Why China Sneezes and the World Collapses?

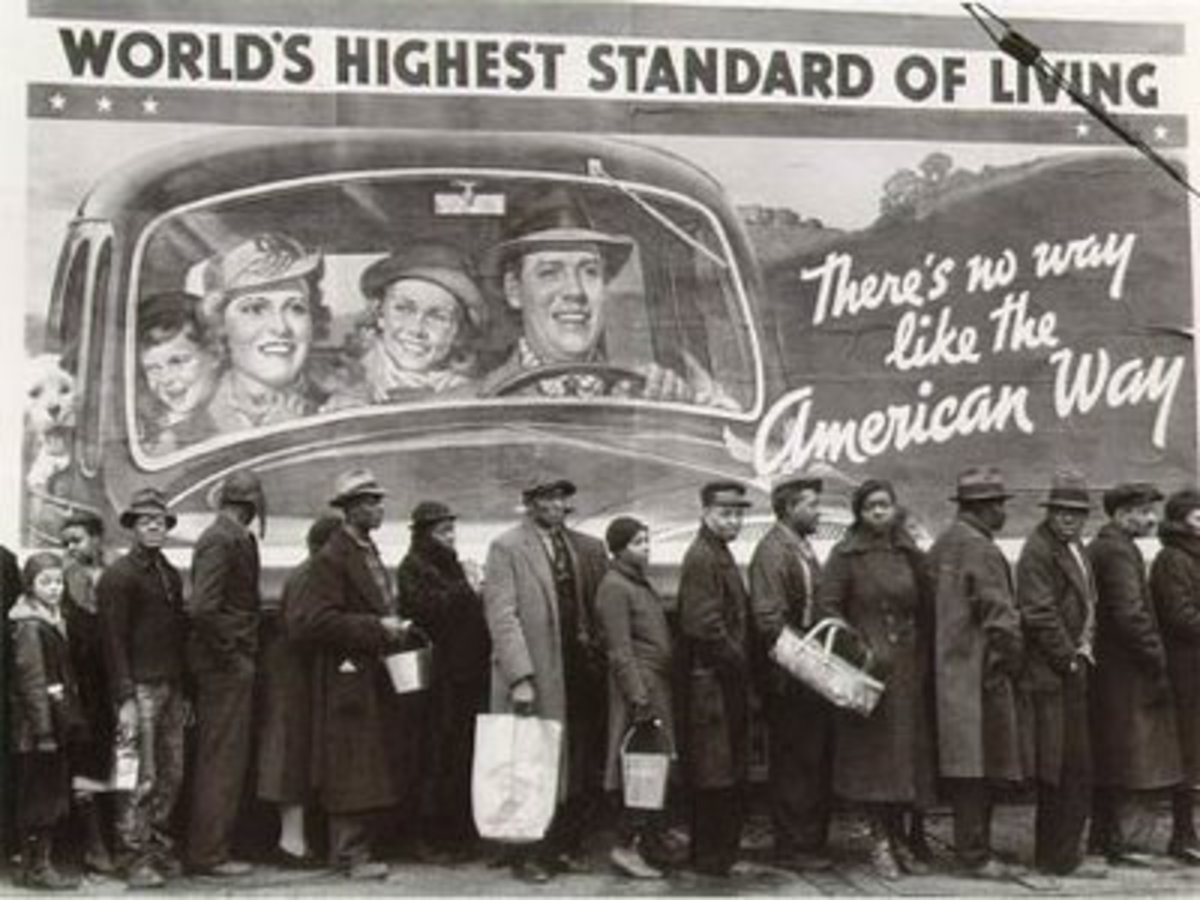

Looking Back in Time

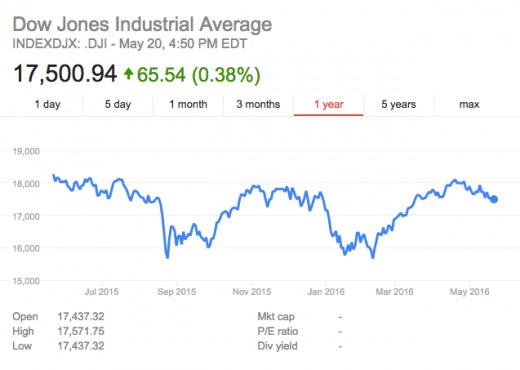

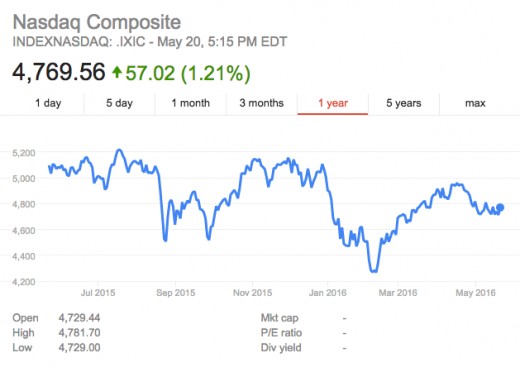

There have been several times this past year in which China has suffered a stock market fall and some economies like the US or the Spanish have suffered from these falls when we thought he had left behind the 2007 crisis.

To understand what is happening, we must go back long ago when everyone was happy, when we all were spending regardless of the money that we had. At that time, the years 2000-2006 we all did very well.

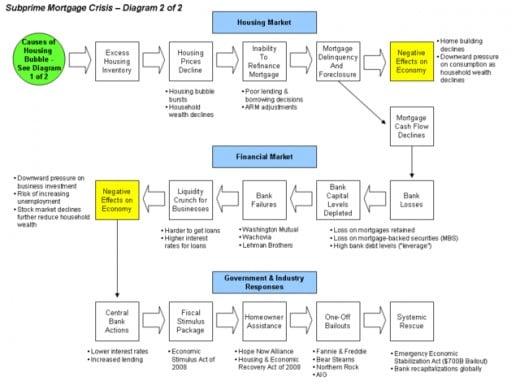

However, as expected, the United States entered a major financial crisis and suddenly the other countries followed with the crash. We should all know how the business cycle works. For those who do not know I will briefly explain it in the next point. The important point in this analysis is determining how global economies left behind the crisis and analyse those policies followed to overcome this crisis, already believed abandoned.

Phases of the Economic Cycle

To understand a little the economic cycle, it can be basically divided into four phases or stages. These phases are the rise, crisis, depression, and recovery. These four stages are repeated all the time. You can make a similar for those who are mathematicians with a cosine function represented in time.

The rise is when the economy is growing. Economic expansion occurs, increase investment, full employment and everything seems to be going well.

After the rise comes the crisis (if we go back in history, there has always been a crisis) where growth no longer exists, the economy stands on the highest peak, and therefore, these doubts about the economy, give way to depression. And so the cycle is repeated again.

With depression comes the destruction of employment, investment paralysis, corporate bankruptcy, spending cuts, etc. When this phase is over and the economy sinks further, comes the recovery.

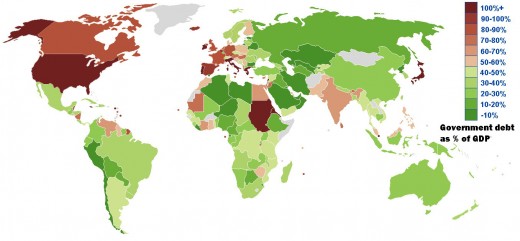

World Map

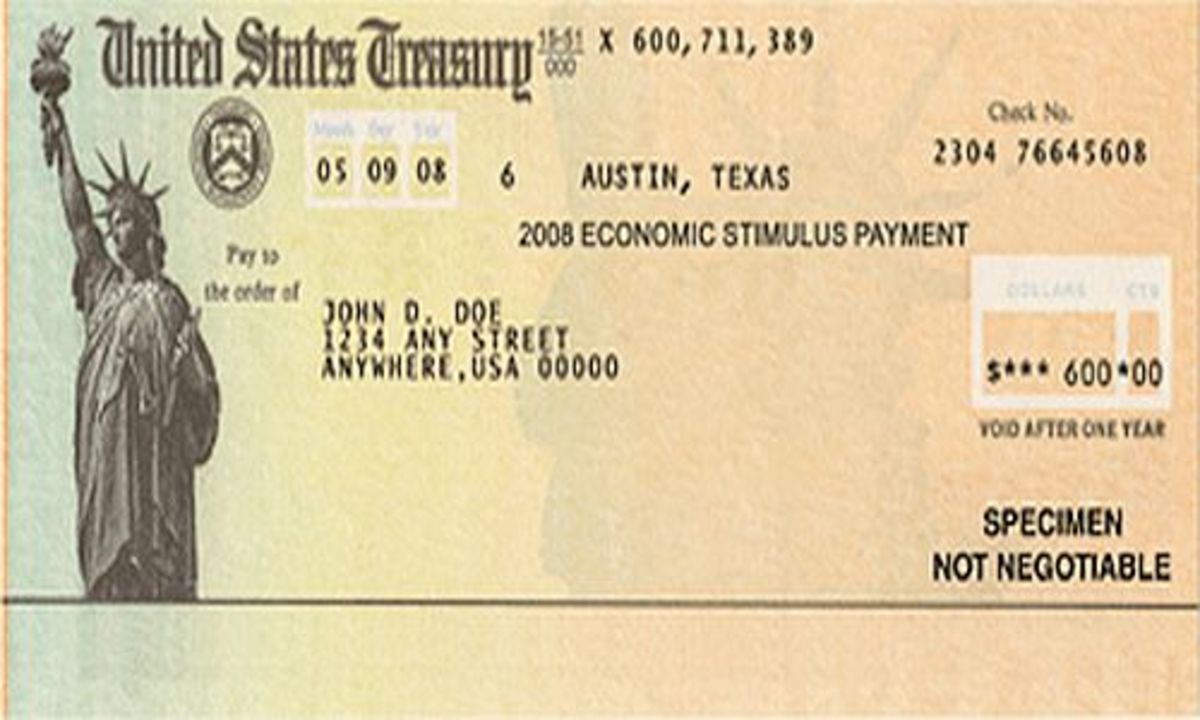

What did the United States do to Overcome the Crisis?

In view of the great crisis that had flogged on the US, the bankruptcy of banks and businesses, the ruin of many citizens, the stock market crash, etc... or government or monetary authorities stood still. Due to the crisis, the government began their policies to try to alleviate the heavy debt in all sectors of its economy. Some of the measures taken by the Obama administration were as follows:

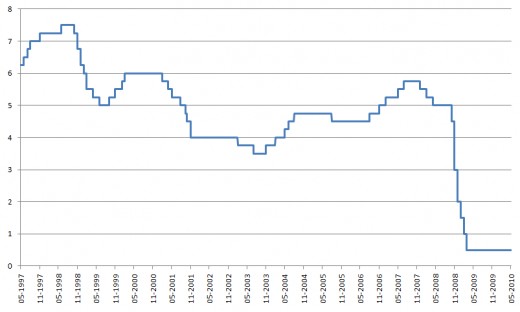

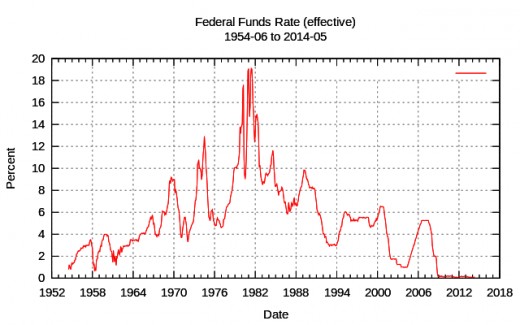

- Lowering interest rates

- Negative deposit rates

- Cash injections

- Purchase credit packages

- Debt purchase

- QE

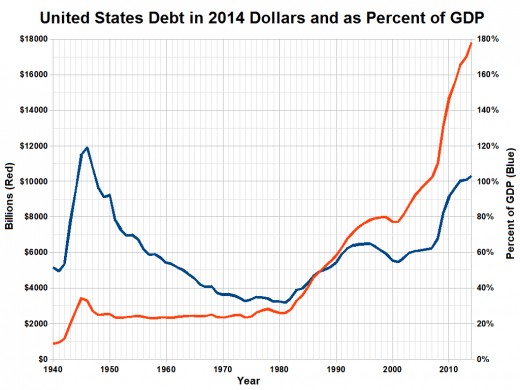

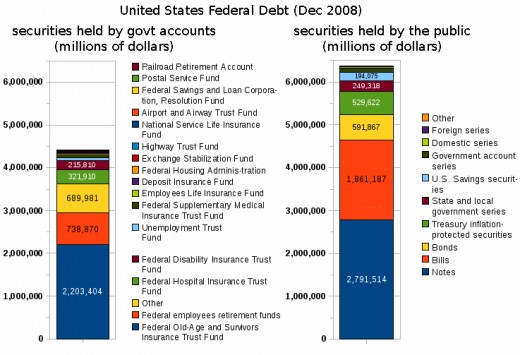

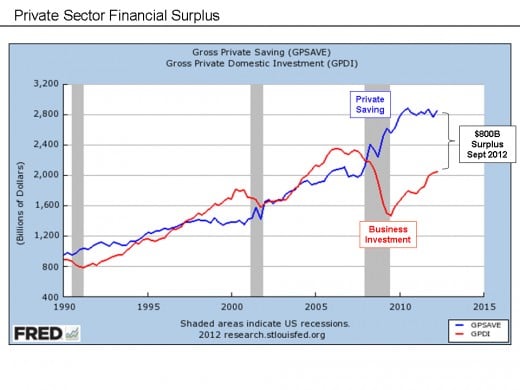

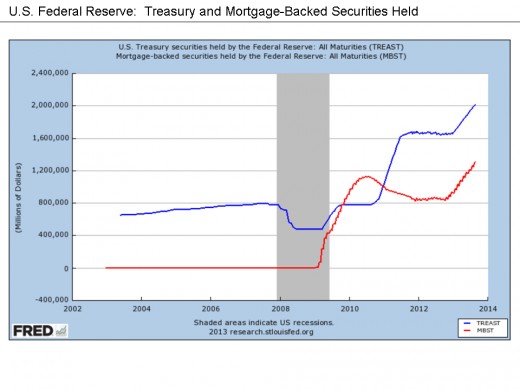

The latter being the most important for our analysis and that really affects the rest of the world. The QE consists in that the Federal Reserve of the United States, a monopoly on the currency, is dedicated to printing money to buy government debt. If the central bank demands a lot of public debt, what happens is that interest rates fall in public debt. Therefore, the profitability of public debt falls, as well as the profitability of investors who had public debt. Hence, public debt investors have to seek other assets where profitability is higher. Investors who came from public debt found several assets to invest. One of these assets was the stock-market. The stock rose from record lows, after the fall of the market, to record highs. One could say that these rises are positive for the economy, as companies manage to attract more capital. However, these sudden increases may carry a risk of generating a stock market bubble.Which as you can guess would be little benefit to the economy. This phenomenon of the stock market was an internal phenomenon of the United States.

Not all the money that came from the public debt was going to the stock-market.

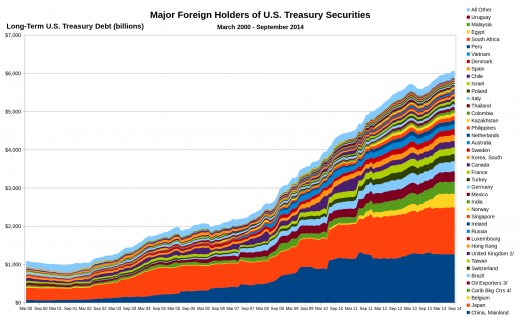

QE in US an Japan

More about QE

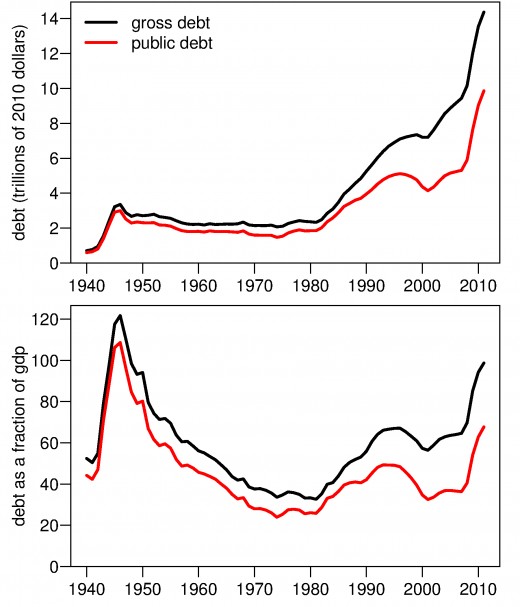

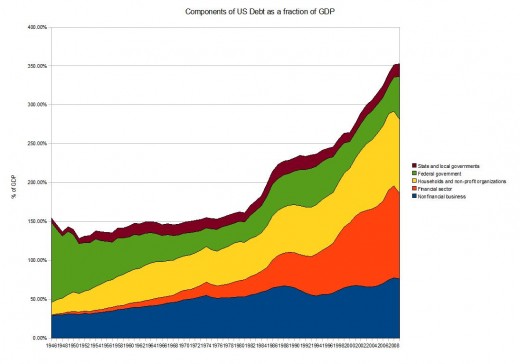

US Debt

Interest Rates

Cash Injections

What did the Rest of the Money?

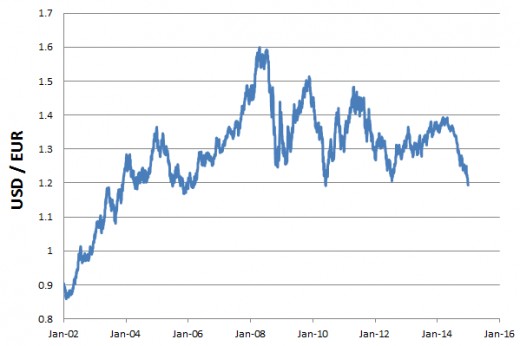

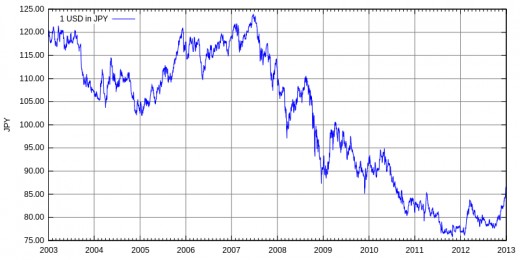

As we have seen, a large portion of the money did not end up in the stock market. This significant part of that capital left the country, left the US, looking for profitable investment destinations. Since the change of currency sold dollars and other divisis are bought to invest in other countries, what happens is that the dollar depreciates.

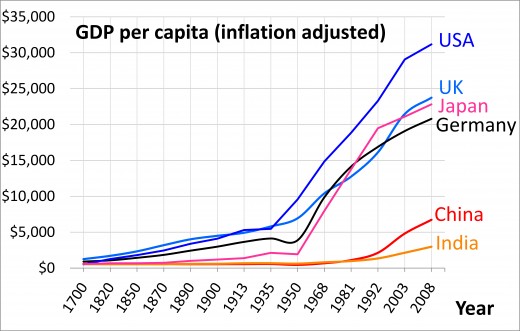

All the money that came from the United States turned to emerging economies or emerging countries. These countries had hardly been affected by the economic crisis and therefore, gave high returns to foreign investors. The money left the country bound for countries such as Brazil, Russia, Turkey, India and of course China.

Companies from these countries could issue debt in dollars paying historically low-interest rates. In addition, to issue debt in dollars, which was depreciating, had to repay this debt in a currency that was worthless, therefore, it was double the profit and profitability. Because this business seemed very beneficial, companies in these countries begin to borrow and invest so on. All this generates an internal economic boom and a "false" prosperity and, especially in China began to grow while countries had to supply raw materials and equipment so it can continue to prosper industrially. By increasing the demand for raw materials price rises. In addition, countries producing these raw materials are not other that emerging countries, which have a market where to put their products on sale at an inflated price. Brazil and Russia exported to China.

This system seemed to provide much wealth to the countries involved, however, in 2013, United States announced that it will stop implementing the measures that had been undertaken during the crisis. This is due to the large bubble that had been generated since 2009.

Now the flow of money had changed. The money that had reached emerging countries began to return to the United States. The dollar begins to appreciate as well as the currency of these countries since foreign investments are settled to extract the capital and interest rates begin to rise. We see how companies that were calm now are beginning to get into trouble as interest rates begin to rise. In addition, companies that borrowed in dollars were seeing the dollar appreciated again. Therefore, every time they cost more to repay the debt.

All this could have ended in 2013, and economic bubbles created by states and governments would be over. As we know, this did not happen, and the economic outlook remained the same. We all thought the economy was recovering and that the great crisis of 2007 had left behind. But what stopped the economy from exploding?

Most Important Stock Markets during Last Year

Dollar/Euro

Dollar/Yen

An Unexpected Event

The United States had already withdrawn their investments, and emerging countries were left without funding. The only thing they did not know was that in 2013, Japan would start its expanding economy like the US did in 2009, which gave a break to emerging economies. So the crisis was coming in these countries relaxes and gets wait a little longer. Japan is not as powerful as the United States, so capital received can not be equated by emerging economies. However, in 2014, the euro zone economy also begins its expansion, and the same process happens as in the two countries earlier. This allows the Chinese economy put up with more capital and pursue industrial economy.

The Real Crisis in China

Lately, it has been discovered that the Chinese economy is not doing as well as expected, and investment no longer flees to find higher profitability but because the Chinese economy does not give confidence to invest. It promotes panic among investors.

Since the Chinese economy no longer produces as much as before, the demand for raw materials from outside falls, therefore, its price also falls (such as the fall of the price of a barrel of oil). And all those countries that had borrowed to even produce a greater quantity of raw materials for export do not generate the same benefits as before and hence also accuse the Chinese crisis.

So, all this leads to accusing a certain crisis, generated by the alleged output of the previous.

The "Small" Crisis

Debt by Countries

The Real Problem

We have just seen that many countries may enter into a new crisis or a "small" crisis. The problem is not that some countries can not continue their productive pace. The real problem with the global economy is that all these ditherings of bad investments have been financed with debt. What happens with bad investments that have been financed with debt is that if benefits are not achieved debts can not be paid. What gives rise to a debt default. And what is worse, an uncertainty among all investors who do not know where to invest due to the unreliability of markets. Investors, due to the uncertainty generated shelter their capital in safe assets, such as government bonds or currencies of strong countries. This leads to the investment in the rest of the world is paralyzed. And if the investment is paralyzed, economies stop growing and coupled with the crisis that was believed surpassed, even worse.

United States does Wrong

The Truth of the Global Economy

That is why the sneezing China reverberates across Asia as well as in all other emerging countries, and the rest of the global economy. This can generate a very serious global problem of debt. It is why stock markets around the world are falling.

We do not really know if a new global crisis as of 2007-2008 may happen, but it is certain that some adjustment has to be done. Whether through new economies expansion by Governments to return the confidence of investors or through an adjustment that sooner or later will have to arrive. The more you do expect the worst fit the fall.

Crisis in the Different Sectors of the Economy.

News about QE, Global Crisis...

- G7 Finance Leaders Debate Global Economy, Risks - Fortune

From Brexit to Japan's fiscal policy, the G7 leaders are discussing it all. - The world economy is running on monetary fumes - Business Insider

With global growth stalling, the International... - This is how the next financial crisis will spread around the world economy | Voices | The Independen

A new economic crisis, which I believe we are on the brink of experiencing, will have similarities, and differences, to 2008. The problem of crowded trades – where market participants all have the same basic positions and strategies, and identical ri - QE: Is Draghi Getting What He Paid for? | Watch the video - Yahoo Finance

Watch the video QE: Is Draghi Getting What He Paid for? on Yahoo Finance . May 20-- Bloomberg's Julie Hyman reports on Euro-area inflation and quantitative easing. She speaks on "Bloomberg ‹GO›." - Fighting the next global financial crisis - AzerNews

What do people mean when they criticize generals for “fighting the last war”? It’s not that generals ever think they will face the same weapon systems and the same battlefields. They certainly know better. - EconoMonitor : Thoughts From Across the Atlantic » The Russian Economic Crisis: How Severe

Thomas Grennes and Andris Strazds offer perspectives from the U.S. and Europe on current economic issues. - Professor suing ECB over QE warns of 'surprises' - MarketWatch

- The Vicious Spiral of Economic Inequality and Financial Crises

There is compelling evidence that economic inequality is both a result of, and contributor to, economic crises. - What's behind Brazil's economic and political crises? | UCLA

Five UCLA experts from across the campus recently assembled a big-picture view of the political turmoil, economic crisis and investigation into widespread ...

© 2016 Leonhard Euler