Trade Carbon Credit: World’s Biggest Commodity Market with Futures and Options?

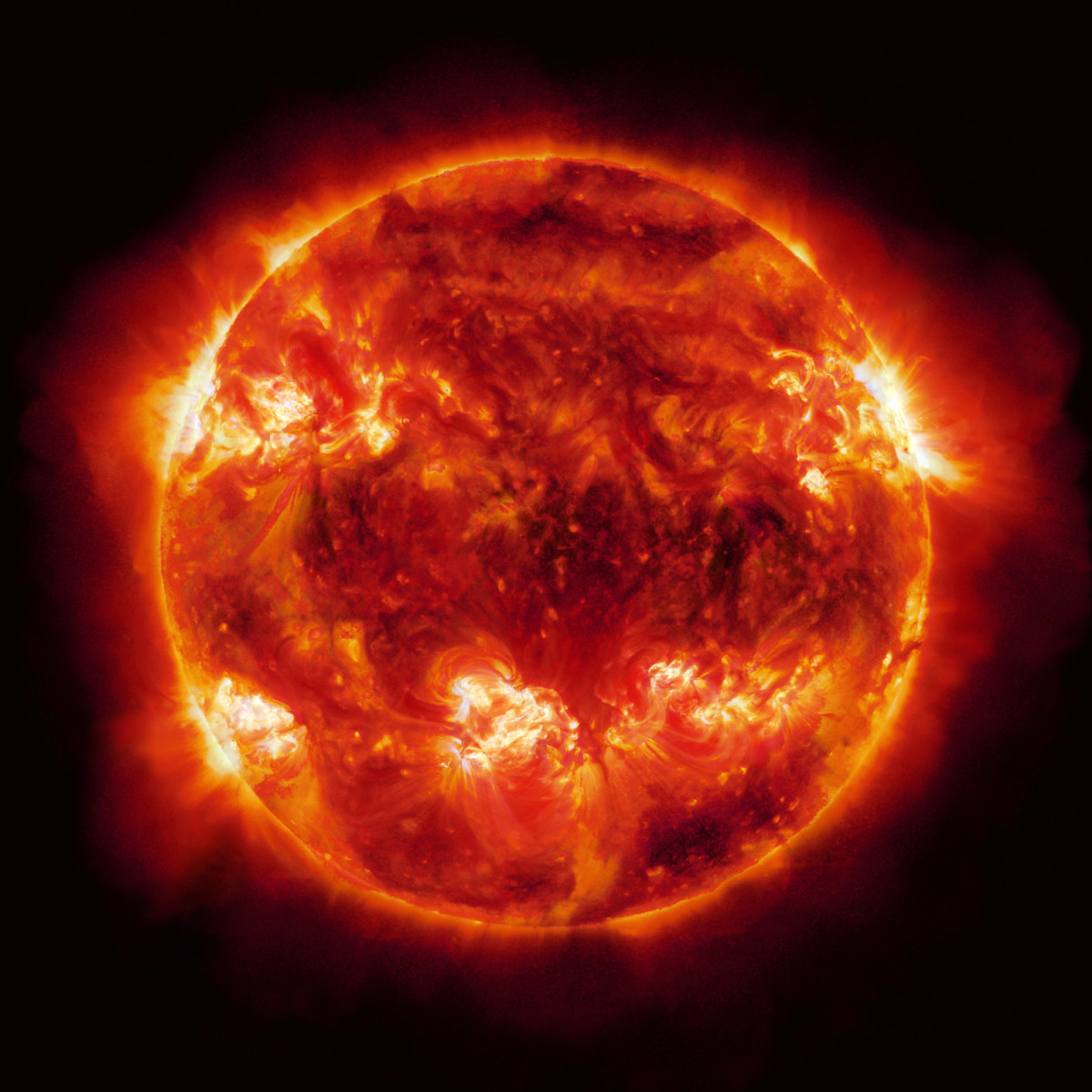

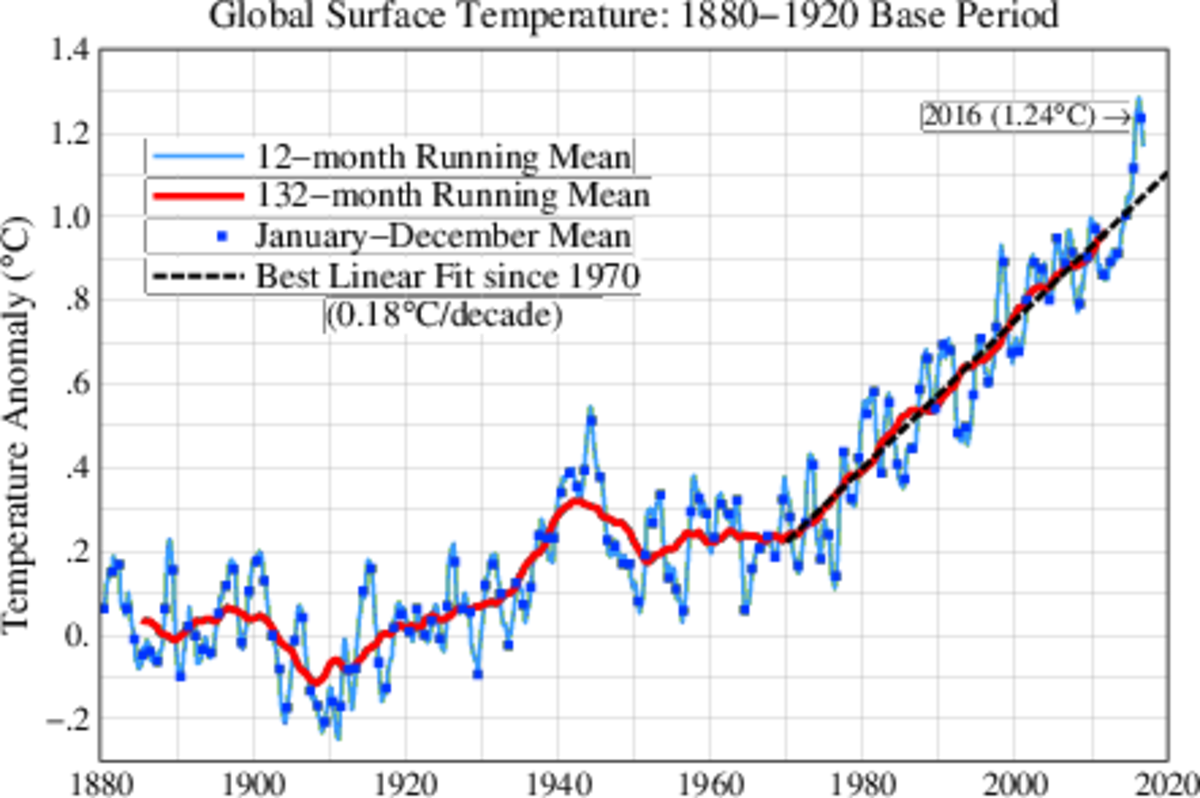

Climate Change and Global Warming is now a Reality

It is not difficult to understand that:

1. Carbon dioxide, along with other Greenhouse gases such as chlorofluorocarbons (CFCs) and halons gasses, traps heat in the Earth's atmosphere by imposing positive radiation forces which lead to global warming.

2. We Humans are pumping unprecedented amounts of these carbon gasses into the Earth's atmosphere

3. Every year the earth is getting hotter and ice fields are disappearing, all increasingly in line with the amount of carbon in the atmosphere.

4. That a rise in global mean temperature by 0.7˚C is significant in the sense that a temperature of 0.7˚C will expand the waters of all the oceans by such huge volumes that all coastlines known to man will be no more.

5. That weather is mainly determined by sun, land mass and water mass. Increase the water mass, reduce the land mass keeping the sun constant and the whole global weather equation is in a mess. This messed equation is showing Climate Change and Global Warming is now a Reality.

Kyoto Protocol

To reduce carbon and greenhouse gasses emissions thus mitigating global warming, is Kyoto Protocol. Kyoto Protocol is an agreement between 170 countries which provide mechanisms to reduce greenhouse effect emissions on an industrial scale by capping total emissions and letting the free market assign a monetary value to any shortfall through trading.

Trading Carbon Credit

Mechanisms to Reduce Greenhouse Effect Emissions

To reduce carbon and greenhouse gasses emissions thus mitigating global warming, is Kyoto Protocol. Kyoto Protocol is an agreement between 170 countries which provide mechanisms to reduce greenhouse effect emissions on an industrial scale by capping total emissions and letting the free market assign a monetary value to any shortfall through trading.

Trading Unit is One Allowance

For trading purpose, the trading unit is one allowance which equals one metric tonne of carbon dioxide (CO2) emissions.

How Trading Carbon Credit is Done

But how is the trading done? Take an industrialized country like Germany and a developing country like Kenya as an example. Both countries have enacted law to limit the emissions that businesses can produce as per Kyoto Protocol.

1. Germany has allocated a quota of 50,000 tonnes of greenhouse gas emissions per year to factory A GmbH. But factory A GmbH is putting out 75,000 tonnes of greenhouse gas emissions per year for its operations. Factory A GmbH will either have to reduce production to meet 50,000 tonnes of greenhouse gas emissions per year limit or it has to purchase the deficit of 25,000 tonnes of greenhouse gas emissions per year from the open market.

2. In the neighboring industrial area there is factory B GmbH. Factory B GmbH has been allocated a quota of 100,000 tonnes of greenhouse gas emissions per year. Factory B GmbH has invested in new and efficient machineries and CO2 emission has dropped to 60,000 tonnes of greenhouse gas emissions per year. Factory B GmbH has a credit of 40,000 tonnes of greenhouse gas emissions per year of which they can sell 25,000 tonnes to factory A GmbH. But at what price? And what if they are not in the same area, how would they have known each other? This is why Carbon Credit Commodity exchanges Market is coming about.

3. Project C Kenya Limited is a fossil fuel power generating company in Kenya. The cost of greenhouse gas reduction is far much lower in Kenya as a developing country but the atmospheric effect is globally the same. And because every game has its tricks, Factory A GmbH may find it economical to sponsor Project C Kenya Limited recover methane from sewerage waste to feed the power station that previously would have used fossil fuel. This way, Factory A GmbH will recover 25,000 carbon deficit and even generate extra carbon credit which they can sell in the open market.

Exchanges Trading In Carbon Credit

Like the way the stock market evolved, there currently are five exchanges trading in carbon credit. These exchanges are providing spot market in carbon credit allowances as well as futures and futures' options to help discover market prices and maintain liquidity. The carbon credit exchanges are:

- 1. Chicago Climate Exchange

- 2. Nord Pool

- 3. European Climate Exchange

- 4. PowerNext

- 5. European Energy Exchange

Futures and Options Worthy Trillions of Dollar

Managing emission of Carbon dioxide, along with other Greenhouse gases such as chlorofluorocarbons (CFCs) and halons gasses is indeed becoming World's Biggest Commodity Market with Futures and Options worthy trillions of dollar.

The hubber's website is designed to help beginners and average readers make money online to supplement the few dollars they may be earning from their Google Adsense - details of which you can find in my profile here, if you will.