil Conservation and Preservation Act. This essentially reduced the acreage for food crops by actually paying farmers to grow grass and NOT food all in an attempt to keep prices high.

The Commodity Credit Corporation was created to make loans to farmers while they used their land as collateral. If the price of the crop dropped in value, they could keep the money and forfeit the crops. The primary beneficiaries were wealthy farmers with more land, while the smaller farmers were impacted negatively. Most of these deals were also concentrated in swing states for votes. All the while, the foreclosure rate on farms remained high throughout the 1930’s.

One of the most positively regarded programs was the Tennessee Valley Authority (TVA). The purpose was to build dams and bring electric to more rural areas. Yet in doing so, the TVA seized private property through the laws of “eminent domain” in many cases for less than fair market value. Another theoretical benefit was that these dams were to help prevent the cycle of flooding. Yet in fact, the areas permanently flooded by TVA lakes covered and even larger area than those that flooded naturally by rivers.

The Social Security Act was passed in 1935. As originally passed, it was designed as a program where the funds would go into an old age retirement account and benefits would start to pay the beneficiaries in 1940. This would give the accounts time to build and begin paying benefits to recipients. Accept by 1940 FDR and congress had already spent all the funds that were to be used for Social Security. It was then modified to a pay as you go program. Today it is still an unfunded liability. The act itself immediately depressed wages for most Americans since employers were paying a SS tax on behalf of each employee and this made hiring more expensive. The employees paid a SS tax as well, so the implementation reduced the take home pay and the purchasing power of each individual

Numerous other programs were declared unconstitutional. In FDR's frustration with the Supreme Court of the United States refusing many of his mandates, he took an unprecedented step towards a power grab and tried to alter the separation of powers. In 1937 he proposed the Judiciary Reorganization Bill. Through this bill, he would have been permitted to simply add more judges to the court which he would appoint, who would be more friendly towards his constitutional violations. The bill was not passed. However, it was successful in that many of the justices, particularly Justice Hughes and Justice Roberts were greatly intimidated by his actions that they simply stopped opposing him.

The cost of these programs had grown so out of control that the gov't could no longer finance them as the US used the Gold Standard in regards to the US dollar. If people were to see an increase in inflation because of his reckless spending, it would be a political disaster. People would simply trade in their paper fiat dollars for gold. So to avoid this FDR amended the Trading with the Enemy Act of 1917. Under this authority, he issued Executive Presidential Order 6102 which forced people to turn over all but a small amount of gold they had in their procession at the price of $20 per troy ounce. After he had seized all the nations gold, he then set the price at…$35 per troy ounce !!! This was one of the largest thefts in modern history.

With all of these unprecedented spending measures being implemented, what was the result ??? By 1938, nearly a decade later, the US had entered a Depression within another Depression. The Treasury Secretary Henry Morgenthau testified before congress in 1939 and said “We are spending more money than we have ever spent before and it does not work…I say after eight years of this administration we have just as much unemployment as when we started and an enormous debt to boot”

In reality, the New Deal polices favored labor unions and ignored non-union labor. This kept prices artificially high and led to numerous labor disruptions via union strikes. Business owners felt so threatened by these policies that capital investment went on strike. Those of means hoarded their wealth rather than invest in any new enterprise. The public concern for the attack on the private sector was so great that in 1941 fortune magazine conducted a poll that showed that 91% of those that responded believed the US was potentially headed for some form of a dictatorship or the loss of private property rights. While that may not have been FDR’s intent, he essentially panicked the marketplace.

The conventional wisdom was that WW2 and all the massive production that was required is what eventually ended the depression. It did put people to work, but only for a limited time. The price was a soaring out of control national debt. Once the war ended, the gov’t stopped spending, the jobs went away, and private capital went back into hiding. By the end of the war, Truman was the new US President. He proposed more New Deal like spending policies. Instead a Georgia Senator named Walter F. George, who chaired the US Senate Finance Committee stonewalled them. Congress had seen enough. The top marginal tax rates dropped nearly 10% while the amount of earnings that would be exempted from taxation was increased. 12 million Americans would no longer be subject to taxation. The excess profits tax was repealed. The corporate tax rate was dropped from 90% to 38%. All of the FDR price controls were abolished and Gov’t spending was slashed. The revenue to the treasury went higher under the lower rates as private investment was stimulated. The increased revenue meant budget deficits were gone and replaced with a budget surplus. The Depression had ended.

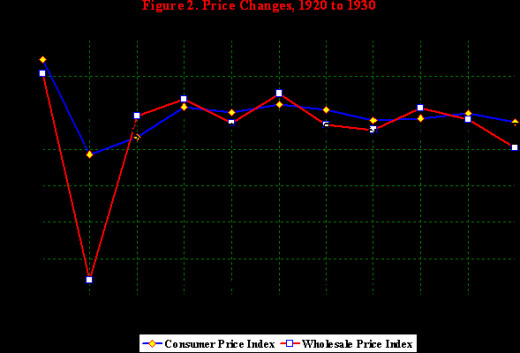

The Forgotten Depression 1920-1921

The depression we rarely hear of is the Great…Great Depression. Shortly after WW1, there was an extremely sharp economic contraction. Wholesale prices declined by about 36%, unemployment spiked quickly from 5% to over 8%, the stock market declined by 47%. The rate of business failure more than tripled. Companies that survived saw a 75% decline in profits. Total industrial production declined by 30% nationwide. The Consumer Price Index fell by over 15%. In contrast, the deflationary pressures of the 1929 depression at its worst point was 11%. The severity of the sudden price deflation can be seen in the below chart.

By any economic measure, this was a calamity. The sudden shock was just as impactful, if not more so than the eventual would be events of 1929. The US was faced with a crushing debt due to the financing of WW1. So what were the policy responses of the day ???

The president and congress took steps that today would be regarded as heresy by the academics. The Federal gov’t slashed the budget from 18.5 billon to 6.4 billion…an astonishing 65%. The next two years the budget was further slashed to 3.3 billon by 1922. Furthermore, the top marginal tax rates were reduced from 73%-56%.

On the Monetary side the Federal Reserve actually raised interest rates, which many cite as one of the causes to the economic contraction. After this extreme contraction, the monetary base collapsed worse than anything seen in 1929.

So what was the result ??? Within 18 months the depression was over and along came the roaring 20’s, probably the most prosperous decade of growth in modern U.S. history. The recovery did not require another subsequent monetary expansion by the Federal Reserve. And there were no massive fiscal stimulus programs. This quick recovery is precisely the opposite result of what should have happened based on the policy responses at the time if we listen to either the Keynesian or the Monetarist viewpoint.

The New Deal spending induced fiscal stimulus has been the conventional wisdom of the policy makers since the experiments of 1929. Is it possible that these policies are designed more to empower those in Washington rather than those whom they govern ??? With each passing crisis, Gov’t gets bigger. With each period of prosperity, Gov’t gets bigger. In the natural business cycle there will be expansions and contractions. Markets are not perfect, they often develop imbalances and need time to work these imbalances out. Markets are also largely self-correcting. Yet with each passing crisis, the Federal authorities grab for more power and authority.

Perhaps the economic models of neither the Keynesians or the Monetarists are correct. In my view economic policy is something that should be addressed on an ad hoc basis. However, the fundamental principal that seems to tie directly to quick recoveries is the limiting of Gov’t intervention, while allowing markets to self correct any misallocation of capital. The alternative seems to be more of a slow bleed while the Gov't simply delays and prolongs the agony. This does not mean that there is no role for Gov't in a crisis. But that role should not likely be taking away additional profits, setting price controls, or determining what industries receive greater investments through taxpayer dollars.

The failure of fiscal stimulus to create sustainable growth can be summed up with a basic example... If you owned a small motel in a sleepy town, you may employ a few people to help. But what if the Gov't decided to throw a convention in your town for the week. You might be forced to hire some individuals on a temporary basis to service the need. Both you and those hired recognize it is temporary. As a result, when the convention is over, they are let go. Those employees know full well it is temporary. They will take the work because they are in need of the money. However, they are not likely to alter their behavior of spending knowing the work is temporary. Nor would you as the employer build a new wing on the motel since you also realize the demand is artificial and temporary. At the end of the week/stimulus, nothing has changed.

Since economic contractions across the business cycle are inevitable and unavoidable, In more simple terms...would you prefer to peel the band aid slowly...or just rip it off ???

Suggested Reading

- Starting A New Job...Understand Your Benefits Packag...

If you’re fortunate enough to have been hired into a new job there can be a number of things that need to be addressed at the beginning of employment. Often times it can be a little overwhelming to address all the issues that come up with regards... - The Best Ways to Pay for College

There is an old saying when it comes to saving for education. Either save a lot of money or don’t save anything at all. However, don’t fall in between the two strategies. The cost of education has gone up dramatically over the last several... - What should your Financial Advisor ask you ???

Often we read articles & commentary about what to ask your financial advisor. But what should your financial advisor be asking you. Often times that alone can tell you whether or not you are engaged in a financial advisory relationship that is in - Recently Unemployed...Some Things to Think About

In recent years the US population has had no shortage of those whom have had the unfortunate experience of a job loss. As of August 2012 we currently have and official unemployment rate of in excess of 8% of the population. This data is based on the. - Should I Pay off My Mortgage Early ???

For many Americans, the ability to pay down their mortgage sooner is simply not realistic. However in some cases it is quite possible. The Question of whether or not you should accelerate mortgage payments or use liquid cash to eliminate the... - Small Business Retirement Plan Options

Those investors who are self employed understand more than anyone the importance of a return on your investments. Yet part of the reason many of us may be encouraged to pursue the path of self employment is due to the potential tax benefits. While... - The Risks Of Starting Your Own Business

Perhaps my nature was that of an entrepreneur at heart, or perhaps it was born out of the frustration of working under a large group of “yes men” in multinational conglomerates. However for many years I wished to work for myself. After years of... - Prioritizing Your Debt's

Quite often individuals find themselves under a pile of debt for various reasons. Sometimes we fall upon hard times due to a set of unfortunate circumstances beyond our control. Other times we may have simply lived irresponsibly for periods in our... - Preparing For The Tax Law Changes In 2013

The topic of taxes is always one which is greatly debated from both a political as well as an economic perspective. Regardless of one’s political persuasion on such issues, one constant always remains the same. We each do all that we can to avoid... - Refinancing to a 15 or 30 year mortgage ???

Over the course of the last few years I have received numerous calls from clients asking me whether or not it makes financial sense to refinance their mortgage as a result of this unprecedented low interest rate environment. And in many cases the...