Could we fix our budget deficit by cutting back the Federal Government's budget

Could we fix our budget deficit by cutting back the Federal Government's budget by 1% per year...

for the next 20 years?- Mr Tindleposted 14 years ago

0

It would be a start, but my personal view is that we need to take bigger steps. I would say that at least 5% of the budget should be slashed every year. Preferrably even more than that in order for the U.S. to really make a dent in our gigantic deficit. After all when analyzing the federal budget we have to realize that the deficit has grown into an enormous beast! We are now overspending by $2 Trillion every year. So we need to take large steps to make a difference.

Also I think tax cuts are desperately needed as part of the equation. More money in the pockets of both individuals (rich, middle-class, and poor) and businesses (Multi National Corporation & Small Businesses) means more revenue for the government to work with over the long-term.

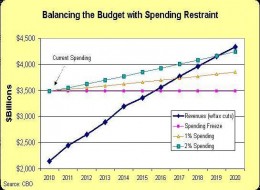

The Cato Institute contends that if we froze the budget and the taxes exactly where they are right now we would be even in 2016. We could increase spending by 1% per year and still balance the budget by 2018 or 2% and balance by 2020. It is freezing tax rates where they are that is the key.We should start with reducing congressional pork barrel spending

the only thing that is going to fix the deficit is for americans to take back their country from the wealthy. the love for capitalism is killing the U.S. and whether people want to admit it or not it's a great idea that is impossible to sustain. canada and the united states both need to forget about the original ideas and rethink what is needed to become truly free and self-supporting. i know many people will disagree that capitalism won't work and they have that right but so far it looks like it is destroying us and it will continue to do so.

Surely all waste should be reduced or stopped if possible.

However, the difficulty is in sorting out what is beneficial spending and what is not. This can vary depending on which party a politician is associated with. The wealthy individuals and corporations should provide more in taxes. After all they benefit more from the education of masses, infra-structure, law enforcement, and the military.

Cutting the Federal budget is not always the answer. These are usually proposed by the wealthy through the politicians they fund, so that their taxes are kept low.

A better solution is stimulating the economy and or increasing the taxes on wealthy corporations and individuals. The tax revenues will then go up and reduce the deficit. No one will go hungry or homeless while we reduce the deficit. It is really not that painful unless one is greedy. Read my hub on Government spending and taxes during recession.That would be part of it, but I really think the answer lies in finding small solutions. Wasted money can be found anyway. Can we identify incentives for employees to identify ways to save money? I wrote a hub about it:

http://equine.hubpages.com/hub/CostSaving

Related Discussions

- 65

What should be done about the national budget deficit?

by Ralph Deeds 13 years ago

Paul Krugman:" Back in 2010, self-styled deficit hawks — better described as deficit scolds — took over much of our political discourse. At a time of mass unemployment and record-low borrowing costs, a time when economic theory said we needed more, not less, deficit spending, the scolds...

- 14

We have to pay our Bills Marjorie

by Mike Russo 2 years ago

MTG and her MAGA buddies want to hold the country hostage and not pay our bills that were incurred last year. It's like charging on a credit card for a year and then there is a moment of truth were the bills have to be paid. But they think they can hold the country hostage like spoiled...

- 7

Are higher taxes the best way to reduce the budget deficit?

by Max Dalton 13 years ago

Are higher taxes the best way to reduce the budget deficit?It seems like that coupled with a reduction in defense spending would be a good start, but there's still a lot more that will need to be done. I think people are discounting how much pain is going to be required to pull the deficit down to...

- 44

USA Budget Deficit Hits Record High

by leeberttea 15 years ago

How's that hope-y change-y thing working out for ya?3% growth is better than what we've had the past 2 years but will we actually be able to achieve it once the new taxes kick in? What about the debt crisis in Europe? It seems they have made the same mistake we made approving a trillion dollar bail...

- 1071

Thinking about how to vote in 2024? I Am!

by tsmog 16 months ago

We all know it will be party-line loyalty for most voters. According to Pew Research, six percent of voters for the 2022 elections crossed party lines. For the mythical independent voter, it is a binary choice for the President. We are fortunate to be able to assess two Presidents based on criteria...

- 19

With a New President Coming In, What Do You Think Will Happen To The U.S. Budget

by John Coviello 8 years ago

With a New President Coming In, What Do You Think Will Happen To The U.S. Budget Deficit & Debt?We have a New President of the United States taking office with big spending plans and big tax cuts. What do you think will happen to the U.S. budget deficit and debt over the next four years?