Deflation - What is It and Why are We Worried About It?

Monetary Deflation is Just Falling Prices

August 24, 2010

The word deflation is being used with increasing frequency these days when the discussion involves the economy or markets.

In addition, when the word deflation is used, there is an ominous ring to that instills a certain fear about our economic future.

However, monetary deflation is nothing more than falling prices and what is so bad about that? Retailers reduce prices and announce sales all the time and people flock to take advantage of the lower prices. Wal-Mart has grown and prospered by advertising its practice of continually cutting prices.

Deflation Defined

In economics deflation is nothing more than the reduction in the prices of goods and services. It is the economic opposite of inflation which refers to increases in the price of goods and services.

Just as we inflate a tire by pumping more air into it and deflate a tire by releasing air in it, governments can inflate the supply of money in the economy by adding more or deflate it by removing money from circulation in the economy.

What is the Problem With Deflation?

In a market economy we measure the value of goods and services by how much they cost in terms of money - dollars in the case of the United States.

When a person buys something they trade dollars for the good or service. Thus, if chicken is selling for $1 per pound a customer pays one dollar at the meat counter of a grocery store in exchange for one pound of chicken. The customer is, in effect, trading $1 worth of currency for one pound of chicken.

However, from the store’s point of view the store is trading one pound of chicken for one dollar’s worth of currency.

Price in a market is, of course, determined by supply and demand so, if the supply of chicken increases by 25% while the supply of dollars remains the same, then, barring any other changes, there will be more pounds of chicken available to trade for the same number of dollars which means that sellers will have to offer more chicken in order to get the same number of dollars as before.

Of course, from the consumers point of view, they can now buy more chicken for the same number or dollars or, buy the same amount of chicken as before but not pay as much. In effect, thanks to the increased supply of chicken, the consumer can now buy one pound of chicken for seventy-five cents. While, the store now has to give up one and one-quarter pounds of chicken in order to get a dollar’s worth of currency.

Just as changes in the supply of a product will result in an increase or decrease in prices when the supply of dollars remains unchanged, so too, will increases or decreases in the supply of dollars result in changes in price when the supply of goods remains the same.

When the supply of dollars increases with no corresponding increase in the supply of goods we have inflation. When the supply of dollars decreases with no corresponding decrease in the supply of goods we have deflation or falling prices.

Good Deflation vs Bad Deflation

For the past half century or more, inflation has been the major monetary problem in most of the world. With the exception of some, mostly debunked, Keynesian economic theories, true inflation is never good.

Deflation, however, can be either good or bad. In fact, a major reason why deflation is now being talked about and fears are being raised about it is due to the fact that it is only recently that the so called Bad Deflation has become a threat.

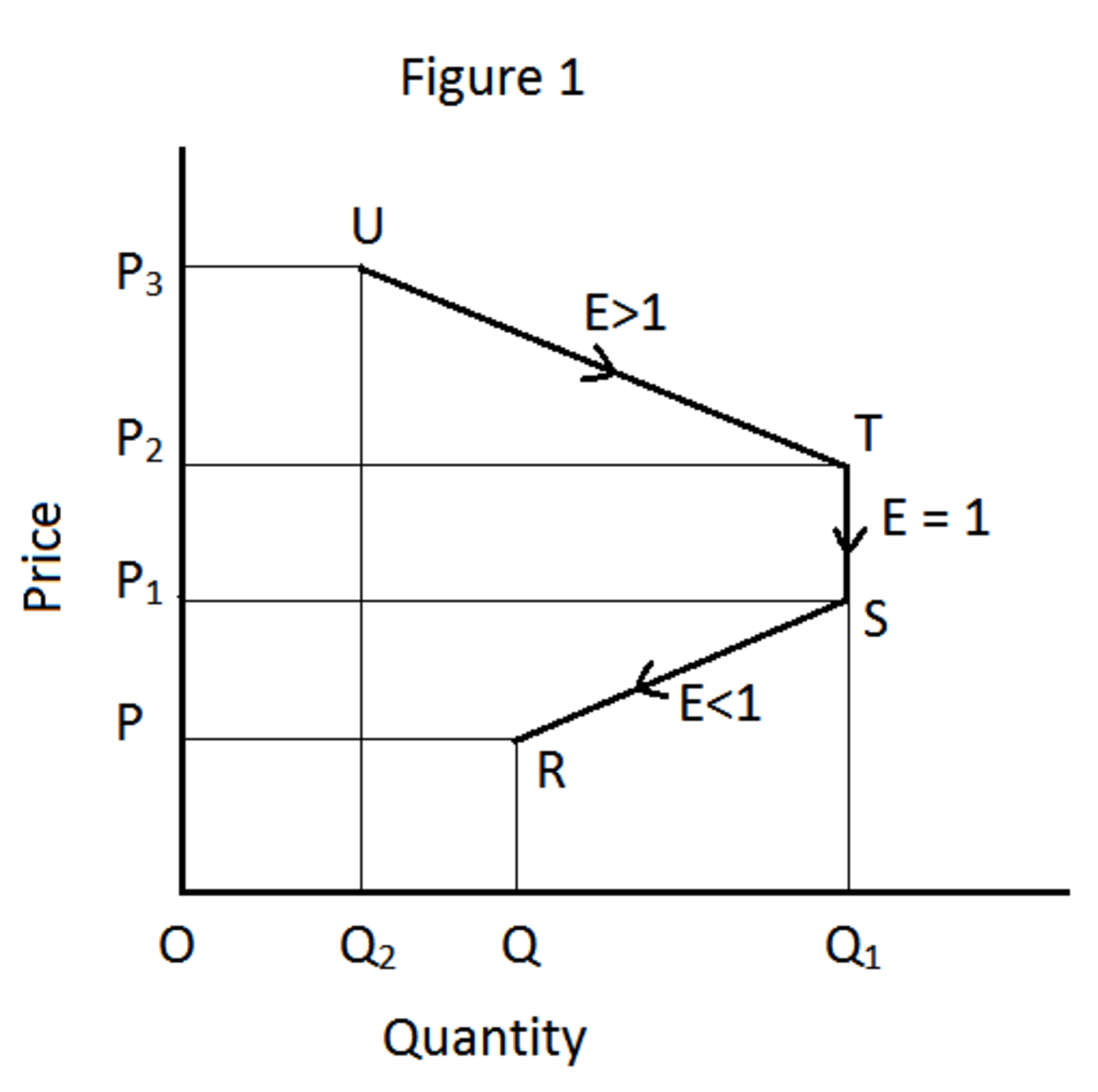

Falling prices are usually looked upon as a good thing, especially by consumers. There are a number of reasons why prices of specific goods may fall with the two major ones being an increase in the supply of that good or a decrease in demand for the good.

When demand for a good decreases it causes the price for that good to fall in the market. This falling price is a signal to producers and workers that the product is no longer desired by an increasing portion of the population and that they should move into the production of some other product that consumers want.

Increases in supply, like the increase in chicken in the example above, result in more of good being available and this results, in the absence of any other changes, in its price falling. Increases in supply are generally the result of one or two things. The first is access to an abundant new source of the good - a major oil discovery will cause the price of oil to fall or a flood of imports resulting from the cutting or eliminating import quotas and/or tariffs will also result in falling prices.

There is also increased productivity which results in producers being able to produce more with existing resources as the result of better processes and/or increased use of capital equipment or technology, any of which allow existing workers to produce more with the same or less effort.

In the last half of the nineteenth early years of the twentieth centuries, the United States experienced a considerable amount of deflation as manufacturers steadily drove down the prices of their products by extensive application of technology to the production process as well as continuous investment in capital equipment both of which served to increase the productivity of their workers.

Men like Andrew Carnegie, John D. Rockefeller, Henry Ford and others steadily increased the productivity of their workers through the use of technology and increased use of capital. While consumers benefited from steadily falling prices for the products produced by the companies run by these men, the cost savings from the increased use of technology and capital resulted in rising revenues for the companies.

The increased revenues resulted in not only rising profits for the companies led by these men - Carnegie, Rockefeller, Ford and many of their contemporaries amassed huge personal fortunes during their lifetimes - but also steadily rising wages and shorter work weeks for their employees. Consumers weren’t shortchanged either as not only did the pay less for the products produced by these companies, the quality improved as well.

We have seen the same thing in the last half of the twentieth century, especially in the areas computers and other electronic devices. Prices have steadily fallen and quality has risen just as steadily. The Blackberry cell phone in my pocket, which cost me less than $100, has more computing power (to say nothing of its use as a phone, camera, GPS device, radio, etc.) than the first office personal computer that my employer provided me with when these came out some 30 years ago - the PC was not only much bigger, could only do a fraction of the things my Blackberry is capable of and cost close to $3,000.

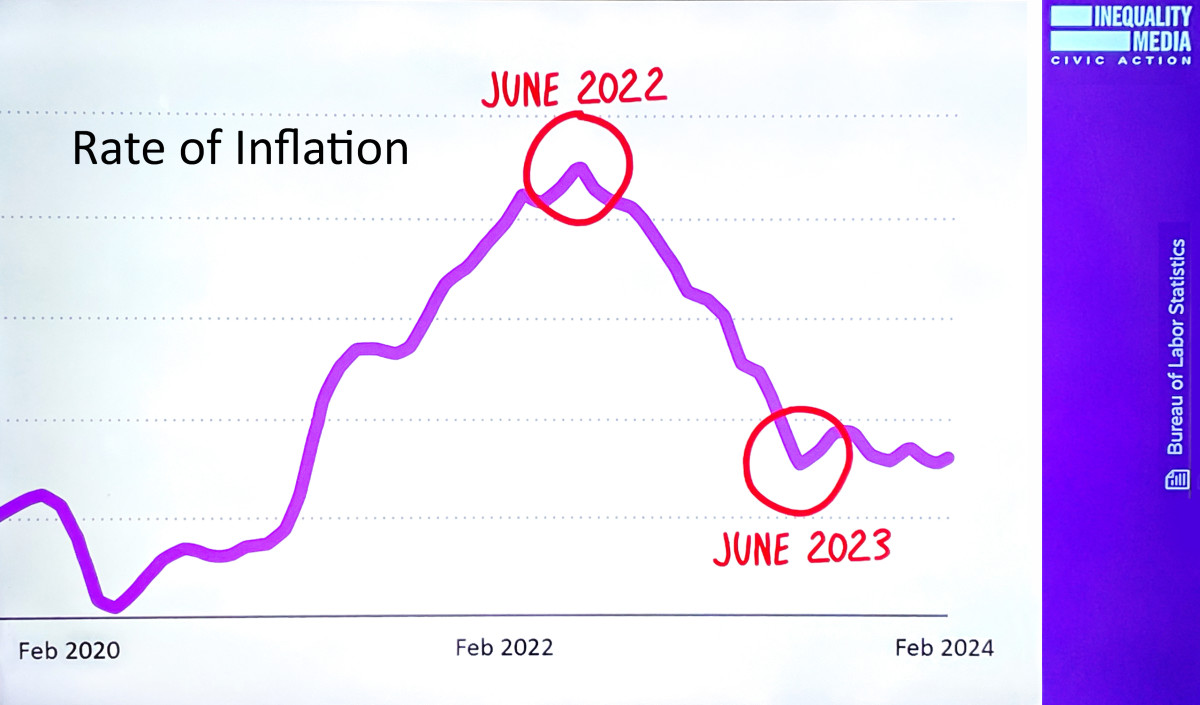

Deflation can also be good when, during run away periods of inflation, the government reverses its monetary policy and not only stops increasing the money supply but actively pursues policies designed to reduce the supply of money relative to the supply of goods and services. Policies put in place by the Administration of Ronald Reagan brought inflation in the United States down from 20% plus per year to less than 5% per year. This policy of disinflation or deflation was a great benefit to consumers and the economy as a whole.

Bad Deflation

Good or beneficial deflation is a supply side phenomenon in which increases in the supply of certain goods as a result of improved productivity and efficiency serve to increase the supply of and drive down the price of goods benefiting from increased productivity.

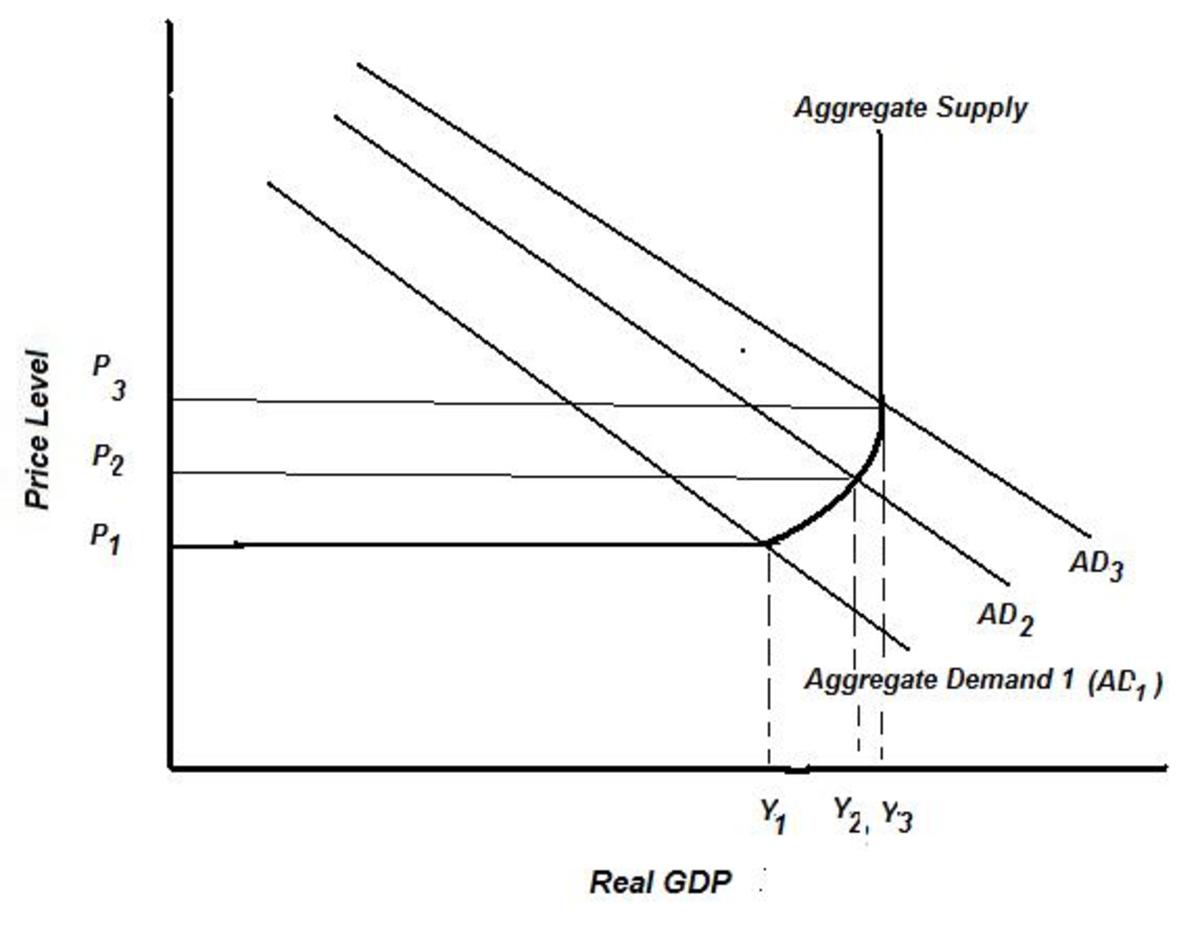

While an increase in supply can cause prices to fall so too can a decrease aggregate demand (overall demand for all goods in the economy) cause prices to fall. However, falling aggregate demand and the falling prices associated with it is not a good situation.

Falling aggregate demand means that peoples’ demand for all goods and services is declining. This is not a case of the population deciding to simplify their lives and consume less. Instead it is a case of fear and uncertainty driving people to hold cash as security against an uncertain future rather than spending it. And not only people, as businesses also elect to hold cash rather than investing in new plant and equipment and banks increasing their cash reserves by reducing lending.

The decrease in aggregate or overall demand causes businesses to reduce production and begin to lay off workers and idle plant and equipment. Laid off workers, of course, have their incomes cut off which causes them to restrict their consumption further. Also, adding to the decrease in demand is a decrease in buying and investing by businesses which, because of the slowdown in production, they don’t need to purchase as many raw materials and, with part of their plant and equipment sitting idle, have no incentive to invest in increasing the size of their plant and amount of equipment.

While existing workers still have their incomes but choose to spend and consume less, and accumulate cash, fearing they may need it in the event they are laid off.

Unlike prices falling due to new technology and processes that result in increased supply, falling prices resulting from a decrease in aggregate or overall demand, tend to feed on themselves. In addition to wanting to accumulate cash for financial security reasons, consumers, being rational, know that if they hold off buying something, its price will likely fall further giving them a better deal for their money. This, of course, further reduces demand and adds to the pressure pushing prices down.

On the investment side, some businesses that want or need to invest and expand, have the same hesitancy as consumers in that they believe that they will be able to get a lower price in the future.

However, others will look at the potential lost income from waiting and figure that will cancel out any savings from future reductions in price so they will try to buy now, but find that banks are unwilling to lend money for new plant and equipment. Bankers fear that the falling prices will result in the asset being worth less in the future than the value of the loan which it secures, which means that the bank stands to lose if the business should default on the loan leaving the bank with an asset whose sale won’t cover the outstanding loan.

Once it Starts Bad Deflation is Difficult to Overcome

This type of so called bad deflation is accompanied by fear and uncertainty and it feeds on this fear and uncertainty which makes it very difficult for an economy to turn around once this type of deflation sets in.