- HubPages»

- Personal Finance»

- Tax & Taxes»

- Income Tax

IRS Audit Manual: The Installment Agreement and Other Payment Options

The question always arises when a client owes money on their tax return or from the result of an audit. You should not feel angst over a balance due. Owing the IRS money is not fun, but there are programs available to help simplify the process. In this issue of the IRS Audit Manual I will outline the IRS Installment Agreement and other payment options.

Before we begin, I assume you really owe the money to the IRS. If you dispute the IRS assessment, please review other IRS Audit Manual articles listed below. Even if you dispute the IRS claims of tax liability, you can pay the tax to avoid interest and penalty charges should the IRS prevail in the dispute.

IRS Installment Agreement

Some Facts to Consider

The IRS has no problem taking an installment agreement, but thinks about the installment agreement differently than you. In considering an installment agreement, the IRS always considers the statute of limitation where the IRS has 10 years to collect from the time the tax is assessed or they lose the right to collect.

A balance due on a timely filed tax return will rarely run into the 10 year statute of limitation issue. However, if your tax liability has been stewing for a while, your installment offer may bump up against the 10 year limit and the IRS usually denies the installment request when this happens.

Since the IRS cannot pursue additional collection actions while an installment agreement is in place, payment requests that will not pay the tax in full prior to statute of limitation are denied, except in extraordinary circumstances. The IRS will file liens against assets around six months prior to expiration of statute. An installment agreement may preclude the IRS from this remedy, so the IRS denies the request.

Planning Points

The statute of limitation creates a planning point. If the taxes you owe are eight years into the statute of limitation and you owe no assets, it may make sense to wait out the remaining two years. After the 10 years elapse, the IRS cannot take collection action against you.

It is a good idea to pull a transcript from the IRS to see how much time remains in statute. The IRS will take every collection action at its disposal as the time limit gets closer. You will need to consider you tax liability and the fact that the IRS will also attach wages besides filing liens against real estate and other property.

You may not have the resources to offer an installment that satisfies your tax liability prior to statute. In these cases, your options are limited. The IRS will deny the installment request and will file liens and attach wages.

You should also consider an Offer in Compromise (OIC) in certain cases. I discuss the OIC in other articles listed below. Bankruptcy is another option. Remember, you cannot file bankruptcy in most cases until a tax liability has aged three years. Read, the IRS has the right to swing at you three years before you can seek relief in bankruptcy court.

IRS Installment Agreement

If you are going to pay the IRS a balance due from a filed tax return or audit within 120 day, do not make any payment arrangements. Call the IRS at 1-800-829-1040 and set up a payment in full request, saving the Installment Agreement fee.

Cost: The IRS charges a $105 fee for filing an Installment Agreement; $52 if you pay by electronic funds transfer. Isn’t that nice? They charge you to pay them.

The fear many have about electronic funds payments is that the IRS will dip into your bank account and grab more money than agreed upon. People do not want to tell the IRS where they bank. Do not worry; the IRS already knows.

I recommend electronic funds payments because you save on the fee and it assures you make all payments on time. Failure to make a payment on time will result in termination of the Installment Agreement and the IRS will begin aggressive collection actions.

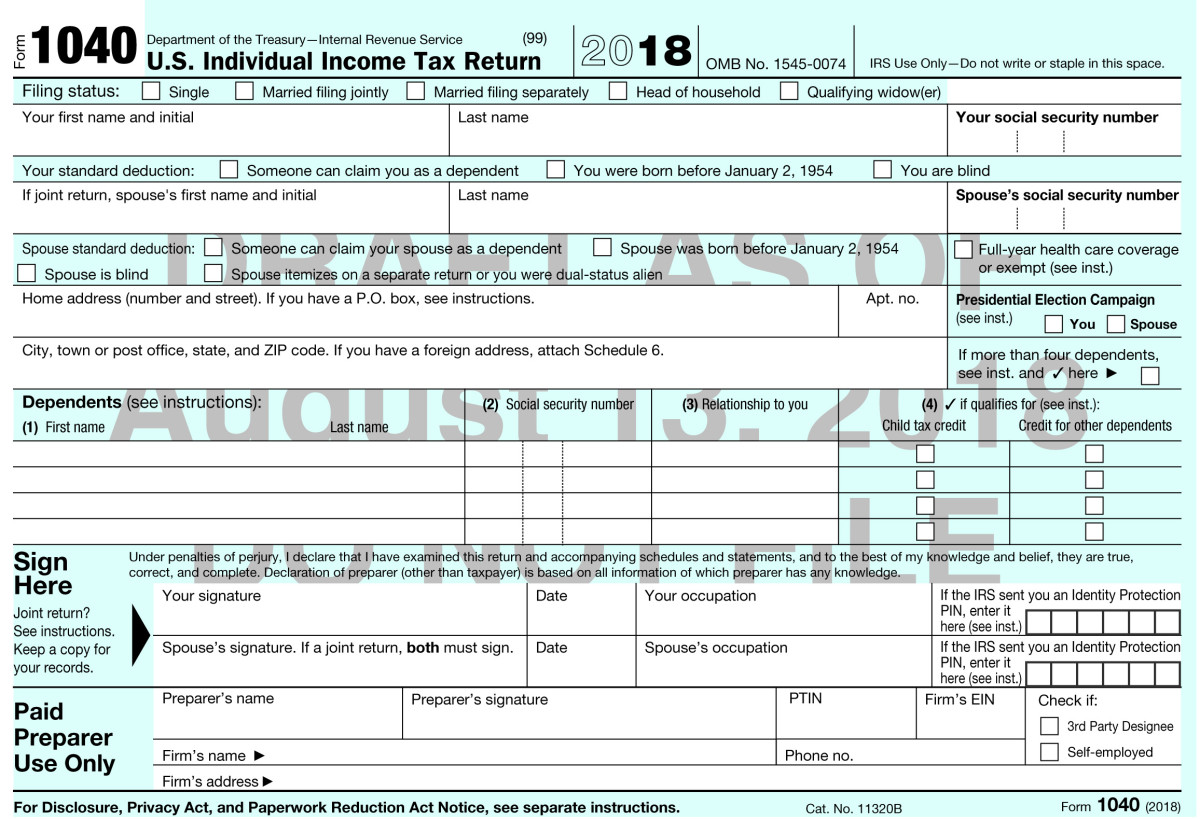

Form: You request an installment agreement with the IRS by filing form 9465. You can also file online at www.irs.gov. Under the pull-down menu “I need to…” select “Set up a Payment Plan.”

Guaranteed Installment Agreements: The IRS is required to accept your installment request if you owe less than $10,000 and you meet the following three points:

- In the last five years you filed your taxes on time and paid all taxes due

- You provide the IRS information required to make the installment determination

- You agree to pay the tax in full within three years.

Large Tax Liabilities: If you owe the IRS more than $25,000 you must complete and attach Form 433-F, Collection Information Statement, to the request.

Final Notes

Owing the IRS is not fun. Letting the issue fester only makes the matter worse. As soon as you face a tax liability, contact the IRS and make arrangements. You reduce interest and penalties when you face the issue and work on resolving it.

The IRS Installment Agreement is the best way to deal with a tax bill you cannot pay within 120 days. IRS collection actions are stopped while you have a valid Installment Agreement in place.

If your circumstances change and you are unable to meet the installment payments, contact the IRS and have the agreement modified.

You can always make additional payments to satisfy your tax bill sooner. The faster you get the bill paid, the sooner you stop paying the IRS interest. You want to get off the IRS’ radar at the earliest possible moment.

Most important, never bury your head in the sand when a tax problem arises. The problem will only get worse. Deal with the issue. File a request with the IRS for an Installment Agreement. Then get your life back. Good luck. (Luck has nothing to do with it.)