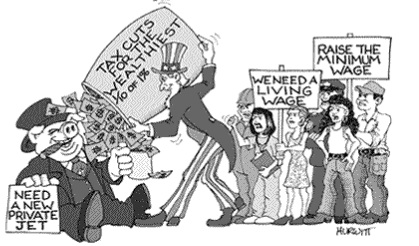

Trump's tax plan: Trickle Down Economics: Give your opinion

yea or nea? Are you HAPPY! that the richest .01% get less taxes? I mean - they did earn it didn't they?

Do they just work harder? Is everybody else just stupid and lazy? Hard work will only get you so far if circumstances aren’t amenable. Do you believe that “If you’re still poor at 35, you deserve it,”? If hard work and dedication were the secrets to becoming wealthy, the worlds richest people would be {insert your favorite very hard working poor person[s] here}.

As much as we like to think that the wealthy earn their money with hard work, is it really possible that 85 people worked harder than 3.5 billion?

Can this problem be solved by dividing all the world’s wealth up equally? If all the world’s wealth were divided equally we’d all only have about $9,000 each. Which should give you a good idea of how much of the world lives in abject poverty.

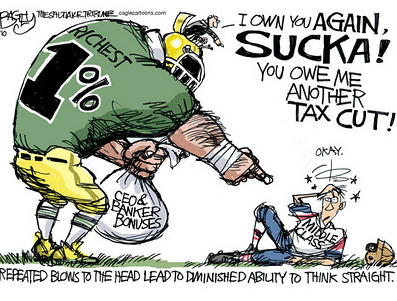

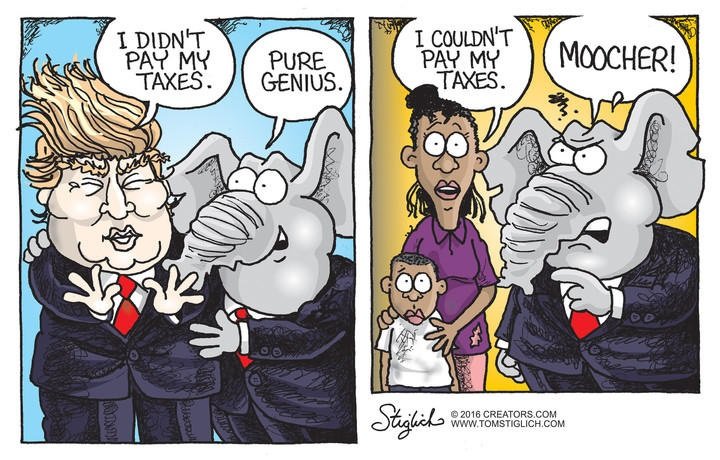

Increasing inequality exists because rich people have politicians doing them too many favors. The income gap isn’t growing because the 1% is working harder, it’s growing because they get tax cuts, because they’re allowed to use tax havens, because they don’t have to pay their employees very much.

The most common way for billionaires to make their money is investing. So ... it's not like the top 0.01% work harder.

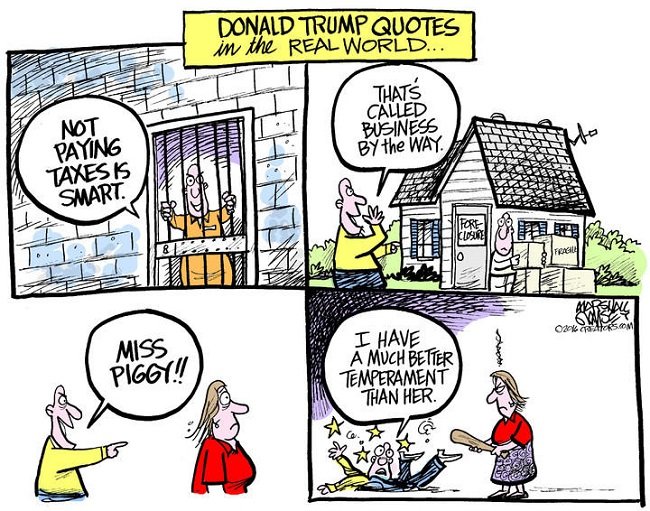

DJT wants to slash or eliminate many of the taxes that disproportionately hit the wealthy. If Trump's plan were implemented, "it could exacerbate inequality," said Steven Rosenthal, a senior fellow at the Tax Policy Center.

Owners, partners and shareholders of so-called pass-through entities pay taxes for their businesses on their individual tax returns at a top tax rate of 39.6%. Trump would cut that down to just 15%.

Pass-throughs run the gamut from mom-and-pop shops to big law firms to hedge funds. Most, if not all, of Trump's hundreds of businesses are considered pass-throughs. - http://money.cnn.com/2017/04/26/news/ec … index.html

The Tax Policy Center (TPC) has estimated the revenue cost and the distributional effects of a plan consistent with the House GOP blueprint. We estimate that a plan such as this would reduce federal revenue by $3.1 trillion over the first decade of implementation and by an additional $2.2 trillion in

the second decade, before accounting for added interest costs or considering macroeconomic feedback effects. The revenue loss is primarily due to reductions in business taxes. - http://www.taxpolicycenter.org/publicat … -plan/full

The findings by the Tax Policy Center contradict assertions by the White House and congressional Republicans that the plan unveiled this week would not benefit the wealthy — including Trump himself.

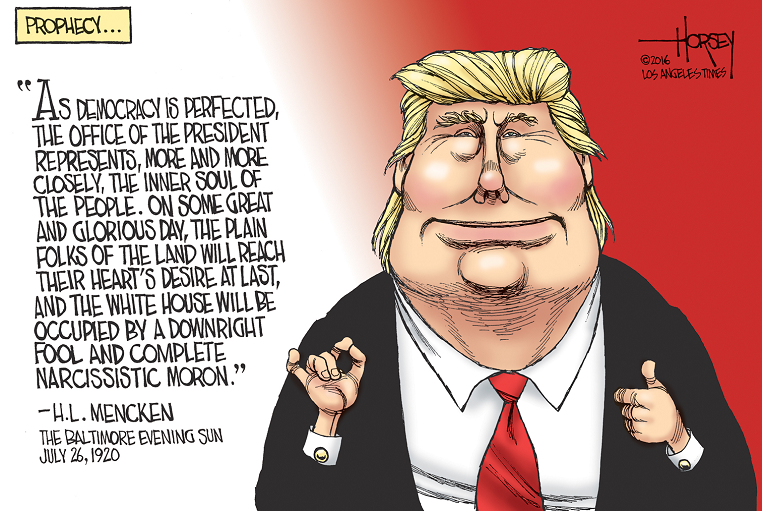

Trump lying again?

Shocking abuse of assuming everyone in the country is an idiot.

"yea or nea? Are you HAPPY! that the richest .01% get less taxes?"

Uh...less that what, exactly? Less than you'd like to take from them? Less that politicians can spend? Because it sure isn't less that the average person pays!

Sounds like the same old, same old, to me - "I have a right to what others earn because I don't think they deserve it, and should take more than I do. They're lucky I don't have the IRS strip them of every dime.Sounds like you are in denial ... still.

Equitable system of taxation includes such as equity, simplicity, neutrality.

Well it ain't simple and if I had an answer to solve that one -

I would win theNobel prize!

Which system of taxation do you support?

Proportional

Progressive

Regressive

Trump plan is Regressive https://en.wikibooks.org/wiki/Principle … s/Taxation

This is very rarely done intentionally by a government, as it would be extremely unpopular and would be seen as supporting wealthy, high income individuals over more needy households. However, indirect taxation could be said to partly support this. Very high income earners may spend a lower proportion of their income on goods and services, and so pay proportionally a fewer taxes as a percentage of their income.

https://apps.irs.gov/app/understandingT … _les01.jsp

Fairness and Taxation \ People's taxes should be in proportion to their wealth and income. Our federal income tax is based on the ability to pay principle. It is hard to get people to agree on what is a fair tax because people have different values and priorities.

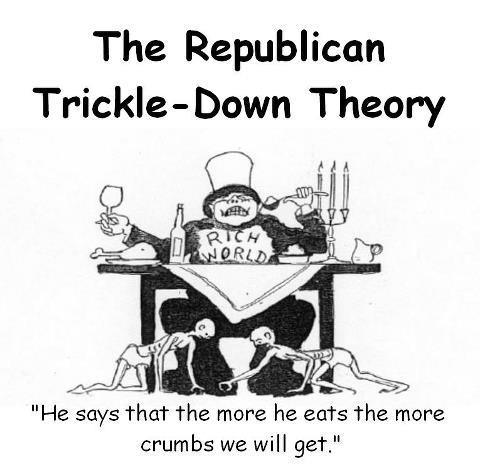

Architect of the Reaganomics trickle down voodoo economics, Bruce Bartlet:

the systematic denial of many inconvenient truths about the Reagan tax-cuts and the cuts that came after, including the fact that Reagan repeatedly raised taxes after the 1981 cuts; that the "prosperity" of the 1980s is grossly overstated (GDP growth in the 1980s was weaker than in the 1970s); that the Reagan years ended with a series of unprecedented market crashes and a deep recession; that Clinton's tax increases ended the recession; that GWB enacted near-annual cuts that coincided with collapsing GDP growth and federal revenues (and that growth returned when Obama allowed the Bush cuts to start expiring) and so on.

https://boingboing.net/2011/08/17/why-p … -rich.html

“last-place aversion”, the people who were a spot away from the bottom were the most likely to give the money to the person above them: rewarding the “rich” but ensuring that someone remained poorer than themselves."It is hard to get people to agree on what is a fair tax because people have different values and priorities."

On this we can certainly agree. Some see the rich as no more than an endless supply of things they want but can't afford; others see them as people with the same right to keep what they've earned as anyone else.

Some see small, politically weak, groups as a source of unchallenged income; others see them as people just like they are.

Some see taxation as a method of encouraging or coercing desired behaviors from people; others see it purely as collecting monies to fund government.

Some see taxes as a method to redistribute wealth; others see it as a method of funding government.Which system of taxation do you support?

Proportional

Progressive

Regressive

Trump plan is Regressive supporting wealthy, high income individuals over more needy households.

Which system of taxation do you support?

Which system of taxation do you support?

Which system of taxation do you support?

Which system of taxation do you support?

Which system of taxation do you support?

Which system of taxation do you support?

Which system of taxation do you support?Uh...less that what, exactly?

Uh...less that what, exactly?

Uh...less that what, exactly?

Uh...less that what, exactly?

Uh...less that what, exactly?

Uh...less that what, exactly?

If you wish answers to your questions you might consider answering them as well - real discussion instead of just spouting liberal rhetoric, for within this simple question lies an infinitely important point, one which you refused to expressI am the original poster. You can see it right there on the top of the page. Three Questions that you answered with questions.

yea or nea? Are you HAPPY! that the richest .01% get less taxes?

Do they just work harder? Is everybody else just stupid and lazy?

Do you believe that “If you’re still poor at 35, you deserve it,”?

As much as we like to think that the wealthy earn their money with hard work, is it really possible that 85 people worked harder than 3.5 billion?

Trump lying again?

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Your evading by answering the questions with more questions.

Uh...less that what, exactly?

Your answer means you didn't read the entire post/links because its says within the original post/links that the top .01% pays lower percentage than middle class taxpayers via tax loopholes that are only available to the super rich who fund the politicians who vote in tax relief favorable only to the top 0.01% at the expense of the rest of the nation. You of all people who hate free-loaders should be pissed as hell about this. Why aren't you pissed off?

Less than you'd like to take from them?

I am not stealing any money from a single person, rich or poor in the United States. I an irked that you are calling me a thief!

Less that politicians can spend?

??Did you mean, "Pay less taxes than politicians can spend? The answer is obvious with the US debt which means politicians spend more than what EVERYBODY pays in taxes."yea or nea? Are you HAPPY! that the richest .01% get less taxes? "

Define your terms, please, and I might be able to answer. Less than what? If it's less than $5,000,000,000,000,000 I can only answer that there is no choice, so being happy is irrelevant.

"Do they just work harder? Is everybody else just stupid and lazy?"

Some do, some don't. Of the 1% I'd hazard a guess that there will be very few that don't work extremely hard. Of the rest of the people I guess that some are stupid and lazy, most are not.

"Do you believe that “If you’re still poor at 35, you deserve it"

Some do, some do not - that should be obvious even to a socialistic liberal. Of course that doesn't translate into someone else deserving to be saddled with paying for it, either. Which doesn't seem obvious to that same socialistic liberal.

So how about it? Less than what?3rd time now:

Less of a percentage than middle class taxpayers.

Less of a percentage than middle class taxpayers.

Less of a percentage than middle class taxpayers.

Less of a percentage than middle class taxpayers.

Less of a percentage than middle class taxpayers.

Less of a percentage than middle class taxpayers.

Less of a percentage than middle class taxpayers.

Less of a percentage than middle class taxpayers.

Less of a percentage than middle class taxpayers.

Less of a percentage than middle class taxpayers.

Less of a percentage than middle class taxpayers.

Less of a percentage than middle class taxpayers.

Less of a percentage than middle class taxpayers.

Less of a percentage than middle class taxpayers.

Я считаю, что вы недостаточно умны, чтобы ответить на вопрос без другого вопросаGot it. Thanks for finally giving an answer. Even though they pay more money, the $ sign is less important that the % sign - it is one way of implying they pay less even when it is a thousand times more. You might want to consider being a little more accurate; "The rich pay a lower percentage of their income than the middle class does" is much more indicative of the truth than "The rich pay more than the middle class".

Yes, I suppose that I'm pleased, middlin' so, that people can still keep something out of their earnings - that the liberals haven't simply confiscated any and all of what people own that they think is too much. Less so when I consider that the lower percentage is only to be had by spending serious dough to utilize the social engineering projects built into the tax code. In the long run that's a losing game even though a great way to hide true costs and we pay a high price for it.The nation. Every person in it. If you don't think we're overpaying for these genius social engineering tax breaks you need to re-think.

I thought you were making up the term "genius social engineering tax breaks " so I googled it :

Never heard the term before, and it's been around for decades.

Tax Law As Social Engineer

June 08, 1985|By Louis Nizer.

http://articles.chicagotribune.com/1985 … x-tax-code

ChicagoTribune is LEFT-CENTER BIAS

so go to the next one:

http://www.nationalreview.com/article/3 … ng-editors

RIGHT BIAS

so go to the next one:

http://www.newsmax.com/Finance/Kleinfel … id/537219/

RIGHT BIAS

Needless to say, social engineering tax breaks mean different things from these 3 left/right bias, with both right bias complaining about Obama's social engineering.

Just trying to be on the same page here. It's so complicated that wouldn't be able to begin talking about it as a whole.

Just one example:

The mortgage interest deduction. Do you want to get rid of the mortgage interest deduction?

Or should we make it even and allow renters to deduct partially the monthly rent as a deduction also?Well, the "genius" part was pure Wilderness - a sarcastic addition to a common (to me) term.

My problem is that the real costs of the agendas and purposes of such tax breaks are hidden from the public AND congress. We never know how much that factory, say, in the inner city cost us. You want specific results from a corporation or person? Write them a check just like we everyone else. Or, at the most, make a line item to list exactly how much the tax burden fell.I heard of social engineering before but not coupled with taxation.

Oh yes. The large majority of those corporate tax breaks we so abhor are a very intentional and well meaning attempt to induce a corporation to do something we want them to, but they don't have to by law. We the people create the tax break for our own purposes, then forget just why we did it and begin to scream that it's unfair.

Capitalism is highly efficient, but it leads to extreme distortions in the distribution of capital. In other words, someone can earn $9 billion in a single year (John Paulson) partly by effort and partly by pure luck.

Wise heads created a progressive tax system to help fix that problem. A progressive system is good for society. The hard part is figuring out the tax rate for each income level.

But giving billionaires the same tax rate as everyone else is bad economics and leads to the kind of abuse of political power we see in the Koch brothers.

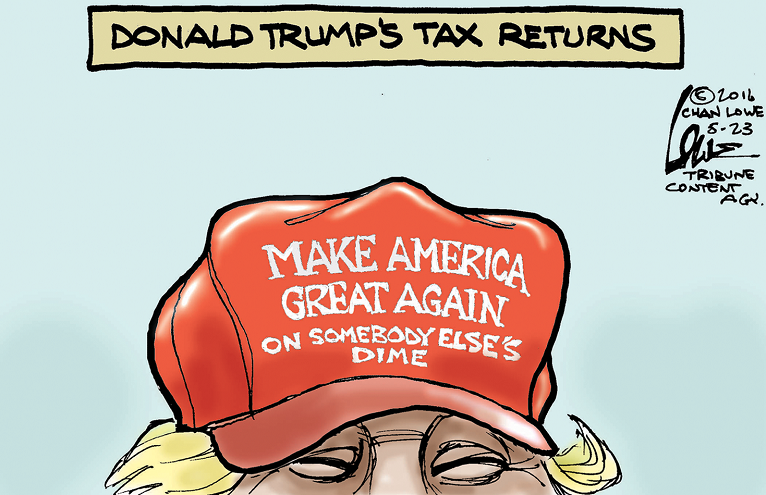

Donald Trump declared a massive net operating loss of $916 million in 1995, enough to allow him to avoid paying federal income taxes for up to 18 years. The documents shed light on provisions in the U.S. tax code that allow wealthy individuals to avoid income tax payments even in years when they make millions.

The "mega-rich" pay about 15 percent in taxes, while the middle class "fall into the 15 percent and 25 percent income tax brackets, and then are hit with heavy payroll taxes to boot." — Warren Buffett

Six-in-ten Americans said they were bothered a lot by the feeling that “some wealthy people” and “some corporations” don’t pay their fair share.

The Institute on Taxation and Economic Policy, found that "virtually every state's tax system is fundamentally unfair, taking a much greater share of income from low- and middle-income families than from wealthy families." It added that state and local tax systems are "indirectly contributing to growing income inequality by taxing low- and middle-income households at significantly higher rates than wealthy taxpayers."

In other words, it said the tax systems are "upside down," with the poor paying more and the rich paying less. Overall, the poorest 20 percent of Americans paid an average of 10.9 percent of their income in state and local taxes and the middle 20 percent of Americans paid 9.4 percent. The top 1 percent, meanwhile, pay only 5.4 percent of their income to state and local taxes.

“We don’t pay taxes. Only the little people pay taxes,” - Leona Helmsley

Law experts believe 'Ol Bone Spurs may be benefiting from provisions in the tax code that specifically benefit real-estate developers. These generous tax breaks could reduce his reported income in later years to zero, or even a loss. More to the point, those loopholes would allow him to claim losses on someone else’s money—in other words, money he borrowed to buy real estate that then depreciated in value."The "mega-rich" pay about 15 percent in taxes, while the middle class "fall into the 15 percent and 25 percent income tax brackets, and then are hit with heavy payroll taxes to boot."

Which means that the rich pay thousands of times more in taxes for the exact same product. But that's "fair" isn't it? After all, you always pay more for a gallon of milk than the poor do - why shouldn't the rich pay more for government services than YOU do.

But I do have to question just how the poor are hit with 25% tax rates plus payroll taxes. Because they have such enormous stock portfolios?Hi ptosis, since you went to the trouble of providing all those stats for your perspective, I thought it only fair for me to go searching for stats to support another perspective I am hopeful you will consider - instead of just offering my usual contrary opinion.

In the food-service business we too dealt with percentages; relative to food costs and stuff. 27% food costs was a standard target, (a more defined 'fair share" as related to your tax thoughts), but we also considered another perspective - relative to profit, (as might compare to your idea of total tax revenue), and that was, contributory dollars, as in how much actual money did a percentage-cost item contribute to total income. For instance; we could sell a fountain soda at about a 16% food costs, ie. a $1 drink costs 16 cents to make, and contributed 84 cents to total income. Sweet - if only we could sell all the sodas we could make.

But, we also sold steak dinners at a 35% food cost, ie. a $20 steak entree costs $7.00 to make and contributed $13.00 to total income. As you can see, we would prefer to sell a steak dinner to a soda any day.

I apologize for appearing to offer a lesson on something you probably already knew, but I just wanted to be sure you understood my basis for the "contributory dollars" tax perspective I hope you will compare to your "individual percentage" tax mantra.

*I know your stats were for the States, and mine are Federal, but I think the concept still lends itself to comparison.

You noted that individually, the bottom line is that the 1% pay about 5.4% of their income, the middle about 9.4% and the bottom about 10.9%.

Here's what those numbers represent in real money, (contributory dollars), actually paid to the government; according to a Pew Research Center Study

The top 1% pay about 43.6% of all tax monies, or about $671 Billion

Those making over $250,000 pay about 51.6%, or about $795 Billion - and that group is less than 3% of total tax filers.

Your bottom 20% paid between $22 - $86 billion, depending on your cut-off point - either under $30,000, ($22 billion), or under $50,000, ($86 billion)

That is my "contributory dollar" perspective, as compared to your "individual rate" perspective.

I think the reality of actual tax monies paid is more illustrative than mere percentages. A contributory dollar perspective shows that less than 3% of tax filers pay over half - $795 billion, of all taxes. Or put differently, the comparison between the top and bottom that you seem to prefer - less than 3% of all tax filers pay between 10x and 36x more than the bottom 20% bracket of filers.

Is that a perspective you could consider as realistically comparative?

ps. I hope you will take a look at the Pew link. There are several more stats that pertain to your individual rate preference that show a bit of a different outlook when considered.

pps. I even hunted down a picture for you

GA

Trickle down economics never works. The wealthy already have enough money to create more jobs and industry if they desire to do so. Now many big businesses are so rich they're buying their own stock back from the shareholders. I suppose with Trump's tax cut to them they'll simply get more control and power over the poor and middle class. Is that a good thing?

They can never have more control than we are willing to give them.

But "trickle down never works"? Far as I know it has only been tried once, for a short time, where it did not do well. The question was "why"

Interestingly, I watched a PBS segment the other night wherein the latest thought is that there is nothing the government can do that will help an economy. It can destroy it, of course, but not help. Or perhaps a better terminology might be that the best thing a government can do for an economy is leave it alone.Reagan and both Bush's used trickle down economics. How'd that work out?

Not really, Dubya left us in a recession which Obama had to fix and now we have a growing economy again which Trump is taking credit for. DOH!

Or multiple wars put us into a recession. Easy to blame economic policies, but not necessarily true. Just as the tried and true method of ending recessions by spending our way out of the isn't economic policy that resulted in solving a problem or the could or should be continued indefinitely.

Reaganomics was another name for trickle down economics, Dan. If I had to bet, I'd wager you were a Reagan fan as well.

Related Discussions

- 226

Top 10 Reasons for Higher Taxes on the Top 1%

by kerryg 15 years ago

Funding for our country's children is being cut, but we allow a hedge fund manager to make enough money to pay the salaries of every public school teacher in New York City. Most of his earnings are taxed at a rate less than that of his secretary.We haven't been able to do anything about it because...

- 203

Trickle Down Economics doesn't work

by Moderndayslave 14 years ago

With the income gap between the wealthiest American's and the soon to be decimated middle or working class ever increasing. How much more proof do you need that tax cuts for the wealthy isn't creating jobs or supplying wages that are holding their own against inflation....

- 26

Do tax breaks for the rich really create jobs?

by Dennis L. Page 13 years ago

Do tax breaks for the rich really create jobs?Nick Hanauer, a venture capitalist states consumers create jobs and not the wealthy. He claims the rich only hire if consumers are buying goods and products and that there are not enough wealthy to support our economy. He says, "If it were true...

- 167

Is the president whipping up class warfare?

by Jason Menayan 14 years ago

What are your thoughts on this?"We're going to close the unproductive tax loopholes that allow some of the truly wealthy to avoid paying their fair share. In theory, some of those loopholes were understandable, but in practice they sometimes made it possible for millionaires to pay nothing,...

- 53

What Does It Mean for The Wealthy to Pay Their Fair Share of Taxes?

by Scott Belford 6 months ago

This topic has come up recently across several forums, so I though I would start on specifically for this subject.The question comes up when mainly Democrats and some Independents complain that the wealthy do not pay their fair share in taxes. The rebuttal ranges from they already do to why should...

- 7

Congressional Research Service analysis on "trickle down economics"

by Don W 6 years ago

About the Congressional Research Service:"The Congressional Research Service (CRS) works exclusively for the United States Congress, providing policy and legal analysis to committees and Members of both the House and Senate, regardless of party affiliation. As a legislative branch agency...