Basic Forex Tips for Everyone

Basic Forex Tips

Here are a few basic Forex Tips to help you get started in Trading the markets. Most of these tips or tricks have been accumulated over the years of trading forex and continuously learning. Investing is a continually learning profession and you must always able to learn new things. Otherwise, when you stop learning, you will stop earning.

There is so much information now that it can be very overwhelming. Specially if you try to tune into all the hype that surrounds these markets. It's best to hone in on only a few key elements and then make them work for you.

Through some very tough trial and error, here are a few pointers that hopefully can save you some costly mistakes!

Let's move onto Tip #1

- Candle Stick Basics

Learn how to read Candle Stick Charts. This hub will go over some basic principals to help you become a much better trader.

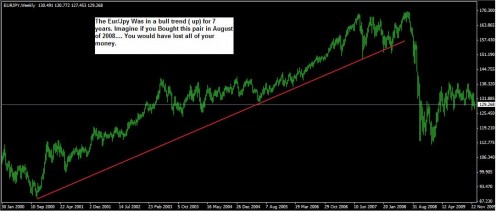

The Trend is your Friend, or is it?

What makes us get into a trade? What is our confirmation?

I hear the saying " The Trend is your Friend" way to much! Every time I got in with the trend I ended up losing. How was this possible? Confirmations. They forgot to mention that part. If the currency pair is trending down, you can't just sell the pair anytime and expect to profit.

You must wait for a trade confirmation to happen. eg. the pair has to bounce off its moving avg., or the pair must hit significant resistance or support. There are things that must happen before you enter that trade.

So be very careful if you just want to follow the trend. You need to get in at the right moment to make a profit.

Another part of the " Trend is your friend " they forget to mention with clarity is the time frame. If you click on the EUR/USD daily chart, you will see it going up, but yet on the 4 hour chart, its going down, and on the 30 minute chart its going up. how do you know which trend to follow?

This part is crucial. You must know what kind of trader you are. Are you looking to get in and out within a few minutes? Hours? Days? Weeks? Months? Short term trends change quickly and are less reliable. Long term trends are slow in developing which in turn give more reliable signals. It also depends on how much margin ( trading capital) you have.Can you handle the pair going the wrong way ? For how long?

You should ask yourself all these questions before you follow some vague forex investment advice. The trend is your friend. Or is it?

Be careful trading the trend. Learn what time frame you prefer to trade. I like 5 min- 1 hour charts. I prefer to get in and out within 1 day or less. Wait for your confirmation. Your signal that will help you get in. Read my hubs on candle sticks to learn when to get in.

You should never risk more then 5% of your account. This is easy to say, difficult to do, and continue to do everyday. The more you watch the market, the more you want to get in. This will allow you to have room to make bad trades and not worry about taking the loss.

Books every Forex Trader should have

Trade 2 instead of 1

This principal is easy to grasp, and can greatly increase your winnings. Remember never risk more then 5% of your account.

Trade 2 lots instead of 1. This way once you have a good profit, have a bad gut feeling, or see a reversal confirmation, you can close 1 lot. Keep one lot open. Now move/create the stop loss at break even.

Example:

You are profiting $200 on 2 lots. Close 1 lot. You will Keep $100. Set a stop loss at break even. This will allow the other lot to go up or down and you cant lose any money. You are guaranteed that $100

Don't Add When You Should Subtract

When you are in a profitable trade and you see your winnings increasing quick. It can be very easy to see profit and want more, so you add more positions. This is the worst thing you could do.

I remember one morning I was learning to trade the news. It was the first Friday of the month. On that Monday I invested $100. By Friday I had about $250. I was so excited and emotional that I was making so much profit! I went short on the GBP/USD as soon as the news came out. The pair dropped like a rock. I was profiting about $70 within 2 minutes from 1 lot. So I added another position. I was then profiting about $150. And this pair just kept dropping so added another position and another and another. I went on like this more about 10 minutes. My profits were up over $600. I took a look at the bigger trend and the overall trend was down so I thought this was a great trade.

About 30 minutes after I placed the first trade I was up over $1,200 from these trades on the GBP/USD pair. So, now that I had all this new margin, I shorted another 4-5 lots at once. So now I was into this trade about 10 lots, with about $1,200 in margin. The pair consolidated for a few minutes. Then like a sling shot, it retraced its entire downward movement within 5 minutes. Shot up like a rocket! I was so horrified I couldn't even close my trades or click my mouse fast enough to salvage any profit. I lost my initial $100. Never mind the $1,200 I had in equity about 5 minutes ago.

I didn't trade a live forex account for the next 6 months, I was so horrified I didn't want to look at a chart for the rest of my life. But I knew that this market could be won eventually.

You should never be greedy! Don't add to a winning trade! Instead close small lots during your profit. Pocket as much money as you can when you can. If you see a profit, close your trade, Subtract lots from the trade, don't add. Always play it safe, and always close trades early then late. this way you will live to trade another day.

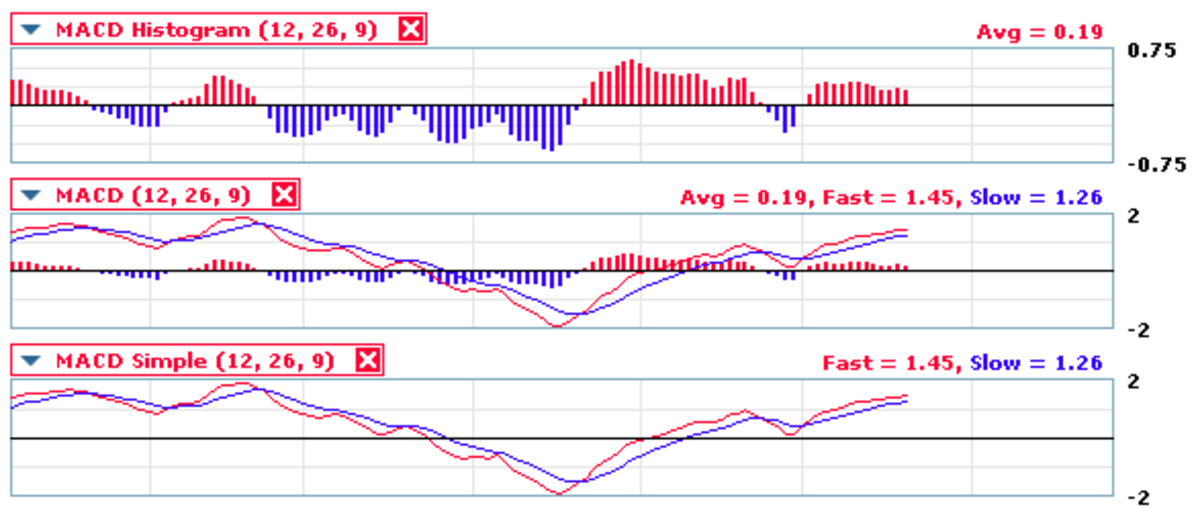

Too Many Forex Indicators

I will keep this one short.

Don't add too many indicators. Different indicators give off different signals. Eventually you will clutter your chart up so much you will barely be able to see the price! I know, I have done it, my friends have done it. And its NOT the way to trade!

Putting too many indicators on your chart and trying to read the signal is like putting 100 people in a room and asking them to yell the answer to you. You wont be able to understand what they said. Its too much noise going on. Just look at the picture.

You really only need 0-5 things on your chart. I can break this down really easy for you.

1 Price action. Just put your chart on candle sticks this will give you the best indication of the direction, and confirmations of reversal or continuation patterns.

2 General direction. Apply a moving average typically a 20, 50, or 100 period moving average. most people will use one of these or all three. your choice

3 Trend Strength. I use the Relative Strength Indicator ( RSI ) It helps you know if the trend is strong or weak.

4 Support and Resistance. Be sure to know where significant support or resistance is. Go to a larger time frame and mark the highest peak and the lowest low. This way you know where the currency pair should stay between.

For Every UniqueTrader there is a Unique Chart

Indicators are Personal

Most traders have tried 100's of indicators in their time. Maybe only a few work for them. It makes me laugh when I hear that a certain indicator doesn't work. You should not just trade becuase of an indicator.

Indicators are like Manual instructions. They tell you how to do something. So if you do it wrong that is your fault, not the indicator.

I remember I tried the Fibonacci scale for a while. I ended up losing terribly. I then realized that it wasn't the indicator giving my the wrong signals. I was trading the indicator wrong. It was my fault. I also realized that the Fibonacci inductors were not for me. They were not conducive to my trading style.

I am lazy, I don't want to keep drawing lines on my charts all the time. So I need indicators that fit my style. Like moving averages, stochastics, bollinger bands, and RSI. Those work fine for me. They don't clutter my charts, They tell me where the price is, its direction, its strength, and when I should trade it.

Most platforms give you certain basic indicators. It jsut so happens that those indicators are the same indicators on every trading platform. They are also the ones people use on stocks and mutual funds. Most of them have been around before you were born! Every one of these indicators I have tried WORK. You just have to know how to read and trade it.

If you make a losing trade by using an indicator, then you should re-learn what that indicator does and tells you.

use the RSI indicator to understand if the trend is strong. Don't buy becuase the RSi is going up, and don't sell because the RSI is going down. Learn what each indicator indicates. They each have their own purpose.