US Credit Rating Downgrade

One Year Ago (Summer 2011)

The political gridlock that is United States politics was on full display one year ago, when Congress and President Obama engaged in a prolonged battle about raising the debt ceiling. Congressional leaders and the White House finally agreed to an 11th-hour bill to raise the debt ceiling over the weekend of July 30-31, 2011. The bill passed the House by a 269-161 vote on Monday, August 1, then passed the Senate by a 74-26 vote on Tuesday, August 2, and was signed into law by President Obama that same day—mere hours before a midnight deadline to complete a deal and avoid financial chaos.

The resulting bill wasn’t pretty. It provided an immediate $400 billion increase in the $14.3 trillion debt ceiling, and promised an added $500 billion increase later in the year. It also created a special bipartisan committee tasked with recommending up to $1.5 trillion in deficit cuts over 10 years. If this “super committee” was not able to reach consensus or if Congress failed to approve its recommendations by December 23, 2011, then the bill called for automatic spending cuts of $1.2 trillion over 10 years. These automatic cuts, however, were not scheduled to begin until 2013, leaving Congress time to undo them.

Almost nobody was happy with the bill. Democrats were unhappy the bill called on spending cuts alone to reduce the deficit without any balance in the form of increased revenues. Republicans were unhappy that the bill did too little to decrease the culture of spending that had taken over Washington politics. Voters on both sides of the aisle were disgusted by the dysfunction that threatened to turn a normally routine vote about raising the debt limit into a high-stakes ideological battle threatening a US default.

A few days later, on Friday, August 5, 2011, Standard & Poor’s also expressed its unhappiness when it downgraded the long-term U.S. credit rating by one notch, from AAA to AA+. S&P said: “The downgrade reflects our opinion that the fiscal consolidation plan that Congress and the Administration recently agreed to falls short of what, in our view, would be necessary to stabilize the government's medium-term debt dynamics." The political gridlock was identified as being a major factor in the downgrade.

Immediately following the downgrade, many commentators predicted higher interest rates, which would be demanded by investors in US government bonds due to the higher risk of default. They also predicted more selling in the stock market due to the turmoil, thereby leading to lower stock prices.

Today (Summer 2012)

Now that a year has passed, let’s look back at last year’s debt ceiling debacle to see what has changed.

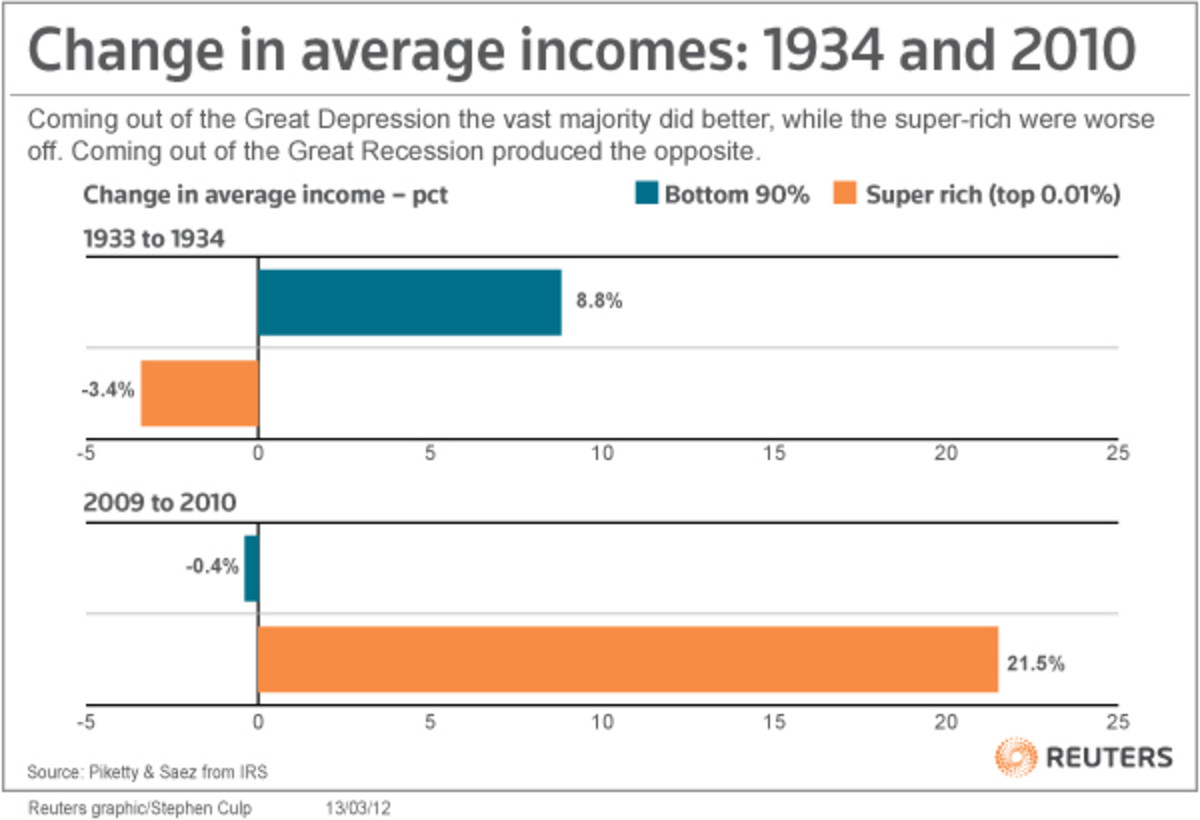

To the surprise of few people, the “super committee” failed. Its co-chairs said: “After months of hard work and intense deliberations, we have come to the conclusion today that it will not be possible to make any bipartisan agreement available to the public before the committee's deadline." Predictably, the Democrats blamed the Republicans, and vice versa. President Obama blamed the Republicans for rejecting a “balanced approach” to cutting the deficit that included tax increases on the wealthy. Senator Mitch McConnell, a Republican from Kentucky, said that a bi-partisan agreement "proved impossible not because Republicans were unwilling to compromise, but because Democrats would not accept any proposal that did not expand the size and scope of government or punish job creators." The day after the committee’s failure was announced, the Dow Jones Industrial Average fell by 248 points.

Oddly enough, interest rates on US government debt have decreased substantially over the last year. On Friday, August 5, 2011—just before the credit rating downgrade--the yield on the US government’s 10-year Treasury bond closed at 2.58%. Today, on July 25, 2012, the yield on this bond closed near a record low at 1.43%. That’s a decrease of 1.15%, or a staggering 45%! While the credit downgrade likely had some impact on this yield, the substantial decrease in the 10-year rate is most likely due to the continuing debt problems in Europe combined with the still-sluggish economy in the US and globally.

During the same period, the Dow Jones Industrial Average has gone from a close of 11,444.61 on August 5, 2011 to a close of 12,676.06 on July 25, 2012. That’s a gain of 1231.45 points, or 10.8%. As with interest rates, it seems the stock market has basically ignored the downgrade of the US credit rating.

As for the dysfunctional US political system that led to last year’s debt ceiling debacle and the US credit downgrade, it’s fairly clear that nothing has changed since last year, and that this status quo is unlikely to change at least until after the presidential election in November 2012. President Obama and the Democrats have stuck to their positions that we need a balanced approach to cutting the deficit that includes tax increases on the wealthy, while the Republicans have stuck with Grover Norquist’s pledge against any new taxes whatsoever, even if every $1 tax increase is matched with $10 in spending cuts.

Congress has not passed any meaningful tax or spending bill since last summer’s debt ceiling debacle, and has not raised the ceiling again even though the new ceiling may be reached by November 2012.

So, “What’s Changed Since the US Lost Its AAA Credit Rating One Year Ago?” is really a trick question. Nothing’s changed. We still have a dysfunctional government that’s stuck in gridlock and incapable of passing any meaningful legislation that impacts taxes, spending or other key issues. Unless the November elections result in a mandate for either Democrats or Republicans in both houses of Congress and the presidency, it’s unlikely that any meaningful legislation will be passed until we reach the brink of the next crisis.