Canons of Taxation

Introduction

Public revenue and expenditure are the two important divisions of Public Finance. In the words of Dalton, “It (Public Finance) is concerned with the income and expenditure of public authorities and with the adjustment of the one to the other”. The term ‘public authorities’ includes all sorts of government and so on. In Public Finance, we study about public debt and financial administration too.

Public Revenue

A modern government gets its revenue from various sources. They are taxation, fees, special assessments, fines, receipts from public enterprises, receipts from the use of the printing press, gifts and so on. Public revenue may be broadly classified into (1) Tax revenue and (2) Non-tax revenue

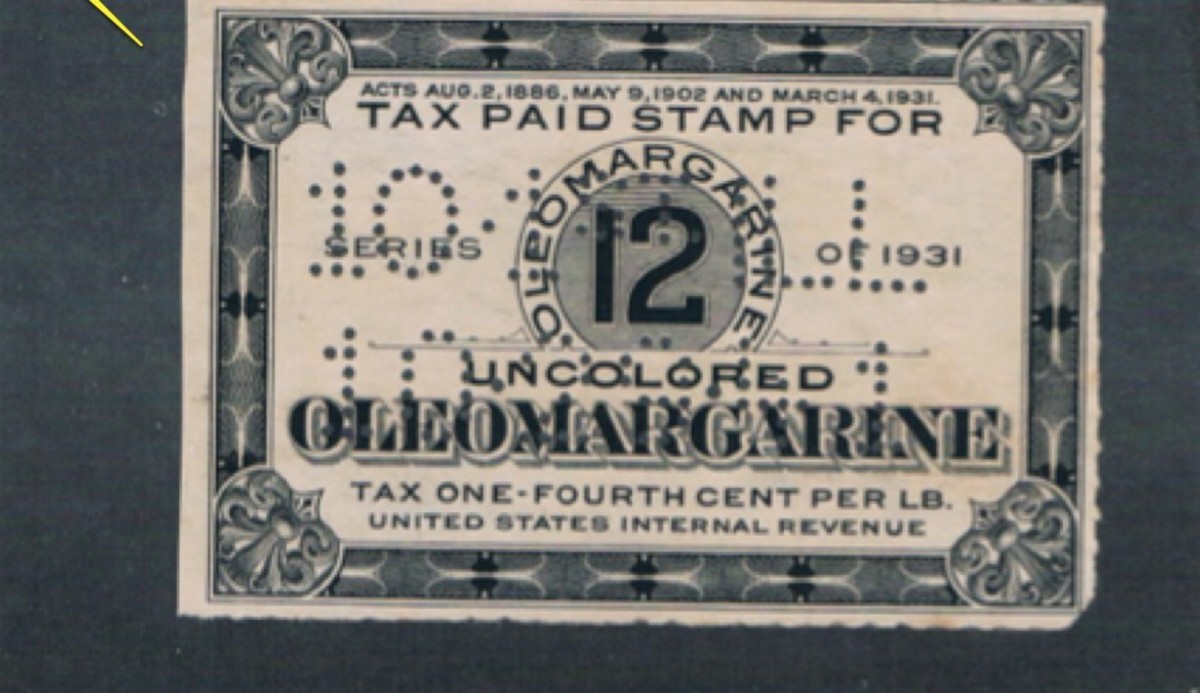

Taxation is an important source of public revenue. A tax is a compulsory charge imposed by a public authority. Taxes may be classified into direct taxes and indirect taxes. According to Dalton, “A direct tax is really paid by the person on whom it is legally imposed while an indirect tax is imposed on one person, but paid partly or wholly by another”. Income tax is a fine example of a direct tax and sales tax is a good example of an indirect tax.

The distinction between a direct and an indirect tax is based on the process of shifting the burden of taxation. In the case of a direct tax, the person on whom the tax is levied should bear the burden. Examples of direct taxes are income tax, wealth tax, estate duty and gift tax. But in the case o fan indirect tax, the impact will be on one person, but the actual burden will be on somebody else. For example, customs on a good, say a watch, may be paid by the importer. But the burden of the tax will be shifted to the wholesale dealer, then to the retailer and ultimately, the consumer will bear the burden. Excise duties and sales tax are good examples of indirect taxes. It is said that “indirect taxes are borne by the poor and direct taxes are borne by the rich”. But for a healthy economy, a country has to depend upon both direct and indirect taxes. Since the expenditure of the government is growing day by day, it needs money for so many things. So direct taxes alone cannot provide all the revenue. That is why government has to depend upon indirect taxes also though it means suffering to the poor.

Canons of Taxation

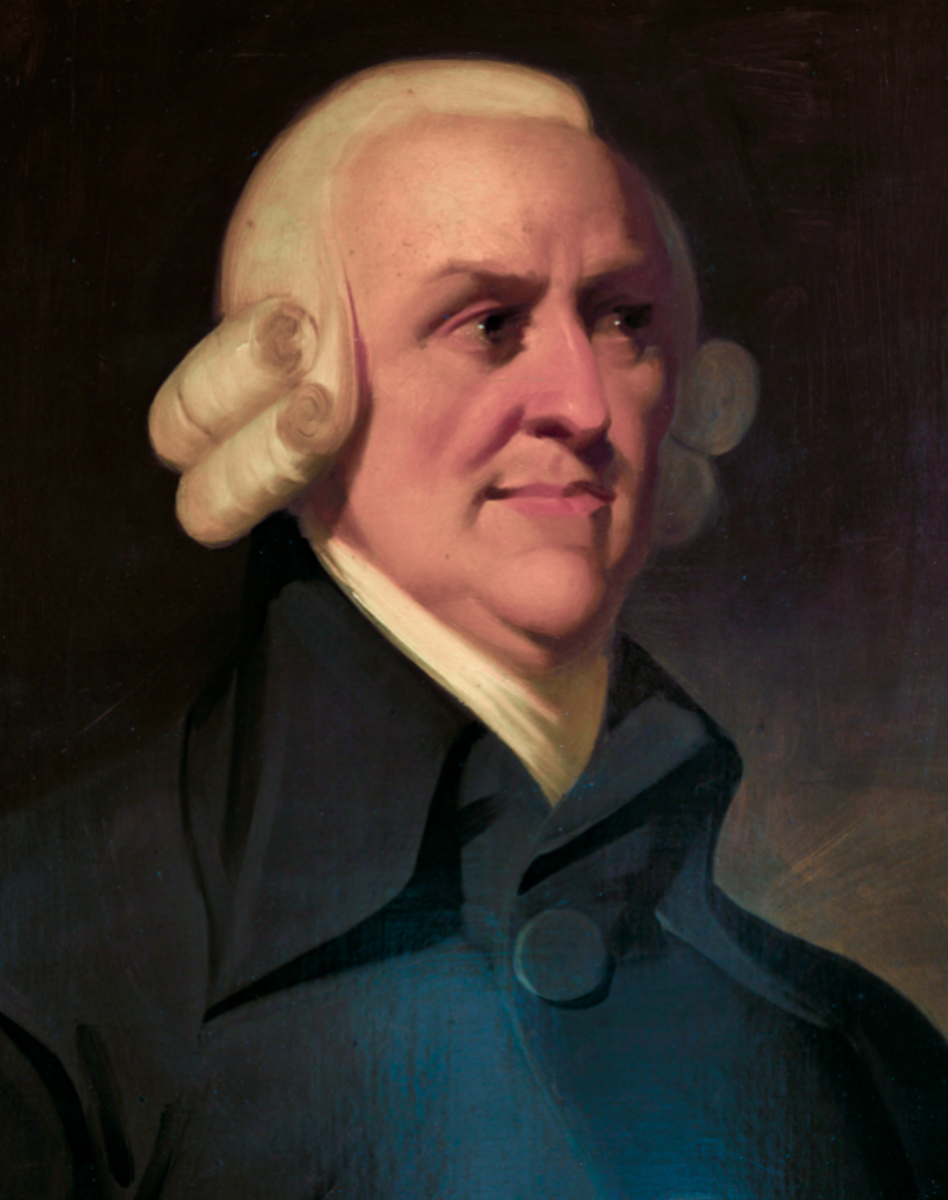

A tax system should be judged as a whole. We should not judge a tax system by taking into account the effect of one or two taxes alone. A good tax system should satisfy certain conditions. Adam Smith laid down some rules for a good tax system. Even today, they are valid. They are known as the canons of taxation. They are the canons of equality, certainty, convenience and economy.

1. Canon of Equality

It is based on the principle of justice. Progressive taxation is based on the ability to pay. Income tax more or less satisfies the canon of equality. It tells that people should pay taxes in proportion to their respective abilities. It does not mean that all people should pay an equal amount of tax.

2. Canon of Certainty

There must be certainty about the tax, which an individual has to pay. Things like the time of payment, the manner of payment and the amount to be paid should be clear and paid to the taxpayer. A tax should not be arbitrary. There is a certain amount of arbitrariness in the case of the imposition of urban property tax and sales tax in our country.

3. Canon of Convenience

A tax should be levied in such a manner that it is convenient for the taxpayer to pay it. For example, farmers may be asked to pay the land revenue after the harvest is over. Similarly, income tax of salaried people is collected at the time they receive their salaries.

4. Canon of Economy

It tells that a tax should be productive. That is, if the cost of collection of a tax is more than the revenue, which it yields, it goes against the canon of economy.

Besides satisfying the above principles of taxation, modern economists feel that a tax system should be simple, elastic and beneficial. In the past, there was no need to raise a large amount of revenue because public expenditure was limited to a few things like defense, internal peace and order. Some economists believed in the past that a good tax system should consist of only a few taxes.

Henry George, a famous American economist advocated a single tax on land and suggested the abolition of all other taxes. But such a system cannot work for a long time. For it cannot meet the increasing expenditure of a modern State. Not only that, it will be an unjust tax also, because while a millionaire who owned no land paid no tax, a poor man who owned even a small bit of land had to pay tax. But there are others who believe in a multiple system. That is, they want a number of taxes. They believe that the burden of taxation would be light if a number of taxes are paid by different categories of people. A tax system in a poor country should be adjusted to meet the needs of developmental planning. It should be productive enough to provide enough revenue for the plans. At the same time, it should not be regressive. We must make one more point. While judging a tax system, we should also take into account the purpose for which the revenue is raised and the way in which it is spent.

© 2013 Sundaram Ponnusamy