How Can A First Time Home Buyer Avoid Foreclosure

The First Time Home Buyer

Buying A Home

Buying your first home can be a very scary thing. The first time home buyer can avoid a first time foreclosure by following a couple of proven steps. Dealing with the paperwork, loan companies, inspectors and so much more gets to be overwhelming, but you can find your way with a little help. In today's market you see so many good-people losing their homes to foreclosure and failed loans. So, who's looking out for you? To ease much of the first time home buyer jitters you need to do two very simple things; know your budget number and find your personal Realtor®. No matter who you are, without these two components, your first time home buying experience could turn into a first time foreclosure nightmare.

Who Is Considered A First Time Home Buyer

A first time home buyer is a buyer who has NOT owned a principal residence in the last three years prior to the purchase (If married, both partners must qualify as first time buyers). If you own vacation homes or rentals they usually do not count, but it is best to check with your states Real estate regulations.

STEP 1

Finding Your Budget Number

You may be asking how do you know your budget number? It is as easy as knowing your budgets limits. Being a first time home buyer you are most likely renting your place of residence. You have an income that you use to pay your bills and general cost of living expenses that includes your rent. In a perfect world, your monthly rent would not exceed ¼ of your monthly income amount. This is how the bank/loan company is going to look at your financial world, they desire perfection. You have to show them that you may not be perfect, but you have a plan and a few bucks in the bank to back it up. The lender (bank or loan company) is going to want to see that you have at least 6 months of rent money in your savings account, this shows them you have planned ahead. And besides, you will be grateful for the cushion when the wheels of home ownership start rolling.

Budget Your Money

How Much Do I Need For A Home Deposit

Your savings account should also be able to cover an initial deposit of no less than 5% of the home's purchase price along with a credit rating that a loan company will trust. If you don't know your rating you can go online to any free website that will give you your three combined credit ratings. NOTE: Be certain to choose a reputable site as you will be required to give your social security number to acquire a rating status. In the past I have used freecreditreport.com with good results (I get nothing for suggesting their site).

Preapproval vs Prequalified

- How To Get a Home Loan Preapproval Letter

The preapproval letter is an item that you and the home seller can bank on, literally. It is a written commitment by the lender to lend you money. The preapproval letter states that if the property you are...

Stay Within Your Budget Amount

What you need to remember is this, once you have determined your budget number, Do Not allow anyone—Realtor®, loan officer, family, spouse, friends or priest—to tell you that you can afford more than what your budget number adds up to be. Stick with your number, never spend more than this number, and make everyone aware that this is how you work. By sticking with your budget number, your first time home buying experience can become a stepping stone to the dream of home ownership and personal financial security throughout your lifetime.

The chart below gives you an example of how to determine your own budget number.

Based on a Monthly Income of $4,000

RENT

| CAR PAYMENT

| FOOD

| UTILITIES AND CREDIT CARDS

| ALL OTHER EXPENSES

| LEFT OVER INCOME (LOI)

| 3/4 OF LOI

| 3/4 LOI x 6 MTHS = SAVINGS

|

|---|---|---|---|---|---|---|---|

$1,000

| $325

| $625

| $285

| $225

| $1,540

| $1,155

| $6,930

|

$1,250

| $450

| $544

| $439

| $333

| $984

| $738

| $4,428

|

$1,650

| $389

| $590

| $325

| $295

| $751

| $563.25

| $3,379

|

$2,000

| $349

| $600

| $438

| $427

| $186

| $139.50

| $837

|

Looking at the Chart Results

Do I Really Have Enough Money To Buy A Home

Using an imagined income of $4,000 monthly, we deducted the amount in each column from the monthly income to derive the final savings account potential. Looking at the chart, you can easily see that the first row would be the lenders first choice to work with. The left over income in row 1 manages to cover their rent amount for 6 months with close to $400 left over in disposable income. If your budget number is equal to (relatively speaking) what you see within row 1 and 2 (inserting your monthly income and deducting your monthly expenses) you should have enough room to consider buying your first home. When you combine the $1,000 rent amount currently paid in row 1 and the left over income of $1,155 in the same row, it is easy to see a realistic budget number of $2,000 a month to be the amount row 1 can spend monthly on a first home. Anything less and row 1 may want to consider waiting until a greater savings and disposable income range is available.

Regardless, what ever your number is, Do Not waver from it under any circumstance.

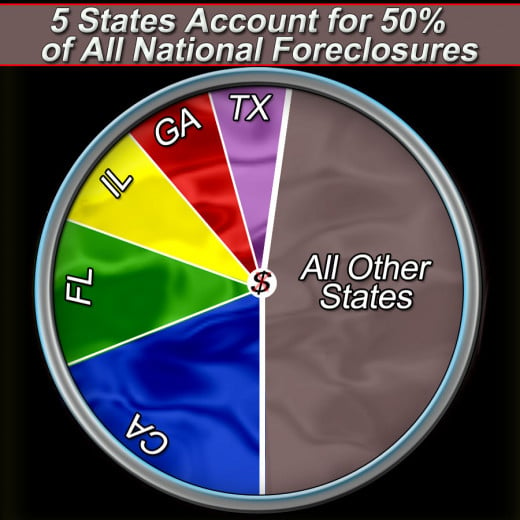

2012 National Foreclosure By State

- Home Loans With Bad Credit

I bought my first home over 20 years ago in 1985. Unfortunately because of a divorce I had to sell it within months, but I sure wish I could have held onto it. Even with very little credit to qualify for a...

Things to consider when buying your first home:

- Impounding Your Loan - This incorporates all of your recurring monthly expenses into your monthly mortgage payment, i.e. insurance, taxes, interest etc. By having all of these things built into your monthly payment it is much easier for a first time home buyer to manage the new home ownership pressure and stay within their budget number.

- Avoid Early Payoff Penalties - You want to make sure, should you need to re-finance your loan at some point, that you will not incur a fine for paying the loan off before it amortises. The initial lender does not get their full amount of interest in most of these cases so they will want to add penalties. Be certain to get this "no early payoff penalty" written into your home buying contract.

- Be Sure To - Write into your contract any oddities surrounding your loan; seller pays for the first years home owner policy, seller pays closing costs, seller must provide a section 1 and 2 pest report, inspection cost are paid by seller should home fail to qualify for loan, and any thing else you wish to negotiate into your contract. This is a good time to listen to your Realtor®!

- Everything within your contract is negotiable, just get it in writing!

The best 4 min. 25 sec. investment of your Home buying experience!

STEP 2

FINDING YOUR PERSONAL REALTOR®

Attacking the first time home buying process can stun even the most confident home shopper. Having someone who cares about your fiduciary well being as much as their own is critical. But where do you find someone who has taken an oath to maintain good ethics, who will put your needs first and has a superb business network and understanding for the world of Real Estate? The only person you should trust the biggest financial purchase of your life to, is a Realtor®.

Find the Right Realtor® for You!

- Find The Realtor That's Right For You!

Find and compare local REALTORS to help you buy or sell your home. Get custom proposals from top REALTORS while remaining anonymous.

A Realtor® vs A Real Estate Agent

You may not know this, but a Realtor® is much different than a Real Estate agent. Realtors® have taken a sworn oath to maintain the highest ethics and are held to a higher standard of operation than real estate agents. A Realtor® co-ordinates all facets of your transaction, protects your interest and defines any questions you may have. A Realtor® makes sure everything is happening as it should and that all of the home selling and home buying players are in the right place at the right time. They will make sure that your first time home buying experience is more pleasurable and not so confusing. Simply put, your Realtor® is a Real Estate ninja!

Only Use One Realtor®

Something else a first time home buyer should know, is that once you decide on a Realtor® you trust and like, you should work with that individual only. Creating a working relationship with one Realtor® offers you greater personal service and less splintering of loyalty. This means your personal Realtor® will know what it is you want in a home, what you can afford, what your budget number is, what homes you have already looked at, where you are within the contractual timing, and most importantly, who you are and what your dreams for a home may be.

Find the Realtors® Oath Here

- The Realtor Oath

Read the actual Oath required to become a Realtor.

6 Things to Know About Your Realtor®

Only Work With The Top 1/3 Real Estate Professionals

- The home buyer gets free service from a Realtor®. The home seller pays for the home buyers agent!

- A Realtor® has a network of people who keep things moving on time during your escrow. These people are made up of inspectors, contractors, insurance companies, loan companies, banks, financial counselors, title companies, plumbers and too many more to mention.

- A Realtor® will always listen to your needs. They may suggest service agencies with good reputations, but you are the boss and what you say goes. They will protect you from making mistakes, so following their advice is very important to your financial well being.

- Realtors® have hired more working labor than most any other service provider, keeping the world's economy in the "flow" of money.

- Realtors® must keep current educationally and must take a required number of college units annually to maintain their license.

- Only about 1/3 of real estate agents are actually REALTORS®; and these are the most effective and reputable 1/3 without a doubt!