Free 90 Days Identify Theft - www.LifeLock.com for Free - Life Lock

Do It Yourself LifeLock

LifeLock's spokesperson Todd Davis had his identifty stolen! Apparently, a guy in Texas borrowed $500 from a payday advance company that did not use any of the 3 major credit bureaus to verify his identity. So, when the company called his wife to collect the overdue payment, weren't they surprised!

LifeLock is a company that specializes in protecting your credit from fraud, so you can see where this was bad news! Several people have filed lawsuits against LifeLock for misrepresentation of the services. However, lest we forget that Todd Davis *ADVERTISED* his social security number to practically the whole world, and only had this one incident? For $500? He probably makes that much during breakfast (for the sacrifices he's made to the company, like advertising his social security number to the world).

Were you wondering how he could confidently and overtly advertise his real social security number on TV, on billboards, through a bullhorn on the streets of New York, and other ostentatious means of giving out the one number any normal person doesn't want advertised?

There are ways of protecting your credit that are pretty sound. Advertising it to everyone isn't one of them! Also, you don't have to give your hard earned cash to a company to do it for you. If you're thinking it's not worth the hassle, it's actually very easy and you're just a few clicks away from doing it. Besides, some of the things I'm going to show you how to do, you'de have to do with LifeLock at least once (during setup).

Follow the Steps Below

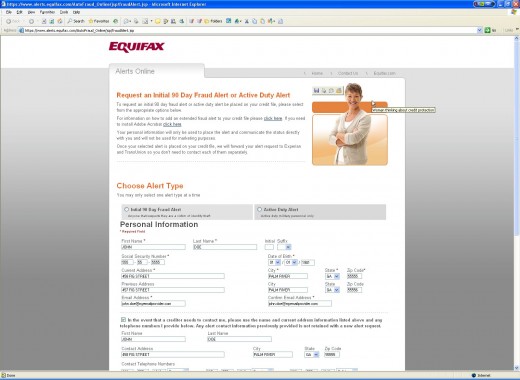

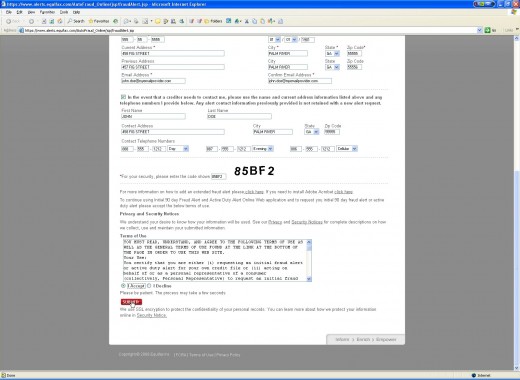

You can click on each of the pictures to the right to get a full-sized view. Follow the steps below to prevent identity theft and what to do when your social security card is stolen.

Step 1

Go to Equifax's web site. Click on the "Free Report, Security Freeze, Dispute and Fraud Protection" tab.

Step 2

Click on "Explore How" on the "Protect your credit" frame.

Step 3

Click on the "Click Here" link in the "Place a free 90-day fraud alert on your credit file...". Here's the link if you want to avoid the previous steps. I've included them so you don't think you're being pointed to an alternate site.

Step 4

Fill out the info they're requesting, including First Name, Last Name, SSN #, DOB, Current Address, Previous Address, and Email Address.

Step 5

If you check the next box, if a creditor needs to get ahold of you, the phone numbers and contact name you list in this section will be used. Read the text next to the box over and over again until you understand exactly what they mean.

Read their "Terms of Use", and click on the "I Accept" radio button as shown in the diagram. Then click "Submit".

Additional links

- FTC's Identity Theft Site

This website is a one-stop national resource to learn about the crime of identity theft. It provides detailed information to help you deter, detect, and defend against identity theft.

Additional Information

Apparently, Equifax will share this information to the other two major credit reporting agencies (Trans Union and Experian), so you should not have to do the same thing with them.

Also, set up dates in your calendar to remember to do this every 90 days.

When you place a fraud alert, you're also apparently eligible to obtain another credit report from each bureau, on top of the one free you can get from each bureau already. So, you can get a total of 15 credit reports (5 from each bureau) a year, merely by filling out this one form every 90 days!

This method is not without its hassles. Placing these alerts, like LifeLock, will make your potential lenders go through extra steps before they can verify your credit worthiness. You can provide your cell phone number to your potential creditor to help speed the process, but beware that the simple 5 minute credit checks you may be used to may take much longer.