Trump Has One Weakness

Introduction

I have been a strong defender of Trump over the past three years. I am also a supporter of most of his policies. He and his administration have done more than expected in a divided country with a divided Congress. The accomplishments are stellar and unprecedented in modern history. However, there is one weakness. This is inexplicable in light of the booming economy. I am referring to the rising debt. In a time when the IRS is raking in record revenues, why are we still spending more than we take in? This is just insanity.

I hope someone from the Trump administration will address this in the upcoming debate. Someone with financial credibility needs to explain in simple terms why we are increasing our debt.

The math is very simple. The justification behind it is hard.

Congress does play a role of course. In our system, the House of Representatives hold the purse string. Spending bills are passed in the House. The President does have veto power. It is inexplicable why Trump is going along with the deficit spending year after year.

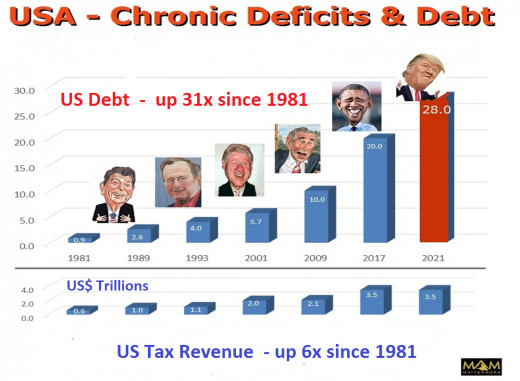

Tied to this is also the Federal Reserve. It is suppose to be an independent agency. It is suppose to set interest rates targets that is conducive to a stable economic growth. However, it is being influenced by the administration in power. First, under President Obama, it was kept artificially low to help us out of the recession of 2008. It kept it low so Obama could borrow money at very little cost to fund his social spending programs. This was not a normal recovery. It lead to the doubling of our debt.

Now, under Trump, the interest rate has risen slowly to about 2%, still very low by historical standards. Why is it kept so low despite a booming economy?

The answer is obvious. The government owes so much money that any rise in interest rate will mean more money spent to service that debt.

- Feb. 2020

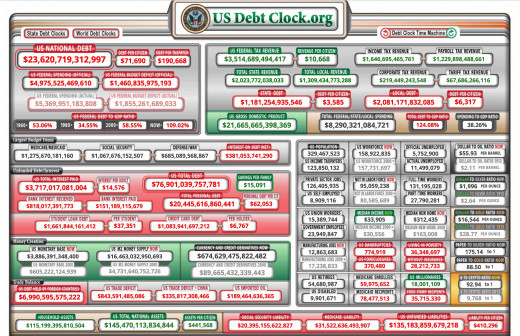

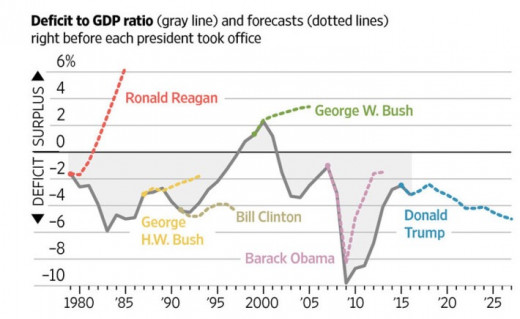

The National Debt

It was $10 trillion at the end of the Bush Administration. It doubled to $20 trillion under the 8 years of the Obama administration. Now, it is over $23 trillion in 2020 and rising at the same rate with no end in sight. This is unsustainable.

It was understandable to have a deficit during a recession. Revenue usually drops and taxes revenues are lower while spending on social programs are rising. That is the way it suppose to work. The government acts as a stabilizing force to guide the economy in times of recession.

Now that we are in an economic boom, there is no reason why the government needs to continue to deficit spend. In fact, just the opposite. In times of boom, the tax revenue is high as more people are working. Less people are collecting unemployment and relying on food stamps and other social programs to make ends meet. The net balance should lead to a surplus.

Yet, we see spending rising even faster at the National level. Why?

National Debt Clock - April 1, 2020

Trump and His Economic Advisors Has to Explain It

This is the one weakness I see with a Trump administration going forward. Despite the boom in the market and the good economic indicators, the underlying economic health of the nation cannot be ignored.

The key to solving this dilemma is the Federal Reserve. It needs to adjust the interest rate to a "normal" level. Once that happens, and money is re-adjusted to a "real" value. Which means money has a cost. If you borrow money, you need to pay it back at a higher rate. This was the history of money since the start of the industrial revolution. We have banks which lend out money and expect a higher rate of return. It applies to credit card debt, auto loans and house mortgages.

When our government borrow money, it must pay it back at a reasonable rate. When the interest rate was artificially set to zero, that was the start of our problem. It is essentially making money "free". That is to say, you can borrow money without paying a cost. This allowed our government to increase its debt without any downside. Unfortunately, it cannot last. At some point, the interest rate must rise.

The government must explain why it cannot pay off this debt or reduce it during economic boom.

Summary

This article is non-Political. It is stating a fact of life. Regardless which party is in power, the economics does not change. When you borrow, you need to pay it back with interest. The higher the interest rate, the more expensive it is to pay off.

We are living on borrowed time. A $23 trillion debt and increasing is a guaranteed path to disaster. The problem will most likely show up at the next economic down turn. When the next recession hit, we will have to pay the price.

This content is accurate and true to the best of the author’s knowledge and is not meant to substitute for formal and individualized advice from a qualified professional.

© 2020 Jack Lee