Why Was Liberty Reserve Shut Down: How Anonymous Money Transfer Systems Are Exploited By Terrorists and Criminals

Introduction

Liberty Reserve was a digital currency service based in Costa Rica that claimed to be the oldest, safest, and most popular payment processor in the world. It is that, but its relatively anonymous nature made it untenable in the modern age of terrorism and criminalism, when money are laundered on the Internet. However, even so, its abrupt shutdown in late May 2013 was a surprise to many, when at first the domain resolved to "site unreachable", then became "domain was seized" 3 days later. Then the full indictment was made public.

In this article, we will discuss what is Liberty Reserve, how it enabled both legitimate eCommerce as well as money laundering by criminals, and why it must be shut down. And finally, we will discuss some possible alternatives.

A Short History of Liberty Reserve

Liberty Reserve, ran out of Costa Rica, is actually NOT a single company, but a series of shell companies owned or operated by Arthur Budovsky Belanchuk, specifically organized to confuse and obstruct investigations into possible money laundering. It primarily operated out of multiple offices in cities of Santa Ana and Escazu Costra Rica, though Budovsky was in the process of moving operations to Europe when he was arrested in Spain in May of 2013.

Liberty Reserve started in 2002 in New York, alongside a company called "Gold Age". Both were started by Bukovsky and Vladimir Kats. Gold Age, ran out of their Brooklyn apartment, was shut down in July 2006 for "transmittal of money without a license", a state level felony. Gold Age functioned as a local "exchanger" for e-Gold, then a popular eCurrency. During its life, Gold Age have moved over $30 million dollars with little or no record keeping. Budovsky and Kats was sentenced to 5 years probation.

It was before the end of Gold Age that Liberty Reserve truly came to life. Apparently aware that they were under investigation, Bukovsky started looking for ways to get out of US legislation, and he settled on Costa Rica, which does NOT have an extradition treaty with the United States.

Budovsky moved Liberty Reserve to Costa Rica in May 2006, 2 months before an indictment was handed down against Gold Age, and proceed to copy e-Gold, as well as enroll a network of exchangers (much like Gold Age was an exchanger of e-Gold) around the world. On the website, it claimed that the company was purchased by Amed Menkovar. However, no such name appeared in the official corporation documents. Instead, this appears to be an alias used by Ahmed Yassine, a naturalized Costa citizen who got his citizenship through a married to a local girl.

Budovksy legally married a Costa Rican woman in 2008 and became renounced his US citizenship in 2011, becoming a full Costa Rican citizen. However, an article published by TicoTimes claimed that Costa Rican authorities have no record of Budovsky arriving in Costa Rica prior to May 2011. Sources told "The Guardian" UK news that the woman is a street vendor and was paid $800 for her services and was promised a divorce in 2 years (which has long expired).

Liberty Reserve is a virtually untraceable system. The only thing you need to open an account is an email address. While you are supposed to type in a name and a birthday as part of registration, no confirmation was needed. Furthermore, you cannot send money to Liberty Reserve directly, but instead, you must deal with one of the local exchanges, which functions as effective "deaddrop" or "proxy" and stopping the financial trail. Liberty Reserve even added an anonymous transaction option where for 75 cents per transaction you can make the transaction completely anonymous. Not even Liberty Reserve itself knows who you sent the money to, so it claimed.

Liberty Reserve effectively created its own currency called the LR. Local exchangers buy LR in bulk at a fixed rate, then resell it to locals who need to transmit money through Liberty Reserve. All transactions are non-reversible. This both made it virtually fraudproof, and anonymous enough to be the favorite payment method of cybercriminals that operate across multiple nations.

Costa Rican authorities have been keeping an eye on Liberty Reserve for a while. SUGEF, the local financial authority, notified Liberty Reserve that it needs to be licensed to continue operating, in 2009. Liberty Reserve then applied for such a license, but was turned down by SUGEF as it has absolutely no anti-money-laundering measures in place.

Instead of changing its business practices to comply, it was revealed in the 2013 indictment that the Budovsky and his partners sought to deceive the Costa Rican authorities by creating a false monitoring portal for SUGEF investigators where no possibly incriminating evidence will show instead of all the data that a monitoring portal is supposed to reveal.

Apparently SUGEF knows it is being tricked, it had formally denied Liberty Reserve an operating license in 2011. SUGEF has also cooperated with US investigators since 2011. US investigators have caught onto Liberty Reserve's utility for criminals.

Budovsky was tipped off by a warning from US Department of Treasury FinCEN notice to various financial institutions that they should not deal with Liberty Reserve in 2011 as Liberty Reserve is probably being used for money laundering. Two weeks after the notice, Budovsky announced that Liberty Reserve is being sold to a foreign buyer, and will be moving out of the country, fired all of his employees, then created 5 shell corporations to obfuscate the paper trail, and continued to run Liberty Reserve through those shell companies with a skeleton crew. He also moved various bank accounts from Costa Rican to various countries including Panama, Morocco, Cyprus, Australia, Hong Kong, Spain, and China, and was may be in the process of moving its internet operations to Europe, when he was arrested in Spain, returning from Morocco.

Illegal Uses of Liberty Reserve

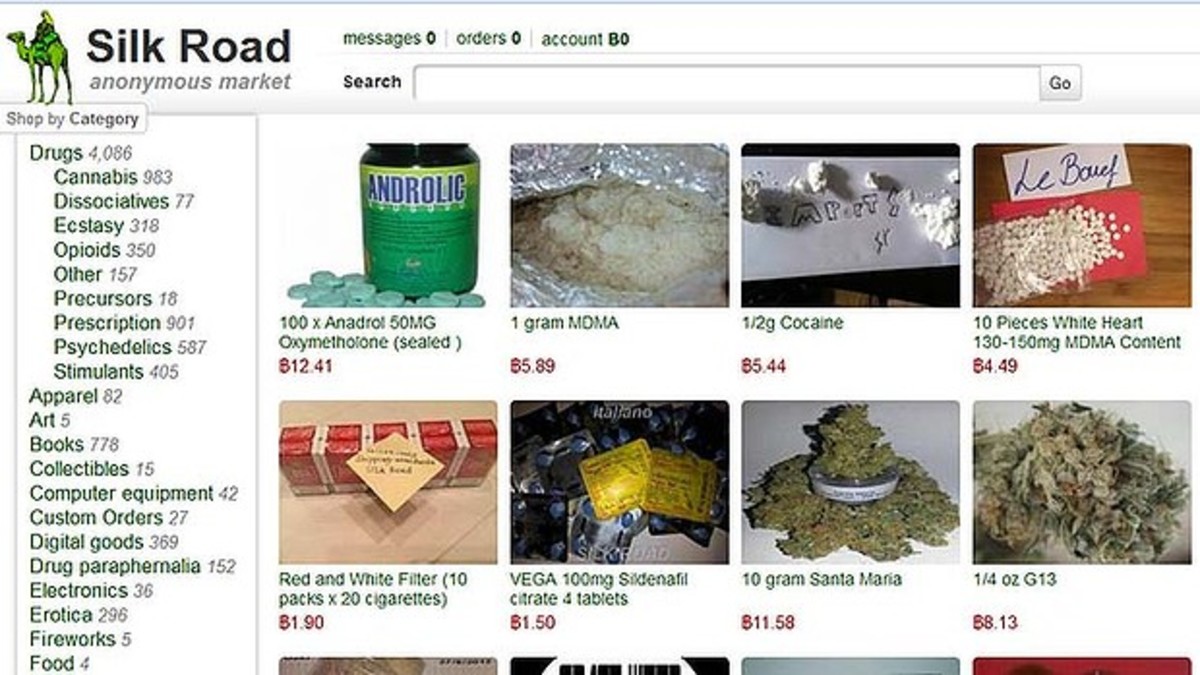

The anonymous nature of a Liberty Reserve account lead it to be extremely popular among the "underbelly" of the Internet, where cybercriminals roam. Some examples from the May 2013 indictment:

- LR was used by hackers to sell hacking software and exploits to steal identity

- LR was used by hackers to sell stolen credit card numbers on the black market

- LR was used by hackers themselves to market themselves out as mercenaries

- LR was used by criminals to send/launder money stolen through the $45 million ATM hack/heist earlier, and by other similar criminal rings around the world

- LR was used by HYIPs, basically Internet micro Ponzi schemes

- LR was used by Internet get-rick-quick schemes to get payment

- LR was used by underground drug pushers to get payment

Furthermore

- LR can be used by Internet child porn purveyors to peddle their "wares"

- LR can be used by terrorists to move money to support terrorism activities

Indeed, one chat between Kats and others indicate that they are well aware that US DOJ (department of justice) knows exactly that Liberty Reserve is heavily favored by criminals.

All the criminals need is an email address to ascertain the LRs in his/her account is there, then they can go to any local exchange, prove their possession of the account, and exchange their LR for local currency. The local exchanges will often fund exchange from LR to a more readily acceptable form such as PayPal, preloaded debit cards, Western Union money orders, or local currency, all for a fee of course. Such transactions are virtually untraceable as they move through multiple cutouts (both at Liberty Reserve and at the local exchanges).

Liberty Reserve had processed 55 million transactions during its lifetime, to the tune of 6 BILLION dollars, according to the May 2013 indictment. At the standard rate of 1 percent transaction fee that's at least sixty million in the pocket of Budovsky and leaders, not counting any other sort of fees.

Legitimate Uses of Liberty Reserve

There are some legitimate uses for Liberty Reserve, and those normal businesses are feeling the hurt.

For example, ePayTarjeta / ePay Cards is a business that allows bankless individuals and/or foreign nationals to obtain a virtual debit card by funding it through Liberty Reserve. As almost all online merchants require a credit card or debit card, this allows these bankless individuals to purchase goods that may not otherwise be available.

Other merchants lauded Liberty Reserve for their non-reversible transaction policy, as they don't have to worry about fraudulent reversal of charges, known as "false chargeback", a problem often encountered by Paypal and credit card merchants.

Such merchants are now wondering what is going on with their money.

Have You Used Liberty Reserve?

Why Liberty Reserve Must Die

Why Liberty Reserve?

Because it is the largest, and it is the most visible of all the various "almost anonymous" payment processing companies around the world.

Why must these almost-anonymous payment processing companies need to go?

Because they are used to launder money for nefarious purposes, from drug and human trafficking to terrorism, and all the other illegal activities such as hacking, drugs, stolen information, and more that can be found on the Internet.

We have previously highlighted the various ways Liberty Reserve was used by criminals to move money around for the underworld trade, including moving some of the money in that giant ATM hacker/heist around the world only a few months ago.

It is not inconceivable that Liberty Reserve or something like it can be used to move money to fund terrorism. A report by European Union's MONEYVAL task force on cybercrime (7MB PDF) reported that:

... It (this report) sets outs a number of findings as regards cybercrime and money laundering and of available countermeasures and good practices, which could inspire policy makers and regulators or become elements of more systematic future approaches and strategies that are aimed at the prevention of money laundering and the financing of terrorism, and at the search, seizure and confiscation of proceeds of crime on the Internet.

Terrorists have become increasingly sophisticated in their money laundering. A report by CTC on the Haqqani Network states that:

The Haqqani network is widely recognized as a semi-autonomous component of the Taliban and as the deadliest and most globally focused faction of that latter group. What receives far less attention is the fact that the Haqqani network also appears to be the most sophisticated and diversified from a financial standpoint. In addition to raising funds from ideologically like-minded donors, an activity the Haqqanis have engaged in since the 1980s, information collected for this report indicates that over the past three decades they have penetrated key business sectors, including import-export, transport, real estate and construction in Afghanistan, Pakistan, the Arab Gulf and beyond. The Haqqani network also appears to operate its own front companies, many of which seem to be directed at laundering illicit proceeds.

And some of the recommendation by the MONEYVAL taskforce above is excepted below:

- Internet money services providers, together with the “traditional” banking system are used both for cyber fraud and money laundering. Money remitting services or Internet payment services providers have been targets and/or victims of cyber-attacks, but also, their services have been used for money laundering purposes. Some Internet based payment methods are more vulnerable to money laundering than others.

- Cybercriminals prefer to transfer values between persons in different countries by bits and bytes of information rather than in the form of banknotes. Cash smuggling is reportedly rarely (next to never) used or might have remained undetected by existing controls. Money mules appear to be mostly used for “breaking the chain” rather than for cross-border movement of cash.

- Proper rules and regulations in the AML/CFT (anti-money laundering / counter financing of terrorism) field with regards to Internet-based payment systems are not always in place. Targeted legal provisions requiring all Internet based payment services providers to implement AML/CFT procedures in terms of KYC (know your customer), CDD (customer due diligence) and reporting obligations, will decrease the ML (money laundering) risks associated to this particular industry

Those with a good memory and/or work in the financial market may recall 20 years ago, a company called BCCI, which was also closed as it was alleged to be created solely for the purpose of circumventing anti-money-laundering legislations by having a web of contacts around the world.

And let us not forget Liberty Reserve's predecessor, e-Gold, whose principals plead guilty to money-laundering in 2008 and completely reformed the company.

Liberty Reserve was given many chances to come clean and implement anti-money laundering measures. It chose to defraud investigators instead. Therefore it has nobody to blame but itself for its demise.

The legitimate merchants are merely collateral damage.

It is likely that after the bank accounts are properly seized and consolidated and claims filed and tabulated, refunds can be issued, but it will be a multi-year process.

What About Bitcoin?

Can Bitcoin exchanges serve as alternative to Liberty Reserve? The answer is "sort of". They need to comply with KYC (know your customer) guidelines and establish a properly audit trail should investigators demand it.

Mt. Gox, based in Japan, had its US account at Dwolla (mobile payment) seized by Department of Homeland Security in May 2013. Mt. Gox was NOT shutdown. It merely lost its money in the US held by Dwolla for exchanging Bitcoins. It can register as a money transmitter with US Department of Treasury's FinCEN group, making itself legal, and it will probably get its money back. However, no bank will likely let them open another account until this is resolved, effectively keeping them out of the US as they can't accept payments for bitcoins.

The "chilling effect" on the other exchangers of Bitcoin around the world is pretty obvious: Bitcoin EXCHANGERS are still subject to anti-money-laundering laws, even though Bitcoin itself may be transmitted anonymously.

Alternatives

Payment solutions are quite numerous on the Internet. However, with Liberty Reserve gone, the more legitimate companies will tighten up on the KYC (know your customer) provisions, which often means you will have to provide some sort of ID or bank account linkage to prove your bonafides, if they haven't already.

The strictest of all the payment processors is PayPal, also the best known. It has very strict KYC policy, mainly because it is a bank, licensed in multiple US states and multiple countries around the world. It also has strict policies against shady and/or questionable companies.

Two others that are well-known but less restrictive than PayPal are Solid Trust Pay (also known as STPay) and Payza (formerly known as AlertPay).

Bitcoin is a possible substitute but it has its own issues that's discussed to the right sidebar.

There are many other smaller players around the world, but the aforementioned three are the largest and are therefore most likely to stay legal and open.

Conclusion

The death of Liberty Reserve is inevitable. It made moving money too easy and almost untraceable. In the modern age of terrorism and money laundering through cyberspace, it cannot be allowed to survive.

More On Internet, Tech, and Scams

- Research company DIY Wazzub, Perfect Internet, GIT G...

How do you research income opportunities on the Internet? Watch me research Wazzub.com (and Wazzub.info) and determine is the company reputable or not, and whether you will see any money. - Investigating Rippln, what does Rippln do? Who is be...

Rippln came onto the Internet scene with a bunch of pretty sleek videos promising to give money back to the people. Is it for real and who is behind it? Just the facts, no hype. - How Pyramid Schemes and Ponzi Schemes are Prosecuted...

Do you know who to complain to when you are a victim of Ponzi scheme or pyramid scheme? Do you know what agencies go after them? Do you know how they do so? Find out here. - The Fake Social Proof, When Scams Review Scams and D...

You can't trust reviews online, as they are often faked. However, scammers have gone even further, creating fake social proof for their scams. Learn how not to fall for such.