Why Even The 47% Who Owe No Income Taxes Want Tax Relief

Almost Half the Population Don't Have to Pay Federal Income Taxes

April 21, 2010

In the days running up to the April 15th tax filing deadline, a number of conservatives were quoting a statistic showing that 47% of the population of the United States don't pay any federal income tax.

On its face this statistic is somewhat scary in that it implies that the productive tax paying half of the nation is carrying the other half financially.

However, like all statistics, one has to look at it and interpret it from different angles.

Background is Needed to Understand This Statistic

On April 13, 2010, two days before Tax Day, the New York Times came out with a closer examination in a well written article by David Leonhardt.

Despite the obligatory pitch for higher taxes on the rich, which one expects in a New York Times article, Leonhardt did a fairly good job of showing that the 47% who don't have a Federal Income tax obligation still face other taxes.

In an April 15th Wall Street Journal piece, Karl Rove made the same point that most of the 47% who owe no Federal Income taxes are still hit by other taxes.

That same April 15th evening Dick Morris, during an interview with Greta Van Susteren made the same point that the while the nature of the Federal progressive income tax excludes a growing number of people from having to pay, the nation is still awash in a sea of other Federal as well as state and local taxes so few, if any, people are totally avoiding paying taxes entirely.

A Partial List of Taxes Everyone Pays

Other taxes, which we all pay including those who do not owe Federal income taxes, include:

- 7.65% Social Security and Medicare tax on everyone's income

- state income taxes in many states (and local income taxes as well in some cities)

- 18.4 cent Federal tax on every gallon of gasoline we buy PLUS anywhere from 8 cents (Alaska) to 32.1 cents (Wisconsin) additional state tax on each gallon of gas we purchase (and, in some places, additional taxes per gallon levied by local governments).

- property taxes on our homes and, in some states other property such as cars as well.

- Federal, and often state and local, taxes on telephone calls and Internet usage

- State and local sales taxes on almost everything we purchase.

The list above is just a sample of the numerous taxes that are paid directly by Americans to the government.

There are also the numerous indirect taxes which are paid by business and then added to the price of their goods and ultimately paid by individual consumers.

Opposition to Increasing Tax Burden Growing Throughout the Population

This sea of taxes is one reason why opposition to taxes, especially the Federal income tax, is growing despite the fact that the number of people who don't have to pay Federal income taxes is also growing.

However, there is another reason why in some recent polls why as many as 78% of the people polled feel taxes are too high even though the burden of paying Federal income taxes only falls on 53% of the people and that is the fact that those who make up the 47% of those who don't owe any Federal income tax are not the same people every year.

America is a Land of Individuals and Not Social Classes

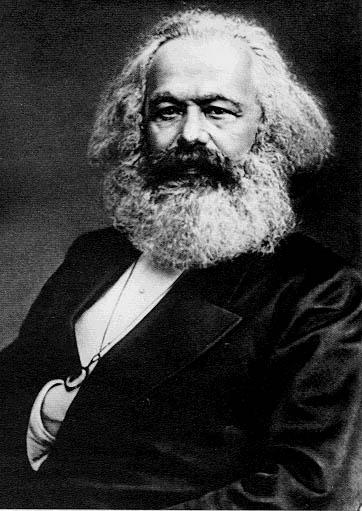

While left leaning politicians and the mainstream media continue to see the world through the lens of Karl Marx in which society consists of fixed groups of people rather than individuals, the fact is that twenty-first century America is not the same as the nineteenth century Europe in which Karl Marx lived and wrote in. Americans are not born into an economic class - proletariat or bourgeois - and find themselves condemned to remain in that class for life.

Today in the United States, both the measurement of poverty and criteria used to determine one's Federal income tax bracket is a mainly a combination of household annual income and household size. However individual annual incomes tend to fluctuate based upon both individual circumstances and changes in the nation's economy.

This means that a sizable portion of the those that make up the low income portion of the scale are in that area temporarily and those who make up that portion are not necessarily the same ones who found themselves in this area a year ago and may not be in it a year from now.

In other words, we don't have a permanent underclass like the one imagined by Karl Marx and his followers.

Tax Burden on Unemployed

A second factor to consider is that income tax brackets and, in many cases, poverty statistics, tend to focus exclusively on income and ignore things like wealth and access to financial resources.

This is how otherwise middle class or upper middle class people who lose their jobs or encounter other difficulties such as accidents or illnesses which result in their incomes temporarily dropping find themselves being classified as living below the officially defined poverty level.

Depending upon the severity and duration of the decline in their income, it is not uncommon to see media stories about people who are classified as living below the poverty level, not having any Federal income tax liability and possibly even receiving benefits such as food stamps while at the same time living in a home worth six figures, having two cars and, in general leading a middle to upper middle class life style.

Because this is not their permanent condition, they are able to make up for the loss of income by a combination of tightening their budgets and watching what they spend while at the same time either drawing down past savings or by borrowing - using credit cards, second mortgages and other types of loans - which is in effect using savings from their expected higher future income.

These people not only expect to be paying high Federal income taxes again as soon as their circumstances turn around but also experience first hand the tax burdens that are making their already difficult situation worse.

If they find a low paying job to bring in income while looking for a job at their previous higher income they will be hit with the 7.65% Social Security and Medicare tax on everything they earn.

If they turn to self-employment by doing freelance work or starting a business they will have to pay both the employer and employee portion of Social Security and Medicare which is double or 15.3% percent of their earnings.

They will also have to continue paying property taxes on their homes along with sales and other taxes.

If they resort to withdrawing money from an individual retirement account (IRA) or a 401(k) account they will have to pay a 10% penalty tax on the amount withdrawn plus have the funds withdrawn added to their income for the year and taxed at the highest income tax bracket they are in.

If they sell securities or other property for more than they paid for them they will have capital gains tax to pay.

Tax Burden Hurts Rich and Poor Alike

While the progressives continue to seek to stay in power with their class warfare and soak the rich rhetoric, the fact is that all Americans are struggling under a growing tax burden that hurts rich and poor alike.

This is why the Tea Party movement continues to grow and attract more supporters including unemployed people who owe no Federal Income taxes this year.

Links to My Other Hubs on Taxes

- Tax Protests and Tea Parties - An American Tradition

April 19, 2009 Tea and taxes became entwined in American culture as a part of our violent birth as a nation when the original thirteen colonies rose in armed rebellion against England's King George III and... - Small Business and the Tax Revolt

While few, if any, people, like to pay taxes, most agree that taxes are necessary to pay for needed government services. In the words of former Supreme Court Associate Justice (served on the Court from 1905... - How to File Income Taxes on the Part Time Income Earned on Hubpages and other Internet Marketing Sit

Income earned as a self employed person as opposed to wage income earned from an employer is reported on your Federal Income taxes by completing and including with your tax return a form known as Schedule C. ... - How Tax Cuts Work

According to October 11, 2006 news reports, the Federal deficit (the amount by which government spending exceeds tax and other government revenues) has shrunk to its lowest amount in four years. In addition...

![The Myth of Unemployment Numbers: How They Help or Hurt in Politics [10]](https://usercontent2.hubstatic.com/13151085_f120.jpg)