What Is the Financial Impact of Coronavirus (Covid-19) on People (Particularly the Poor) and Businesses?

Coronavirus is affecting the world in many ways. With over half of the global population under tight lockdown from the Coronavirus pandemic, most people who toil in the informal employment have lost their sources of income and small businesses are slipping into oblivion due to the financial impact of the coronavirus (COVID-19). Most of the financially vulnerable people have got no safe residence in which to quarantine, many have minimal savings to stock up on supplies, and others don’t even have proper access to basic services like the water required to wash their hands and prevent contact transmission of the Coronavirus (COVID-19).

“Lack of running water and poor housing in poor neighbourhoods makes advice such as self-quarantine, hand washing, and maintaining good nutrition, a matter of privilege,” one Philippines doctor states. And the outcome is grim: Researchers warn that in excess of half a billion people could be driven into poverty due to the Coronavirus’s economic impact.

The financial vulnerable will likely lose their labour income, be it through lack of demand for their services or illness. The number of people relying on government aid will likely swell significantly, assuming such aid packages even exists. Repayment of loans will fall into arrears in turn affecting the day to day operation of microfinance lenders. These institutions will struggle to stay afloat. Remittances which is a key lifeline for the financially vulnerable will most likely decline as remitters lose their sources of income and are incapable of sending money home.

What are governments doing to help the poor/financially vulnerable mitigate the adverse effects of the Coronavirus (COVID-19)?

Governments from Russia to Peru are responding to the economic trauma of the financially vulnerable through the implementation of various policies. However, one that is common among most countries is the increase in social safety net disbursements. Almost 60 nations have resorted to increasing social protection plans through one-time disbursements, increasing their current programs, or even introducing new schemes altogether. Some nations, like Colombia and Pakistan, are introducing government-to-person schemes that cover large populations of the financially vulnerable. For government-to-person distribution, governments across the globe are mostly relying on digital payment infrastructures. Kenya’s M-pesa, for example, is being utilized by the Kenyan government to distribute relief funds to the financially vulnerable countrywide.

Governments aren’t the only sector mobilizing. Development sectors are also in an overdrive evaluating how to respond. Financial donors, in particular, are seeking ways to redirect and repurpose their donations towards alleviating the impacts of the Coronavirus crisis. Although inclusive economic systems are said to be part of their solutions, donors are in most cases unclear on how to effectively tailor their interventions.

How can the global donor community tackle this unprecedented pandemic?

To assist in advancing the dialogue, CGAP recently convened a seminar of over 100 financial inclusion partners and donors in a webinar to discuss ideas on donor needs. Clear views arose on how the donor community would tackle this unprecedented pandemic.

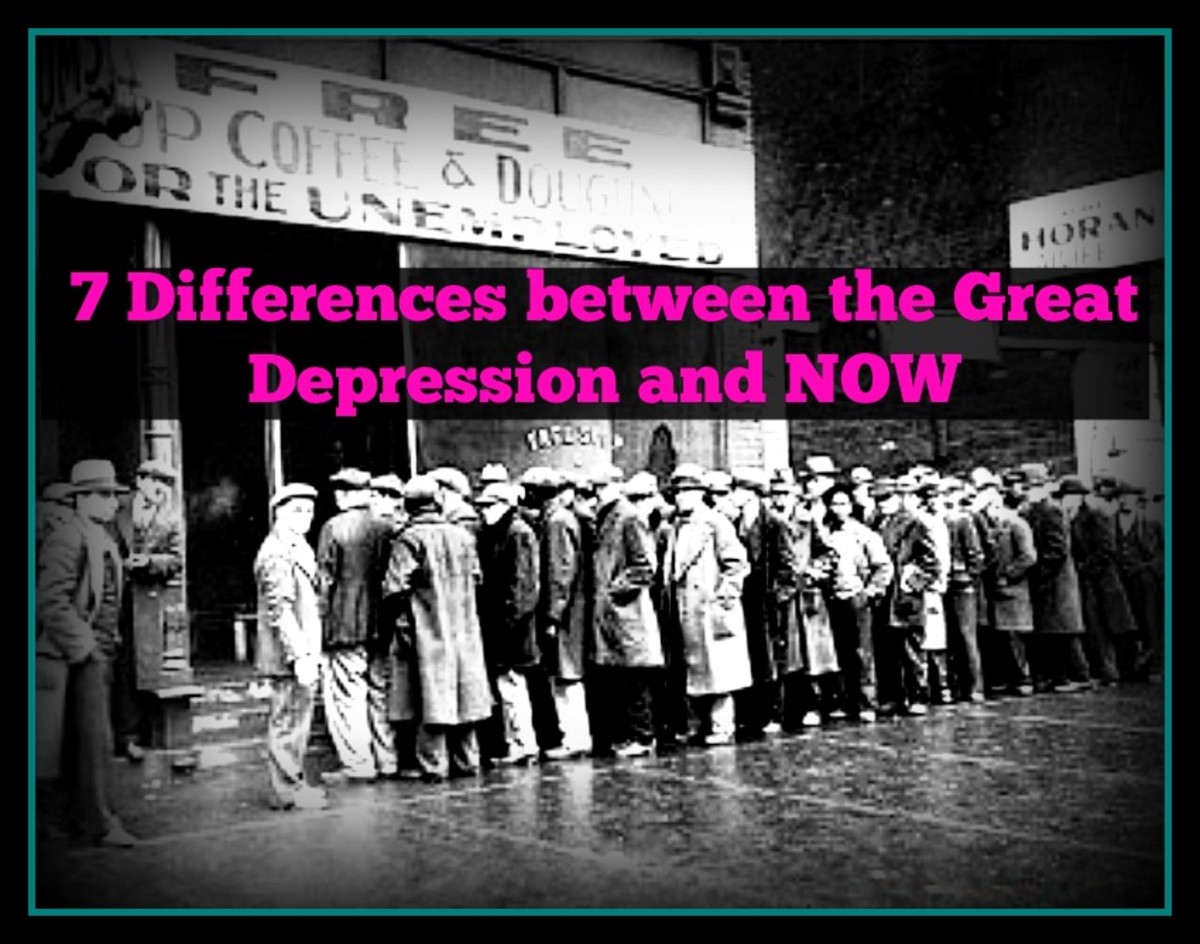

a) Learn from the past. Crises from the past can offer valuable lessons on what to do, but it’s vital to remember that the magnitude of the Coronavirus is different from anything that has been experienced in the past. Its impact goes beyond current health concerns. The effect of the disease and the lockdowns are threatening livelihoods globally.

b) Digital payment infrastructures are essential to getting money effectively and quickly to those in need of it. As many governments rely on safety-net payments to provide a financial defense line against the pandemic, digital systems will play an essential role in mitigating this crisis for the financially vulnerable.

c) Avoid market distortion. This has been witnessed in the past with the microcredit sector after a natural disaster or a financial crisis: As default rates rise and microfinance organizations appear to operate near insolvency, the default donor reaction to this is often to compensate through financial subsidies. Financial subsidies may be the immediate answer to this, but they shouldn’t distort these incentives.

d) Focus on data that can inform donor investments. This specific data can assist donors to identify the funding gaps and make decisions that have the most impact. However, as the pandemic unfolds, financial donors will have to adjust to the unfolding conditions. Markets tend to be dynamic, especially in crisis environments.

e) Donors need coordination. When government imperatives generate pressure to mobilize resources within a set timeframe, there’s a risk of financial donors funding overlapping initiatives.

The take away.

The Coronavirus pandemic has affected almost everyone in the world today. Some people who are financially secure are able to mitigate the adverse effects brought about by the pandemic but the most affected are the poor who do not have the financial freedom to lessen the impact of the pandemic. Governments should step up and help their citizens, especially the financially vulnerable to get through this pandemic.

Above all, financial donors have to be flexible. They undoubtedly have a vital role to play in combating the COVID-19 pandemic. It’s way too early to foresee how COVID-19 will impact the financially vulnerable in society: its reach, duration, and ultimate effect will unfold differently in different countries.