The Tax Compromise: Who Won?

This Beatles song sums up Americans' feelings about taxes

A Compromise With no Sacrifices

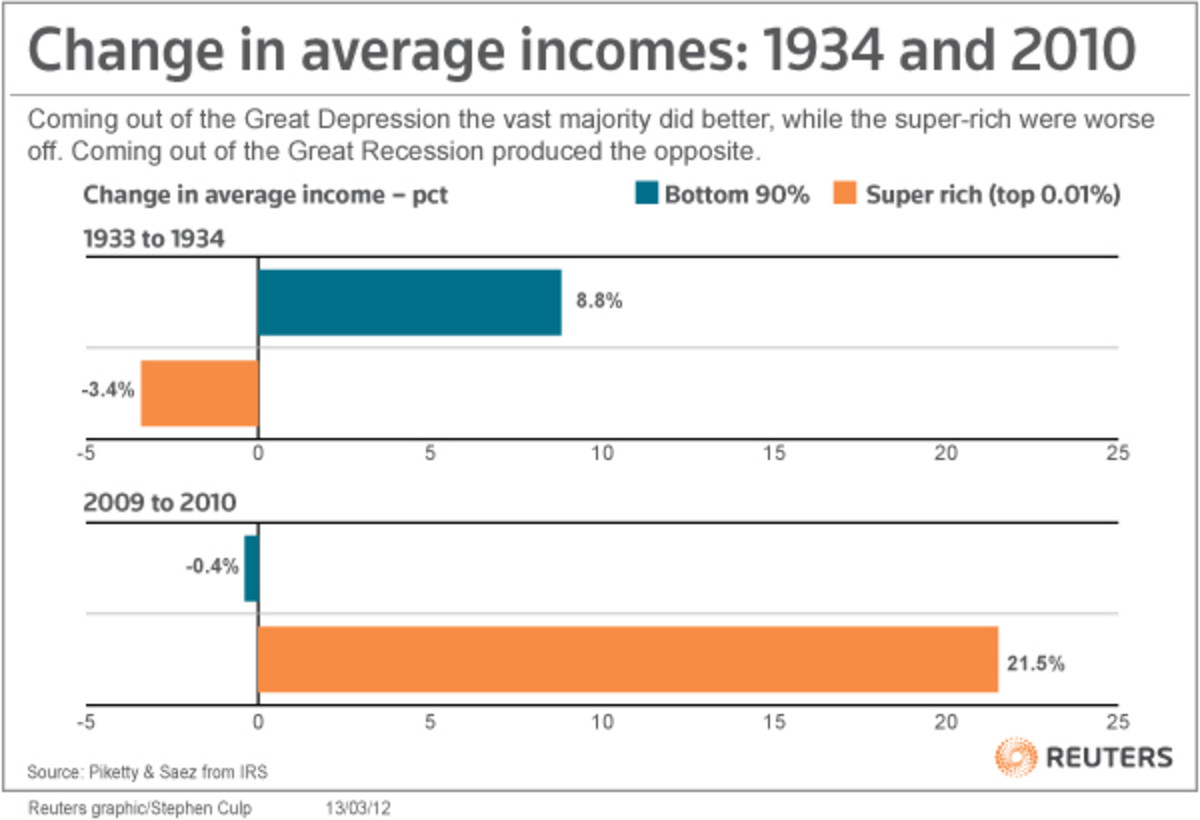

The recent tax compromise reveals a few things about modern American politics. First, it shows that most people in both parties are in general agreement about tax policies. In the midst of a still sputtering economy, neither side showed any desire to raise taxes on the overwhelming majority of Americans. The only question was whether or not to raise taxes on upper income people. President Obama during his campaign argued that income taxes should only be raised on Americans making over $250,000 per year. In his mind, this would be one step toward dealing with the nation’s chronic budget deficits. But due to lingering economic troubles and intense partisan divisions, decisions regarding the Bush era tax cuts, set to expire at the end of 2010, were put off. Also, as few Americans apparently noticed, tax cuts represented almost one-third of the cost of the fairly unpopular 2009 economic stimulus package. The federal deficit, of course, is now even more out of control, and it proved to be one of the major factors in helping Republicans do very well in the mid-term elections. And yet, in spite of our nation’s massive debt, the Bush tax cuts remain popular.

So as the “lame duck” congress came into session, Republicans were emboldened by their electoral success, and taxes on all Americans were set to go up on January 1st, prospects for compromise were in the air (for a change). By nature, President Obama gravitates toward compromise. This is part of the reason why he receives so much criticism from liberals. Those who mistakenly view him as a hard-core liberal have been influenced by a Republican strategy of depicting him as an ideologue with whom real conservatives could never compromise. By refusing to go along with almost everything he has proposed, they could then blame the president for the nation’s lingering problems. During economic bad times, this is an effective political strategy. But with popular tax cuts for all Americans set to expire, would they refuse to compromise once again?

So the two sides were engaged in a game of chicken. Republicans wanted the Bush era tax cuts to stay in place for all Americans and a reduction in estate taxes. Democrats wanted taxes raised on the wealthy and an extension of unemployment benefits. If no action was taken, we would end up with tax hikes for everyone. Apparently, Obama backed off first. He announced that he had worked out a deal with Republican leaders to extend tax cuts for everyone for two more years and raise the minimum level at which people would be subject to estate taxes. Republicans agreed to an extension of unemployment benefits. So on the surface, both sides received something that they wanted. The congressional response, however, revealed a general perception that the Republicans had won. Some Democrats argued that the president had given in too easily, and more complaints rang out from liberals than conservatives in the days before the bill was ultimately passed.

By showing his willingness to compromise, however, Obama now has a chance of winning a political battle for a change. His “victories” on health care and financial regulation were hollow because those pieces of legislation did not receive widespread popular support. But in this case, if Democrats (for once) play their cards right, the president can look like the guy who was willing to cut a deal in order to protect average Americans. Republicans, on the other hand, might look like the party that was willing to risk tax hikes for everyone in their efforts to protect the wealthy. There is a chance that many independents, the voters that really matter, are going to view his actions in a positive light. Die-hard Republicans and Democrats, of course, will accept the version of the story that their respective parties feed them.

What this episode ultimately proves, however, is that neither party is particularly interested in fiscal responsibility. Because we are still struggling economically, I can tolerate another year or two of heavy deficit spending. The question is when (or if) they will finally raise some taxes and make some significant spending cuts in order to get their books in order. Anyone who thinks that the deficit can ever be brought under control without a combination of both of these painful, unpopular actions is living a fantasy. For now, politicians are content to put things off, just as they have been doing for decades. Both parties, after all, are afraid of asking the American people to sacrifice. Because raising taxes and cutting spending are not actions that tend to win votes, politicians are content to talk in theory about deficit reduction and blame the other party for our current situation. Meanwhile, the clock is ticking. At some point, the inevitable, ultimate compromise needs to involve some pain, not more tax cuts and government spending.