What Is Bitcoin and How Does It Work

What is Bitcoin?

Created by a person or persons under the name "Satoshi Nakamoto" back in 2009 still to this day remain unidentified created the worlds first ever currency that is not owned nor run by any official body nor singular/grouped identity.

Bitcoin is a digital currency, decentralized and referred to as a cryptocurrency due to it's cryptographic coding that structures the currency which also enables it to be so secure and revolutionary.

This has developed a tremendous appeal to this concept of crypto currencies because of the privacy and power distribution, the idea that people can transfer money in full privacy and not pay fee's to some corporate fat cat.

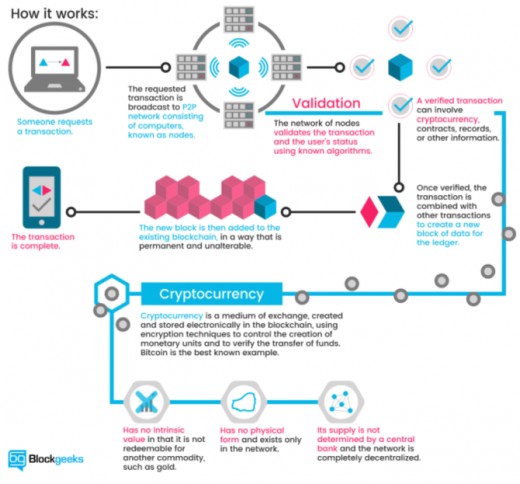

Bitcoin runs through the blockchain which is a shared public ledger, using cryptography, build up of complex mathematical equation as it's structure. This structure is what enables the ability to spend, store and hold privacy in a way no bank or corporation has ever has before.

The Blockchain

Blockchain technology itself is the most useful part that developed from crypto-currencies and will almost certainly be used across all iconic industries in the near future.

For Bitcoin the Blockchain works as a shared public ledger that confirms all it's transactions through cryptography which can be see illustrated above.

Although blockchain technology and cryptographic coding has been used within the military and even banks for some time, there has never been a currency developed and distributed within this manner. Between the blockchain and cryptography this enables bitcoin to exist across the ledger, meaning it doesn't exist on a server. The currency (bitcoin) exists as a form of code, cannot be copied or forcefully added. The currency cannot be destroyed which is why many referred to the cryptocurrency as Gold 2.0.

Pricing and Potential

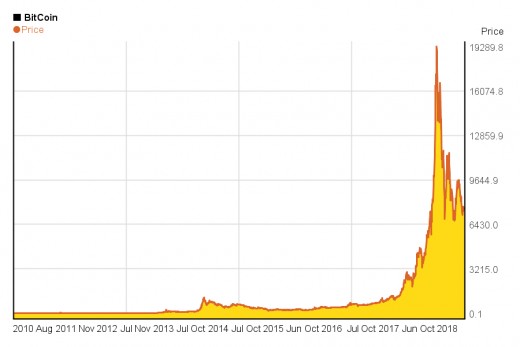

The journey so fare has been fascinating, back in 2009 you could grab several coins for $10 without many really taking much notice untill 2015 the price sky rocketed to $1500. The highest point for one Bitcoin reached $20,089 in December 2017 which is staggering for something you cannot see nor hold and isn't regulated or barely spendable.

As you see from the image above that bitcoin has tumbled since it's peak, many referred to it as a "bubble" panic buyer certainly gave this that effect which hasn't helped bitcoins cause.

A currency that has no physical form and isn't dominated by fact cats leave a huge opportunity that many don't realise which is bitcoins price rises when you own and spend it. Also Bitcoin has no borders, it takes down the walls of USD GBP EUR and gives an opportunity for everybody on the planet to use 1 singular currency. Theoretically speaking if you owned 1 Bitcoin and the currency captured just 33.3% of the worlds currency it would be valued over $300,000.

Costs less to use and saves time

Rich people were delighted when they first fount bitcoin because it could potentially save them multiple days of waiting time and thousands of dollars in transfer fees. Transferring $500,000 abroad can cost you roughly 5% of the transaction which is a staggering $25,000 just to send money! Not to mention the potential 3 days waiting period, transaction of that size. Bitcoin would only cost $50-100 to send and take several hours! This alone was grabbing a lot of peoples attention and it an appealing factor to cryptocurrencies.

Obviously privacy is a huge factor in modern society, so you can see the appeal for both good and bad factors that blockchain technology and crypto-currencies bring. Anyone looking to do something bad and needs privacy with financial transactions is immediately drawn to bitcoin which is why Bitcoin has always taken such bad press. The other side is the option is there if you want to store your money/coins without any third party seeing what your buying, selling or how much you have.

Issues and the future

Issue 1: Bitcoins first major issue is scaling, it simply cannot manage enough transactions at one. The blocks of which build the blockchain and help confirm transactions are limited. Being conceived in 2009 the size issues have obviously changed where now 1mb is considered extremely small. The block size for a long time was only 1mb, scaling changes have been introduced by BU and Segwit but even then will only be 3-4mb in size per block.

The entire blockchain exceed 100GB and which usually consists of around 5-10 transactions a second. When the number rises it slows and begins to freeze up transactions. Compared to the credit and debit card icon Visa averaging 25,000 transactions a second Bitcoin has a long way to go to be considered an even moderately efficient currency for the World. This leaves Bitcoin currently stalled, partially behind technology before it has even reached the majority of the world.

The future odds of Bitcoin becoming the 1 cryptocurrency is shrinking, others like LTC (Litecoin) and BCH (BitcoinCash) are simply more efficient, cheaper to use and move much faster. Bitcoin will always have it nostalgic value of being the one, the Gold standard, no more nor less will ever be made and it was the revolutionary beginning of a new movement.

Issue 2: Electrical usage and potential impact on the planet.

Mining is an essential part of confirmations to the blockchain and the ledgers security. Mining takes massive amounts of electricity from high end graphics cards to effectively resolve blocks. The Independent stated that "Bitcoin will use 0.5% of the Worlds electricity by the end of 2018". Bitcoin already consumes more electricity than some small countries and yet hasn't even reaches 5% of it's potential usage. This impact can be huge on electricity prices, demand and in turn the damage to the planet.

Issue 3: Social structures and outlook changes

For a long time I was pro Bitcoin (I still want to be) but a Netflix programme called Mr robot got me thinking, in the programme he changes the world and gives the power to the people only to find that people would destroy everything and do nothing. Giving poor people riches is like giving a baby a gun, maybe not so dangerous but the concept of giving wealth and freedom to people who don't know what to do with it is pointless. It encourages degeneracy, the majority of norms that do jobs only because they have too would simply quite, thus structures falling and then making more issues than where you started. The bitcoin concept in this manner (giving the power to the people) is a small issue, the majority of people do what they have to, not what they want to in life, this is actually a good thing. People who don't know what they want generally do nothing, they have no dreams so they work for people who do have dreams, this then holds a structure of wealth within western civilisation that dreamers and creators get more, lazy non-dreamers have to work for a paycheck. All this would be mixed if Bitcoins reached huge prices, supermarkets wouldn't have employees, they would be holidaying in the Bahamas with zero value or purpose to anything.

Issue 4: Pricing with rising popularity

Something rarely considered even amongst experts is the general wave of buying into bitcoin. As more buy the prices rise, meaning the later you buy the less % of a singular coin you will get or you have to pay more. This will discourage many the majority to get onboard and the majority is the goal. The problem with the majority is they do what they have too, which means if they are the last onboard they will still be the poorest.

I have spoken to many people, relatives, colleagues and all struggle to even understand the basic structure of satoshi, how 100,000,000 satoshi is 1 Bitcoin. No different than 100 cents to 1 dollar only a scaling difference. Which means you don't need to buy a full coin, no different that 100 dollar bill. If bitcoin is $10,000 you can buy 10,000,000 satoshi for $1,000. The face value is all newcomers will see which makes it even harder for bitcoin to rise as it rises. That may sound silly but I have seen this first hand and seen many people turn away from beginning because of that initial understanding of size and cost.

Believe in better, believe in Bitcoin?

So maybe there is a few more downsides than up, however the upsides to bitcoin and it's long-term goal/vision as the "idea" is fare stronger than the down. Bitcoin as a whole is a phenomenal idea that should revolutionise the entire world. It's not a matter of if but a matter of when we see a cryptocurrency like bitcoin become a world scale payment system.

Still want to know more about bitcoin? Visit https://bitcoin.org