Saving the American Economy

Introduction

I have lived in the U.S. my whole life. I love what this country has always stood for (the history, the ideals, the principles, etc.). As a country, we’ve certainly had difficult times where our leaders were ineffective or were not leading us in the right direction. Pretty much everyone seems to agree on this point. I think we all could list a number of ineffective leaders in U.S. politics. What we disagree on is the actual names on the list. Still, the lists are easy to make.

When I look back, it seems clear that neither side gets a pass. Republicans and Democrats alike have contributed to this country's current economic struggles. They keep doing the same things over and over and our economy continues to flounder. They still fail to balance the budget, and the national debt continues to skyrocket with uncontrolled fervor.

When I look at the economy, I believe there is one particular problem that is a major contributor to our economic troubles. In fact, I think it's the key to why politicians fail to move us in the right direction, and it's the key to why we fail to do anything about it ourselves. In addition, there's actually something government officials could do today that would actually kickstart the American economy in a huge way and likely instigate sustained growth over time.

The State of the Union

According to the Keynesian theory of economics, the solution to the Great Depression would have been to drive people to spend money (ie. to push it back into the economy) through the following forms of stimulus:

- Reduced interest rates

- Increased Government spending

We have seen both of these in various forms for a while now. Interest rates hit their highest point in the last fifty years in December of 1981 (over 18% for a 30 year fixed rate mortgage). Rates have been slowly dropping ever since. Ranging from 7% to 9% in the 90s, 5% to 7% in the 2000s. Since February 2011, rates have consistently dropped half a percentage point every six months, all the way down to 3.5%. As for government spending, we’ve seen plenty of that in recent years as well. The Economic Stimulus Act of 2008 gave tax rebates of $300/$600 per family. Shortly after, the 2009 Gross Domestic Product actually went down from its previous value in 2008, indicating that the U.S. economy was actually contracting instead of growing. Obama later signed the Recovery Act of 2009, which went so far as to bail out financial institutions among other things. This act included over 80 billion dollars worth of investments in each of the following areas:

- Tax incentives

- Healthcare

- Education

- Infrastructure (transportation, water, sewage, government buildings, communications, energy)

- Miscellaneous (energy efficiency, housing, scientific research, etc.)

Chrysler, General Motors, A.I.G., Bank of America, Citigroup, and hundreds of banks have all received bail out money thanks to TARP (Troubled Asset Relief Program), not to mention the bailout money given to Fannie Mae and Freddie Mac.

With all of this, the economy continues to struggle. From 2000 to 2008, the unemployment rate averaged around 5%. It jumped to 9.5% in 2009 and stayed there until finally dropping to around 8% in 2012 (3 years after the 2009 stimulus). Most recently, the unemployment rate measured at 7.8% (December of 2012).While this shows recent improvement, this is still significantly higher than the 5% average from just 5 years ago. In addition, the Gross Domestic Product actually contracted (in Q4 2012) for the first time since the struggles of 2009. While some make claims of recovery, the actual numbers seem to belie their optimism.

Digging Deeper

If the government has released trillions of dollars into the economy between the bailouts/rebates and money left on the table in unclaimed taxes, why doesn’t the economy seem to be picking up steam? If we asked our friends and relatives why they don’t spend money, what would they say? The government has always assumed that if they give $2000 to each family, families will spend that money somehow (stores, restaurants, etc.) which will kick start the economy. If you lower interest rates enough, people will naturally open up their checkbooks and begin to buy. But what if they’ve misunderstood the root cause of our dilemma? What if they've ignored a detail that is actually the key to this nation’s recovery?

According to the Huffington Post, the average credit card debt per person in the U.S. is now a few bucks shy of $5000. But wait, this includes people in the U.S. who actually have no credit card debt at all. In reality, the average credit card debt is in the neighborhood of $15,000 per household. Maybe this is your story. Today, credit card interest rates average around 13% (fixed rate that doesn’t change) or 15% (variable rate that moves with current economic indicators), but this is just the average. In actuality, the rate we’re given depends greatly on our credit score and past history. Some interest rates can be as high as 30% or more. At 15%, the credit card would accrue $180 of interest per month. At 30%, it would be $360 per month. That means I can actually pay $360 a month and make no progress towards paying off the balance. Our monthly payment to the credit card company likely includes some amount of money to go toward principal every month so the balance will actually go down a little bit. But then if we still occasionally use the card (for emergencies only, right?), we’re still not making any progress. Those of us who are actually attempting to get out from under our credit card debt are likely paying two times our minimum payment or more every month just to make headway.

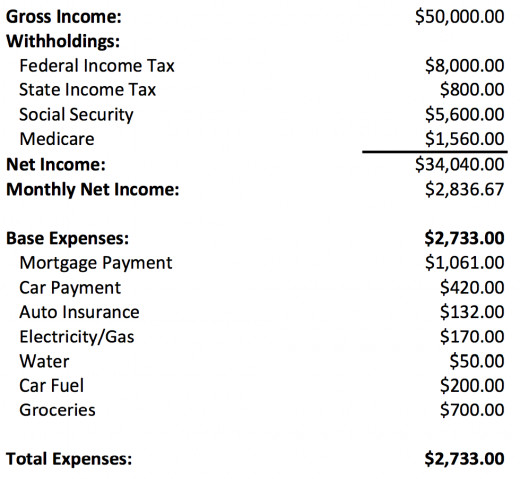

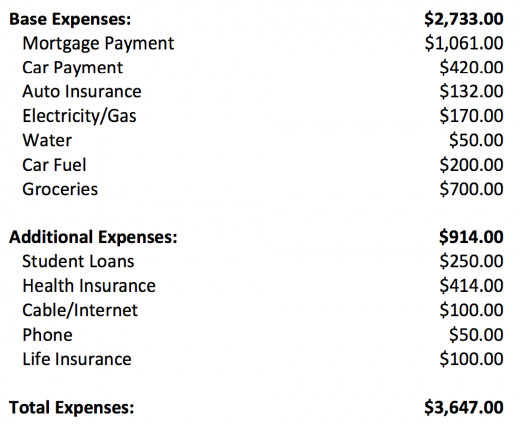

So we need a starting point for the discussion. What we can do is take the average American household income and couple it with the average American household expenses. The average mortgage would be a $1,061 average payment at 4 percent on a loan amount of $222,261. Then we add in the average car payment, auto insurance (can’t drive without it), utilities, etc. What you see here is that the average family spending has already caught up with the average family income ($50,000), and we haven’t even added in things like health insurance, life insurance, cell phones, student loans, a second car, car repair, home repair, copays, surprise medical expenses, etc.

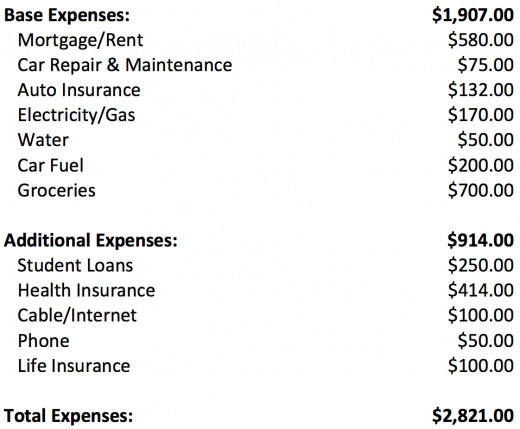

When we add in just a few of those things, our very average family goes very much underwater. Take a look at the numbers to the right. When you add in the average student loan for one person, health insurance, cable/internet, phone, and life insurance, we see that our total expenses are now $800 higher than our monthly income. Imagine what happens when you have a second car loan, a second set of student loans, etc.

Some of this may actually be a little skewed though. For instance, the average home loan excludes the 30% of households that do not have a mortgage. So, we'll assume that our household with $50,000 per year income would find a place to live that's significantly cheaper that the average mortgage. Let's go with $580 p/ month, which may or may not be realistic depending on where you live. Also, let's assume that we've purchased a used car with no car payment but $75 per month average maintenance costs. It is still very tight, with roughly $20 margin between income and expenses. And, our medical, home maintenance, and emergency needs still are not accounted for. Life has a way of throwing us curve balls which don't always fit neatly into a budget like this. So where does the fun money come from? How do we go on vacations, date nights, family outings, etc.? This is, of course a very simple example, but I believe it reasonably shows that the average American income cannot comfortably sustain the average American expenses.

I also believe that the very presence of debt in America is the reason why we see such a disparity. Families have been able to live for a pretty long while as if they have more income than they actually have, and companies have been able to charge more than they should and still sell their product. But now, we see businesses struggling (especially small businesses) because debt has strangled many consumers and their extra money has to go to their creditors (often on minimum payments which does nothing to help their situation). The average person in America has $47,000 in total debt (notice that this is the average person, not the average household). Couple that with the 15% of Americans who live below the poverty line and the problem with the American economy begins to come into focus. It turns out that small businesses (struggling today) play a critical role in the health of the economy. According to aei-ideas.com, "more than 60% of gross job gains–and losses–since the early 1990s have come from firms with fewer than 100 employees, so small businesses clearly play a major role in the dynamism of the labor market."

The Bottom Line

But debt itself is not a root cause, is it? At the very core is a word none of us really want to have associated with ourselves. We just want what we want, don't we? As a rule, we're just... greedy. Credit card companies give increased credit limits to people who have high balances simply because they have reliably made their monthly often minimum payments. Translation: "Let's milk them for as much as we can." At the same time, we ourselves apparently find it nearly impossible to tell ourselves no. At the end of the day, our money goes farther when we're not being charged a ton of interest on what we buy. Paying with cash is clearly the way to go if you want to maximize your spending potential. If we could just learn to live without debt, we'd have more and and could do more! Unfortunately, we want what we want right now and are unwilling to wait. We are only focused on right now and the object of our desire, giving no thought to how we're affecting our financial future. Some of us know that we're doing a bad thing to ourselves similar to the smoker who lights up his next cigarette. He knows it's killing him by now, but he can't stop it. This spending addiction (ie. greed) is in fact the root, and there is no magic answer for it. Each person must deal with it themselves and learn how to behave responsibly not only for their own good but for the good of our struggling economy.

If so many people cannot spend because the load from their debt is too great, how do we move forward as a nation? Some have suggested that we employ a model of periodic debt forgiveness to get the economy going again. But isn't that what bankruptcy is? The option is already available. If our core issue could be summed up as a lack of personal responsibility, a pattern of periodic debt absolvement would only make that worse. At some point we must recognize that the acquisition of debt is the last thing that should go unregulated. I know regulating anything is not popular with many. We all want to be free, and we get irritated when someone takes away our options. Still, I do think that there should be some regulation that prevents someone who has filed for bankruptcy from having a total credit line higher than 10-20% of their monthly income. If you have filed bankruptcy in the past, your options with regard to credit should be severely limited for some lengthy period of time. It should not be left up to the creditor, who is more than happy to put this poor confused person right back in the same predicament. I would support a system where your credit limit is based on your average monthly income and the amount of money you have in savings. Should you really be able to have a credit limit that is higher than what you could pay off in a month? This is why people feel so trapped.

As individuals, we simply don't know how to budget properly and we end up hurting ourselves. So many are in that predicament that now the nation as a whole is suffering. No one can force someone else to deal with the problem that creates the debt. But we can provide guardrails that protects the U.S. economy from going in the ditch. I certainly do not believe that we can sit by and do nothing. I have no confidence that most Americans will suddenly begin to use credit effectively. It certainly is true that many of us need to completely swear off credit cards, and possibly even debt in general. If I have a pattern of stabbing myself in the eye with a screwdriver, the problem is clearly not the screwdriver. Still, it's clear that I shouldn't have one. But, I don't believe it's enough to chastise each other, say "Now don't do that...", and move on as if the problem is solved. At this point, I believe some sort of guardrail is a must. I sincerely hope that our government officials can learn this lesson and implement what is needed to protect our economy. What if we coupled that with a one-time only debt forgiveness decree? Now that would kickstart the economy!! Forgiving the debt would open up the flood gates of spending and the guardrails would prevent us from ending up right back in the same mess. The sooner we are able to do that the sooner we'll actually start to see real recovery in America's economy.