We Do Not Exist?

"For the Indian woman 30+ — forgotten by herself, ignored by brands."

The Great Skincare Paradox for Indian Women above 30 years

Walk into any beauty store in India, scroll through Instagram ads, or flip through a magazine – you'll notice something striking. Every skincare brand, from homegrown favorites to international giants, seems to have forgotten an entire demographic exists: women over 30.

We do not exist in their world of dewy-skinned teenagers and fresh-faced twenty-somethings promoting "anti-aging" serums they don't yet need.

The Gen-Z Obsession

Indian skincare brands have fallen into a peculiar trap. Whether it's Minimalist, Plum, Mamaearth, or The Derma Co., their marketing playbook reads the same: cast a 22-year-old influencer, talk about "preventing aging," and call it a day. These brands focus on generic ingredients – niacinamide, hyaluronic acid, vitamin C – positioning them as one-size-fits-all solutions.

But here's the uncomfortable truth: a 19-year-old's skin concerns are vastly different from a 35-year-old's. Yet somehow, we're all supposed to believe that the same retinol serum will work equally well for both.

The irony is palpable when you see a 23-year-old creator promoting "anti-aging" products. Anti-aging for what? The fine lines they might develop in a decade? Meanwhile, women who actually need these products – those dealing with real signs of aging, hormonal changes, and declining collagen – are nowhere to be seen in these campaigns.

The Biology of 30+: What Science Actually Says

After 30, everything changes. This isn't marketing speak – it's science backed by dermatological research.

Collagen production drops by approximately 1% each year after age 25, with a more dramatic decline post-30. Research published in the International Journal of Cosmetic Science shows that by age 40, women have lost 10-20% of their skin's collagen content. Cell turnover slows significantly, going from every 28 days in your twenties to every 45-60 days in your forties, meaning skin takes longer to regenerate and repair itself.

Hormonal fluctuations become more pronounced, especially approaching perimenopause (typically starting in the late 30s to early 40s), leading to increased sensitivity, dryness, and unpredictable adult acne. The elastin fibers that keep skin bouncy and firm begin to weaken, while decades of cumulative sun damage starts manifesting as dark spots, uneven texture, and deeper lines.

These biological changes demand targeted anti-aging solutions for Indian women 30+ – not the same basic vitamin C serum a college student uses for "glowing skin." Yet Indian skincare brands continue to approach aging skin with generic formulations, as if biology stops at 25.

The Reality Check: Life After 30

Let's talk about the elephant in the room – the lived experience of women over 30 in India.

Picture this: It's 6:30 AM. You're juggling getting kids ready for school while preparing for an important presentation at work. Your mother-in-law needs help with her medications. Your husband can't find his office shirt. By the time you get to your bathroom, you have exactly 5 minutes before you need to leave.

Now imagine trying to follow the elaborate 10-step Korean skincare routine that every beauty influencer swears by. Double cleansing, essence, serum, moisturizer, sunscreen – it sounds wonderful in theory. In reality? It's completely divorced from the chaos of adult life.

Professional responsibilities have intensified. You're likely in a senior role with real deadlines and people depending on you. Family obligations have multiplied – aging parents, growing children, household management. Social responsibilities increase – community involvement, extended family functions, maintaining relationships.

Where in this reality is there time to research ingredients, patch-test products, and maintain complex routines? Where are the skincare brands that understand this context?

The Marketing Mirage

Indian skincare advertising perpetuates a fantasy that bears no resemblance to real life post-30. The typical skincare ad features:

-

A woman in her early twenties with naturally perfect skin

-

Applying products in a pristine, Instagram-worthy bathroom

-

With unlimited time and natural lighting

-

Talking about "preventing aging" with a straight face

Meanwhile, actual women over 30 are dealing with:

-

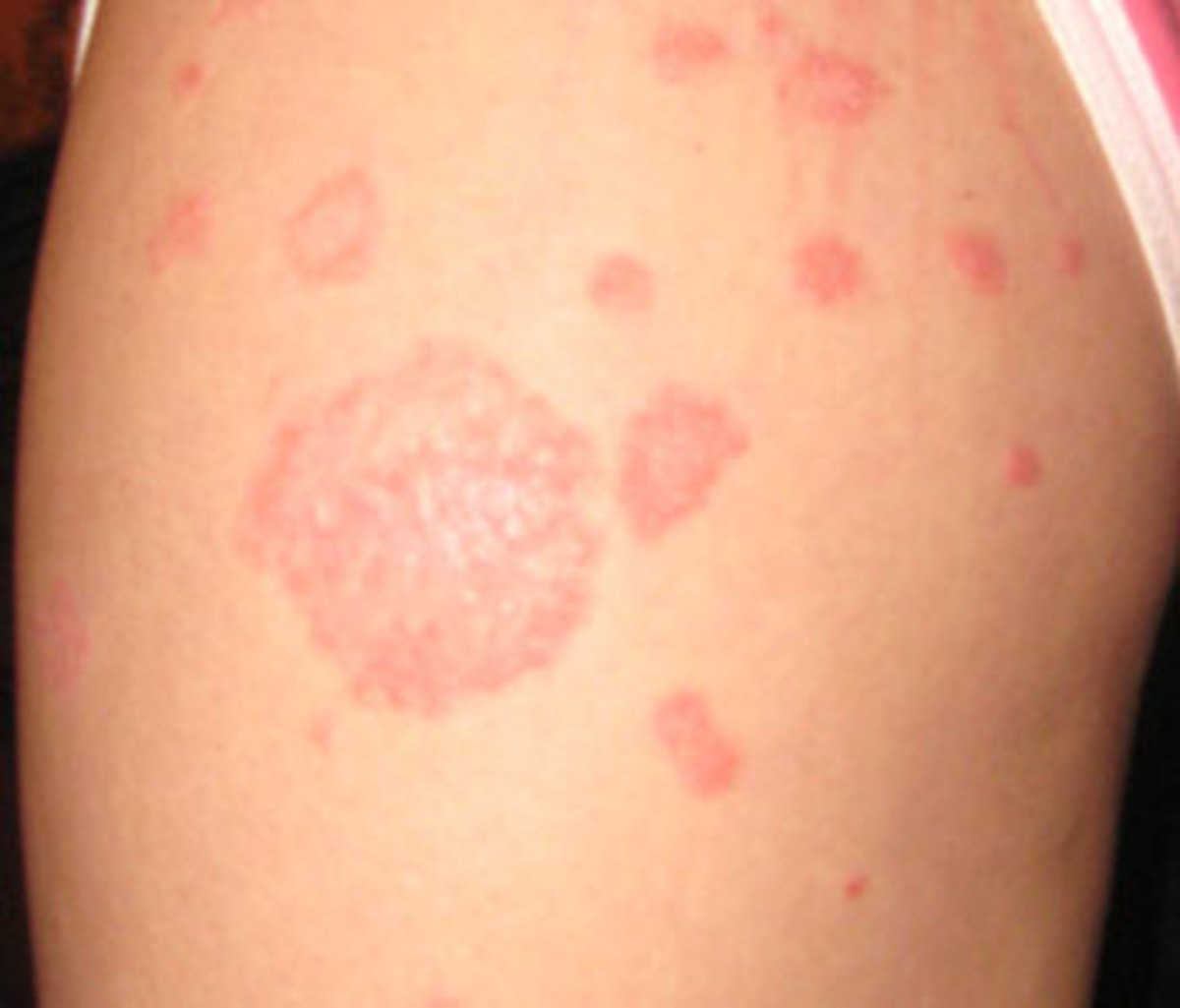

Hormonal acne that appeared out of nowhere

-

Dark circles from juggling multiple responsibilities

-

Melasma triggered by hormonal changes

-

Skin sensitivity that wasn't there in their twenties

-

The need for products that work quickly and efficiently

The disconnect is jarring. It's as if these brands believe women simply stop existing after 30, or that we're all blessed with unlimited time and energy to devote to skincare.

What We Actually Need: The Missing Anti-Aging Solutions for Indian Women 30+

Women over 30 don't need another vitamin C serum marketed by someone who still gets carded. We need authentic solutions designed for our reality:

Efficient anti-aging formulations that deliver visible results without requiring a chemistry degree or 45 minutes every morning. Think multi-peptide serums, targeted retinoid treatments, and clinically-proven ingredients that actually address collagen loss and deep wrinkles.

Targeted mature skincare solutions that address the specific concerns of Indian women post-30 – real fine lines, loss of firmness, hormonal melasma, adult acne, and uneven skin tone that develops over decades of sun exposure.

Realistic expectations and honest marketing that acknowledges the constraints of adult life while delivering proven anti-aging benefits.

Multi-functional products that can replace multiple steps without compromising efficacy – like moisturizers with built-in retinol or serums that address both pigmentation and firmness.

Representation in advertising that shows women who actually look like us, live like us, and face the same mature skin challenges we do.

The Global Reality Check: What the West Gets Right

The global skincare market, valued at $115.65 billion in 2024, is projected to reach $194.05 billion by 2032 – and Western brands understand exactly who's driving this growth.

Unlike their Indian counterparts, US and European beauty giants have built entire empires around mature skincare. Estée Lauder specifically targets affluent women aged 25-54, with dedicated anti-aging lines like Advanced Night Repair and Revitalizing Supreme collections. In Europe, Baby Boomers have become the most influential consumers in the beauty market, driving demand for sophisticated mature skin solutions.

Brands like Olay built their reputation on Regenerist and Total Effects lines specifically formulated for women experiencing real signs of aging. La Mer positions itself as the ultimate luxury anti-aging solution. RoC's entire brand identity revolves around retinol products for mature skin concerns. Clinique's Repairwear line addresses loss of firmness and deep wrinkles.

These brands don't just create age-appropriate products – they cast age-appropriate models. Their advertisements feature women in their 40s, 50s, and beyond, acknowledging that their target demographic actually experiences the problems their products claim to solve.

The contrast with Indian brands couldn't be starker. While Western beauty companies recognize that mature women represent purchasing power and brand loyalty, Indian brands remain fixated on 22-year-old influencers promoting "preventive" skincare.

By ignoring the 30+ demographic, Indian skincare brands are missing a massive opportunity. This demographic has:

-

Higher disposable income and willingness to invest in quality products

-

Brand loyalty when they find products that actually work

-

Influence over family purchasing decisions

-

Life experience that makes them discerning customers who value substance over hype

Instead, brands are chasing a younger demographic that's still price-sensitive, brand-hopping, and influenced by trends rather than results.

A Call for Change

The Indian beauty industry needs a reality check. Women over 30 exist. We have money to spend. We have skin concerns that need addressing. We deserve products formulated for our biology and marketing that reflects our reality.

We're tired of being told that skincare is one-size-fits-all when our lived experience says otherwise. We're exhausted by seeing 22-year-olds selling us solutions for problems they've never faced.

It's time for brands to step up and create products for the millions of Indian women navigating life after 30. Until then, we remain invisible in an industry that profits from our insecurities while refusing to acknowledge our existence.

The Bottom Line

We do not exist in the world of Indian skincare marketing. But we should. And until we do, the industry will continue to miss the mark for the very demographic that needs targeted, effective skincare solutions the most.

The question isn't whether women over 30 need different skincare – science has already answered that. The question is when Indian brands will finally wake up to this reality and create products for the women they've been ignoring.

Until then, we remain the invisible women of Indian beauty – existing in reality but absent from the brands that claim to serve us.

With Love & Care,

References & Sources:

-

Asserin, J., Lati, E., Shioya, T., & Prawitt, J. (2015). "The effect of oral collagen peptide supplementation on skin moisture and the dermal collagen network". Journal of Cosmetic Dermatology, 14(4), 291-301.

-

Fortune Business Insights. (2024). "Skincare Market Size, Share, Trends | Growth Analysis [2032]". Global market report showing skincare market valued at $115.65 billion in 2024.

-

PLOS One. (2023). "Age-related changes in dermal collagen physical properties in human skin". Research on collagen deterioration with age.

-

MDPI Nutrients. (2023). "Effects of Oral Collagen for Skin Anti-Aging: A Systematic Review and Meta-Analysis". Comprehensive analysis of collagen supplementation effects.

-

PMC Research. (2022). "Collagen Supplements for Aging and Wrinkles: A Paradigm Shift in the Fields of Dermatology and Cosmetics". Analysis of collagen loss and aging patterns.

What are your thoughts on this gap in the Indian skincare market? Have you struggled to find effective anti-aging solutions as an Indian woman over 30?

Share your experiences with mature skincare routines in the comments below.

— Ignored by Indian Brand (Founder D&P Skincare)

30 hit hard: dark spots, dull skin, constant stress. I realized Indian women like me

— Founder, D&P SkincareThis content is accurate and true to the best of the author’s knowledge and is not meant to substitute for formal and individualized advice from a qualified professional.

© 2025 Founder, DandP skincare