What is Compound Interest?

What is compound interest or compounding returns?

Have you ever thought that you would like your money to work for you so that you no longer have to? If you answered “YES”, then you are not alone. Many people don’t want to work for their money as there are too many other things they’d rather do like write or travel.

If you understand the magic of compound interest or compound returns, then you are well on your way to having your money work for you instead of you working for your money. This article is about compounding returns with an easy to understand table.

Compounding returns is where the interest you earn on your savings remains invested so you earn interest on both your principal (the amount you've invested) and the interest you earned. Its simple and its incredibly effective. The two terms - compound interest and compound returns are used interchangeably here.

Money and Finance

Your Money Works for You Rather than You Working for It

It’s like having someone in your life who pays you money for having a great idea. The magic of compounding returns is the secret. Your great idea is to save some of your income now so you can reap the rewards or money earned from your great idea.

To start this process you need to earn some money. Then you need to save some of the money you earn and invest it and watch is grow and grow and grow. The most important thing is that no matter how many tempting offers come your way, you leave your money invested to earn returns or interest so it will weave its magic.How does compound interest work?

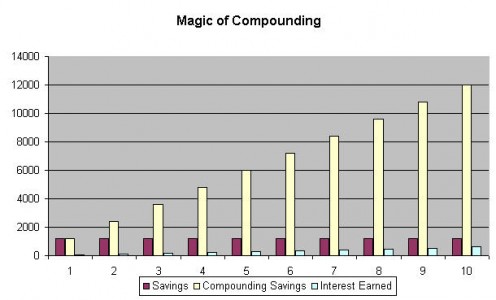

Let’s keep this explanation simple. To do that we need to make some assumptions:

- You are able to save $100 every month

- You save this $100 every month for ten years (no withdrawals are made)

- You earn interest of 5% per annum. We've also assumed that the interest is all paid at year end on the full amount of money saved.

By the end of year ten you have saved a total of $12,000.

Soon Your Interest Equals 50% of your Savings

Remember, in this example you saved $1200 every year but by year ten, you earn $600 just by leaving your money invested and earning interest.

The amount of interest you’re earning is now 50% of the money you worked hard to save every year!

Given that most of us are in work and earning for over thirty years, if you are able to save for all of that time, then the effects of the compounding returns are even more outstanding.

In reality, you would adjust your savings by the amount of inflation (at least). I've written about inflation in Stop the Silent Thief in another article.

More Great Money Books

You Choose - Would you rather have.......?

Option 1: $1,000 per day for 31 days

or

Option 2: 1 cent today and have it doubled every day for 31 days? e.g. 2 cents on day two and 4 cents on day three etc

Make your decision and then link to this page to see the answer. Did you choose the right option?

Leave me a comment to let me know.

And finally.....

This article is copyright Travelespresso. Do not copy.

Writers love feedback so please leave a comment, rate it and/or pass it on. Thank you.