Liquidity Preference Theory of Interest

Introduction

Interest is the price paid for the use of capital. This is ‘net’ interest or pure interest. The word ‘interest’ is generally used to refer to the payment made for money. But we should remember that money is not capital as such. It is used to buy capital. In the past, interest was considered a bad thing. In fact, some religions prohibited taking of interest on money lent. But it is realized now, the rate of interest performs a useful economic function. It is an important weapon for regulating the economic activity in a country. In fact, there is a close connection between the level of employment, interest and money in a country. The volume of employment in a country can be influenced by changes in interest rates.

Gross Interest and Net Interest

Net interest is the price paid for the use of capital without any allowance for risk or any other factor. For example, the ‘interest’ we get on some government securities may be regarded as net interest. But generally, interest does not mean only net interest. It is something more than that. It is gross interest. Gross interest includes besides net interest, other things such as the reward for risk, remuneration for inconvenience and payment for services. For example, when a moneylender lends money to a farmer, usually he charges, high rate of interest because there is the risk of non-payment of the capital, let alone interest. There are trade risks and personal risks.

Further, lending money to others means inconvenience to the lender. It is generally advantageous for a person to keep ready cash on hand. When you lend money to someone, it means you cannot get it for some time. Not only that, you may not get it in the right time also. Just to compensate for the inconvenience, one must be paid some extra income. Further, a moneylender has to perform a number of things before you get money from him. He has to pay for services, keep accounts and all that. So gross interest includes all the above things besides net interest.

Difference in Rates of Interest

The rate of ‘pure interest’ or ‘net interest’ or ‘economic interest’ will remain the same so long as competition is perfect. But imperfect competition is the rule in the real world. Actual rates of interest change from country to country and from time to time.

In the first place, rate of interest depends on the type of security offered by the borrower. For example, government bonds usually carry a low rate of interest because when government borrows money from the public. People are sure of the security of money. But a money lender charges a high rate of interest when he lends money to a farmer because the latter cannot offer any good security against the loan. So the money lender charges a high rate of interest on account of the risk involved in it. secondly, the rate of interest changes according to the purpose for which the loan is taken. Loans advanced for purpose of consumption are generally charged a higher rate of interest than those borrowed for productive purposes. Thirdly, if there is no organized money market in a country, the rate of interest will differ from place to place. Fourthly, the rate of interest changes with the period for which the amount is borrowed. Usually long-term loans have to be paid a higher rate of interest than short-term loans. Lastly, the rate of interest changes with changes in trade. During a period of boom (good trade), the rate of interest is generally high and during depression (bad trade), the rate of interest is low.

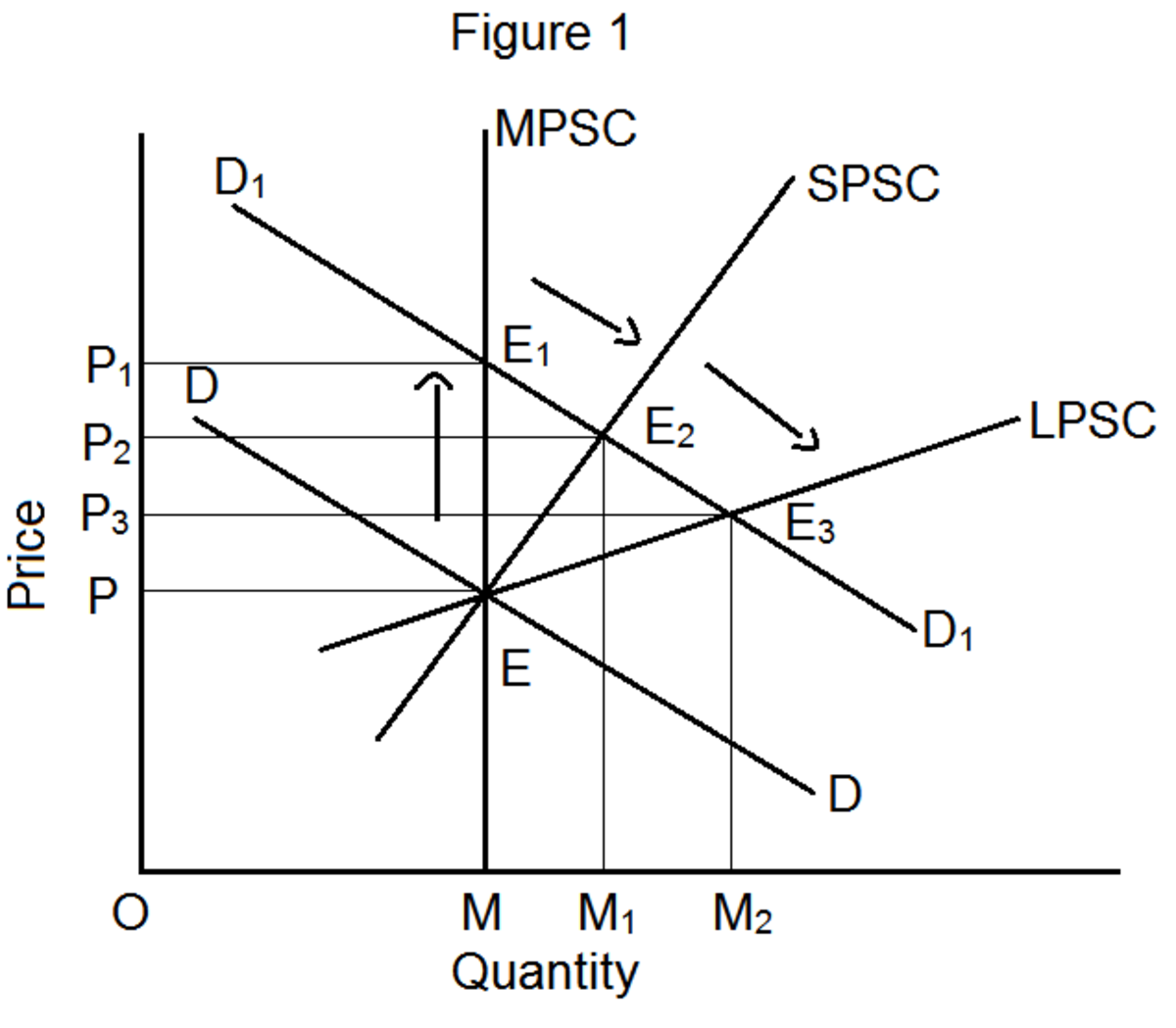

Liquidity Preference Theory of Interest

The Keynesian theory of interest is known as the liquidity preference theory of interest. It is the modern theory of interest. Interest is the price that has to be paid for borrowing money. People generally desire to hold their resources in the form of cash. In other words they want to hold it in liquid from, i.e., they prefer liquidity. They may prefer liquidity for business reason or for speculative purposes or as a measure of precaution. So if a man lends money, he is parting with his liquidity. It means inconvenience to the lender. So the borrower must pay something extra in addition to the sum borrowed. Interest is therefore, ‘the reward for parting with liquidity”. Liquidity preference, on the one hand, and quantity of money available on the other hand, determine the rate of interest.

Criticism

There is no doubt that the Keynesian theory looks at interest in a modern way. It is far superior to the older theories of interest. It is a general theory of interest. But some critics say that Keynes has over-emphasized the liquidity-preference factor in his theory of interest.

There are many other theories of interest. The most important of them are the supply and demand theory of interest, the abstinence or waiting theory, the time preference theory, and the marginal productivity theory.

The Supply and Demand Theory of Interest

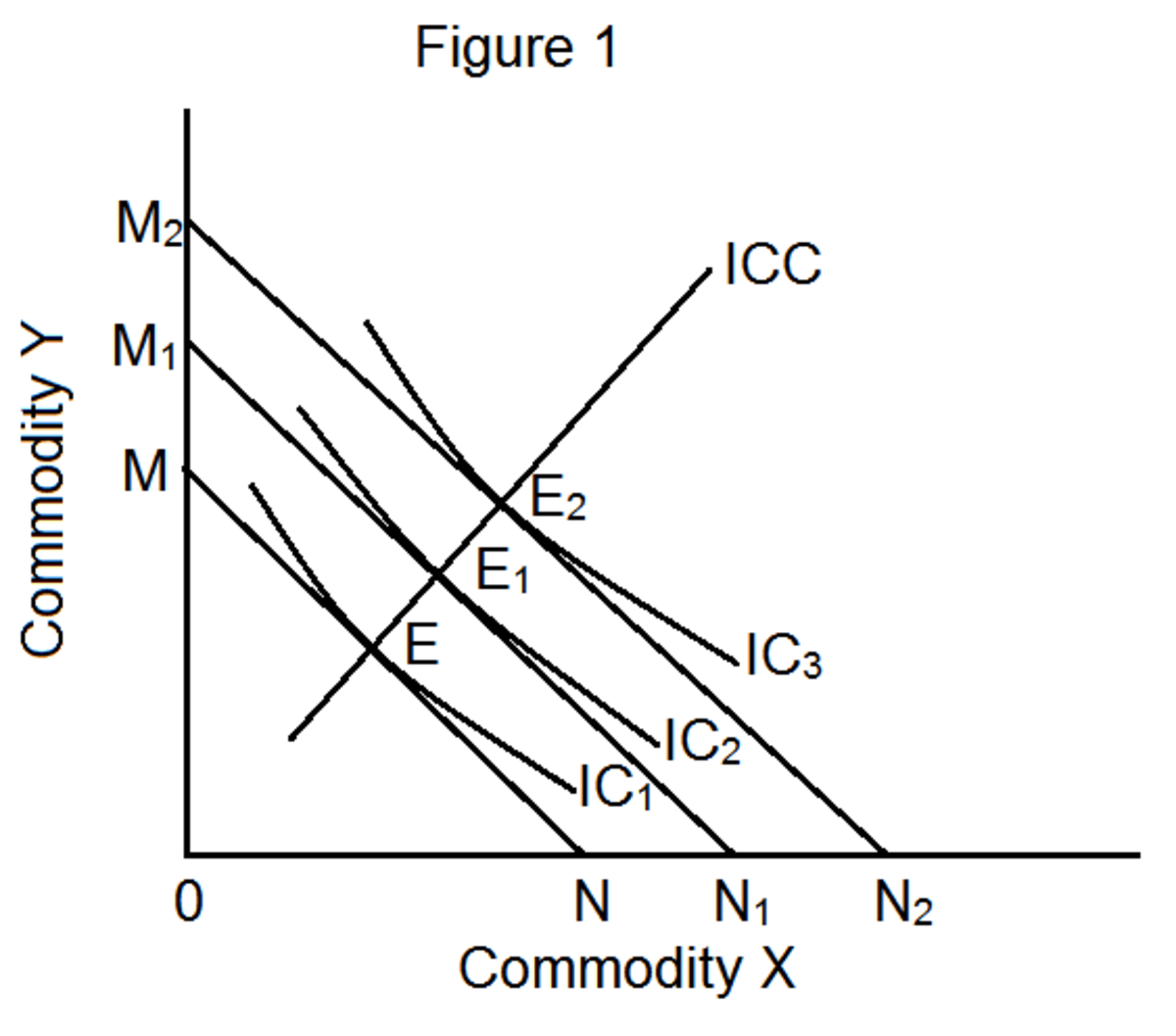

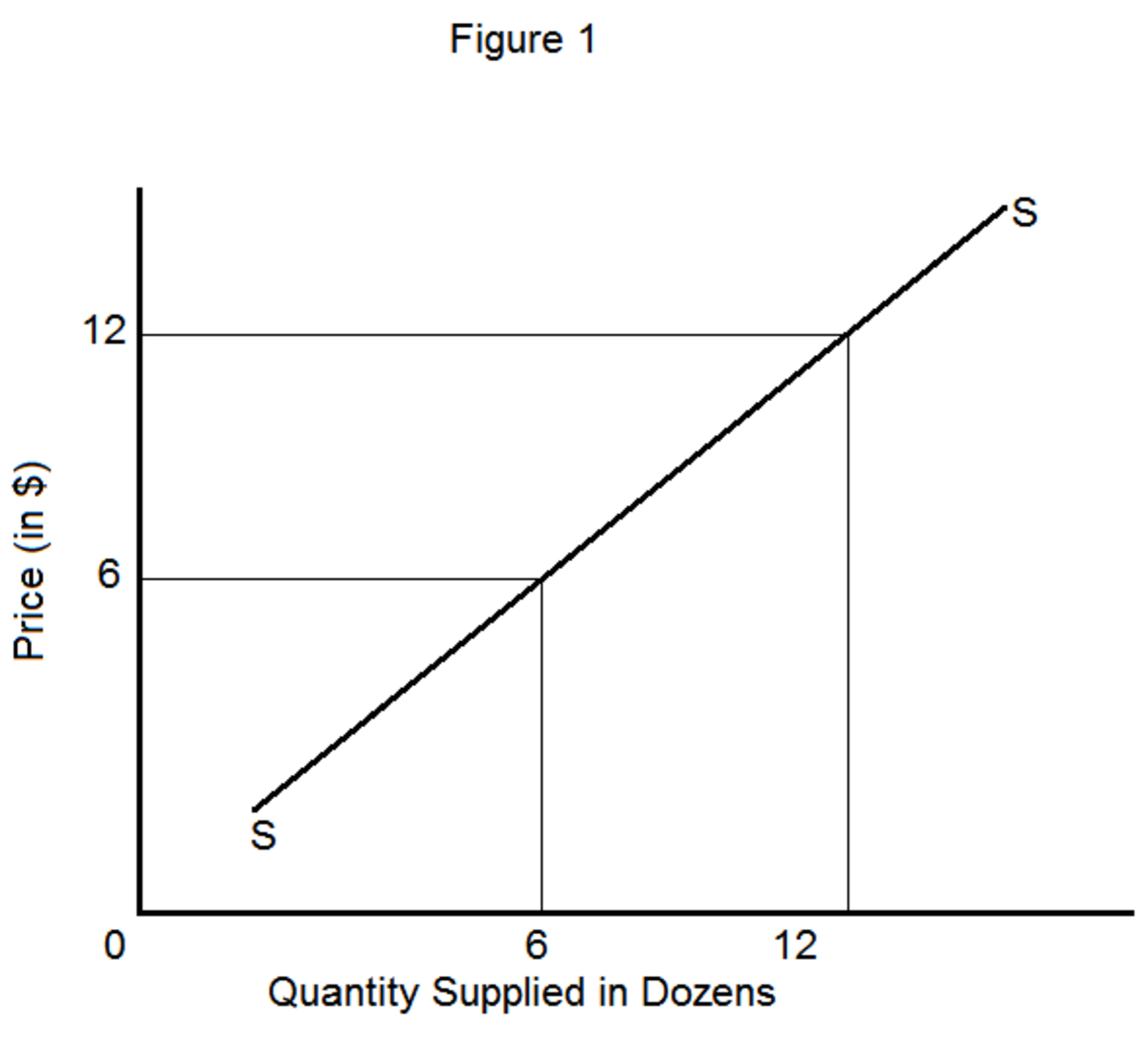

Interest is the price of capital. According to the supply and demand theory of interest, the rate of interest is determined by the supply of capital (or, loanable funds) and the demand for capital. The theory assumes that there is a direct relationship between the rate of interest, savings and investment. The supply of capital depends upon savings. Savings depend upon the incomes of the people and their willingness to save and lend. It was thought by the classical economists that saving and supply of capital would increase whenever the rate of interest went up. This, however, is not always the case. When we consider the supply of capital or loanable funds, we must also take into account the bank money.

There is demand for capital because capital is productive. So on the demand side, the rate of interest is proportional to the marginal productivity of capital. So long as the marginal productivity of capital is greater than the rate of interest, there will be demand for capital. When there is a fall in the rate of interest, normally, there will be an increase in the demand for capital for investment. Thus, the rate of interest is determined by the demand for capital and the supply of capital.

Criticism

Finally, the supply and demand theory, as given by the classical economists, is based on the unrealistic assumption of full employment. Secondly, the theory does not take into account the effect of investment on income and savings. When the rate of interest goes up, savings cannot always increase because investment falls. When investment falls, employment falls, incomes fall and savings decrease. Thirdly, besides the rate of interest, savings depend upon other factors such as the time-preference and liquidity preference. Lastly, the theory assumes that when there is a fall in the rate of interest, there will be an automatic increase in demand for capital for investment purposes. This, however, is not always the case. For during a period of depression, the rate of interest may be low. But it will not result in an increase in demand for capital because marginal efficiency of capital (expected rate of profits) will be low during such periods.

The Abstinence theory or Waiting theory

According to the abstinence theory, interest is the reward for abstaining from the immediate consumption of wealth. Savings are the source of capital. But saving involves sacrifice. When people save, they ‘abstain’ from present consumption. Such abstinence involves some suffering. Hence, in order to make people save, we must offer them something in return for their sacrifice. Interest, therefore, is the reward for abstinence.

Marshall has accepted the abstinence theory. But he has preferred the term ‘waiting’ for ‘abstinence’. According to him, interest is the reward for ‘waiting’. Saving involves waiting, and almost as a rule people do not like to wait. So, in order to make them save, we have to pay them some reward.

Criticism

The main criticism against the theory is that savings do not always involve suffering. Both the rich and the poor make savings. When a rich man saves, there is no suffering or ‘abstinence’ on his part. Further, it is a negative theory. It tells that we have to pay interest to those who do not spend away all their money. If a man saves and simply waits, he cannot get interest. Suppose a man saves a thousand dollars, puts it in a pot, digs a hole in the ground and buries the pot in the ground. And suppose he waits for one year, he cannot get any interest on that money. In other words, it does not take into account productivity as a factor in the determination of interest.

The Time-Preference Theory

According to this theory, ‘interest is the price of time’. The above statement needs some explanation. Generally, a man prefers present satisfaction to future satisfaction. It is considered that present goods are more valuable than future goods just as a bird in hand is worth two in the bush. So when people save, they have to postpone their enjoyment of goods. Since people generally do not like postponement of satisfaction, if you want them to postpone their present satisfaction, you have to pay them some compensation, and that compensation is interest. People consider present goods more valuable than future goods. And “interest measures the difference between the value of present and of future goods of like kind and like amount”. The time preference theory is also known as ‘Agio’ theory of interest. Since it is based on the psychology of people, sometimes, it is also called the psychological theory of interest.

Criticism

The main defect with the time preference theory is that it pays too much of attention to the supply side and ignores the influences acting on the side of demand.

The Marginal Productivity Theory

The marginal productivity theory of interest is nothing but the application of the general theory of distribution. According to the marginal productivity theory, interest arises because of the productivity of capital. Capital is borrowed generally for investment. A person will borrow capital so long as the productivity of capital is higher than the rate of interest. Because of the operation of the Law of Diminishing Returns at some stage or other, beyond a certain point, it will not be profitable for an employer to invest further capital. Thus, interest tends to equal the marginal productivity of capital.

Criticism

The main demerit of the theory is that it takes into account only the factors operating on the side of supply. All loans are not ‘borrowed’ for ‘productive’ purposes. And it cannot explain why interest is paid on loan borrowed for unproductive purposes. But its merit lies in the fact that it explains why capital is demanded. It throws into clear light one of the causes that govern interest.

Conclusion

None of the above theories taken by itself gives a thorough explanation of interest. It may be correct to say that, just as the price of a good is determined by demand and supply, interest, which is the price of capital, is also determined by the demand for and supply of capital. On the side of demand, the rate of interest is influenced by the marginal productivity of capital and on the supply side, it is influenced by the liquidity preference and time preference.

© 2013 Sundaram Ponnusamy