Is a Solar Lease Program a Good Deal for You?

Solar Lease Programs

What is Solar Leasing?

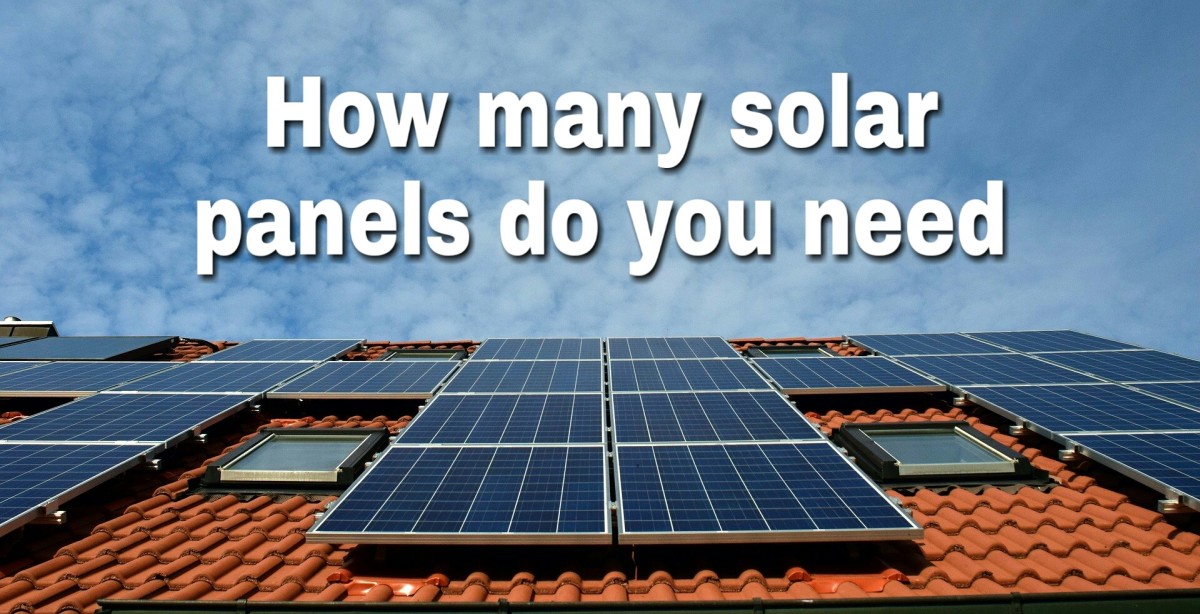

Solar lease programs have been garnering much attention lately and have many homeowners asking themselves if solar leasing is a good deal or not. If you live in a state that has plenty of sunshine or offers of rebate and incentive programs for going solar, then chances are you are aware of these programs or have seen the multiple ads for them on television. So what is solar leasing exactly?

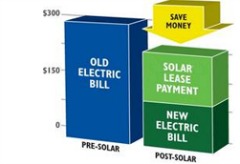

In its simplest terms, solar leasing is when a 3rd party (solar company) installs a solar system in your home at no charge to you and you just pay for the use of the system at a rate that is less than your current energy bill. Savings on your electricity run an average of 10% to 30% depending on your energy use and the size of the system. It's currently available in 13 states: Arizona, California, Colorado, Connecticut, Delaware, Hawaii, Maryland, Massachusetts, New Jersey, New York, Pennsylvania, Oregon, and Texas.

Many of these programs offer leasing for no money down in terms of upfront costs and the homeowner begins saving money on their electricity the first month it is installed. This allows the average homeowner who couldn’t otherwise afford the large upfront cost of purchasing a solar system, to go green and take advantage of the savings of having a solar system for home. This creates the potential to save hundreds of dollars in electricity each year over the life of the lease.

Do you have to qualify for a solar lease?

When you inquire about leasing solar, the first thing the solar company will do is determine if your home initially qualifies based on its location in reference to the amount of sun it should receive. They then assess your total monthly or yearly energy expenditures of electricity and gas if you use it. Based on that formula they determine whether or not you would be a good candidate for solar leasing. If you are, they will then follow up with a home visit to determine if your home can accept solar panels and doesn't have any issues with shade. You must also pass a standard credit check and own the home.

In the meantime, they will offer up a few different leasing options based on your energy needs. Your total monthly bill will usually consist of your lease payment plus any additional electricity payment. That total can run 10% to 30% less on average than your current energy bill. If you are willing to pay some money upfront, your lease payments can be lowered to save even more each month.

Advantages of Solar Leasing

How Can Solar Companies Install a Free System?

Solar companies are able to do this for a number of reasons. First and foremost is the significant decrease in the cost of solar panels and equipment the last few years. Solar companies wouldn’t even contemplate leasing if the costs had not come down like they have. Another big reason is that as the homeowner, you sign over the 30% Federal tax credit to the solar company which can be worth several thousands of dollars. You also sign over any State and local power company incentives that may be offered. This allows the solar company to install the system at a much lower cost that will be made up after a few years or so of collecting solar lease payments from you.

Solar Leasing Pros and Cons

Pros

| Cons

|

|---|---|

Free installation of a solar system disigned for your home

| Solar companies profit from the rebates and tax incentives intended for the homeowner

|

Hundreds of dollars in savings each year over your current energy bill

| Energy savings are not as great as owning your own system

|

All maintenance, repairs, and system monitoring are included

| The average solar lease program is 20 years

|

Flexible leasing programs

| Many lease payments can have an escalator clause of 2% to 3%. Theoretically it's still less than the historic 6% increase each year by utility companies

|

Some leases include the option to own your own system later

| If the home is sold, the buyer must accept transfer of the lease or the seller will pay an early termination fee

|

No money down available

| The longterm savings of purchasing a home solar system is much greater than leasing solar

|

Solar company handles all permits, inspections, and project management

| |

Power performance of the system is guaranteed

| |

All solar lease sytems are fully insured

| |

Homeowners without the financial means can finally benefit from the savings of solar

|

Place your Vote for Solar Leasing

Do you think solar leasing is a good viable alternative?

So is solar leasing a good deal or not?

Solar leasing can be a good deal depending on your living situation. A good example would be someone who is living on a fixed income or a family that doesn’t have the financial resources to purchase their own system. Ideally you would be protecting yourself from large future rate increases while saving money on your utilities at the same time. It would provide for more discretionary income that the homeowner wouldn’t otherwise have.

According to the National Renewable Energy Laboratory;

The sun is shining on homeowners in less affluent neighborhoods who are discovering they can afford solar energy after all — by leasing rather than buying the panels on their roofs.

The new business model lets homeowners save money the very first month, rather than breaking even a decade after an initial investment of $5,000 to $10,000.

In the meantime, some argue that solar leasing is taking advantage of the average homeowner and the taxpayer by profiting from the 30% Federal tax credit, State rebates and other local utility incentives that would otherwise go to the homeowner. The cost of a solar system can be reduced by up to 50% when a homeowner applies these incentives towards the purchase of a home solar system.

There are also $0 down FHA solar loans available that can be easier to qualify for in terms of a credit check compared to a solar lease. You do need to have some equity in your home however to qualify for these programs. Purchasing solar in this way would allow for much greater savings in the long run and can pay for itself in 5 to 10 years. This savings would continue on for much longer than the life of a lease.

Based on this information, the only person who knows for sure if solar leasing is a good deal or not - is you. Make sure to do your research and explore all purchasing alternatives before deciding whether you should lease solar or not.

More Information on Solar

- Federal Residential Renewable Energy Tax Credit

Established by The Energy Policy Act of 2005 , the federal tax credit for residential energy property initially applied to solar-electric systems, solar water heating systems and fuel cells - Home Solar Energy Panels - What is It, and What Does It Do?

Solar Panel Technology. The future for energy efficient homes. How does it work? Are you looking for home solar energy panels for your home?