- HubPages»

- Personal Finance»

- Tax & Taxes»

- Income Tax

IRS Audit Manual: IRS Penalty and Interest Abatement

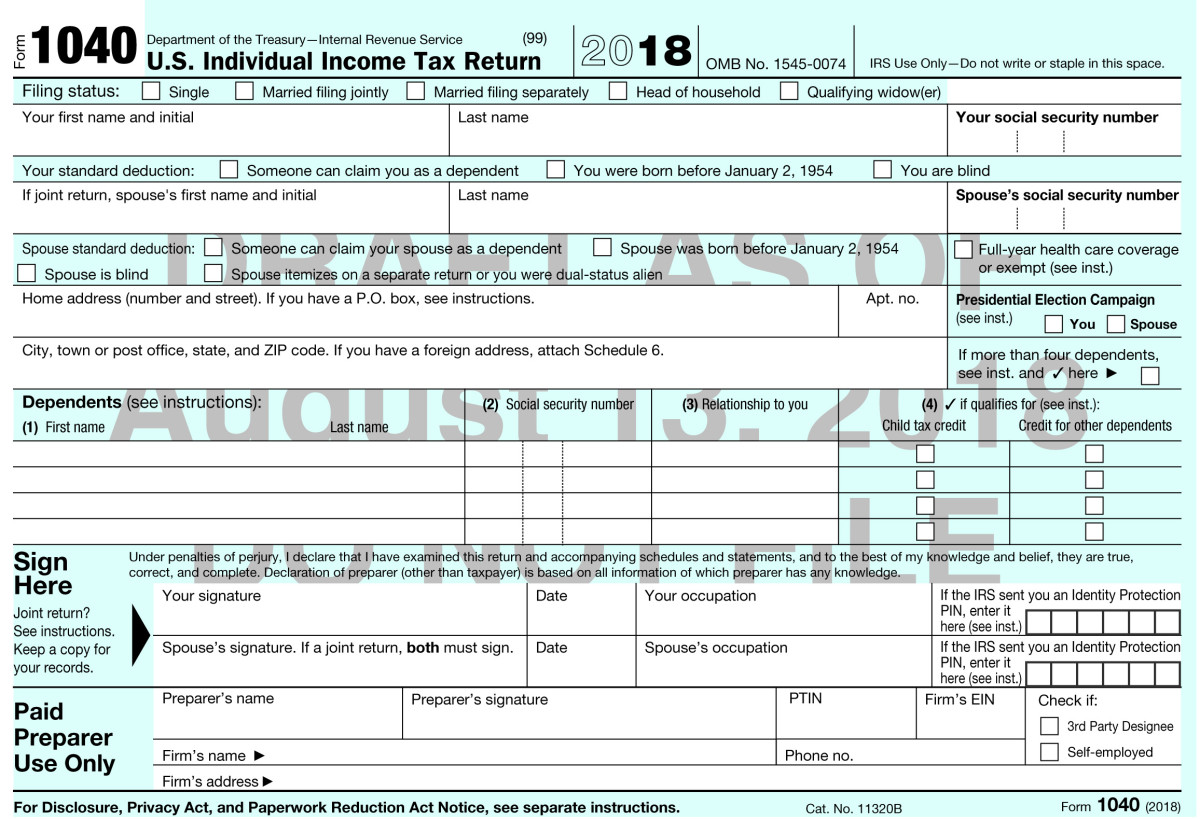

This article completes the IRS Audit Manual. I have provided you with information on preparing for the audit, the first meeting, appeals, offers in compromise, and more. Now I want to show you how the IRS will abate and refund penalties and interest.

Too many accountants do not use this powerful tool to save their clients money. If you ever owe the IRS and are assessed a penalty or interest, print out this article and take it to your accountant and demand he file Form 843, Claim for Refund and Request for Abatement. It is a good idea to bookmark this article for later reference.

The IRS does not automatically grant all requests for abatement. But if you follow the instructions, your success rate will exceed 90%. Since penalties can double your liability to the IRS, it is important to ask for abatement.

IRS Penalty Abatement

When to Request Abatement

Abatement is one of those unique animals in taxes. Before you can request abatement, you first must pay the tax and penalty. Once the tax and penalties are paid for a tax period, you can file for abatement.

Example: You owe money for one tax year. You paid your tax bill on installments. When you make your final payment, file for abatement of the penalties. You have two years from payment to make the request. Requests after two years are denied.

Example: You owe taxes for multiple years. It may result from an audit or several years of unfiled tax returns. Rather than wait until all years taxes are paid, file abatement after each year is paid. The IRS will apply the refund, if abatement is granted, to the next tax period. This next tax period is paid off faster now. When you finish paying the last year's balance due, the IRS refunded abatement will get mailed to you.

Interest Abatement

There are only two reasons the IRS will accept to abate interest: IRS error or IRS delay. If the IRS gave you incorrect written advice, you have reason to file for abatement of interest. The same applies if the IRS unduly delayed an audit or other event (IRS lost your papers) that lead to an interest assessment.

Remember that incorrect IRS advice must be written for interest abatement consideration. This includes email advice, too. In some cases, IRS publications are wrong and later corrected. If you relied on an error in an IRS publication, you have a good case for interest abatement and refund.

Penalty Abatement

This is the most common reason to file for abatement. I think Form 843 should be filed on nearly all penalties. There are several good reasons to ask for abatement of penalties: fire, theft, illness, divorce, job loss, child’s health, and business difficulties top the list. I would not lie when filing Form 843 (or in any other matter with the IRS). Instead, lay out the facts and ask for abatement under "reasonable cause."

Important Points

Form 843 should only take a few moments to fill out. Your explanation should be three or fewer sentences. My experience shows that the longer the explanation, the better the chance you get denied. I had a CPA firm a few years back ask me for help on an abatement case. They had attached three pages of explanation. We narrowed it down to three sentences.

Make certain you include all information asked for on Form 843. Once the IRS denies an abatement claim, it is unlikely they will allow it latter. My opinion, you get one shot.

This powerful tool can put some cash back in your pocket. If you have any "reasonable cause", file for abatement of IRS interest and penalties. The worst the IRS can say is, “No.” My simple approach to abatement has yielded a 92% success rate in my office. That might be the reason some CPA firms ask me to file their abatements. Go figure.