No Merger Between Delta and Northwest Thank Goodness

More Airline Industry News Hits the Top News

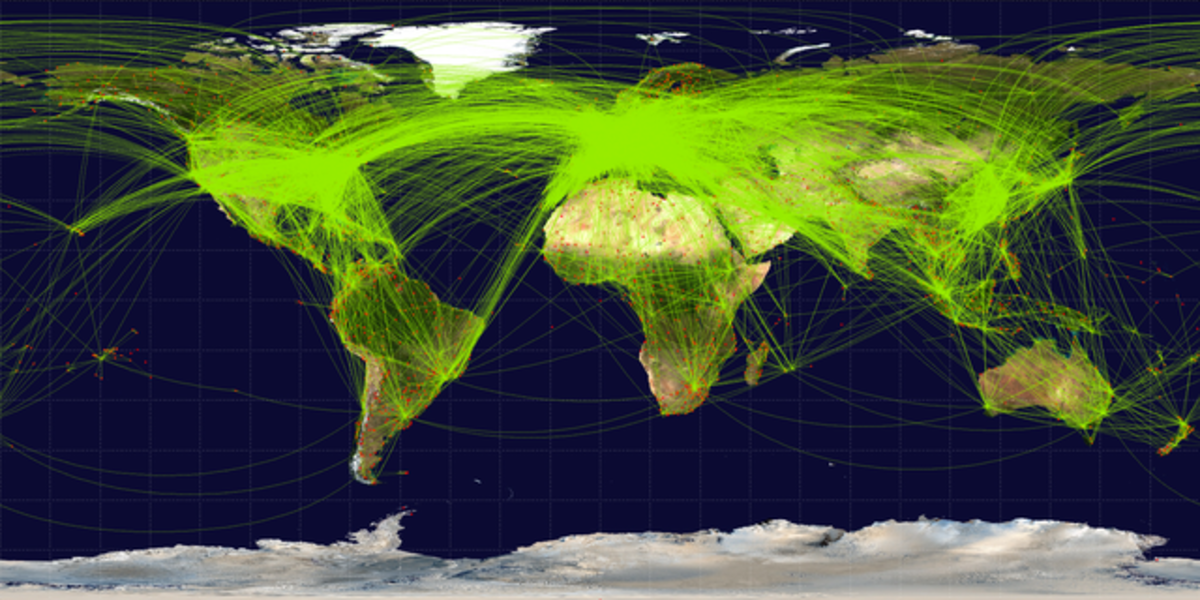

Monday, April 14, Delta and Northwest announced that they have plans to merge creating the world's largest carrier. This is a 17.7 billion dollar deal, which will make the new "Delta" a mega-airline, with $35 billion in revenue, and 75,000 employees. It would now have close to 800 planes servicing more than 390 destinations in 67 counties across the world.

The headquarters will remain in Atlanta, but major hubs will be found across the globe, including Asia and Europe. The change will not create any hub closures or be the cause of any immediate lay offs for front-line employees.

The merger itself will have to meet with federal regulatory approval before it becomes a reality, but is seen to be quite promising, due to the pending economic conditions. The company officials hope to finalize the deal before the end of the year.

Why the Merger?

The merger is simply a logical answer to the problems caused by economic instability. The reason stems from the age old adage, "united we stand, divided we fall." Both of these companies have just emerged from Chapter 11 bankruptcy just last year.

"We believe that consolidation in the airline industry is inevitable, and we want to control our future," Delta Chief Executive Richard Anderson said in a memo to employees. "Combining our companies creates an airline with the size, scale and global presence to weather economic downturns and compete long-term in the global marketplace."

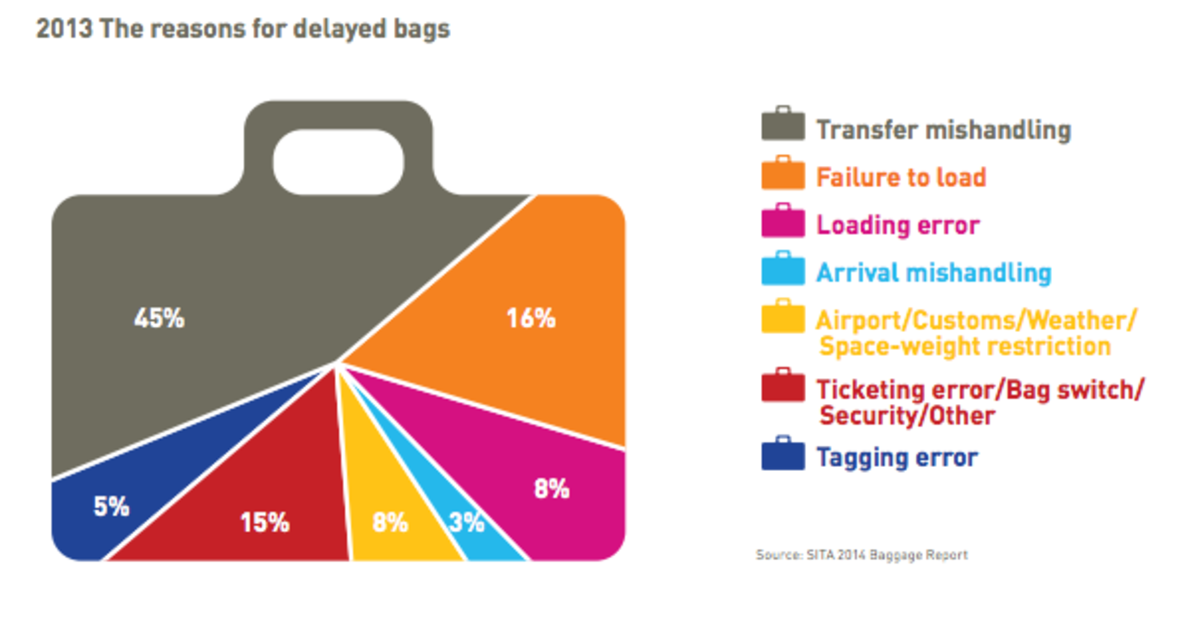

Four other discount carriers have declared bankruptcy or shut down in the last four weeks alone. Fuel has reached a high of $110 a barrel causing the cost of flying to increase drastically. The combination of these two carries into one will give them an added competitive edge in the international market place, making it a dominating force to contend with. Delta has always held a strong position in South and Central America, while Northwest has strength in Asia and Japan, together they will be felt in strength throughout the world,

What will this merger mean to other airlines?

Depending on the success of this innovative deal, other airlines may be quick to follow suit with similar mergers. An ever larger possibility is a merger between United and Continental airlines. These rumored changes may prompt regulators to keep a closer watch on what is actually happening in the industry. The U. S. Department of Justice antitrust regulators will be scrutinizing the deal closely, while some politicians may even oppose the possibility, foreseeing a potential harm to consumers and airline employees alike. These types of mergers could bring capacity cuts to the flights and higher fares for customers as the competition will be less, in terms of the amount of bidders in the ring.

As of now big companies like AirTran see it as a potential to become more competitive in the market and not less. AirTran Airways made a statement that they feel it is a positive move in the industry

Who will possibly lose by this merger?

As of now the biggest opposition to the deal is coming from the pilots themselves. Up for discussion are many issues some of which are, their existing pension plans, job seniority, and equity they have in company stock shares. Both Northwest and Delta pilots and their supporting unions are not seen to favor the merger, but have been working on resolving these issues for the last several months.

A Delta representative made a statement that the new airline would "provide employees with greater job security, an equity stake in the combined airline, and a more stable platform for future growth in the face of significant economic pressures from rising fuel costs and intense competition."

As for the consumer....

I wonder how this will ultimately affect the prices of our airline tickets, and the ability to find a competitive market place? What do you think?