The Electronic Wallet

Emerging Trends - The Electronic Wallet

Conversant Leaders blog by Cyndi Mccoy

The MasterCard and Visa commercials have become increasingly persuasive, with examples of using credit cards to speed through the checkout lines, immediately download music, or the ease of making unexpected purchases. The use of that plastic card to facilitate payment is a process that relies on technology standards and practices to protect data integrity and mitigate risk. Emerging technologies support transformations in various industries such as Healthcare, Financial Services, Energy and Environmental. The information presented summarizes current fundamental technology affecting change in the Financial Services sector.

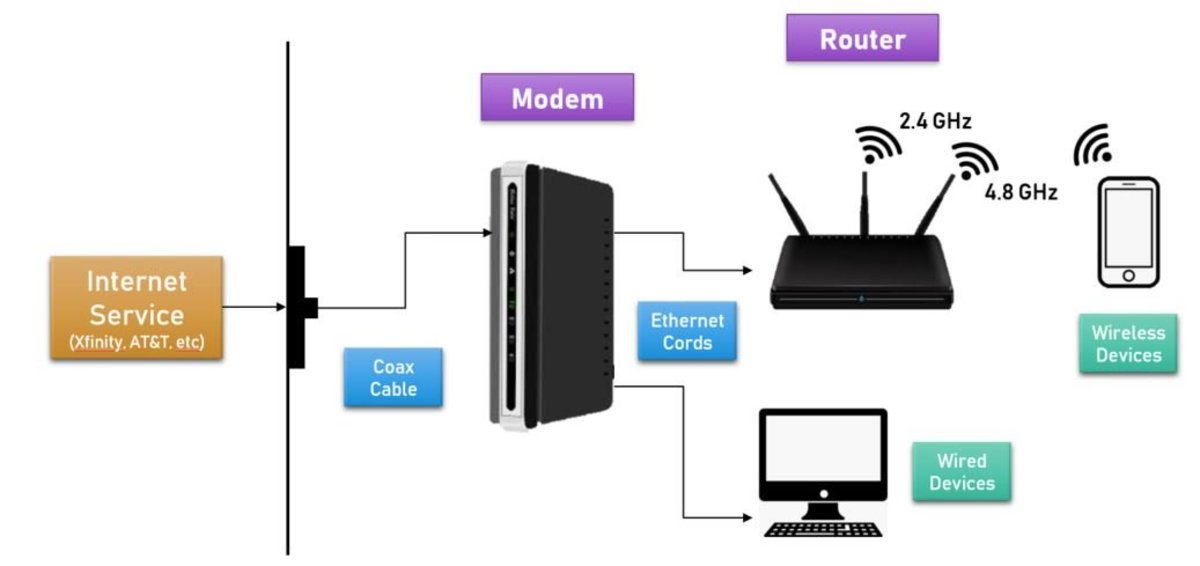

Most networks use broadcast technology to send and receive information. Therefore, careful planning, risk management and monitoring are required to ensure the technology has appropriate security otherwise; network communication technologies may expose the system to additional vulnerabilities. Currently the most significant technology employed to connect payment devices with Point of Sale devices are Infrared, Radio Frequency Identification, Near Field Communication, and Bluetooth. This technology essentially transforms mobile devices into electronic wallets.

- Infrared is a communication technology similar to a television remote control. Infrared supports financial management and data transfers by sending frequency to Point of Sale terminals or Automated Teller Machines equipped with an Infrared port. The Infrared signal can broadcast for several yards enabling consumers to perform financial transactions between devices and payment terminals.

- Radio Frequency Identification or RFID uses machine-readable tags that store binary code and contain antennas that talk to network systems, communicating via radio frequency. RFID’s method of storing and accessing data on devices via tags has the potential to create new environments by providing data and information to support professionals, processes, and customers. RFID tags are in many retail products such as key fobs, credit and debit cards. Tags placed inside security badges, products, or devices can be monitored with a transceiver to improve safety or track human, and inventory movement.

- Near Field Communication or NFC, chips are embedded in mobile devices such as telephones enabling the device to acts as a reader of other NFC devices. This short-range technology similar to RFID shares data and transmits payments enabling devices to act as a contactless payment systems. Consumers can waive a cell phone over a reader and make retail, event, and other purchases.

- Bluetooth is a wireless radio frequency communication protocol that when employed with existing online authentication infrastructure can approve financial transactions. Bluetooth automatically connects devices as they come in range such as a retail kiosk, or keys to start the car without the key being in the ignition. Bluetooth is detectable at greater distances and compliments a wide range of technologies.

Infrared, Radio Frequency Identification, Near Field Communication, and Bluetooth are complementary technologies that inter-operate with other technologies such as proximity and biometric payments systems and used in conjunction with, ISO 8583, NIST, and EMV can provide unlimited services. Innovative products and services are not without compliance, process, or security challenges. Financial Institutions must comply with federal and state laws, operating rules of clearinghouses, bankcard networks, in addition to congressional laws such as Gramm-Leach-Bliley Act or GLBA and Sarbanes Oxley Act or SOX.

Innovations also make modification of customer identification and authentication methods a necessity. Coupled with electronic banking applications use of open network standards requires reliance on multi-factor authentication and layered security approaches to prevent unauthorized transactions. The approach is effective to address the following areas:

- Approval for authorized users

- Secure encrypted delivery

- Load balancing and clustering architecture to support automatic fail-over and centralized data storage

- Logging and log viewing of all client server activities

© 2010 ConversantLeaders