Chicken Little and the U.S. Recovery

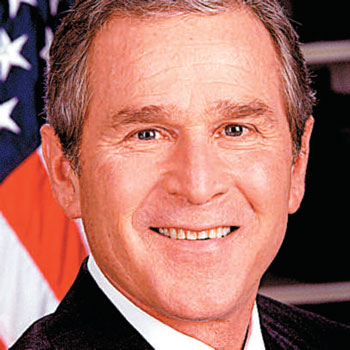

President George W. Bush’s legacy to the United States of America will always include two avoidable military incursions on foreign soil and the largest economic meltdown since the Great Depression. Americans have borne the financial brunt of his policies and they will continue to do so for generations to come. Bush II, after eight years in the White House, left the country with a crippled economy, two wars, and a public debt that had increased $4.9 Trillion during his tenure.

It is much too soon to debate what caused this economic downturn. In time, historians will dissect all of the events, choices, and options to determine what brought it on. But, now is an ideal time to address the often-repeated notion everything has worsened under the present administration.

"The sky is falling!"

According to prevalent doomsday rhetoric, the US is still plummeting to inevitable fiscal destruction at the hands of an ignorant, delusional, incompetent, misguided cadre of criminal charlatans sworn to annihilate our great country at any cost. But the facts paint a different picture.

In the real world, our nation continues to limp toward a complete economic recovery. Citizens scrimp to cover mortgage payments, healthcare costs, and an uncertain future. Unemployment numbers hover close to 10% while debates about the accuracy of this statistic do little to lessen its harsh reality. A nationwide housing inventory, bloated by unprecedented foreclosures, decimates real estate values. The country still has a long way to go but the future is not all gloom and doom. Any one who feels everything in the US is in worse shape today than two and a half years ago needs to make time to verify the following:

- The Dow Jones Industrial Average closed at 10,587 on Jan. 20, 2001 when George W. Bush was inaugurated. It closed 2,638 points (24.9%) lower at 7949 when he left office on Jan. 20, 2009. The index rose 4,689 points (44.3% of 2001) to close at 12,638 on May 6, 2011, less than 2.5 years into President Obama’s first term. 1

- On April 22, 2011, the Treasury Department announced $22.1 billion of taxpayer funds committed in March 2009 to the Public-Private Investment program have yielded a $1.7 billion profit with $500 million from dividends and other investment gains. 2

- On March 31, 2011, the Treasury Department reported bank repayments to the government under the TARP program amounted to $251 Billion compared to $245 Billion paid out. An additional $20 Billion in profit is expect in the future. 2

- The Public Debt, one of the most serious problems for future generations, increased $4.9 Trillion during President G.W.Bush’s Administrations and $3.7 Trillion, between 1/20/2009 – 5/06/2011, under President Obama’s recovery programs. The current administration has not yet matched the increase created by the previous President, although it is likely to happen. An analysis of the history of our national debt confirms Republicans bear most of the responsibility for today’s record level. 3

Sadly, nothing on the political landscape suggests either political party is anxious to end this trend. - On May 11, 2011, Reuters said this about the job market doldrums:

WASHINGTON, May 10 (Reuters) – "Data published [by the Federal Reserve] since its last meeting showed U.S. companies created jobs at the fastest pace in five years in April, pointing to underlying strength in the economy. However, the jobless rate -- derived from a separate survey -- rose to 9.0 percent on a modest increase in the size of the labor force." 4

While the pot may not be boiling, it has begun to simmer. - Higher gasoline prices are largely beyond the control of the US government aside from huge amounts of taxes paid at the pump. They can be expected to rise as the value of the US dollar declines under pressures generated by QE1 and QE2 currency expansions. The dollar should recover when these stimuli are reversed, if it’s not too late. Beside foreign exchange rates and our huge demand, forces beyond our economy drive the price at the pump. On May 10, 2011, The Wall Street Journal Online quoted the Energy Information Administration in the US Department of Energy. "The balance between global supplies and demand will remain tight through 2012, driven by rising consumption in emerging economies and slowing production growth from countries outside the Organization of Petroleum Exporting Countries..." 5

These are facts. They are not fabricated. They are not spun. They are neither red nor blue. Their origins can be traced through the links below. The economy of the USA is on the mend and most economic indicators point to better times ahead. A reasonable and rational observer should be inclined to agree even though the nation still has a long way to go. While some see a glass half-empty, others argue the glass is half-full. But the facts reveal there is more in the glass than there was 2.5 years ago. The economic picture is less bleak than some pessimistic rhetoric makes it out to be.

Our republic relies on an informed electorate able to make a balanced assessment on all aspects of every issue. All Americans must be able to share the role of governance with those with whom they disagree. The country needs a little more civilized persuasion and a lot less voter ignorance. "Liberty and justice for all" means respecting, and protecting, the rights, aspirations and opinions of all citizens. To do otherwise is tyranny.

1.http://moneycentral.msn.com/investor/charts/chartdl.aspx?symbol=$INDU

2. CHRISTOPHER S. RUGABER, AP Economics Writer, Associated Press, April 22, 2011

3.http://cedarcomm.com/~stevelm1/USDebt.png

4.http://www.reuters.com/article/2011/05/10/usa-fed-duke-idUSN1030334520110510

5.http://online.wsj.com/article/SB10001424052748703730804576315361696751504.html?mod=googlenews_wsj