The functions of banks

How is money created? Other than the currency and bills that are made in a national mint, the money that our nation uses on a daily basis is actually created by commercial banks in the form of deposits and other things.

A bank depends on the misfortune of its customers to create money. Someone must be in debt to commercial banks in order for money and credit systems to work. When a borrower spends the money he or she has been loaned, the recipient deposits it in another bank. That deposit represents the creation of new money. A bank pays its bills by borrowing if people don't pay their taxes. The interest that a bank charges customers on the loans it gives becomes that bank's profit. A customer's assets and liabilities add up equally. When a bank makes unnecessary profit, it makes for a burden on taxpayers.

The Federal Reserve processes checks and cash. Banks order cash from the Fed when they need it, and ship it cash when they have too much. Checks can even be processed cross-country; for instance, if someone from Los Angeles writes a check in Philadelphia, the Philly bank credits the person's account and sends the check to the Federal Reserve of Philadelphia, then the check is sent to the Federal Reserve of Los Angeles where it goes to the bank of Los Angeles. The Fed processes one third of all checks written in America. Many of them are deposited electronically. High-tech machines are used for all sorts of transactions. Fedwire is a program that allows money to be transferred over seconds. ACH allows for constant, direct payments. There are also machines designed to detect bill denominations, extent of use, and authenticity.

Banks can borrow money from the Fed as well, although it is considered a last resort lender. It acts to prevent too much borrowing. Types of loans are adjustment credit, for overnight loans or short-term problems; seasonal loans, which are extended up to nine months to help in seasonal swings in deposits and loans; and extended loans, which are prolonged because of financial difficulties if banks have a plan to correct the problems. Banks aren't allowed to take advantage of interest or discount rates and make profits by borrowing, either.

The Fed keeps the banking system competitive by creating new banks and mergers frequently. It examines bank information for security, and the banks themselves for safety. The Fed will fine banks, suspend employees, or pass new laws if they feel the need to.

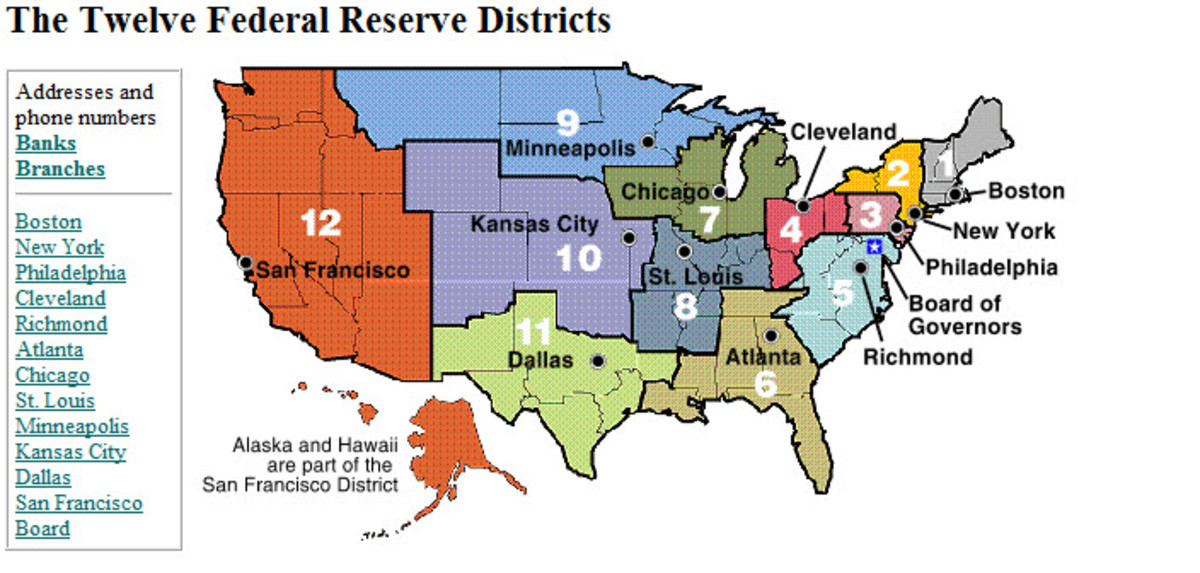

There are 12 Fed district banks, member banks, and the Board of Governors, which heads the Federal Reserve. Each member of the Board is appointed to 14-year terms so the members are well insulated from outside political pressures. It is financially self-sufficient as a bank; it doesn't rely on Congress appropriations, but rather on interest from large holdings on US government securities.

The Board gives the Treasury the excess of what it took as opposed to what it spent. It sets reserve requirements (a monetary policy tool, along with discount rates and open-market operations); this is important because it affects the amount of loans and bank money commercial banks have. (Commercial banks are those that take deposits and give loans on an individual basis.) Reserve requirements are percentages of money or credit banks must keep on hand or on deposit at the Federal Reserve Bank.