What is the Least Unfair? (Thoughts on the Debt Ceiling "Crisis")

An Appropriate Beatles Song

Finding a Balance Between Spending Cuts and Tax Increases

Life isn’t fair. This may be one of the few truths on which both liberals and conservatives can agree. The problem is that they define the term unfair differently, and they view the other side’s remedies for injustice as actually increasing the world’s inevitable unfairness.

From a conservative point of view, an overly large, powerful, and expensive government is inherently unfair. Income taxes have become over time the primary source of revenue, and the wealthy pay a disproportionately larger share of these taxes due to their higher incomes. Meanwhile, people at the bottom of the income scale pay no income taxes at all. And if you create the progressive tax system favored by many liberals, with tax rates even higher at the top income levels than in the middle, this injustice is increased even more. A significant percentage of this tax income is then spent on lower income people (who often pay no income taxes) through various forms of government assistance. In the name of redistributing wealth and helping the poor, the government essentially steals from its most successful, productive citizens and hands it out to others. As a conservative bumper sticker says, “Work hard, millions of people on welfare depend on you.”

To a liberal, excessive inequality is the ultimate injustice. Because the deck is stacked against the poor, they do not have the same opportunity to succeed as the children of more affluent parents. Unsafe streets, poor schools, malnutrition, lack of access to health care, and other social problems keep people mired in poverty. They are then vulnerable to exploitation by powerful business interests, and they struggle to meet their basic needs. Government is therefore responsible to step in and help people acquire their basic rights of food, shelter, clothing, education, and health care. If government does not fulfill this obligation, inequality will only increase, with increasing numbers of citizens either on the streets, in jail, or dead, and fewer over time in decent jobs, homes, and schools. What good is economic growth if a large segment of the population does not benefit from it? And how can economic growth be sustained if large numbers people cannot afford to buy much of anything?

I am sure that most conservatives feel a certain amount of sympathy and compassion for the poor, and they accept to a certain degree the concept of a social safety net. They are skeptical, however, about government solutions to social problems. The government, which relies on tax revenues to get things done, has no incentive to be financially efficient. It will also do an inevitably bad job of distinguishing between poor people who are down on their luck and lazy individuals who have learned to milk the system. And by taking money away from productive, innovative people, they limit the ability of private citizens and companies to create economic growth and opportunity, tasks that have historically been done much better by free market competition than by government engineering. The free market produces goods and services that people actually want. The government spends money based on the priorities of the politicians of the moment. Then, once these programs are created, the people who benefit from the government services and the public sector workers employed to deliver them will fight to protect their self-interests. As the history of socialist countries demonstrates, people who lack personal incentives will not work very hard, and governments do a poor job of managing economies.

Most American liberals recognize the benefits of the private sector and the limitations of the public sector. But they would have some simple questions for conservatives supporting major cuts to social services. If Medicare benefits are drastically reduced, then how will the elderly get affordable insurance? It does not make financial sense for a private medical insurer to provide low-cost, quality insurance to people who are likely to require expensive medical services. If major cuts to Social Security are made, then what happens to people who were unable, for whatever reason, to save up any money for retirement? And if you make cuts to services for the poor, cuts that are generally more popular than limiting benefits to the elderly, what happens to the children of people who are collecting government services. It is understandable that people would want to cut off aid to the lazy or incompetent. But is it just to cause their unlucky children to suffer as well? And if people have various types of disabilities that make them unable to work, what happens to them? It is easy to rant and rave about government inefficiency; lazy, welfare cheats; and out of control government spending. But when you start talking about real people in common situations, both compassion and reason make it difficult to leave some of our citizens hanging out to dry.

Is poverty a personal deficiency and wealth a sign of success? In many cases, this is undeniably true. But it is important to remember that poverty is also essential to the functioning of a capitalist economy. Without low wage workers, business profits and the lifestyles of the more affluent would not be possible. The problem is that these low wage workers need to survive, a particular challenge if they live in an area with a high cost of living. So if businesses are unable or unwilling to provide a living wage, how can these low wage workers continue to play their vital role? By providing government assistance, the state is in a sense subsidizing private industry and the lifestyles of the better paid. Even the unemployed who are collecting government services provide a vital function. By keeping alive an adequate supply of unemployed workers, the government helps to hold wages down even further. And even if government is giving money to the lazy or unemployable, if nothing else, the government assistance stimulates consumer demand. In the end, much of that government assistance ends up back in the hands of the private sector anyway.

It is also important to remember that the government does not take tax dollars and dump all of them into a pit. There is no question that the government spends a lot of money unwisely, but without some of the functions that government performs – policing the streets, building and maintaining roads, promoting American business interests overseas, regulating a (relatively) stable currency, educating the workforce – the private sector would struggle to succeed or even function. Even social services may be a cost effective method of helping to maintain order. They are certainly cheaper than building more jails. So in the end, the wealthy may be getting more out of their tax dollars than they are often able or willing to recognize. Because some of these benefits are more difficult to quantify than a welfare check, I can understand why they will feel that they are getting ripped off. But somehow, even as they have continued to pay more taxes than the poor over the past thirty years, the trend has been for increasing amounts of wealth to be concentrated toward the top. One of the key factors in making a lot of money, after all, is already having a lot of money.

In my view, history has consistently demonstrated that we need a balanced approach. When governments drift too far toward either unregulated capitalism or government social engineering, major problems can arise. But even if you strive for this balance, complete fairness may not be possible. In our country of competing individuals and factions fighting for their perceived short-term self-interest, politicians cannot satisfy everyone, and yet they must take public opinion into account in order to survive. Some complaints will be legitimate, with some people paying more in tax dollars than they get back. Others will get more than their fair share, but many in this privileged group may complain anyway. Politics is about making tough choices, and often none of the options sound very good. Whether our nation tries to solve its debt problem through spending cuts or tax hikes, a lot of people are going to be unhappy.

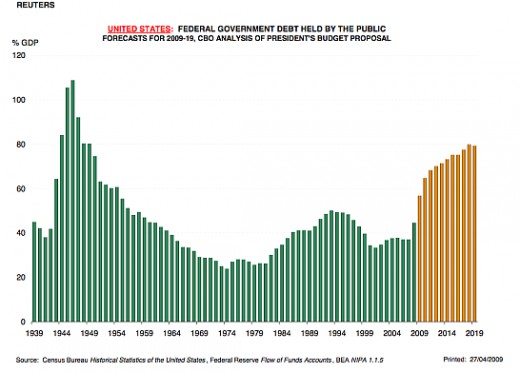

In the end, purely ideological arguments are a waste of time, and compromise in one form or another is unavoidable. We cannot eliminate all taxes, and I know of no feasible way in which every individual can pay an equal amount or we can ensure that each person gets an equal return on their tax investment. It is also impossible for the government to solve or even alleviate all of our nation’s social problems. Any practical person who does the math knows that both revenue increases and spending cuts are the only feasible approach toward getting the debt under control.

Timing, however, is very important. And at a time when the primary concern of Americans is unemployment, it is odd that the federal government has chosen to fixate on deficit reduction. It is reminiscent of taxes being raised in 1932 or spending being cut in 1937 in order to reduce the deficit. In both cases, an already fragile economy sank deeper into the hole. Of course, the only thing more damaging than badly timed and/or excessive cuts or tax increases would be a failure to increase the debt ceiling. I would like to think that even Congress could not be stupid enough to risk another collapse of the global financial system. Unfortunately, I have been surprised before, and life is often not fair.